1. What is a Prediction 시장?

In short, a prediction market is akin to trading the “outcome of a future event.” Participants are not buying stocks but rather buying and selling judgments on whether an event will happen “Yes/No.” For example, for the event “Will Biden win the 2024 US election?”, the market issues “Yes” contracts and “No” contracts. The contract price directly reflects the market’s consensus probability of the event occurring: if a “Yes” contract is priced at $0.60, it means the market believes there is a 60% probability of Biden winning.

Prediction markets typically focus on binary contracts (Yes/No contracts) but can also extend to multi-outcome events. Their advantage lies in using market incentives to encourage participants to reveal true information, thereby improving prediction accuracy.

2. Order Book Trading in Prediction Markets

Platforms like Polymarket employ a Central Limit Order Book (CLOB) model, similar to traditional centralized exchanges (like stock markets). In this model, prices are no longer preset by algorithms but are driven in real-time by buyers and sellers submitting limit orders. The market price is determined by supply and demand, manifested as the matching of the best bid and ask prices.

Recall what we mentioned earlier: contract prices reflect the market’s probability of an event occurring. Yes, the order book model perfectly aligns with the very concept of prediction markets. It allows the market to dynamically adjust probability valuations. However, it’s important to note that the quoted price (market probability) does not always perfectly reflect the true probability of the event. Influenced by FOMO sentiment, independent information channels, or market maker behavior, prices can deviate. This creates opportunities for arbitrage: identifying value mismatches and buying the undervalued side.

3. How to Arbitrage

There are numerous arbitrage opportunities in prediction markets, and participants typically play two roles:

- Role A: Market Maker/Liquidity Provider buys the undervalued side and sells the overvalued side when odds are extreme, closing positions for profit when prices return to rationality.

- Role B: Directionally Neutral Arbitrageur bets on one side in the prediction market while hedging directional risk using perpetual contracts. The focus is not on betting on price movements but on locking in profits by exploiting odds discrepancies.

The following sections introduce specific arbitrage methods one by one. Please note that all arbitrage carries risk and is subject to market sentiment, fees, and liquidity constraints.

3.1 Finding Opportunities for Value Mismatch

Unlike traditional betting with fixed odds set by a bookmaker, Polymarket’s prices are determined in real-time by user supply and demand. The market is susceptible to emotional influence, leading to price distortions. Prices, determined by supply and demand, form “probabilities.” By scanning a large number of events and applying manual, realistic judgment, one can find opportunities where the market price does not match the true value and buy the undervalued side.

Note: The market may not correct (sentiment persists), or your probability estimate may be wrong. This is not risk-free.

3.2 On-Platform Arbitrage

Basic Concept: For the same event, the sum of the Yes + No contract prices should equal 1 (or sum to 1 for multi-outcome events). If a discrepancy appears, arbitrage is possible.

- If the sum > 1 (market collectively overestimates): Short the overvalued side to lock in profit.

- If the sum

Basic Concept: YES + NO does not equal 1, or the sum of multiple outcomes does not equal 1.

Important Considerations: This strategy is easily eroded by the following factors:

- Transaction fees

- Slippage (price movement due to large orders)

- Order limits and platform position restrictions

3.3 Cross-Platform Arbitrage

The same event may have different odds on different platforms (e.g., Polymarket vs. Kalshi). Suppose Platform A offers high odds for “event occurs” (market bullish), and Platform B offers high odds for “event does not occur” (market bearish). If both platforms describe the same event, one can place bets on both sides simultaneously.

By comparing the actual odds on Polymarket and Kalshi, we can create a table.

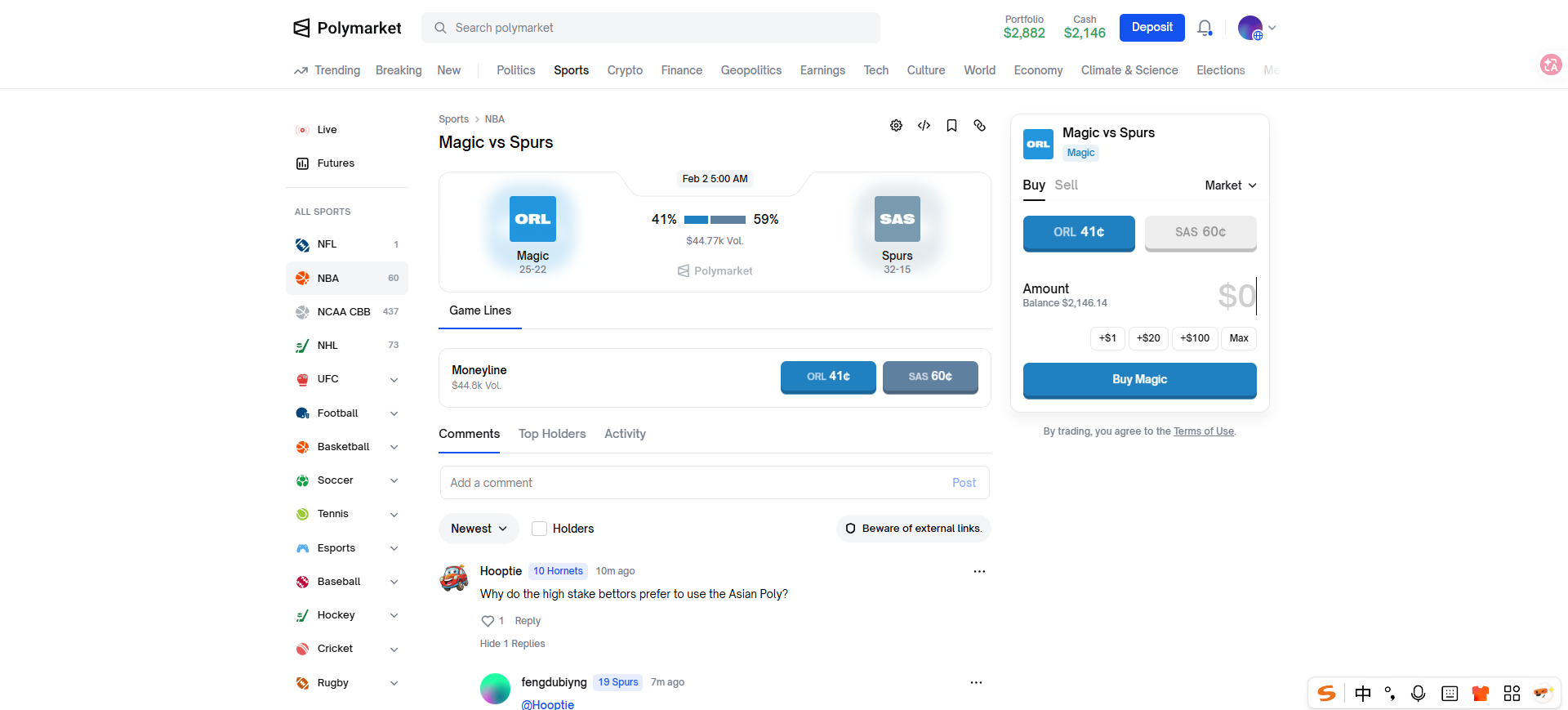

If you buy Magic to win on Platform B (41¢) and buy Spurs to win on Platform A (57¢), total cost = 41¢ + 57¢ = 98¢.

- Regardless of which team wins, you will receive a settlement of $1 (100¢).

- Net profit = 100¢ – 98¢ = 2¢, yield ≈ 2%.

Important Considerations: Fees, transfer costs, and settlement differences between platforms can erode profits. Ensure event 디파이nitions are consistent.

4. Summary and Actionable Arbitrage

Prediction markets are filled with numerous automated bots and professional market makers who, with their efficient algorithms and professional techniques, capture the vast majority of profits. As ordinary participants, we need to reflect: what is our competitive advantage when facing these streamlined mechanisms? It’s difficult for us to monitor all arbitrage opportunities through high-frequency scanning, so we should integrate more subjective judgment.

AI-assisted tools combined with personal expertise and insight into specific event domains will become the key path to standing out. This collaborative approach can effectively compensate for algorithmic blind spots and achieve differentiated profitability.

Actionable Suggestions:

- Record and Review: For each bet, meticulously record position size, hedging details, and final outcome. Subsequently, review and analyze: Did significant deviations where the sum of Yes/No contract prices significantly deviated from 1 occur? Were there price inversion mismatches? Use reviews to optimize future decisions.

- Semi-Automated Monitoring: Utilize market tools or develop scripts/bots to monitor odds discrepancies in real-time and receive alerts, improving efficiency rather than relying on manual operations.

- Small-Scale Live Testing: Use minimal capital to run the complete process in a live environment, including prediction market bets and perpetual hedging, to verify strategy feasibility and accumulate practical experience.

Always remember: markets are unpredictable, and arbitrage must be combined with rigorous risk management and continuous learning.

이 글은 인터넷에서 퍼왔습니다: Prediction Markets: Concepts, Mechanisms, and Arbitrage Strategies

Related: From PolyMarket to Hyperliquid: App Chains Are Becoming the New Alpha

This sounds like a further technical upgrade, but in essence, it’s an inevitable choice for an application entering the deep waters of growth. Once product validation is complete, trading behavior stabilizes, and user scale expands, applications begin to grow dissatisfied with “renting someone else’s infrastructure” and instead wish to control the key user experience and revenue streams. The same path has emerged in another, more classic case: the leading Perp DEX, Hyperliquid. It wasn’t content with being just an “application” on a mainstream public chain. Instead, it built its own App Chain from the ground up, unifying the trading system, execution environment, and user experience, ultimately achieving a level of smoothness and throughput close to that of a “centralized exchange,” thereby building its moat. Looking at these two cases together…