On June 17, eye medicine digital technology company Eyenovia (stock code: EYEN) announced that it had signed a securities purchase agreement to conduct a PIPE (Private Equity) with institutional qualified investors for US$50 million. The funds will be used to establish its first 암호화폐currency reserve program, targeting Hyperliquids native token HYPE. The investment amount of US$50 million even far exceeds the companys market value of US$20 million.

To promote the implementation of this strategic transformation, the company simultaneously appointed Hyunsu Jung as the new Chief Investment Officer (CIO) and member of the board of directors, and announced that the company name will be changed to Hyperion DeFi, and the stock code will also be updated to HYPD. As the first US-listed company to use the tokens of an on-chain exchange for a micro-strategy plan, what exactly is Eyenovia? Who is Hyunsu Jung, the driving force behind it? Now that more and more companies are using Crypto tokens to rebirth, will $Hype be a better choice?

On the verge of delisting, Eyenovia’s lifeline

With Hyperliquids recent activity, the TVL of its mainnet has jumped into the top 10 public chains, and the market value of $HYPE has jumped to 11th place among all cryptocurrencies. The number of participants has gradually increased, and the platforms daily transaction fees can be maintained at US$2-3 million per day. The platforms annual revenue has approached US$100 million.

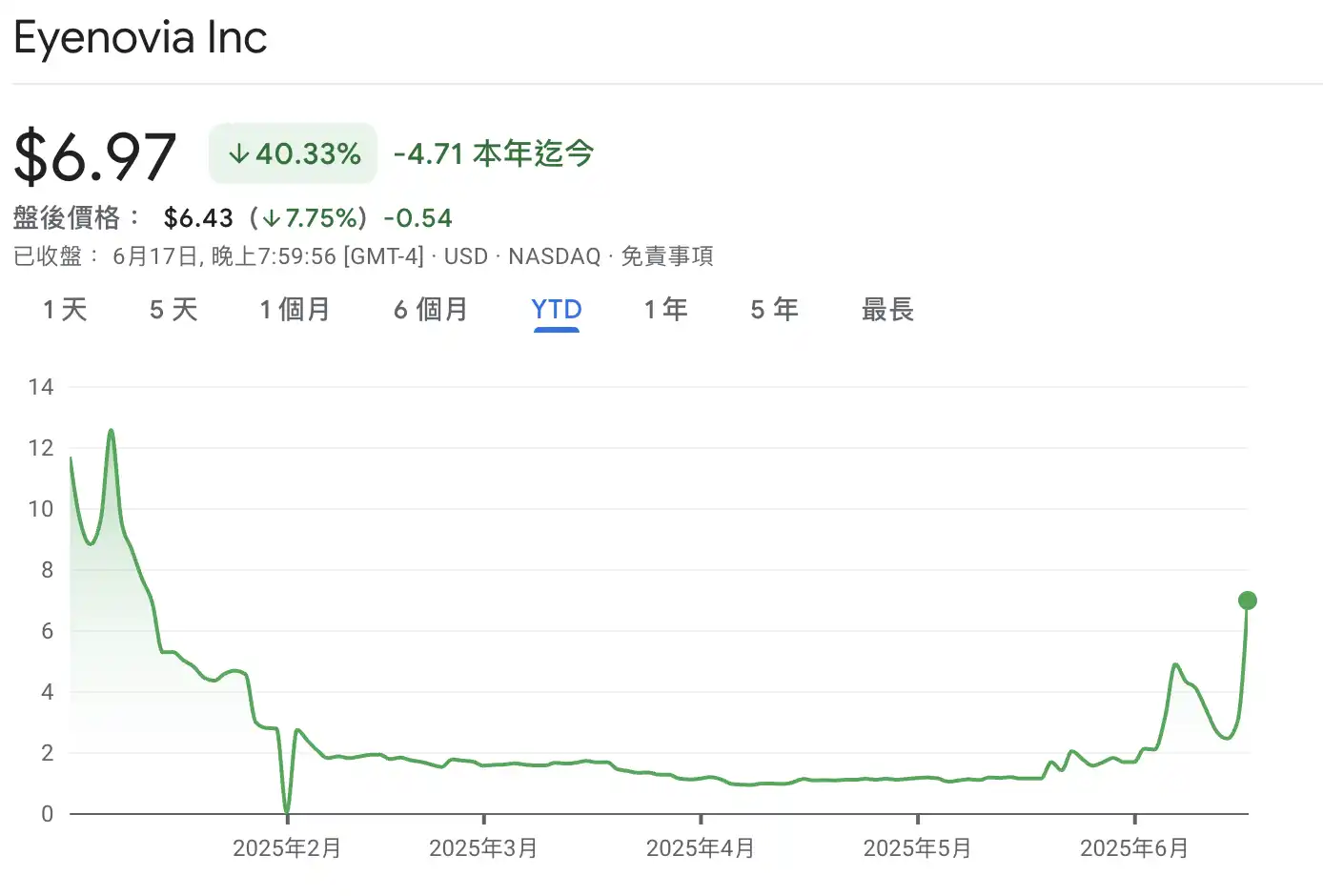

But Eyenovia, another protagonist of the cooperation, is not doing so well. Since it was listed at $800 in February 2018, it has fallen to as low as $1 in April 2025. Eyenovias main business is an ophthalmology company with a device-driven microdose drug delivery platform as its core. Its product directions include pupil dilation, postoperative inflammation reduction and treatment of myopia in children.

Eyenovias main product Optejet

The companys annual revenue in 2024 was only $56,000, with a net profit of negative $50 million and debts of over $10 million. The exhaustion of cash flow and the failure of new product trials have led Eyenovia to face delisting. However, HYPEs reserve strategy has given Eyenovia a chance to extend its life. After the relevant news leaked, Eyenovias stock price soared 134% in a single day.

HyunsuJung, the new executive from the cryptocurrency industry

Previously, Eyenovia had no connection with blockchain or related industries, so the chief investment officer (CIO) who was rewarded with 500,000 common shares by Eyenovia attracted everyones attention. According to public information, Hyunsu Jung previously served as a senior consultant at Ernst Young Parthenon. In addition, he also worked as an investment analyst at GoldenTree Asset Management and an asset management analyst in New York City.

He officially entered the blockchain industry at DARMA Capital, an investment advisory company founded by Andrew Keys (one of the co-founders of Consensys) in 2018. DARMAs philosophy is to help clients hold ETH for a long time while increasing returns and controlling risks through DeFi tools. It provides Ethereum staking custody and verification node services, combining strategies such as restaking and LST to obtain additional returns.

In December 2023, he joined Aligned as a partner. Aligned is an infrastructure that solves mining and high-performance computing, staking and liquidity supply. Its founder Neal Kaufman previously worked at McKinsey. Like the main creative team of Hyperliquid, he also graduated from Harvard University and graduated as a Baker Scholar (ranked in the top 5% of the graduating class).

His work in the DARMA product department and Aligned also helped him accumulate a wealth of relevant experience and connections for executing Hyperliquid DeFis micro-strategy.

Not much information about Hyunsu can be found on public websites, but Max @fiege_max , a core member of the Hyperliquid ecosystem, shared his fate with HyunsuJung for 10 years: It has been nearly ten years since Hyunsu and I were penniless exchange students in Edinburgh; and five years since we took the risk of trying cryptocurrency as roommates in San Juan.

An account suspected to be Hyperion, retweeted by community member Max.

On-chain Hyper micro-strategy, pledge HYPE and make money

Eyenovia said the deal is open only to institutional investors and that the company will issue 15.4 million convertible preferred shares and 30.8 million common stock warrants, both with a conversion price and exercise price of $3.25 per share. If all warrants are fully exercised, Eyenovia is expected to raise up to $150 million.

Although there is no guarantee that all warrants will be exercised, if the transaction is completed successfully, Eyenovia will be able to acquire and stake more than 1 million $HYPE.

The official announcement said that the funds used to purchase more than 1 million HYPE will be entrusted to Anchorage Digital for custody. A few days ago, on June 12, Canadian listed company TonyG Co-Investment purchased 10,000 $Hype and its stock price soared by more than 800% in one hour, directly leveraging a market value of $57 million with only $430,000.

We are excited to join a growing number of companies adopting similar strategies to realize the diversification, liquidity, and long-term capital appreciation potential that cryptocurrencies represent, said Michael Rowe, CEO of Eyenovia. After a comprehensive review of all available options, the Board and I unanimously believe that this transaction is in the best interests of our shareholders.

Jung added: “I am honored to join the Eyenovia team and help lead this groundbreaking crypto treasury strategy built around what we believe to be the most robust digital asset, HYPE. We believe Hyperliquid is one of the fastest growing and highest revenue blockchains in the world.”

These two statements mentioned that Eyenovias strategy may not just be to buy Hype but to build a complete strategy system around it, and if they choose to. According to the HIP-3 protocol on Hyperliquid, in order for a node to be able to list a coin, it is necessary to stake at least 1 million $Hype. As a token deployer, you can get 50% of the total market fee and can configure custom fees on this basis.

As for how to build a Hyperliquid version of MicroStrategy, community member Telaga _Telaga_ gave his idea. He believes that HyperStrategys on-chain structure is gradually emerging and becoming a decentralized extension of MicroStrategys currency holding logic. Rather than saying it is a simple asset allocation model, it is better to say that it is a strategy protocol system that embeds liquidity, returns, leverage and capital structure into the on-chain financial infrastructure.

Telagas HyperStrategy concept is to treat $HYPE, the native token on Hyperliquid, as a highly volatile digital asset similar to BTC. The difference is that $HYPE does not exist as a digital gold narrative, but as an on-chain economic engine with endogenous cash flow to participate in the entire protocol ecosystem. HyperStrategy has therefore designed a treasury mechanism that combines structural exposure and returns, allowing users and institutions to obtain long-term and stable on-chain returns through staking, lending, trading, market making, etc.

Specifically, the treasury is funded by external users, mainly in the form of USD stablecoins. After the funds are deposited, users will receive two types of on-chain certificates: one is a convertible bond token (CDT), which represents the principal equity; the other is an options NFT, which symbolizes future income options or repurchase rights. This design allows user assets to be both liquid and bound to long-term value growth expectations through a contract structure.

After the funds enter the vault, the protocol will deploy this part of the stablecoin into multiple revenue modules. The most important strategy is to lend $HYPE to other users through the on-chain lending system to earn interest. In addition, the vault can also participate in transactions and liquidity provision on the Hyperliquid platform, charging transaction fees and platform incentives. Or pledge $HYPE as a validator node to obtain rewards generated by network operation. In more advanced configurations, funds can also be invested in Nests trading protocol to obtain additional profits through LP market making and locking veNEST. At the same time, HyperStrategy also integrates on-chain derivatives protocols, such as HIP-3 perpetual contracts, to further improve the efficiency of fund use.

In the revenue repatriation mechanism, the treasury will periodically collect and consolidate income from staking rewards, transaction fees, loan interest and other channels. The protocol uses the income for repurchase, reinvestment, or CDT repayment and Options NFT performance according to the rules. Some designs may also introduce NAV (net value) growth logic to make the entire strategy system closer to the transparency and stability of traditional asset management institutions.

Following Eyenovia, on June 20, the US listed company Everything Blockchain Inc. (EBZT) also included HYPE in its portfolio and announced plans to invest $10 million in five major blockchains including Hyperliquid (including Solana, XRP, Sui, and Bittensor) to create a multi-token staking vault for institutional adoption trends. EBZT officially stated that this strategy will make it the first US stock company to return staking income directly to shareholders. It is expected to generate about $1 million in staking rewards each year after deployment, and plans to return investors in the form of dividends in the future. From this perspective, it seems that using on-chain vaults with compound returns to return investors will be more sustainable than simply buying coins for speculation.

Why HYPE?

HyperStrategys gameplay is different from BTC. It is not just a single point of increasing $HYPE holdings, but building an on-chain treasury that can generate compound returns in the long term. This structure makes the behavior of holding coins no longer just static holding, but becomes a configurable, manageable, and dividend-paying on-chain asset operation model. For traditional listed companies like Eyenovia that enter Hyperliquid, this type of strategy agreement not only provides a starting point for on-chain exposure, but also creates a complete financial model with liquidity, cash flow, governance rights, and potential capital appreciation.

The protocol economy formed around $HYPE seems to be providing a basic experimental field for the on-chain construction of corporate financial operations, fund management, and balance sheets. Of course, some community members believe that with Coinbase and Robinhood announcing the issuance of perpetual contract derivatives in the United States, the pressure faced by Hyperliquid, most of whose major investors are from the United States, is unprecedented.

Can Hyperliquid continue to maintain its current growth model? Can “on-chain micro-strategy” succeed or is it just a way to “exit liquidity”? BlockBeats will continue to pay attention to this.

This article is sourced from the internet: Hyperliquid, a new player in the cryptocurrency stock market

Related: OKX launches xBTC on Sui to promote the development of Bitcoin DeFi ecosystem

As the TVL of Bitcoin on Sui soars and BTCfi assets become increasingly abundant, OKX chose Sui, a leading Layer 1, as the first launch partner for xBTC. On Sui, Bitcoin holders have more choices than ever before. As BTC-backed assets become increasingly popular in Web3, Sui is building the most comprehensive BTCfi infrastructure and asset matrix. And OKX s blockbuster asset xBTC – a BTC asset natively issued by OKX – is officially launched today, further enhancing the asset matrix. Sui is one of the first three public chains to support xBTC. With its secure, high-speed and scalable environment, it simplifies the path for users to access Bitcoin DeFi. xBTC can be minted directly on the OKX exchange and withdrawn as a native asset to any on-chain wallet, including…