The U.S. market resumed trading after the July 4 long weekend and quickly announced a small concession on the upcoming tariff deadline. Commerce Secretary Lutnick said that tariffs on various countries will be postponed until August 1, giving trading partners a final period of negotiating time to reach a deal at the last minute.

Meanwhile, risk markets continued to perform solidly last week as non-farm payrolls once again turned out unexpectedly strong (at least on the surface).

-

Nonfarm payrolls increased by 147,000, much higher than the expected 106,000, and the data for the previous two months were also revised up by 16,000 (previously -95,000).

-

The unemployment rate was 4.12%, lower than the expected 4.3% and the previous value of 4.2%.

-

Average hourly earnings rose 0.2% mom (+3.7% y/y), slightly below expectations of 0.3% (+3.8%) and the prior reading of 0.4% (+3.8%).

Although economists pointed out that the employment population growth this time was mainly concentrated in service industries such as catering and accommodation, and the employment structure was unbalanced, the market still tended to interpret the surface data optimistically and continue to maintain the narrative of ideal prosperity.

In terms of market reaction, the strong employment data has reduced the expectation of a rate cut in 2025 by about 15 basis points, leaving the probability of a rate cut at the July FOMC meeting at only about 5%, compared with about 24% a week ago. The terminal interest rate is estimated to be around 3.8% at the end of 2025 (a 50 basis point reduction from the current 4.3%), and the interest rate at the end of 2026 is estimated to be around 3.15% (a reduction of 85 basis points).

The dollar rebounded against major currencies (USD/JPY rebounded to around 145), while US stocks closed flat last week after hitting new highs. BTC is also approaching recent highs again (>109,000) driven by stable capital inflows, and the ETH ETF has recorded the largest single-day capital inflow in the past quarter. Fundstrats Tom Lee has recently become the focus of discussion. Its ETH asset reserve operation entity BMNR soared more than 30 times after announcing that it raised $250 million to purchase a large amount of ETH.

Fortunately, stocks are “regulated” securities, otherwise investors might mistake them for some highly volatile altcoin. As always, TradFi has the most fun.

With 암호화폐currencies still trading near cycle highs in correlation with equities, BTC is expected to continue tracking the SPX during what looks to be a fairly quiet summer.

At the same time, despite tariff threats, geopolitical tensions and policy uncertainty, the United States did make some important progress in the past month. Specifically, the U.S. government:

-

A major tax reform bill was passed, providing a significant fiscal injection and significantly reducing the risk of a recession.

-

NATO and other trade allies have agreed to increase defense spending as a global push.

-

The U.S. economy continues to grow slowly, and corporate profits have managed to climb amid concerns.

-

Although concerns about out-of-control fiscal 디파이cits had previously intensified, fixed income market yields have stabilized.

-

The worst of the geopolitical conflict appears to be over.

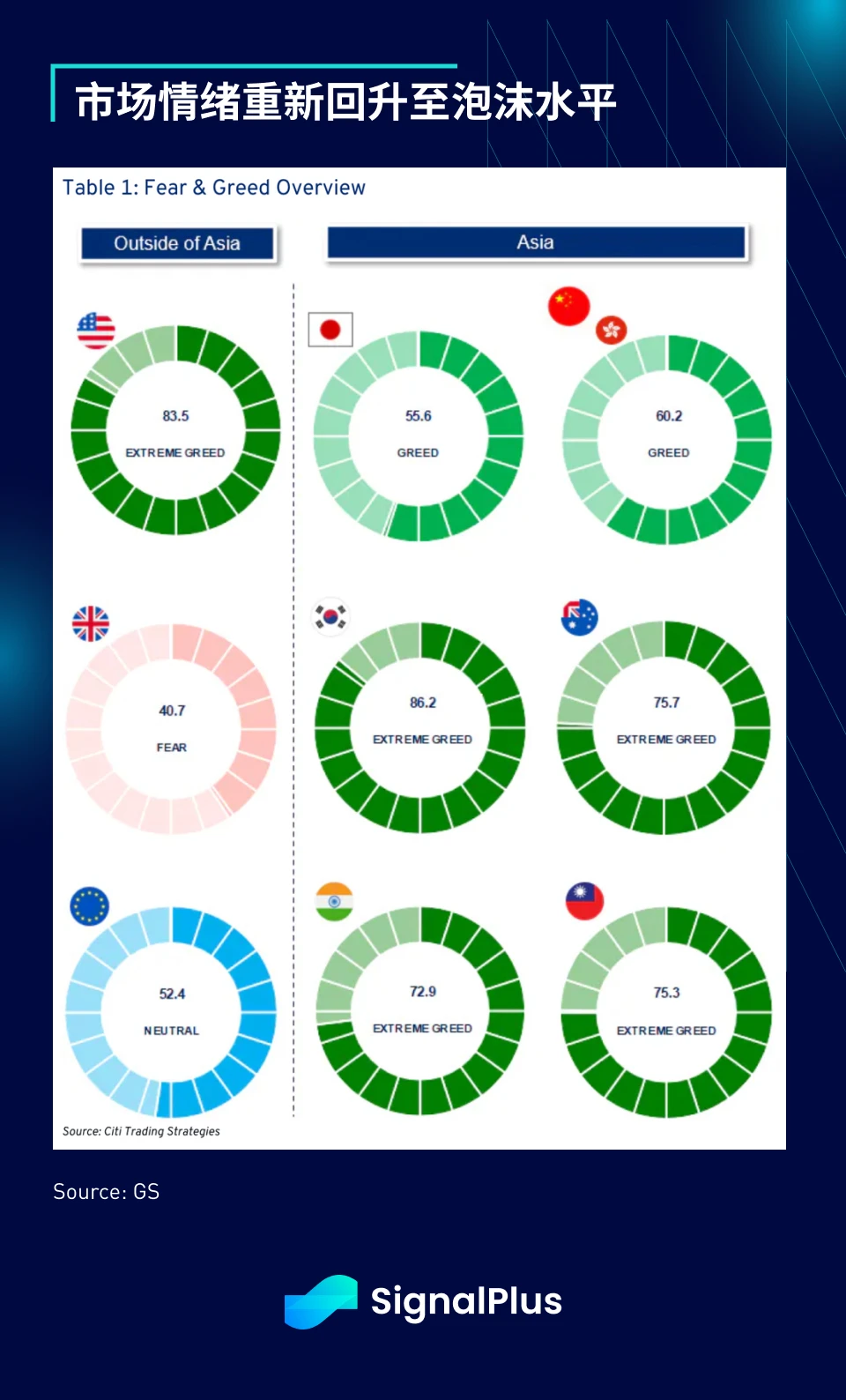

Against this backdrop, the SPX index hit a record high after the passage of the tax reform bill and the release of non-farm payrolls, and gained further momentum this morning on the latest tariff extension news. Last week, 36 of the SPX components closed at 52-week highs, and the US stock market sentiment also remained in the extremely optimistic range.

Seasonal trends usually perform well in the summer months, with July historically being one of the strongest months, so don’t miss out!

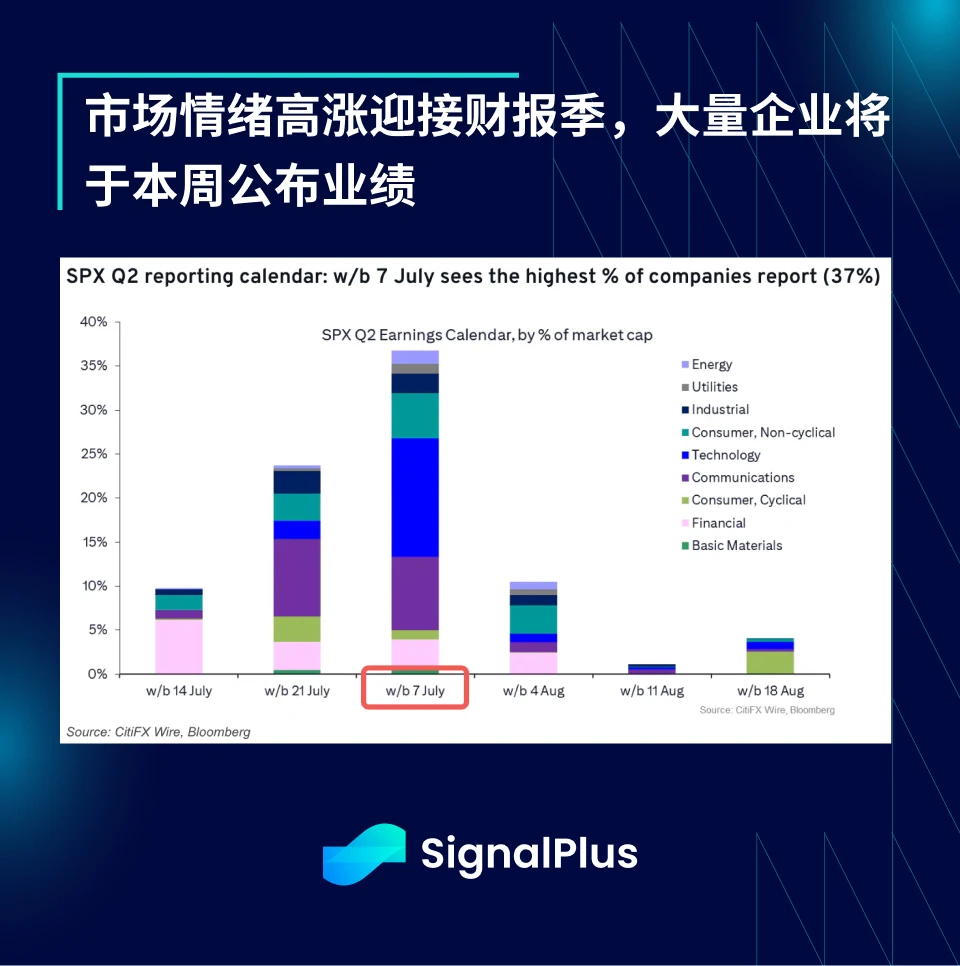

Finally, this week will mark the start of earnings season, with a large number of companies set to report earnings this week. It is expected that tariff-related disruptions will be less severe than in the second quarter, and the market expects overall financial guidance to be more positive.

This summer looks like it will be hot but calm. Good luck with your trading and enjoy the market!

You can use the SignalPlus trading indicator function for free at t.signalplus.com/crypto-news/all, which integrates market information through AI and makes market sentiment clear at a glance.

If you want to receive our updates in real time, please follow our Twitter account @SignalPlusCN, or join our WeChat group (add the assistant WeChat, please delete the space between the English and the number: SignalPlus 666), Telegram group and Discord community to communicate and interact with more friends.

SignalPlus 공식 웹사이트: https://www.signalplus.com

This article is sourced from the internet: SignalPlus Macro Analysis Special Edition: Up Only

On June 19, Korea IT Times, a well-known Korean technology media, focused on the keynote speech of Jason Jiang, CertiKs Chief Business Officer, at the Proof of Talk 2025 conference, focusing on his systematic insights on building trust in Web3. Jason Jiang pointed out that static audits are indispensable, but far from enough to support the trust system required by Web3. Audited is by no means the same as secure, and true trust should be built on a comprehensive mechanism of code, behavior, culture, and compliance. Jason Jiang said that CertiK is promoting a dynamic security as a service model, and continues to promote the construction of security infrastructure through on-chain audit certification, real-time security monitoring and risk scoring, AI-assisted auditing, etc. Technology products represented by Skynet are reshaping the…