원문: TechFlow

There’s been a lot of discussion lately about the CCM (creator capital market, related to the content creator economy), so I crunched some numbers on creator earnings for @pumpdotfun vs. @Twitch . Pump isn’t just competing with Twitch, it’s taking market share from Twitch.

Creator income

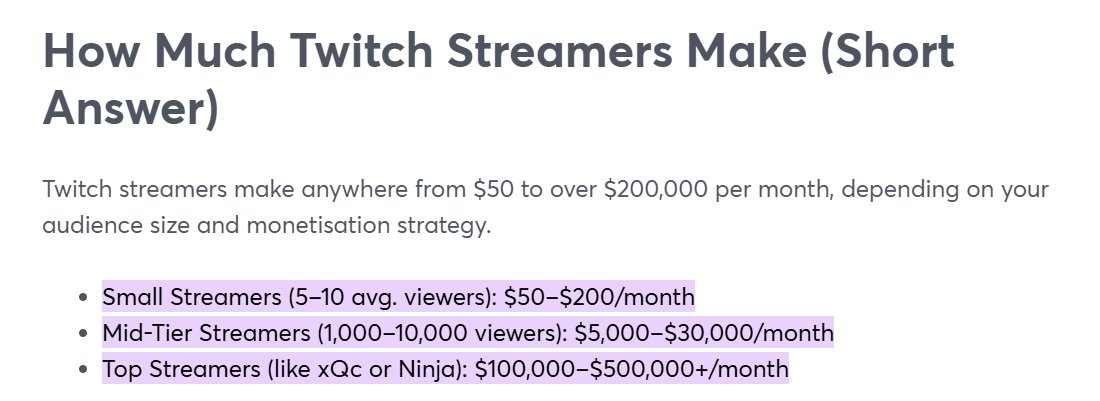

Creators on Twitch make money through subscriptions and advertising. Subscriptions cost $4.99, $9.99, or $24.99 per month, with the creator and Twitch taking a 50/50 split. Ads have an average CPM of $3.50, with creators receiving 50% to 70% of the ad revenue. In practice, this means small streamers only make a few hundred dollars per month, mid-tier streamers can earn $5,000 to $30,000, and top streamers can earn over $100,000 per month.

Pump completely disrupts this model. Instead of earning commissions from subscriptions and ads, creators earn transaction fees from their tokens. In the early stages (market cap between $88,000 and $300,000), the fee per transaction was approximately 0.95%, gradually decreasing to 0.05% once the market cap exceeded $20 million.

Yesterday alone, 9,000 wallets claimed $2.8 million in creator fees, meaning the average creator is receiving approximately $300 per day, or approximately $9,000 per month if this trend continues.

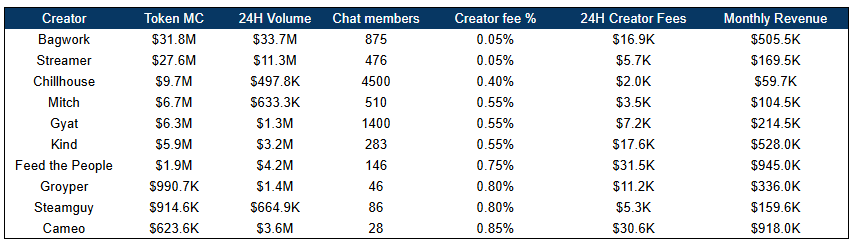

Looking at the 10 creator coins featured on Pump’s homepage, most are already generating significant daily revenue. On Twitch, reaching six figures requires 10,000+ concurrent viewers. On Pump, creators can achieve similar income levels with a much smaller community.

시장 valuation

From a valuation perspective, @Twitch is valued at $45 billion in October 2024, with revenue of $1.8 billion that year, equating to a 25x multiple. @pumpdotfun , based on its August figures, has a valuation multiple closer to 14x.

More importantly, the incentive structure is crucial. Early creators on Pump can earn up to 80% of the fees, and as they grow, the platform gradually increases its share. This is precisely where Twitch falls short, and why Pump seems so disruptive.

Core Competitiveness

Pump offers smaller creators an income opportunity previously reserved for Twitch’s top 1% of creators. If even a fraction of Twitch’s creator base migrates to Pump, the entire streaming economy could be radically reshaped. Creators on TikTok and YouTube, not just Twitch, are also likely to be part of this migration, creating even greater potential for future growth.

Sustainable Flywheel

The biggest question is sustainability. Pump’s growth depends on how creators use the fees they earn. If they reinvest their revenue into their own tokens or better content, it drives a flywheel effect.

We still need to see more livestream viewers to attract top streamers. Right now, it feels more like opportunism than genuine content consumption, but it’s a promising start. Kudos to Pump!

이 글은 인터넷에서 퍼왔습니다: Which is more profitable, live streaming on Pump.fun or Twich?Recommended Articles

Related: Who will own the most Bitcoin in 2025?

Original translation: Block unicorn introduction Satoshi Nakamoto, the anonymous creator of Bitcoin, is the largest Bitcoin holder, holding 1.096 million BTC (approximately $128 billion). Arkham’s label derives from a known mining pattern known as the “Patoshi Pattern,” which contains a unique (known) address where Satoshi used Bitcoin. Arkham’s research indicates that he acquired this wealth by mining 22,000 blocks. The largest individual Bitcoin holding is held by Binance, which holds nearly 250,000 BTC. Using Arkham, we can see which specific wallets hold the most Bitcoin: Bitcoin is a decentralized digital currency that runs on a blockchain (a peer-to-peer network). Due to these characteristics, no one person is the true owner of the entire Bitcoin network, but individuals can access and own Bitcoin through their own private keys. Bitcoin’s massive price…