Which Web2 businesses are more suitable for the rapid introduction of stablecoins?

Source: Josh Solesbury (ParaFi Investor)

Compiled by Odaily Planet Daily ( @OdailyChina ); Translated by Azuma ( @azuma_eth )

Stablecoin-related headlines have exploded in the past six months, catalyzed by Stripes acquisition of Bridge and progress on the GENIUS Act. From CEOs of major banks to product managers at payment companies to senior government officials, key decision makers are increasingly mentioning stablecoins and touting their benefits.

Stablecoins are built on four core pillars:

-

Instant settlement (T+0, significantly reducing working capital requirements);

-

Very low transaction costs (especially compared to the SWIFT system);

-

Global accessibility (24/7, only an internet connection required);

-

Programmability (money driven by extensible encoded logic).

These pillars perfectly capture the advantages of stablecoins that are being touted in headlines, blog posts, and interviews. As a result, the “why stablecoins are needed” argument is easy to understand, but the “how to use stablecoins” is much more complex — whether it’s a fintech product manager or a bank CEO, there is currently very little content that specifically explains how to integrate stablecoins into existing business models.

Based on this, we decided to write this high-level guide to provide an introductory guide for non-crypto companies to explore the application of stablecoins. The following will be divided into four independent chapters, corresponding to different business models. Each chapter will analyze in detail: in which links stablecoins can create value, what is the specific implementation path, and the schematic diagram of the transformed product architecture.

At the end of the day, headlines are important, but what we are really after is the mass adoption of stablecoins — the scaled use of stablecoins in real business scenarios. Hopefully, this article will be a small stepping stone to that vision. Now, let’s take a deeper look at how non-crypto companies are using stablecoins today.

To C Fintech Bank

For consumer-oriented (To C) digital banks, the key to improving enterprise value lies in optimizing the following three levers: user scale, revenue per user (ARPU), and user churn rate. Stablecoins can currently directly help the first two indicators – by integrating the infrastructure of partners, digital banks can launch stablecoin-based remittance services, which can not only reach new user groups, but also add revenue channels for existing customers.

With the two decades-long trends of digital interconnection and globalization, the target markets of today’s fintechs are often multinational in nature. Some digital banks position cross-border financial services as their core (such as Revolut or DolarApp), while others use it as a functional module to increase ARPU (such as Nubank or Lemon). For fintech startups focusing on expatriates and specific ethnic groups (such as Felix Pago or Abound), remittance services are a rigid demand of the target market. All of these types of digital banks will (or have) benefited from stablecoin remittances.

Compared to traditional remittance services (such as Western Union), stablecoins can achieve faster (instant arrival vs. 2-5 days or more) and cheaper (as low as 30 basis points vs. more than 300 basis points) settlement. For example, DolarApp only charges $3 to send US dollars to Mexico and the payment arrives in real time. This explains why in some remittance corridors (such as the US-Mexico corridor), the penetration rate of stablecoin payments has reached 10-20%, and the growth momentum continues.

In addition to creating new revenue, stablecoins can also optimize costs and user experience, especially as an internal settlement tool. Many practitioners are well aware of the pain points of weekend settlement: bank closures cause settlements to be delayed by two days. Digital banks that pursue real-time services and ultimate experience have to fill the gap by providing working capital credit, which not only generates opportunity costs for funds (especially heavy in the current interest rate environment), but may also force companies to raise additional funds. The instant settlement and global accessibility of stablecoins completely solve this problem. Robinhood, one of the worlds largest fintech platforms, is a typical case. Its CEO Vlad Tenev made it clear in the February 2025 earnings call: We are using stablecoins to handle a large number of weekend settlement businesses, and the scale of application continues to expand.

Therefore, it is not surprising that consumer-oriented fintech companies such as Revolut and Robinhood have deployed stablecoins. So, if you work in a consumer bank or fintech company, how can you use stablecoins?

After the stablecoin is introduced into this business model, the practical plan is as follows.

Real-time settlement around the clock

Use stablecoins such as USDC, USDT, USDG to achieve instant settlement (including holidays);

Integrate with wallet service provider/coordinator combination (such as Fireblocks or Bridge) to open up the USD/stablecoin flow between the banking system and the blockchain;

Connect with fiat currency channel service providers in specific regions (such as Yellow Card in Africa) to realize B2B/ B2B2C exchange between stablecoins and fiat currencies;

Filling the gap in fiat currency settlement

During the weekend, stablecoins will be used as a temporary substitute for fiat currency, and reconciliation will be completed after the banking system restarts;

It can work with suppliers such as Paxos to build an internal stablecoin settlement loop between customer accounts and enterprises;

The counterpartys funds are instantly available

Quickly transfer funds to exchanges/partners, bypassing the ACH/wire process, through the above schemes or liquidity partners;

Automatic rebalancing of multinational entities

When the fiat currency channel is closed, funds between business units/subsidiaries can be allocated through on-chain stablecoin transfers;

The headquarters can use this to establish an automated and scalable global fund management system;

In addition to these basic functions, we can also imagine a new generation of banks based entirely on the concept of all-weather, instant, and composable finance. Remittance and settlement are just the starting point, and subsequent scenarios such as programmable payment, cross-border asset management, and stock tokenization will also be derived. Such companies will win the market with their ultimate user experience, rich product matrix, and lower cost structure.

Commercial Banking and Corporate Services (B2B)

Currently, business owners in markets such as Nigeria, Indonesia, and Brazil must overcome numerous obstacles to open a dollar account in a local bank. Usually only companies with large transaction volumes or special relationships can qualify – and this is also based on the premise that the bank has sufficient dollar liquidity. Local currency accounts force entrepreneurs to bear both bank risk and government credit risk, and they have to keep a close eye on exchange rate fluctuations to maintain working capital. When paying overseas suppliers, business owners also have to pay high fees for converting local currency into mainstream currencies such as the US dollar.

Stablecoins can significantly ease these frictions, and forward-looking commercial banks will play a key role in their adoption. Through a bank-custodial compliant digital dollar platform (such as USDC or USDG), businesses can achieve:

-

Hold balances in multiple currencies without having to establish multiple banking relationships;

-

Cross-border invoice settlement in seconds (bypassing the traditional correspondent banking network);

-

Stablecoin deposits earn interest;

This allows commercial banks to upgrade basic checking accounts into global, multi-currency funds management solutions that provide speed, transparency and financial resilience that traditional accounts cannot match.

After the stablecoin is introduced into this business model, the practical plan is as follows.

Global USD/multi-currency account services

Banks host stablecoins for businesses through partners such as Fireblocks or Stripe-Bridge;

Reduce startup and operating costs (e.g., reduce license requirements, eliminate FBO accounts);

High-yield products backed by high-quality US bonds

Banks can offer returns at the level of the federal funds rate (about 4%) and have significantly lower credit risk than local banks (U.S. regulated money funds vs. local banks);

Need to connect to interest-bearing stablecoin providers (such as Paxos) or tokenized Treasury partners (such as Superstate/Securitize).

Real-time settlement around the clock

Please see the consumer finance sector plan above for details.

We are optimistic about the global application scenarios (stable currency platform/commercial banks can solve)

Importers pay for goods in US dollars in seconds, and overseas exporters release goods immediately;

Corporate financial officers can transfer funds across multiple countries in real time, eliminating the delays of the correspondent banking system, making it possible for banks to serve super-large multinational groups;

Business owners in high-inflation countries anchor their corporate balance sheets in U.S. dollars.

Product architecture example (stablecoin-based commercial banking services)

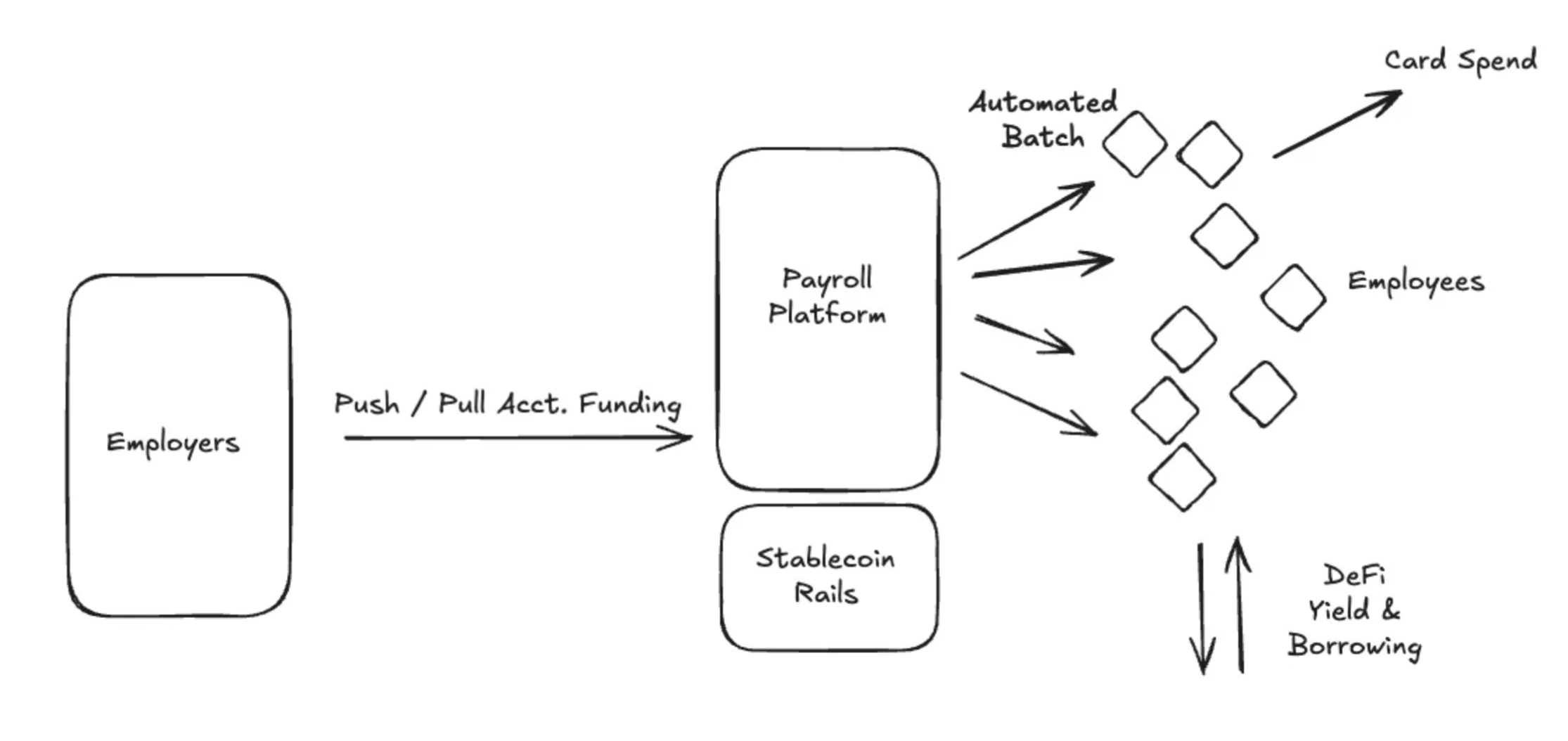

Payroll Service Provider

For payroll platforms, the greatest value of stablecoins lies in serving employers who need to pay employees in emerging markets. Cross-border payments, or payments in countries with underdeveloped financial infrastructure, will bring significant costs to payroll platforms – these costs are either absorbed by the platform itself, passed on to employers, or deducted from contractors remuneration. For payroll service providers, the most achievable opportunity is to open a stablecoin payment channel.

As described in the previous section, cross-border stablecoin transfers from the U.S. financial system to contractors’ digital wallets are virtually cost-free and instantaneous (depending on the configuration of the fiat currency entry). While contractors may still need to complete their own fiat conversions (which incur fees), they receive instant payments in the world’s strongest fiat currency. Multiple pieces of evidence suggest that demand for stablecoins is surging in emerging markets:

-

On average, users are willing to pay a premium of about 4.7% to obtain USD stablecoins;

-

In countries such as Argentina, this premium can be as high as 30%;

-

Stablecoins are increasingly popular among contractors and freelancers in regions such as Latin America;

-

Freelancer-focused apps like Airtm are seeing exponential growth in stablecoin usage and user growth;

-

More importantly, the user base has already been formed: in the past 12 months, more than 250 million digital wallets have actively used stablecoins, and more and more people are willing to accept stablecoin payments.

In addition to speed and end-user cost savings, stablecoins also have a number of benefits for corporate clients (i.e., paying customers) who use payroll services. First, stablecoins are significantly more transparent and customizable. According to a recent fintech survey, 66% of payroll professionals lack the tools to understand their actual costs with banks and payment partners. Fees are often opaque and processes are confusing. Second, the process of executing payroll payments today is often highly manual and drains finance department resources. In addition to the payment execution itself, there are a host of other considerations, from accounting to tax to bank reconciliation, and stablecoins are programmable and have a built-in ledger (blockchain), which significantly improves automation capabilities (such as batch scheduled payments) and accounting capabilities (such as automatic smart contract calculations, withholding and record-keeping systems).

In this case, how should the salary platform enable the stablecoin payment function?

Real-time 24/7 settlement

The relevant content has been covered in the previous article.

Closed-loop payment

Partner with stablecoin-based card issuance platforms (such as Rain) to allow end users to directly spend stablecoins, thereby fully inheriting their speed and cost advantages;

Partner with wallet providers to offer stablecoin savings and earnings opportunities.

Accounting and tax reconciliation

By leveraging the immutable ledger feature of blockchain, transaction records can be automatically synchronized to the accounting and tax systems through the API data interface, realizing the automation of withholding, bookkeeping and reconciliation processes.

Programmable Payment and Embedded Finance

Leverage smart contracts to enable automated batch payments and programmable payments based on specific conditions (such as bonuses). Can work with platforms like Airtm or use smart contracts directly.

Connecting to DeFi base protocols to provide wage-based financing services in an affordable and globally accessible way. In some countries, bypassing local banking partners that are often cumbersome, closed, and expensive. Apps like Glim (and indirectly Lemon) are working to provide these capabilities.

Based on the above solution, let us further explain the specific implementation method:

Payroll processing platforms that support stablecoins work with US fiat on-ramps (such as Bridge, Circle, Beam) to connect bank accounts to stablecoins. Before the pay date, funds are transferred from the clients corporate account to an on-chain stablecoin account (these accounts can be hosted by the above companies or institutions such as Fireblocks). Payments are fully automated and broadcasted in batches to all contractors around the world. Contractors receive USD stablecoins instantly and can spend them through Visa cards that support stablecoins (such as Rain) or save them through tokenized Treasury bonds in on-chain accounts (such as USTB or BUIDL). With this new architecture, the overall cost of the system has been significantly reduced, the contractor coverage has been greatly expanded, and the system has been greatly automated.

Card issuer

Currently, many companies are earning their core income through card issuance. For example, Chime, which just went public on June 12, has achieved annual revenue of over $1 billion through transaction fees in the US market alone. Although Chime has established a huge business in the US, its partnership with Visa, banking partnerships and technical architecture can hardly help expand its overseas market.

Traditional card issuance requires applying for direct licenses from institutions such as Visa in each country, or cooperating with local banks. This cumbersome process seriously hinders the cross-regional expansion of enterprises. Take the listed company Nubank as an example. After more than 10 years of operation, it only started overseas expansion in the past three years.

In addition, card issuers are required to pay a deposit to card organizations such as Visa to prevent default risks. Card organizations use this to promise merchants such as Walmart that cardholders payments will still be honored even if the bank or fintech company goes bankrupt. Card organizations will review the transaction volume in the last 4-7 days and calculate the deposit amount that the card issuer needs to pay. This is a heavy burden on banks/fintech companies and forms a significant industry entry barrier.

Stablecoins have revolutionized what is possible in the card issuance business. First, stablecoins are fostering a new class of card issuance platforms, such as Rain, where businesses can leverage their principal membership with Visa to offer global issuance services through stablecoins. Examples include enabling fintechs to issue cards in Colombia, Mexico, the United States, Bolivia, and many other countries simultaneously. Additionally, because stablecoins have 24/7 settlement capabilities, a new class of issuing partners can now settle on weekends. Weekend settlements greatly reduce risk for partners, effectively reducing collateral requirements and freeing up funds. Finally, the on-chain verifiability and composability of stablecoins creates a more efficient collateral management system, reducing the working capital requirements of card issuers.

After the stablecoin is introduced into this business model, the practical plan is as follows.

-

Partnering with Visa and card issuers to launch a global card issuance program denominated in U.S. dollars;

-

Flexible card network settlement options;

-

Direct settlement in stablecoins (enabling weekend and overnight settlement);

-

The card network generates a settlement report containing bank account numbers and routing numbers every day, and the stablecoin address will be displayed after using the stablecoin;

-

You can also choose to convert the stablecoin back to fiat currency and then settle with the card network;

-

Lower collateral requirements (thanks to 24/7 settlement capabilities).

The following is an example flow of a global card product architecture that supports stablecoins:

in conclusion

Today, stablecoins are no longer a future promise that requires effort to imagine — they have become a practical technology with exponentially growing usage. The question now is not “if” to adopt, but “when” and “how” to adopt. From banks to fintech companies to payment processors, developing a stablecoin strategy has become a necessity.

Those that move beyond the proof-of-concept stage and truly integrate and deploy stablecoin solutions will outperform their competitors in terms of cost savings, revenue growth, and market expansion. It is worth mentioning that the above practical benefits are supported by a large number of existing integration partners and upcoming legislation, both of which will significantly reduce execution risks. Now is the best time to build stablecoin solutions.

This article is sourced from the internet: Which Web2 businesses are more suitable for the rapid introduction of stablecoins?

Original | Odaily Planet Daily ( @OdailyChina ) Author: Wenser ( @wenser 2010 ) One day in the future, a day for the crypto crowd may be like this: when you get up in the morning, you turn the smart ring on your hand, look at the flashing green light, and check your sleep quality last night on the APP; after a simple wash, you click on the sports option in the APP and start your morning run, and the heart rate, calories, blood oxygen and other health indexes are clear at a glance; after running, the AI coach has helped you plan todays menu, down to the proportion of protein, carbohydrates, and fat, and helped you set up todays work plan; after a busy day, you check your social…