Interest rate cuts are a foregone conclusion, but three major questions remain to be answered

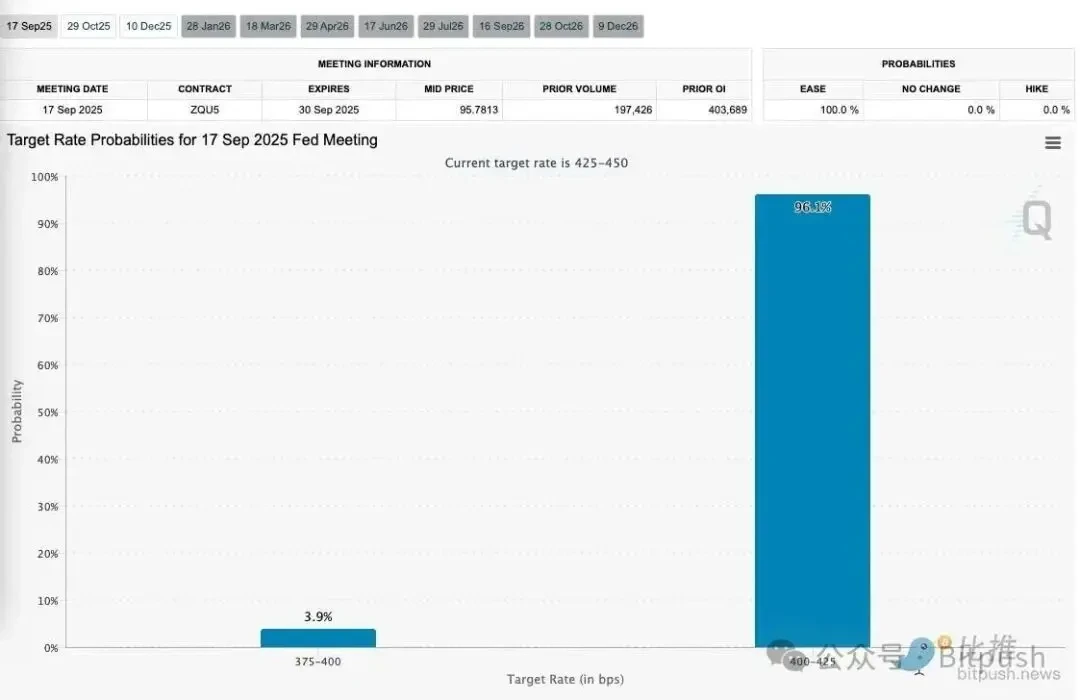

시장s are almost unanimous in their expectation that the Fed will announce its first interest rate cut in nine months on Wednesday following its two-day policy meeting. According to the CME’s FedWatch tool, the probability of a 25 basis point cut to a range of 4.25%–4.50% is as high as 96%, making it virtually certain.

The Fed finally decided to start a cycle of interest rate cuts, with the core reasons being the continued weakness in the U.S. job market and officials’ growing confidence that tariff-induced inflation may be only temporary.

Data from the Department of Labor shows that in the three months ending in August, job creation averaged only about 29,000 per month, the weakest three-month growth since 2010 (before the pandemic). Furthermore, the number of unemployed people now exceeds the number of job openings; initial unemployment claims have reached a nearly four-year high; and the number of long-term unemployed (unemployed for more than 26 weeks) has reached its highest point since November 2021. Preliminary revisions to employment data released last week further suggest that the foundations of the US labor market have been more fragile than previously thought since the summer began.

In addition, Federal Reserve Chairman Jerome Powell laid the groundwork for this rate cut in a speech at the end of August, when he explicitly stated: “Downside risks to employment are rising.” This reflects that concerns within the Fed about achieving its “full employment” mission have surpassed concerns about inflation.

However, while a rate cut is a foregone conclusion, uncertainty surrounding this meeting and future monetary policy has reached an unprecedented level. These unresolved factors are the real key factors affecting financial markets and asset pricing.

Mystery 1: The “dot plot” of the future interest rate path – how many times will interest rates be cut this year?

Since a 25 basis point rate cut is already highly priced in by the market, traders will no longer be concerned about whether there will be a rate cut, but will instead focus on the Fed’s policy forecast for the rest of 2025.

Market expectations for future guidance

In their announcement on Wednesday, Fed officials will release updated economic projections, with the most closely watched component being the “dot plot” – a reflection of FOMC members’ expectations for future interest rate levels.

- Expectations of continued rate cuts: Traders are betting that the Fed will not cut rates in a “one-off” move, but rather begin a cycle. According to the CME’s FedWatch tool, the market sees a greater than 70% probability of further rate cuts in October and December.

- Potential divergence signals: Goldman Sachs economists expect the “dot plot” to show two rate cuts rather than three, but “divergence will be narrow.” If the Fed ultimately signals a slower pace of rate cuts than the market expects, it could trigger a repricing and sell-off in risk assets. Conversely, if it signals three or more rate cuts, it would be a significant positive for doves.

- Goldman Sachs economists believe that the key to this meeting is whether the committee will indicate that “this will be the first in a series of rate cuts.” They do not expect the statement to explicitly mention an October rate cut, but Powell may “gently” hint in that direction during the press conference.

Split vote between hawks and doves

The voting structure of this meeting is also full of uncertainty. Although the majority of members are expected to support a 25 basis point rate cut, there are clear divisions within the committee:

Calls for a “substantial” rate cut: Newly appointed Governor Stephen Miran is likely to vote against the bill, arguing for a larger rate cut. Treasury Secretary Scott Bessent has also publicly encouraged the Fed to take a “full” rate cut.

Opposition to a rate cut: Kansas City Fed President Jeffrey Schmid and St. Louis Fed President Alberto Musalem are likely to oppose a rate cut, citing concerns about inflation risks from tariffs.

Such a split would highlight growing policy disagreements within the committee and make the central bank’s future actions even less predictable.

Suspense 2: Powell’s “tone setting” – how to balance inflation and employment?

Powell’s choice of words at the press conference following the rate decision is often more important than the FOMC statement itself, as he will be responsible for articulating the committee’s thinking.

Is inflation “temporary” or “persistent”?

Fed officials generally believe that the increase in inflation caused by the Trump administration’s tariff policies is likely to be temporary.

San Francisco Fed President Mary Daly said, “Tariff-related price increases will be one-off.” Other officials also expect that the tariff effects will be transmitted over the next two to three quarters, and the impact on inflation will then subside. They believe that amid a weak labor market and an unstable economy, businesses have less flexibility to raise prices, so persistent inflationary pressure is low.

Powell’s speech will have to strike a balance between the Fed’s two mandates: maximum employment and price stability. He will need to strike a “pragmatic and more dovish” tone. As strategists at B. Riley Wealth Management put it, his tone will be “pragmatic, but more dovish,” suggesting the Fed needs to do more to defend its full-employment mandate.

Data dependence and future policy flexibility

Traders will be watching closely to see if Powell gives any soft hints about October action. If he emphasizes “data dependence” and suggests there is still a lot of room for future policy adjustments, it will leave the market in suspense, allowing asset prices to continue to fluctuate with the fluctuations of economic data.

Suspense 3: Unprecedented political interference – Federal Reserve independence is challenged

The uniqueness of this meeting stemmed in part from the political turmoil surrounding the Fed’s core power structure. The Trump administration’s continued pressure on its independence was the lingering “elephant in the room” during the meeting.

New directors’ rapid rise to power

Trump’s chief economic advisor, Stephen Milan, was confirmed by the Senate on Monday and sworn in on Tuesday morning, securing a vote in time for this FOMC meeting. This expedited process, which typically takes months, is seen as a sign that Trump is eager to secure Milan’s crucial vote in favor of a “substantial rate cut” at the September meeting. Milan has stated that he will act independently, but his swift confirmation undoubtedly reflects the impact of political pressure on the Fed’s operations.

Cook’s dismissal controversy

Trump has publicly stated his desire for a Republican majority on the Federal Reserve Board and set a precedent by attempting to fire Fed Governor Lisa Cook in late August. Although an appeals court temporarily blocked Trump’s firing order, allowing Cook to vote in this session, her position remains unresolved and litigation is ongoing.

These changes highlight the enormous challenges facing the Federal Reserve’s political independence. This means that any policy decision it makes will be politically shadowed, and for investors who rely on macroeconomic stability, this “noise” itself is a risk.

Summary: The market is waiting for signals, not decisions

A 25 basis point rate cut is already a market consensus. However, the real significance of this meeting lies in how it will set the tone for monetary policy in the final four months of 2025.

As BNY strategists put it, the Fed’s “dual mandate objectives are ‘under strain,'” and growing politicization is complicating the situation. Markets will be hanging on Powell’s every word for signals on portfolio allocations.

이 글은 인터넷에서 퍼왔습니다: Interest rate cuts are a foregone conclusion, but three major questions remain to be answeredRecommended Articles

Recently, a Web 3 soccer fantasy game called Football.Fun went viral after launching on Base. A KOL claimed he turned $100,000 into $200,000 in just five hours, and another 11 hours to turn $200,000 into $300,000, netting a $200,000 profit in less than a day. The wealth effect is so strong, what is the origin of Football.Fun? Project Introduction Football.Fun is positioned as an “on-chain fantasy sports platform,” fully deployed on Base. Players can own and freely trade football player tokens, build fantasy teams, and participate in competitions. Player cards can be traded on the AMM market like meme tokens. Users can open player card packs to acquire player shares and build teams. The system automatically calculates points based on real football matches and rewards outstanding player holders after the…