BNB Chain’s journey to immortality, with both high market capitalization and on-chain popularity

BNB Chain has been buzzing lately. BNB’s price has repeatedly hit new highs, reaching a peak of $1,349, with a monthly increase exceeding 25%. BNB’s market capitalization briefly surpassed USDT, ranking third among 암호화폐currencies. Furthermore, the BNB Chain meme season has exploded again, sparking a global craze for Chinese language learning. This has not only attracted overseas meme investors to join the Chinese meme community, but has also inspired many overseas project developers to learn and speak Chinese.

On October 9th, Binance Wallet’s newly launched Meme Rush platform garnered widespread market attention. Its successful launch of BNBHolder, the first meme token migrated to a decentralized exchange (DEX), saw its market capitalization surpass $100 million within half an hour. This demonstrates the current concentration of attention, capital, and traffic on BNB Chain.

A bull market for BNB Chain

There is no doubt that this bull market belongs to BNB Chain, and the on-chain indicators reflecting the prosperity of the ecosystem are “blossoming in all directions.”

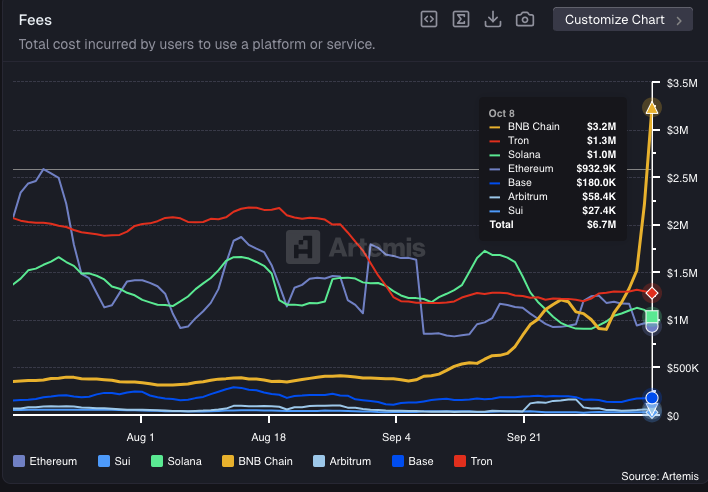

According to Artemis data, BNB Chain’s on-chain DEX trading volume has been steadily increasing since September, rivaling Ethereum and Solana. Entering October, as the on-chain’s popularity continued to grow, on October 8th, BNB Chain’s on-chain DEX trading volume surpassed Ethereum and Solana for the first time, becoming the largest on the entire network. This momentum has continued, widening the gap between them. On October 8th, BNB Chain’s on-chain DEX trading volume reached $6.38 billion, while Solana’s was only $4.96 billion.

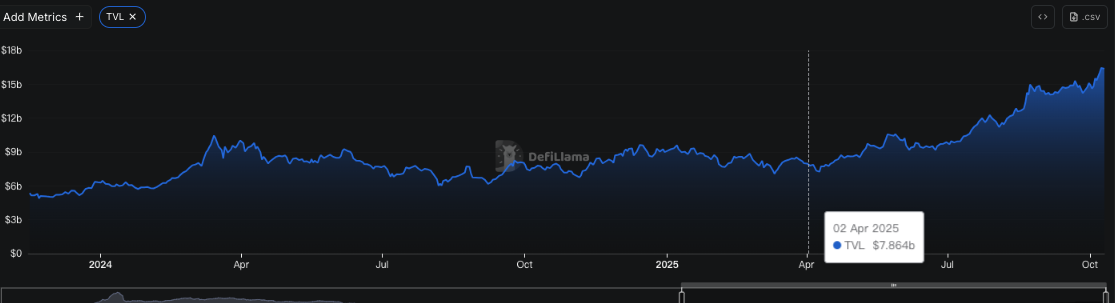

Meanwhile, DeFiLlama data shows that BNB Chain’s TVL has been steadily increasing. In April 2025, BNB Chain’s TVL was approximately $8 billion. In just six months, its TVL has reached $16.38 billion, a growth rate exceeding 100%. This growth in TVL not only reflects investors’ trust in BNB Chain but also signifies the continued prosperity of the BNB Chain ecosystem, creating more investment opportunities for investors.

The enthusiasm for trading capital can be better reflected from the perspective of on-chain fees. Artemis data shows that BNB Chain’s on-chain fees surpassed Tron to become the highest on the entire network on October 5th. Since then, it has been in a continuous lead. On October 8th, BNB Chain’s on-chain fees reached $3.2 million, while Tron, ranked second, had $1.3 million.

Capital always seeks profit. The rise in user trading enthusiasm suggests a wealth effect on the BNB Chain, with meme users flocking to the platform. Data from the meme distribution platform Four.meme is also worth noting. According to 모래 언덕 데이터 , Four.meme’s total revenue currently exceeds 35,231 BNB (approximately $45 million). Its revenue over the past seven days has surpassed Pump.fun, and it boasts over 70,000 daily unique users.

Of course, BNB Chain isn’t just a “meme chain.” It also played a key role in the previously popular Prep DEX market. Artemis data shows that on September 23rd, Aster’s on-chain contract trading volume surpassed Hyperliquid to become the largest on the network, with a peak single-day contract trading volume reaching $99 billion.

Aster’s success is inseparable from the support of BNB Chain. Its current TVL is US$2.44 billion , of which US$2.167 billion is on BNB Chain, accounting for as much as 88%.

The widespread prosperity of BNB Chain has instantly eclipsed other public chains. Previously, BNB Chain seemed to be a perpetual third-place performer, often overshadowed by Ethereum and Solana. People even habitually assumed that Solana’s only competitor was Ethereum. This time, BNB Chain’s rise to the top across all metrics was unexpected.

Solana shared 50 Cent’s “Many Men (Wish Death)” on social media, expressing its unwavering commitment to “not being defeated.” BNB Chain responded with 50 Cent’s “Window Shopper,” expressing its commitment to “proving myself through hard work and fighting back against the onlookers.” The two parties are both rivals, each pursuing their own goals, and also fellow crypto industry players.

BNB Chain Immortal Cultivation Journey

However, some believe that BNB Chain’s recent surge in popularity is merely a statistical phenomenon, driven entirely by the meme-fueled market created by CZ and He Yi’s “calls,” rather than BNB Chain’s own success. After the meme craze dies down, BNB Chain will likely be surpassed by Solana, or even fade into obscurity.

Regarding the meme call, CZ responded that the BNB Chain meme coin boom was not a deliberate endorsement by him, but rather a coincidence, not an endorsement. While the BSC meme coin boom may have been a coincidence of favorable timing, location, and people, the current prosperity of BNB Chain is 디파이nitely not a coincidence.

On October 10th, Binance co-founder He Zhang published a lengthy article on Binance Square, systematically expounding on his entrepreneurial philosophy of cultivating immortality through the principles of “Taoism, Dharma, Art, and Instruments.” BNB Chain’s current bull market performance is a testament to his advanced studies in these areas.

High-quality asset trading engine

Becoming a trading engine for high-quality assets has always been one of BNB Chain’s ultimate goals. To achieve this, BNB Chain must possess sufficient throughput and sufficiently low on-chain fees. To this end, BNB Chain has undergone multiple technical upgrades this year. The Lorentz and Maxwell hard fork upgrades in April and June reduced BNB Chain’s block time to 0.75 seconds, significantly improving network responsiveness and providing solid logistical support for the recent BSC meme craze.

At the end of September, BNB Chain’s transaction fees were reduced from 0.1 Gwei to 0.05 Gwei. This improvement attracted more users and developers. Recently, BNB Chain’s daily gas usage exceeded 5 trillion, primarily driven by 24 million Swap transactions, accounting for 77% of the total network transaction volume, bringing it one step closer to becoming a high-performance public transaction chain.

Sufficient funding and builder support

In addition, BNB Chain provides ample financial support for ecosystem development. On October 8th, BNB Chain announced the establishment of a $1 billion Builder Fund, backed by YZi Labs, to strengthen support for founders of BNB ecosystem projects. The fund will support projects in areas including trading, RWA (Real World Assets), artificial intelligence (AI), DeSci (Decentralized Science), DeFi, payments, and wallets, enabling project developers to fully leverage BNB Chain’s high-performance, low-cost infrastructure.

At the same time, BNB Chain’s flagship accelerator program, Most Valuable Builders (MVB), has also been helping builders within the ecosystem grow. In the past ten quarters, MVB has supported over 200 projects, helping founders and builders improve their products, obtain funding, and reach millions of users.

RWA, stablecoins, and AI are still gaining momentum

While BNB Chain’s on-chain memes and decentralized exchanges currently attract much of the market’s attention, the platform also offers comprehensive infrastructure support for RWAs, stablecoins, and AI. BNB Chain boasts the most comprehensive RWA stack, encompassing everything from compliant issuance and secondary liquidity to DeFi functionality, all within a single ecosystem. BNB Smart Chain ensures secure, low-cost, and real-time transaction execution and settlement, while opBNB facilitates high-throughput rollups and Greenfield provides decentralized data storage. Many major companies, including Circle, VanEck, and Ondo, have chosen BNB Chain to issue RWAs.

At the same time, BNB Chain’s “One BNB” architecture (consisting of BSC, opBNB, and BNB Greenfield) also provides strong infrastructure support for the development of AI projects, providing the scalability, speed, and secure data management required for advanced AI applications.

BNB Chain is also actively promoting the development of the stablecoin ecosystem. BNB Chain launched a “0 Fee Transfer” promotion for stablecoins. Until October 31st, transfers of USDT and USD 1 on BNB Chain will be free of gas fees. Since the launch of this promotion on September 20, 2024, BNB Chain has covered over $5 million in gas fees for users. In addition to eliminating fees, BNB Chain is integrating USD 1 into more protocols and strengthening partnerships with more exchanges, wallets, and bridges. These initiatives not only save users substantial funds but also contribute to making stablecoins more accessible and widely used.

In short, BNB Chain’s current success isn’t accidental; it’s the result of years of continuous development. Without BNB Chain’s support, Four.meme wouldn’t have surpassed Pump.fun, and Aster wouldn’t have surpassed Hypeliquid. Similarly, thanks to BNB Chain’s continued support, the RWA, AI, and stablecoin sectors could also see similar success in the future as Meme and DEX have today.

“Dual Cultivation of Coins and Stocks”

In addition to building its ecosystem within the crypto-native sector, BNB Chain is also actively expanding BNB’s reach within traditional finance. Many traditional financial institutions have recognized BNB’s long-term value and are actively building BNB DAT treasuries. “We’ve reached out to approximately 50 potential DAT teams, but will only support a handful of strong companies,” CZ stated in mid-September, stating that while many institutions are interested in BNB, he will not blindly support it.

The BNB treasury company that currently holds the highest market value of BNB is CEA Industries, which raised $500 million in private financing in July with the support of YZi Labs. It currently holds 480,000 BNB, worth over $600 million.

In the past few years, Binance and BNB have been under continuous regulatory criticism. However, as regulatory attitudes have shifted, BNB Chain, which has flourished in ecological fields such as Meme, DeFi, stablecoins and AI, is being recognized and “buyed in” by traditional finance.

The Evolving BNB Chain

Even if we take a step back, the current BNB Chain meme craze started with a familiar formula: the familiar “CZ-style build.” In February and March of this year, CZ leveraged his personal influence to drive massive traffic and a meme craze for BNB Chain. Meme concepts like CZ’s pet dog and his Arabic image became popular, only slightly surpassing the current Chinese meme craze.

However, BNB Chain was often criticized by the community at the time. On the one hand, the on-chain transaction experience was poor, with frequent delays. On the other hand, there was no timely marketing support to cope with the huge traffic brought by CZ. Therefore, after the market sentiment faded, BNB Chain returned to calm.

Having learned its lesson, BNB Chain is no longer the “new kid on the block” it was at the beginning of the year. Building on its accumulated infrastructure, BNB Chain has remained stable despite the increased popularity and influence it has received. No complaints have been raised about the chain’s performance. Furthermore, BNB Chain officials are collaborating more closely with CZ, actively addressing community concerns and fostering a fair trading environment for users.

A day in the cryptocurrency world is like a year in the real world. In this environment, self-renewal is paramount. While there’s no eternal champion in this market, the ever-evolving BNB Chain has provided the answer to maintaining its position in each cycle.

이 글은 인터넷에서 퍼왔습니다: BNB Chain’s journey to immortality, with both high market capitalization and on-chain popularityRecommended Articles

Related: Digging Deep into the True Value of CARDS: Collector Crypt’s Five MoatsRecommended Articles

编译 | Odaily 星球日报(@OdailyChina) 译者| 叮当(@XiaMiPP) 编者按:最近,加密行业最火热、也最有趣的叙事之一,来自于 Collector Crypt 将 TCG(集换式卡牌游戏)带上链的尝试。其原生代币 CARDS 在短时间内上涨近十倍,也让人们重新思考加密与现实收藏品结合的潜力。本文作者 Kyle 聚焦于 Collector Crypt 的核心护城河,提出这是一个远比常规 RWA 叙事更具深度与壁垒的项目。由于原文篇幅较长,Odaily 星球日报对内容进行了删减与整理。同时需要提示,作者本人持有 CARDS,请读者保持独立判断。 任何认为 CARDS “只是一个加密 RWA”的人,其实是严重低估了这个项目的价值。虽然这么说并不完全错误,但却过于简化了 Collector Crypt 所搭建的商业模式。 我认为,Collector Crypt 实际上拥有多重护城河,可以归纳为以下几个方面: 代币壁垒 强大的分销与物流能力 创始人与项目利益高度一致 独特的供给侧优势 韧性极强的商业模式 这些因素的重要性不容忽视。过去几天,TCG(集换式卡牌游戏)叙事的爆发让我们看到了一个“小型淘金热”的典型加密现象:人人都想去挖金子,试图复制已有的成功。但很多人没有意识到,这不是一个可以轻易复制的产品。 事实上,我甚至认为,和 SaaS 模式驱动的 AI Agents 不同(那类产品具备天然的规模化与复制优势),复制一个 TCG RWA 的难度要比想象的高出 1000 倍。这是因为它背后涉及庞大的物流网络与深厚的现实世界关系,这与大多数“纯数字业务”的加密项目完全不同。写几行代码、快速分叉功能,并不能让一个 TCG 业务跑起来。 在我看来,强大的商业模式叠加高速增长的赛道,会形成复利般的优势,随着时间推移,这种优势将愈发难以被竞争者复制。Collector Crypt 的防御力远超大多数加密项目,它还有一个别人不具备的时间优势:他们花费数年时间,搭建了那些枯燥却至关重要的基础设施——采购网络、鉴定流程、物流体系,更重要的是,凭借处理 7,500 万美元交易的经验,赢得了市场的信任与声誉。 TCG 的市场机会 在进入 Collector Crypt 之前,我们先看看 TCG 的市场机会。虽然我并非行业专家,个人经验也只是童年玩过《决斗大师》,但这并不妨碍我看到其中的巨大潜力。这里我们聚焦于宝可梦卡牌——这是 CARDS 当前的核心产品,也是整个 TCG 行业的基石。 宝可梦卡牌在过去 20 年里累计上涨 3261%,涨幅居各类卡牌之首。更宏观来看,艺术品、汽车与收藏品市场的规模甚至超过黄金市值,其中 TCG 在 2024 年已达到 74.3 亿美元,并预计以 7.86% 的年复合增长率持续扩张。 不过,比起冰冷的数字,更重要的是驱动这些数据背后的社会趋势和逻辑。基于我的观察,有三个关键趋势正在重塑这一市场: 千禧世代与 Z 世代的财富转移 未来十年,全球财富将迎来最大规模的代际转移,千禧世代与 Z 世代逐渐掌握资产分配权。这一群体对收藏品、潮玩和数字资产的接受度远高于上一代,他们更愿意为情绪价值与身份认同买单。Collector Crypt 所处的 TCG(集换式卡牌)赛道,正契合了这种代际偏好转移。 “Labubu 化”的社会 在社交媒体放大与消费主义驱动下,年轻人追捧具备符号意义的物品,如 Labubu、盲盒和限量版球鞋。收藏已不只是兴趣,而是社交身份和文化标签的外化。Collector Crypt 通过卡牌与代币的结合,切入这一“符号消费”浪潮,使收藏既能满足情绪价值,又能被金融化、流动化。 泡沫过后依旧增长 NFT 市场的狂热已褪去,但卡牌等实物收藏的需求并未消失。相反,经历泡沫洗礼后的玩家更看重稀缺性、真实价值与长期持有收益。Collector Crypt 在此背景下成长为新的承载体:既承接了数字资产玩家的金融化需求,也捕捉了收藏品市场稳步增长的趋势。 Collector Crypt 的护城河 1.代币护城河 CARDS 是 Collector Crypt 的原生代币,在这里,代币的存在是合理的: 这是一个高成长行业中的高速增长型业务,与加密行业存在强烈的主题交集; 它提供了高度流动性的敞口,是该领域的“独一份”,而这个领域恰恰是所有人都想进入的。 宝可梦卡牌玩家、加密交易者和球鞋收藏者往往比人们想象的更接近。理解 PSA 10 喷火龙价值的人,和理解数字代币价值的人,几乎就是同一群体。加密交易者天性投机,而当投机与 TCG 结合时,代币自然能够释放此前无法被满足的潜在需求。并非所有人都想直接购买宝可梦卡牌,但如果能用一种代币在某种程度上代表整个 TCG 市场,那将极具吸引力。 数据已经验证了这种趋势——2025 年,卡牌代币化交易量呈指数级增长。 CARDS 提供了对该垂直领域的流动性敞口,而这一领域又是“超级金融化”(hyperfinancialization)叙事的重要组成部分。加密行业中最成功的产品无一不是围绕“金融化”展开的:无论是 DeFi、永续合约 DEX,还是预测市场。如今,宝可梦市场成为全球最炙手可热的另类资产之一。 与此同时,CARDS 背靠一个基本面稳健的高速成长业务。其他代币往往只能押注于某个主题,而缺乏基本面支撑,充其量只是 Beta 敞口,无法真正捕捉…