10 Questions for xStocks: What are we trading when we trade US stock tokens?

オリジナル | Odaily Planet Daily ( @OdailyChina )

著者: ウェンザー ( @ウェンサー 2010 )

After launching the tokenized Coinbase U.S. stocks in March, RWA asset issuer Backed has come up with a new idea – this time they chose to launch the U.S. stock tokenized asset trading platform xStocks in conjunction with the U.S. 暗号 exchange Kraken. As a pioneer in the U.S. stock tokenization market, xStocks has ignited the enthusiasm for cooperation in the crypto market in just two days. In addition to Kraken, Bybit, Raydium, Solflare, Kamino, Jupiter, Chainlink, AlchemyPay and other crypto platforms and projects have joined its alliance camp, and GMGN, Backpack and other platforms have also launched some U.S. stock token trading windows. Many people believe that this move may sound the clarion call for crypto assets to counterattack the U.S. stock market.

But in contrast, a series of problems followed. Can the tokens purchased by users on the xStocks platform be redeemed for US stocks? How is the price anchored? What is the specific fee? Does the purchase of US stock tokens have dividend rights or voting rights? My colleague Asher used GMGN to speculate on some US stock tokens today (for details, see I speculated on US stocks on the chain, and my mentality was floating on the first day ) , and encountered many detailed problems in the actual test. Although I can understand the general principle, according to the discussion of the Odaily Planet Daily reporter team, the specific practice still needs further verification and observation. In view of this, we have compiled a QA list for readers reference, and we also welcome everyone to leave a message to discuss related issues or point out errors.

Q1: What US stock tokens are currently supported by xStocks?

によると the xStocks official website , the U.S. stocks currently supported by the platform include:

Nvidia, Coinbase, Circle, Berkshire Hathaway, McDonalds, Chevrolet, Apple, Amazon, Mastercard, JPMorgan Chase, Meta (formerly Facebook), Tesla, Strategy, SP 500 and other 61 US stock tokens.

List of some US stock tokens

その 公式ウェブサイト , compared with traditional stock brokers, the US stock tokens issued by xStocks have the advantages of 7*24 hours trading (Chainlink provides price oracle support), free transferability, no transaction fees (only for Kraken channel), support for DeFi integration and ease of use.

Advantages at a glance

Q2: Does the token have a 1:1 real stock reserve corresponding to US stocks?

According to the existing information on the platform, xStocks does have corresponding 1:1 real stock reserves, but they are mainly managed by some cooperative custodians, so the authenticity of the information still needs to be verified.

によると Backed’s official website そして xStocks’ US stock token introduction , most US stock custodians include the following institutions:

-

Maerki Baumann Co. AG, a Swiss private bank, focuses on investment consulting and asset management, and also provides services to external asset managers. The company is headquartered in Zurich and was founded in 1932. In addition to traditional private banking services, Maerki Baumann also provides sustainable investment solutions, professional consulting, personalized services, and indirect real estate investment. In addition, the company also cooperates with Bitcoin Suisse Ltd., a leading Swiss crypto financial service provider.

-

InCore Bank AG, a B2B transaction bank headquartered in Zurich-Schlieren, Switzerland, focusing on traditional and digital assets, was founded in 2007 and is a regulated bank supervised by the Swiss Financial 市場 Supervisory Authority (FINMA).

-

Alpaca Securities LLC is a US brokerage firm founded in 2015. Its official X-platform account is @AlpacaHQ .

As for the redemption mechanism of many US stock tokens, according to the information on the product page, the fund currently does not charge management fees, and may introduce a management fee of up to 0.25% per year in the future; when buying and redeeming, the maximum is 0.50% of the users investment value; the redemption amount is based on the market price of the stock (reference source: Nasdaq, https://finance.yah oo.com ), minus up to 0.5% investor fees (minimum US$100) , and the amount will be adjusted due to management fees, foreign exchange hedging errors, currency conversion, etc.

In addition, crypto KOL @_FORAB previously published an article analyzing the principle behind the circulation of xStocks coins and stocks , saying that (the tokenization of US stocks is mainly) controlled by the parent company registered in Switzerland, which controls Backed Assets in Jersey. They buy stocks in the US stock market through the channel of IBKR Prime under Interactive Brokers, and then transfer them to a segregated account under Clearstream. Clearstream is the depository under the Deutsche Börse, helping them to store these stocks. When the above purchase, transfer, and deposit operations are completed, the contract deployed on the Solana chain will be triggered, corresponding to the issuance of stock tokens, that is, for every 1,000 shares of Tesla stock purchased and stored, 1,000 TSLAx tokens will be minted on the chain at a 1:1 ratio.

Q3: Which platforms are xStocks’ crypto partners?

According to the information released by xStocks official account and Backed official X platform account, its crypto partners include the following platforms and projects:

-

CEX: Kraken, Bybit (Byreal) , Crypto.com

-

Solana Ecology: Raydium, Kamino, Jupiter

-

Oracle: 金網

-

Payment platform: AlchemyPay

-

Other support channels: backpack, GMGN

Official release of partner information

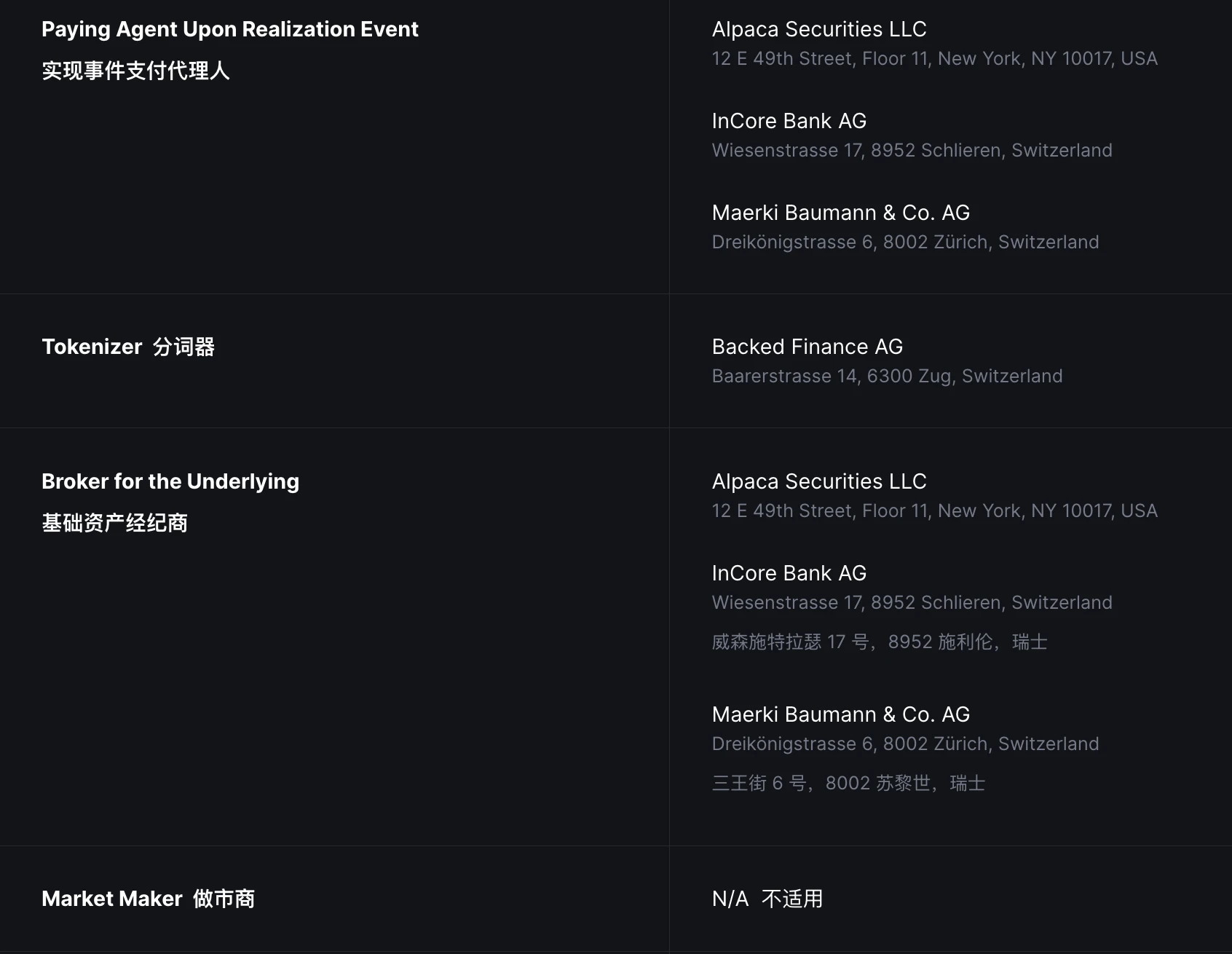

Q 4: Which service providers provide the corresponding services for x Stocks U.S. stock tokenization services?

Specifically, these US stock tokens are all issued and put on the chain by the issuer Backed, and the corresponding stock custodians are the US brokerage firm and two Swiss companies (banks) introduced above . In addition, they also include security agents and authorized participants.

It is worth noting that perhaps because the U.S. stock tokenized asset market is still in its early stages, xStocks does not currently have a market maker role.

Information source: https://assets.backed.fi/legal-documentation/service-providers

Q5 : Which countries and regions are included in the areas where xStocks and Backed platform services are disabled?

によると the guidance information on Backed’s official website , the platform does not serve high-risk jurisdictions such as Iran, North Korea, Syria, and the United States.

In addition, it emphasized: Backed will not sell its tokens to U.S. persons, nor will it sell tokens for the account or benefit of U.S. persons, and the tokens will not be promoted, offered or solicited in the United States.

It can be seen that although it is engaged in the business of tokenizing U.S. stocks, it still stays away from the U.S. judicial system to avoid the risk of unregistered securities brought by the Mirror Protocol launched by Terra.

Q6 : Does holding US stock tokens entitle you to voting rights or dividends on the corresponding assets?

具体的には、 no.

ソース: https://assets.backed.fi/terms-of-service

In addition, xStocks’ US stock token-related buying and selling operations do not require KYC, but according to the guidance document information , individual users or corporate users related to the Backed platform must complete KYC before logging into the platform to participate in transactions.

Q7 : What are the arbitrage opportunities for Crypto Native people?

At present, in addition to enjoying the volatility of U.S. stocks by buying low and selling high, crypto investors can also gain returns by becoming LPs and other means.

In addition, due to factors such as liquidity and trading time difference, there is often a price difference between stock tokens and real stocks. It is recommended to read the article A Quick Look at 5 Arbitrage Opportunities under Coin-Stock Parallelism , which also provides references for time zone arbitrage, cross-market arbitrage, event-driven arbitrage, etc.

It is worth noting that since the LP pools corresponding to the platforms connected to xStocks are common, the opportunities for price arbitrage between these platforms are relatively small.

Q8 : If liquidity continues to be insufficient, will xStocks introduce new market-making mechanisms and market makers in the future?

At present, the authorities have not given any further information, and representative figures in the crypto market industry have different opinions.

Jupiter co-founder Siong 書いた classic AMM is not suitable for stock tokens and a new AMM design is needed to achieve higher liquidity. Ordinary trading terminals are also not suitable, and there will be problems such as market value mismatch.

Yu Xian, founder of security company SlowMist, also 書いた after the tokenization of stocks, the stock market has new ways of playing in cryptocurrencies, but also new risks in cryptocurrencies. If it becomes popular, there will be innovation and conflict between the old and new worlds, and you will be in me and I will be in you.

As for the specific risks, I personally think that perhaps we can get a glimpse of the stock tokenization attempts promoted by platforms such as Terra and FTX, including but not limited to regulatory risks, price manipulation risks, and short-term volatility risks.

Q9 : Are the team members of Backed, the development company behind xStocks, the original team of Rug project DAOStack?

Based on the information currently available, yes.

According to a previous article by crypto KOL @cryptobraveHQ, the team behind xStocks is the original zero-return project DAOStack. According to the relevant information of Backed, the Israeli development company behind XStocks, its first three co-founders Adam Levi, Yehonatan Goldman, and Roberto Isaac Klein were all co-founders of DAOStack in their previous entrepreneurial experience in the cryptocurrency circle, and DAOStack basically stopped updating and operating in 2020. After its token GEN IC0 raised about 30 million US dollars, the team was too lazy to even go to a small exchange, and just let the token return to zero after issuing it. The DAOStack team then started a business @xStocksFi, which was mainly driven by investors such as Coinbase. The relevant information of Backed Company is also recorded in detail on the LinkedIn interface.

For more information about this inside story, please see: A Deep Dive into xStocks Developer Backed: The Zero Teams Second Venture and the Growth of the Music Production Management Project.

Q10 : Will Backed issue its own tokens?

The popularity of xStocks has also triggered market speculation about whether the company behind it, Backed, is planning to issue its own tokens. However, according to official documents, it has no plans to issue tokens.

ソース: https://docs.backed.fi/frequently-asked-questions

This article is sourced from the internet: 10 Questions for xStocks: What are we trading when we trade US stock tokens?

Original author: Frank, PANews In the first half of 2025, a relatively low-key track in the cryptocurrency world – the tokenization of real-world assets (RWA) – has seen a remarkable explosive growth. As of June 6, the total market value of the global RWA market has soared to US$23.39 billion (excluding stablecoins), a sharp jump of 48.9% from US$15.7 billion at the beginning of the year. Behind this growth, private credit (accounting for about 58%) and US Treasury bonds (accounting for about 31.2%) constitute the absolute dual core of the market, and the two together account for nearly 90% of the market share. However, behind this impressive report card lies deep-seated problems such as highly concentrated asset categories, limited liquidity, questionable transparency, and low correlation with the crypto-native ecosystem. RWA…