Sun.io: From TRON Ecosystem DEX to Global Stablecoin Trading Hub

Recently, stablecoins have set off a wave of enthusiasm in the financial market and have become a strategic location for mainstream financial institutions around the world to compete for layout. Countries are actively legislating to promote their compliance process and try to incorporate them into the traditional financial system. A fierce battle for the right to mint coins has already begun.

In the global stablecoin market, the total circulation of USDT issued by Tether exceeds 158.2 billion US dollars, accounting for more than 62% of the overall market share. The amount of USDT issued on the TRON network has exceeded 80 billion US dollars, accounting for more than 50% of the total USDT issuance for a long time. This means that 1 out of every 2 USDT in circulation on the market comes from the TRON network, making it a well-deserved stablecoin overlord.

Relying on TRONs core position in the global stablecoin field, Sun.io, as the largest one-stop financial trading center in the TRON ecosystem, has attracted the attention of global stablecoin traders. Through a diversified product matrix including the DEX platform SunSwap, the stablecoin trading tool SunCurve and PSM, and the Meme issuance tool SunPump, it has successfully aggregated the core traffic of the ecosystem and is expected to become the worlds largest stablecoin trading hub.

Among them, SunSwap supports the free circulation of stablecoins as basic assets in the on-chain ecosystem, providing a wide range of stablecoin transactions.

Tools such as SunCurve and PSM, which focus on stablecoin transactions, provide low slippage and accurate stablecoin exchange services, which can meet the large-scale transaction needs of institutions.

With these advantages, Sun.io is undergoing a magnificent transformation, gradually upgrading from a DEX within the TRON ecosystem to a core hub for global stablecoin transactions, redefining the boundaries of DEX.

Diversified product matrix builds a one-stop financial transaction center

In the prosperous ecosystem of TRON, Sun.io has grown into a comprehensive one-stop financial service hub that covers the entire life cycle of assets and has complete functions. Through the coordinated operation of three core engines, including the asset trading platform SunSwap, the stablecoin trading product SunCurve and PSM, and the Meme issuance tool SunPump, Sun.io has built a full-link closed-loop service system of asset issuance-transaction matching-value-added, becoming the core hub for traffic aggregation and value circulation in the TRON ecosystem.

Asset Trading Engine SunSwap

SunSwap mainly provides asset exchange services. Its operating mechanism is similar to Uniswap, using the AMM model and constant product formula to determine the price of assets.

Currently, SunSwap products have gone through three versions of iterative upgrades: V1, V2, and V3. The latest version V3 supports a dynamic fee mechanism, that is, liquidity providers (LPs) can provide funds within a specific price range and set different fee rates. Currently, it supports four fee rates of 0.01% -0.05% -0.3% -1%, which can adapt to token assets of different risk levels and meet the needs of different trading characteristics.

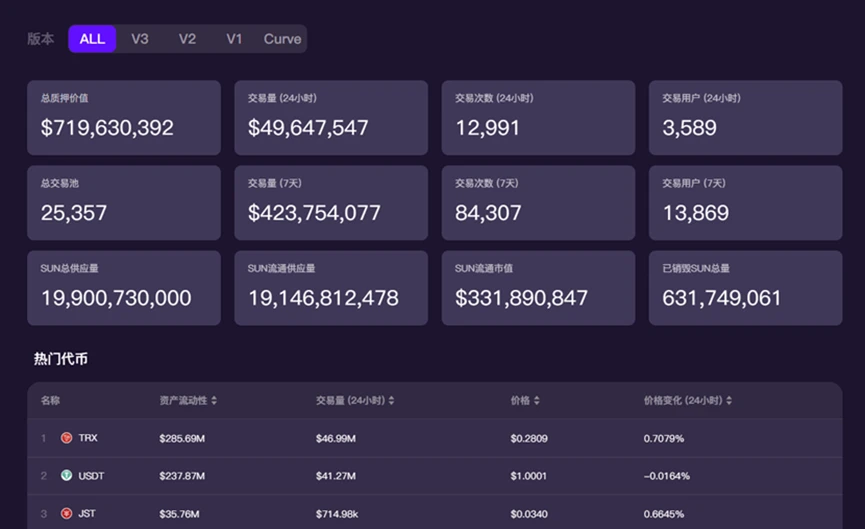

According to official data, on July 2, the value of crypto assets locked in the SunSwap fund pool was about 715 million US dollars. Among them, the number of fund pools created on SunSwap has exceeded 25,000, the transaction volume processed in the past 7 days exceeded 400 million US dollars, the number of transactions occurred was as high as more than 84,000, and the number of trading users exceeded 13,800. Among them, the most actively traded assets are TRX and USDT, with a trading volume of more than 4,000 US dollars in 24 hours.

Stablecoin trading engine: SunCurve and PSM

SunCurve and PSM focus on stablecoin transactions. The former SunCurve has a similar working mechanism to Curve, mainly providing users with low-fee (0.04% per transaction fee) and low-slippage stablecoin exchange services, supporting the mutual exchange of stablecoins such as USDD, USDT, TUSD, and USDC; the latter PSM is a stablecoin exchange swap tool launched by TRON DAO specifically for the stablecoin USDD, supporting users to exchange USDD with stablecoins such as USDT/USDC/TUSD at a fixed ratio of 1:1, and the transaction process has 0 slippage and 0 fees. It is currently the main place for USDD to exchange stablecoins.

Meme coin issuance engine SunPump

SunPump is the first Meme coin issuance platform in the TRON ecosystem launched by Sun.io. It supports users to create and issue their own exclusive Meme coins with one click. Each issuance only requires a creation fee of about 20 TRX (about 5 US dollars). On June 27, the market value of the Meme coin CSI on SunPump once exceeded 10 million US dollars, with a single-day increase of more than 800%, becoming a new wealth code hotly discussed in the crypto community.

In addition, SunGenX, an AI coin issuance tool launched for the X platform, supports users to issue coins by tweeting. Users only need to tag @Agent_SunGenX on the X platform to directly deploy Meme coins to the SunPump platform.

In summary, in the Sun.io product matrix, the three engines of SunSwap, SunCurve/PSM, and SunPump are mainly used to drive the efficient circulation of funds in the ecosystem, creating a one-stop financial experience for users. Among them, the DEX platform SunSwap provides asset exchange transactions and liquidity mining services, allowing users to easily realize the free exchange of assets and earn lucrative returns by providing liquidity (LP); SunCurve and PSM exchange tools specially designed for stablecoin transactions provide guarantees for low-slippage transactions of stablecoins, ensuring stable value transmission and maintaining market balance; the innovative Meme asset issuance platform SunPump accurately covers emerging assets in long-tail traffic, stimulating the communitys continuous innovation vitality. The three engines work together to inject continuous power into the Sun.io ecosystem.

This diversified layout enables Sun.io to provide users with a one-stop asset issuance, trading and value-added solution. Users no longer need to operate across multiple platforms. They can easily complete the entire process from asset creation, large-scale stablecoin exchange to value enhancement on one platform, Sun.io. This greatly improves the user experience and operational efficiency, making on-chain transactions more convenient and efficient.

Compared with general DEXs such as Uniswap and PanCakeSwap, Sun.io has redefined the boundaries of DEX through a combination of diversified product matrices, embarked on a differentiated development path, and demonstrated unique competitive advantages.

More than 600 million SUN tokens have been destroyed, and TVL ranks among the top five DEXs in the world

The ecological value of Sun.io lies not only in its perfect product matrix, but also in the double moat built by its unique token economic model and strong capital accumulation ability. As the governance token of the Sun.io platform, the SUN token is gradually moving towards deflation by virtue of its continuous repurchase and destruction mechanism; at the same time, the TVL (total locked value) of the Sun.io platform has long been ranked among the top five in the global DEX market, providing a solid foundation for the stable operation and development of the platform.

SUN tokens are used throughout SunSwap, SunCurve/PSM, SunPump and other product matrices, with rich and diverse application scenarios. It is not only the core tool for platform governance, providing rewards for liquidity providers, but also continuously empowering token holders through a repurchase and destruction mechanism.

On July 2, SunPump released the second announcement of All SunPump Revenues Will Be Used to Repurchase and Destroy SUN. Starting from September 4, 2024, all revenues of the SunPump platform will be invested in the repurchase and destruction of SUN tokens. A total of 124 million SUNs will be destroyed in this period, and all have been transferred to the black hole address. So far, the number of SUN tokens used for repurchase and destruction through SunPump revenue has exceeded 285 million.

In addition, the 0.05% handling fee generated by each transaction of SunSwap V2 is also used for the repurchase and destruction of SUN tokens, and the SUN team has publicly disclosed 43 periods of related destruction data.

According to the latest disclosed data, as of July 2, the number of SUN destroyed has exceeded 600 million (specifically about 632 million), accounting for more than 3% of the total supply of SUN (about 19 billion). Among them, the number of SUN destroyed through SunSwap V2 revenue repurchase is about 345 million, and the number of SUN tokens destroyed through SunPump revenue repurchase is 285 million.

This continuous repurchase and destruction mechanism effectively reduces the circulating supply of SUN tokens. Since the total supply of SUN remains unchanged, as the number of SUNs destroyed increases, the amount flowing into the market will also decrease, thus automatically causing deflation. According to Coingeck data, the current price of SUN tokens is only $0.017, an increase of more than 50% in the past year.

The competitiveness of the SUN.io platform in the DEX track can be seen from the TVL data. According to DeFiLlama data, as of July 2, the TVL of the Sun.io platform exceeded US$970 million, ranking among the top five in the entire DEX market for a long time.

TVL not only reflects the value of the crypto assets locked up on the platform, but is also an important indicator for measuring the scale and market influence of the platform. A high TVL means that a large number of users and assets are pledged and traded on the Sun.io platform, which reflects the users high trust and recognition of the platform. At the same time, a high TVL also has a strong appeal, which can drive more users and funds to flow into the platform, forming a virtuous circle and further consolidating Sun.ios leading position in the DEX market.

From TRON Ecosystem DEX to Global Stablecoin Trading Hub

In TRONs on-chain financial landscape, Sun.io, with its full-stack product layout, allows users to easily complete the entire process from asset creation to transaction value-added on just one platform, becoming a traffic aggregator for the TRON ecosystem.

On the asset issuance side, Sun.io has the Meme platforms SunPump and SunSwap, which can significantly lower the threshold for cold-start projects and provide a stage for rapid growth for many innovative projects. On the transaction matching side, SunSwap, SunCurve, PSM, etc. provide billion-level deep support. SunPump will serve as an emerging traffic portal, actively guiding assets to be traded on SunSwap and accumulating added value in the LP pool, further enhancing the markets activity and liquidity.

Sun.io is not only the core source of liquidity in the TRON ecosystem, but also plays an indispensable role as a coordinator in the ecosystem. It is like a precision-operating central system. On the one hand, it efficiently connects buyers and sellers, provides a smooth channel for transactions to be accurately connected, and ensures that every transaction can be completed quickly and accurately; on the other hand, as a key entry point for project cold start and asset issuance, it can accurately guide the liquidity of new assets, find suitable trading opportunities for each project and asset, and become a central hub that precisely connects assets, projects, and users. In this way, Sun.io continues to drive the circulation of value and the cohesion of consensus in the TRON ecosystem, laying a solid user foundation for it as a stablecoin hub.

With the strategic upgrade of TRON and the entry of traditional capital, Sun.io is also accelerating its transition from an ecological DEX to a global stablecoin trading hub.

In the field of stablecoins, TRON has taken a multi-pronged approach to build a stablecoin matrix covering different scenarios. While consolidating the dominant position of USDT, it has actively adopted a multi-track parallel strategy of compliant stablecoins + decentralized stablecoins, continuously expanding its boundaries, and formed a multi-line layout of USDT+USDD+USD1.

As of July 3, TRONs USDT issuance volume reached 80.7 billion US dollars, an increase of more than 20 billion from the beginning of the year to date; the issuance volume of the native decentralized stablecoin USDD has exceeded 450 million US dollars; USD1, a compliant financial stablecoin supported by the Trump family, has also started minting on TRON.

In the traditional financial market, TRON has successfully entered Wall Street as a listed company, breaking the gap between traditional finance and the on-chain ecosystem. In mid-June, TRON entered the US stock market through a reverse merger with Nasdaq-listed SRM (SRM Entertainment), officially joining the ranks of the mainstream financial market. At the same time, the TRX Micro Strategy was launched simultaneously, incorporating TRX assets into the reserve assets of listed companies, allowing traditional financial institutions to indirectly allocate TRX through holding SRM. On June 30, SRM announced that it had pledged its 365 million TRX tokens on the chain through JustLend DAO, a lending platform for the TRON ecosystem. In addition, as the application results of the TRX ETF approach, TRON is expected to leverage tens of billions of dollars of incremental new funds into its ecosystem.

With the dual support of the stablecoin scale of hundreds of billions and the listing bonus, Sun.io will become a beneficiary of the TRON ecosystem. Institutional funds have a strong demand for low slippage and large-scale transaction channels. With its billion-dollar depth, SunSwap will become the best place for institutional large-scale transactions; SunCurve will become the preferred platform for stablecoin exchange with its low fee rate of 0.04% and PSM exchange tool that supports the use of USDD to pay USDT, TUSD and other stablecoins at 1:1 with zero fees.

In addition, Sun.io s products can work in synergy with TRONs ecological applications to build a diversified income path. Taking the RWA product stUSDT as an example, users can obtain the RWA voucher token stUSDT by staking USDT. This voucher token can not only be freely exchanged for other stablecoins or various assets on SunSwap, but also easily earn fee income by providing relevant liquidity pool (LP) shares, realizing asset appreciation and flexible use. It can also be linked with the lending protocol JustLend DAO. Users can pledge stablecoins such as USDT and USDD to carry out asset lending business. The borrowed assets can be directly invested in the SunSwap liquidity pool, thus forming a triple cycle of deposit-lending-mining income, and the comprehensive annualized rate of return can reach more than 10%, bringing rich and stable returns to users.

With the deepening of diversified product layout and coordinated development of the ecosystem, Sun.io has broken the boundary restrictions of a single DEX and become a global stablecoin trading hub connecting traditional finance (TradFi) and decentralized finance (DeFi), the compliance field and the decentralized field, the real world and the on-chain world.

This article is sourced from the internet: Sun.io: From TRON Ecosystem DEX to Global Stablecoin Trading Hub

Original author: Mary Liu, Cody Feng The US inflation data in May showed a milder sign than expected, bringing positive signals to risk assets. Specifically, the unseasonally adjusted consumer price index (CPI) recorded an annual rate of 2.4%, lower than the markets general expectation of 2.5%; the monthly rate was only 0.1%, also lower than the expected 0.2%. Core inflation data (excluding volatile food and energy prices) also showed a similar slowdown trend: the annual rate was 2.8%, lower than the expected 2.9%; and the seasonally adjusted core CPI monthly rate was only 0.1%, significantly lower than the market expectation of 0.3%. After the report was released, the crypto market showed a trend of rising first and then falling. Bitcoin once approached $110,000 during the day, Ethereum (ETH) rose 3%…