Funding Rate is regarded by many industry insiders as one of the most revolutionary mechanisms in the 暗号 derivatives market. As the market mechanism continues to mature, the funding rate itself is quietly recording the profound changes in market behavior from extensive to sophisticated.

The XBTUSD perpetual contract launched by BitMEX in 2016 is the longest-lived and most complete Bitcoin perpetual contract in the crypto industry today. This article systematically analyzes funding rate data from May 2016 to May 2025, attempting to reveal how funding rates have gradually evolved from early violent fluctuations to todays institutional-level stability, with a special focus on the significant convergence during the 2024-2025 bull market.

Basic concepts of perpetual contracts and funding rates

Perpetual contracts were first created by BitMEX. They broke the limitation that traditional futures must be settled on a certain expiration date, and therefore quickly became a core product for crypto derivatives trading. In order to ensure that the trading price of perpetual contracts remains highly consistent with the spot price, the designer introduced a funding rate mechanism: in each fixed billing cycle, if the contract price is higher than the spot price, long position holders must pay a funding rate to short position holders; and vice versa. When the funding rate is positive, market sentiment is generally considered to be bullish; when the funding rate is negative, it suggests that selling pressure is stronger. For this reason, the funding rate is not only an important source of income for arbitrageurs, but is also regarded as a barometer that reflects market sentiment in real time.

This article provides an in-depth analysis of XBTUSD’s funding rate evolution over the past 9 years. Our key findings show a clear shift from previous high volatility to unprecedented stability for XBTUSD, even as Bitcoin reaches an all-time high of over $100,000 in the 2024-2025 market cycle.

Panorama of nine-year evolution: from barbaric to institutionalized

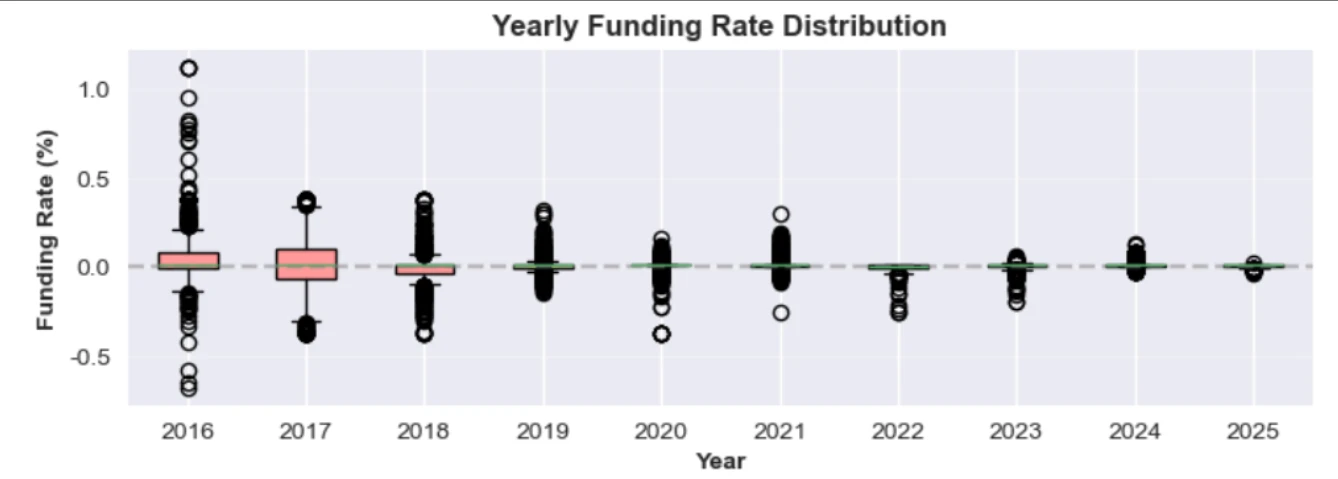

Figure 1

Looking at the nine-year data, we found that the frequency of extreme funding rate events has dropped by 90% compared to the historical peak, while the annualized volatility has been compressed to a narrow range of plus or minus 10%. Such stability is unprecedented in the history of Bitcoin derivatives.

This nearly decade-long transition can be broken down into three distinct phases that shaped today’s funding rate landscape:

Phase 1: Wild West Era (2016-2018)

During the first 2 years of its debut (2016-2018), data shows that the funding rate market was characterized by extreme inefficiencies and alarming volatility. Figure 1 shows the dramatic contrast between XBTUSD’s early and current funding rate behavior:

-

Funding rates often exceed ± 0.3%, which is equivalent to an annualized rate of more than ± 1000%

-

The 2017 bull run saw the highest concentration of extreme events in Bitcoin history

-

In 2017 alone, more than 250 extreme funding events were recorded, representing an almost daily occurrence of market inefficiencies.

-

Extreme funding periods last for 6-8+ intervals (2-3 days), indicating persistent market inefficiency

Phase II: Gradual Maturity (2018-2024)

During the 2018-2024 period, the XBTUSD funding rate market begins to correct itself:

-

Annual extreme events decreased significantly from more than 250 in 2017 to about 130 in 2019

-

Funding rate distribution gradually compresses to the normal range

-

Key market shocks such as COVID-19, LUNA and FTX crashes triggered notable volatility, albeit at a lower frequency

Phase 3: Giants enter the market (2024 to present)

Two key developments in early 2024 have reデフィned the market landscape:

January 2024: Bitcoin ETF Launches

-

Institutional arbitrage interest surges as spot ETFs enable large-scale spot-futures arbitrage trading

-

ETFs anchor contract prices more closely to spot prices, compressing funding rates and eliminating significant arbitrage spreads

February 2024: Ethena protocol launch

-

Ethena introduced systemic funding rate arbitrage via synthetic stablecoins, gaining massive adoption ($4B+ TVL)

-

The influx of institutional and retail arbitrage funds into the arbitrage market has pushed the funding rate further closer to zero.

The legendary benefits of rate arbitrage

Understanding this evolution may be fascinating only from an academic perspective, but traders only care about one thing: profit. What have the historical returns been like for BitMEX traders who have participated in funding rate arbitrage strategies?

To answer this question, we performed a comprehensive backtest analysis covering the entire 9-year history of XBTUSD funding rate data. The results revealed a shocking fact about Bitcoin funding rates: a simple $100,000 investment in funding rate arbitrage in 2016 would have turned into $8 million today.

Figure 2 shows a comparison of cumulative profits between funding rate arbitrage (green) and simple Bitcoin holding (orange) from 2016 to date. While the market is often busy chasing Bitcoin’s wild price swings, funding rate arbitrage opportunities offer one of the best risk/reward profits. The strategy has delivered an astounding 873% annualized return with a perfect record – no losing years, no major drawdowns, just consistent profit accumulation, turning a modest six-figure investment into generational wealth.

BitMEX’s Bitcoin Payment Multiplier Effect

BitMEX pays funding rates in Bitcoin rather than USD stablecoins, which creates a wealth multiplier opportunity for arbitrageurs. Any funding payment received in 2016 at $500 Bitcoin will be worth 200x in 2024 when Bitcoin reaches $100,000.

If BitMEX paid out funds in USDT like other exchanges, the $8 million profit would be closer to $800,000 — still impressive, but nowhere near the compounding effect created by Bitcoin payments, which has made arbitrage one of the most profitable strategies in cryptocurrency history.

Figure 2

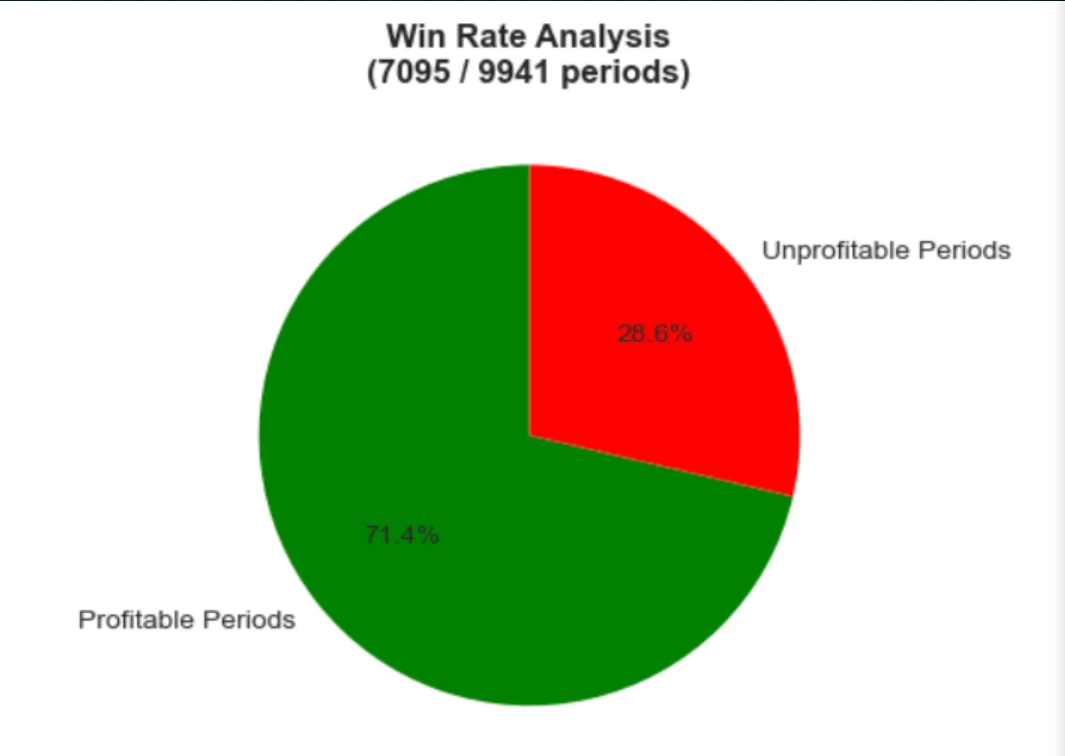

Figure 3

Figure 3 breaks down the risk-adjusted metrics and reveals why funding rate arbitrage achieves such impressive results. In 9,941 funding cycles, XBTUSD had a positive funding rate 71.4% of the time, meaning that approximately 3 out of every 4 funding cycles were profitable.

While these historical returns paint a picture that is almost too good to be true, experienced traders know that past performance rarely predicts future results – especially when market structure changes fundamentally.

This paints a good picture for the current state of the funding rate. Many have noted that its excess opportunities seem to be disappearing. Despite Bitcoin breaking its all-time high in 2024, the funding rate refuses to surge.

Given market developments and Bitcoin’s increasing entrenchment, the lack of high funding rates creates a key question for basis traders, yield farmers, and Ethena YT/sUSDe holders: Are funding rates a thing of the past?

Funding squeeze: Where did the disappearing high fees go?

Compared with the bull markets in 2017 and 2021, the funding rate when Bitcoin hit a new high in 2024-2025 was unusually calm: the highest peak was only 0.1308%, which was not only lower than the half peak of the past few rounds of market conditions, but was also often wiped out in an instant after it appeared. From the data, the average rate is only 0.0173%, which is far lower than the psychological expectations of many traders.

Figure 4

Previous bull market performance

-

2017 bull market: Funding rates often exceeded 0.2%, with peaks exceeding 0.3%

-

The first peak in 2021: the continuous rate is about 0.2-0.3% for several weeks

-

Second peak in 2021: still reaching 0.07-0.1% during the uptrend

The disappointing reality of 2024

-

Maximum fee rate: 0.1308% (less than half of previous bull markets)

-

Sustained high rates: Almost non-existent

-

Average Fee Rate: 0.0173% (despite Bitcoin price reaching $70k+)

Figure 4 clearly visualizes this shift – how most funding rates are now tightly clustered around the zero line, with far fewer extreme outliers, compared to historical periods.

This leaves arbitrage traders questioning their future profitability, or yield-generating protocols wondering if “funding rate alpha” has disappeared.

So what explains this behavior? Two main theories attempt to explain why the funding rate gold mine appears to be drying up:

Theory 1: Institutional Intrusion

Large-scale institutional and DeFi arbitrage capital quickly neutralizes funding bias.

ETF launches and protocols like Ethena are rapidly correcting funding anomalies, leading to market saturation and a rapid return to neutral funding rates.

Theory 2: Efficiency Revolution

市場 structure has permanently evolved towards institutional-grade efficiency.

Improved market depth, liquidity and cross-market arbitrage have eliminated persistent extreme events.

The Current State of Funding Rates: What the Data Reveals

Before declaring the death of capital arbitrage, our analysis uncovered three interesting findings:

Finding 1: High funding rates are short-lived

Comparison of 2024 vs 2021 bull run at $53,000 Bitcoin:

High funding rates still occur, but they are more brief and predictable. The opportunity has not disappeared – it has evolved.

Finding 2: Funding rate opportunities still exist after ETFs

Contrary to the “saturation” theory, Bitcoin’s ETF approval actually increased funding rates in the first 3 months, suggesting that funding rates may persist amid more institutional arbitrage.

-

Pre-ETF period: October 2023-January 2024 (0.011% average)

-

Post-ETF period: January 2024-March 2024 (0.018% average)

-

Net Impact: +69% funding rate increase

Institutional adoption creates systemic demand imbalances, generating consistent (if smaller) arbitrage opportunities.

Finding 3: Sustained Positive Funding Rates

Figure 5

As shown in Figure 5, funding rates have remained positive despite increased institutional participation and the introduction of major basis trading opportunities such as Bitcoin ETFs and DeFi protocols.

This suggests that the market has found a new equilibrium – one where sustained positive funding rates coexist with complex arbitrage activity. While the magnitude of these rates is more modest than in previous cycles, their stability and persistence demonstrate the markets acceptance of this new normal.

The end or a new beginning?

After nine years of evolution, Bitcoin funding rates have transformed from a speculative roller coaster to an institutional pendulum. The basis trading brought by spot ETFs and the system arbitrage of DeFi protocols such as Ethena have jointly built a deeper, more stable and more efficient derivatives ecosystem. Although the Wild West era has been dusted, funding rate arbitrage has not gone extinct – it has just entered a new era with high-speed execution, sophisticated risk control and cross-institution integration as the core.

For traders who still hope to obtain excess returns through funding rates, the real competitive advantage is no longer the courage to blindly withstand high volatility, but the comprehensive polishing of infrastructure speed, capital efficiency and strategy iteration capabilities. Only in this way can we continue to discover our own Alpha in the increasingly institutionalized ocean.

This article is sourced from the internet: BitMEX Alpha: Evolution of Funding Rates

1. Popular currencies on CEX CEX top 10 trading volume and 24-hour rise and fall: BNB: -0.78% BTC: 1.44% ETH: 4.24% SOL: 1.87% DOGE: 3.09% PEPE: 5.16% NEIRO: 55.85% PNUT: 14.79% TRUMP: 0.84% XRP: 0.25% SUI: 2.71% 24 H increase list (data source: OKX): BOME: 13.24% GODS: 10.54% RADAR: 8.77% MEMEFI: 6.02% SLERF: 5.70% ELON: 4.59% FLM: 4.20% X: 4.09% ZBCN: 3.51% AIDOGE: 3.13% 2. Top 5 popular memes on the chain (data source: GMGN ): MOONUT POPCAT Fartcoin REVS DISTRIBUTE 3. 24-hour hot search currencies LAUNCHCOIN: A meme coin on the Solana chain, it belongs to the Believe App ecosystem and was founded by social celebrity Ben Pasternak. The core function of its corresponding platform Launch Coin ( @launchcoin ) is to quickly deploy smart contracts on the X…