The Fed remains on hold, the market is calm, but on-chain data reveals unusual signals

원저자: BitpushNews

On Wednesday afternoon (June 18th) local time, the U.S. Federal Reserve (Fed) announced that it would maintain the benchmark interest rate at 4.25%-4.50%. This is the fourth consecutive meeting at which the Fed has remained on hold, which is in line with general market expectations.

The Fed said in a statement that although uncertainty about the economic outlook has eased, it is still at a high level. At the same time, the Fed lowered its forecast for US GDP growth in 2025 to 1.4%, but raised its inflation forecast to 3%. This shows that the Fed is still facing a dilemma between economic recovery and inflation control.

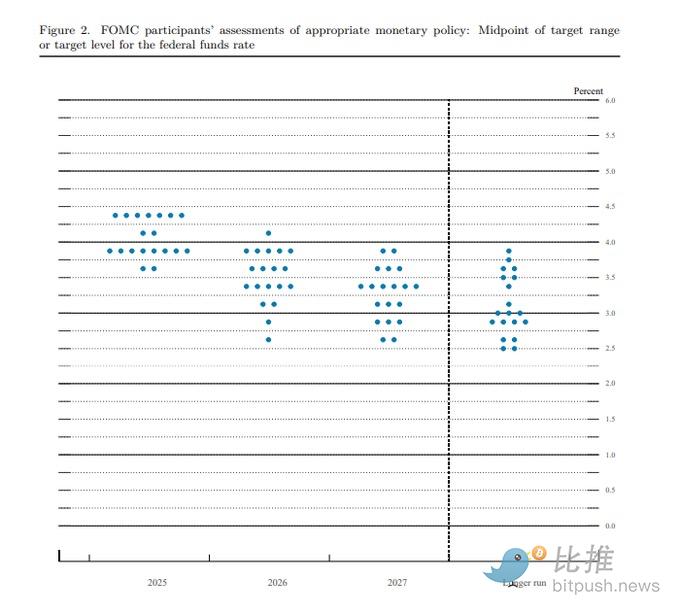

Expectations for rate cuts have also been adjusted: The Fed’s “dot plot” shows that while two rate cuts (50 basis points in total) are still expected in 2025, consistent with expectations in March, expectations for rate cuts in 2026 have been lowered from two to one (only 25 basis points). More notably, seven of the 19 Fed officials believe there will be no rate cuts at all in 2025, showing that there are still significant differences within the Fed on the future policy path.

Crypto market: Undercurrents surge beneath the calm surface

Although the Feds decision has a huge impact on the global financial market, the 암호화폐currency markets reaction seems somewhat Buddhist. Bitcoin (BTC) basically remains around $104,000, Ethereum (ETH) hovers around $2,520, and XRP and Solana are also basically flat.

According to CoinGlass data, although the total market value of the cryptocurrency market fell slightly by 2% to $3.35 trillion that day, leveraged liquidations of up to $224 million also occurred at the same time, with Ethereum having the largest liquidation volume, followed by Bitcoin. This shows that the long-short game within the market is still fierce.

It is worth mentioning that the US spot Bitcoin ETF recorded a net inflow of US$216 million on June 17, while the spot Ethereum ETF also inflowed US$11 million. This shows that institutional funds are still continuing to enter the crypto market, forming support for the bottom.

시장 experts believe that this calm reaction reflects investors cautious sentiment after the Feds decision, and everyone is waiting for clearer macroeconomic signals.

Trump criticizes Powell again: political factors mixed with market judgment

Interestingly, on the day of the Fed meeting, Trump once again publicly blasted Fed Chairman Jerome Powell, calling him stupid and predicting that the Fed would not cut interest rates today. Trump has long criticized Powell, accusing his policies of losing the country a lot of money. He believes that Europe has cut interest rates 10 times, while the United States has not cut once, and questioned Powells political stance.

Although this kind of political speech has attracted attention, it has not had a direct and huge impact on the crypto market at present. The market seems to be more concerned about the economic data itself.

The global situation is tense, why is the crypto market calm?

Ray Yossef, CEO of NoOnes, noted that cryptocurrency prices have barely moved over the past week despite heightened tensions in the Middle East and a volatile macro environment.

He explained that Bitcoin remains stable in a narrow range around $105,000, with daily volatility below 2.1% and no major panic selling.

Ray Yossef also warned that escalating macro risks cannot be ignored. He stressed: If geopolitical tensions escalate or begin to affect the financial system through sanctions, infrastructure disruptions or capital controls, the crypto market will not be immune. He noted that Bitcoins market dominance rate is close to 66%, indicating that in the current environment, investors risk appetite for altcoins is decreasing.

On-chain data reveals: Bitcoin scarcity is increasing

In addition to prices and macroeconomics, on-chain data also provides interesting perspectives.

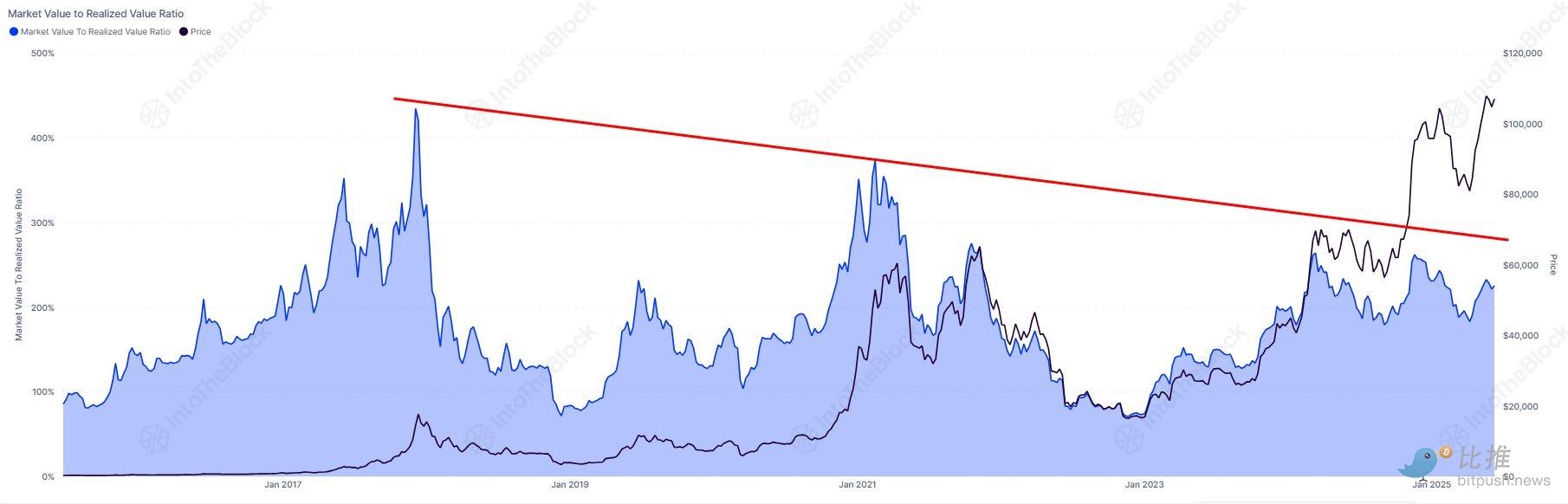

According to data from institutional DeFi solutions provider Sentora (formerly IntoTheBlock), Bitcoins market value to realized value ratio (MVRV Ratio) is currently still below its historical market peak.

The MVRV Ratio is an indicator that measures the total market value of Bitcoin to the total value of all Bitcoins when they were last moved on the chain (i.e., realized value). It reflects whether investors in the entire network are making a profit or loss as a whole.

Data shows that extreme peaks in Bitcoins MVRV Ratio have historically coincided with tops in asset prices, because when the MVRV value is high, the average investor holds a substantial profit and is more inclined to take profits. However, Bitcoins current MVRV Ratio is 2.25, and although the market value is more than twice the realized value, this value is significantly lower than past cyclical tops. This means that the market is not yet as overheated as before, and Bitcoin still has potential room to rise.

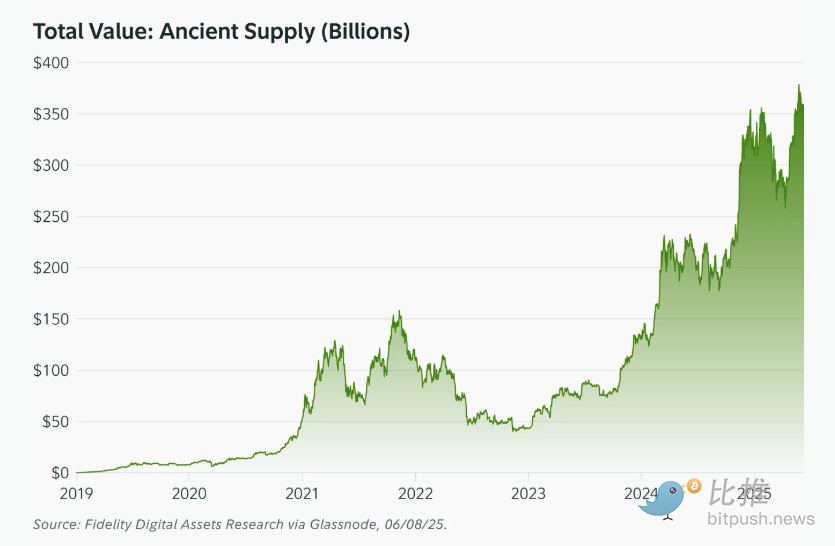

Fidelity Digital Assets’ June 18 research note noted that Bitcoin’s “Ancient Supply” is growing faster than the daily issuance of new Bitcoins.

“Ancient supply” refers to Bitcoin that has not been moved for at least ten years. Since April 2024, an average of 566 Bitcoins have entered the “ten years and above” unused queue every day, which exceeds the 450 Bitcoins added to circulation by miners every day. This happened less than a year after the 2024 block reward halving, which cut the issuance in half and completely changed the supply dynamics of Bitcoin.

The “ancient supply” currently accounts for more than 17% of all mined 비트코인s, worth about $360 billion. Although Satoshi Nakamoto holds 33% of it and some bitcoins may be lost forever, analysts point out that any coin may be put back into use.

Fidelitys report also mentions the HODL rate (i.e., old supply inflow minus new issuance). This indicator turned positive in April 2024, with an average increase of 116 bitcoins per day, further confirming that core holders are absorbing circulating bitcoins at a faster rate than miners produce them.

Fidelity predicts that based on current trends, by 2035, the old supply will exceed 30% of the circulating supply of Bitcoin. While this scarcity does not directly guarantee price increases (demand support is also required), the continued increase in Bitcoin controlled by long-term holders will tighten the number of Bitcoins available for traders to circulate, making price discovery increasingly dependent on marginal flows.

The report concluded that Bitcoin is now distinguished from commodities with elastic supply. Its scarcity, combined with factors such as long-term holding and lost tokens, is expected to increase over time. If demand grows in tandem in the future, this feature may reshape its value discovery logic and become a core advantage that distinguishes it from other assets.

This article is sourced from the internet: The Fed remains on hold, the market is calm, but on-chain data reveals unusual signals

Related: BTC Volatility Weekly Review (May 5-May 12)

Key metrics: (May 5, 4pm -> May 12, 4pm Hong Kong time) BTC/USD rose 10.7% ($94.7k -> $104.8k), ETH/USD rose 39.2% ($1,825 -> $2,540) The market tested the $99-100k resistance area and successfully broke through, taking us to $101-110k with surprisingly little resistance. Overall, while the weekly gain is decent (10.7%), realized volatility is low as there are sellers above the price from profit taking and hedging of long Gamma positions, and price action is very orderly on the way up. The market has risen nearly 40% from a low of $74-75k in a month, which is quite impressive. It also confirms that we are entering the final stage of the trend since September last year. We currently expect the market to consolidate between $92-106k in the next few weeks,…