Bullish: The parent company bought 160,000 BTC and made billions in 6 years

Circle, the issuer of USDC, was successfully listed on the U.S. stock market, soaring 168% on the first day and raising US$1.1 billion, becoming the first stablecoin stock; Gemini also submitted its IPO documents shortly afterwards; and another trading platform that was rarely mentioned before, Bullish, was also revealed by the media to have secretly submitted a listing application to the SEC.

In the most profitable CEX track in the 암호화폐currency world, Bullish is not a familiar name, but in fact its origin is very prominent.

In 2018, EOS emerged, claiming to be the terminator of Ethereum. The company behind it, Block.one, took advantage of this wave of enthusiasm to conduct the longest and highest-value ICO (initial coin offering) in history, raising a staggering $4.2 billion in total.

A few years later, when the popularity of EOS faded, Block.one started a new business and turned to create a cryptocurrency trading platform, Bullish, which focused on compliance and targeted the traditional financial market. As a result, it was swept out by the EOS community.

In July 2021, Bullish was officially launched. The initial start-up capital included: $100 million in cash from Block.one, 164,000 비트코인s (worth about $9.7 billion at the time) and 20 million EOS; external investors also added $300 million, including PayPal co-founder Peter Thiel, hedge fund tycoon Alan Howard and well-known crypto investor Mike Novogratz.

Calculated in this way, the total asset size of Bullish when it went online exceeded 10 billion US dollars, which is extremely luxurious.

Bullish is close to Circle and far from Tether, aiming at compliance

Bullish’s positioning was clear from the beginning: size is not important, but compliance is.

Because Bullish’s ultimate goal is not to make a lot of profit in the crypto world, but to build a formal trading platform that can be listed.

Before its official operation, Bullish reached an agreement with a listed company, Far Peak, to invest US$840 million to acquire 9% of the companys shares and conduct a US$2.5 billion merger to achieve a curve listing and lower the traditional IPO threshold.

The media reported at the time that Bullish was valued at $9 billion.

Thomas, the former CEO of the merged company Far Peak, is the current CEO of Bullish. He has a very strong compliance background: he was previously the COO and president of the New York Stock 교환, where he performed outstandingly; he has established deep connections with Wall Street giants, CEOs and institutional investors; and he has extensive resources at the regulatory and capital levels.

It is worth mentioning that Farley did not invest in or acquire many projects at Bullish, but many of them were well-known in the cryptocurrency circle: the Bitcoin staking agreement Babylon, the re-staking agreement ether.fi, and the blockchain media CoinDesk.

In short, it can be said that Bullish is the trading platform in the cryptocurrency circle that most wants to become a Wall Street regular army.

But ideals are full of hope, while reality is very skinny. Compliance is much more difficult than they imagined.

As the US regulatory attitude becomes increasingly tough, Bullishs original merger and listing agreement was terminated in 2022, and the 18-month listing plan fell through. Bullish also considered acquiring FTX to achieve rapid expansion, but it ultimately failed. Bullish was forced to find a new compliance path – such as moving to Asia and Europe.

Bullish team at the Consensus conference in Hong Kong

Bullish also obtained a Type 1 license (for securities trading) and a Type 7 license (for automated trading services) issued by the Hong Kong Securities and Futures Commission at the beginning of this year, as well as a virtual asset trading platform license; in addition, Bullish also obtained the license required for crypto asset trading and custody issued by the German Federal Financial Supervisory Authority (BaFin).

Bullish has approximately 260 employees worldwide, more than half of whom are based in Hong Kong, with the rest located in Singapore, the United States and Gibraltar.

Another obvious manifestation of Bullishs compatibility ambition is: being pro-Circle and staying away from Tether.

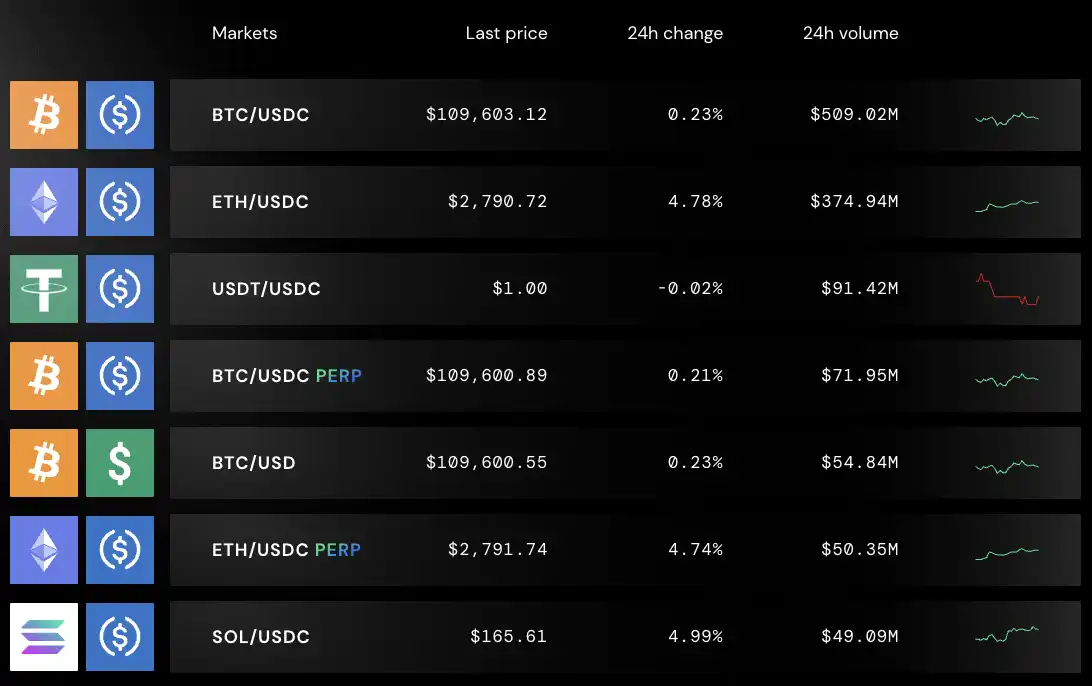

On the Bullish platform, the top few stablecoin trading pairs with the largest trading volume are all USDC, rather than USDT, which has a larger circulation scale and a longer history. This reflects its clear stance on regulatory attitudes.

In recent years, as USDT has been under regulatory pressure from the US SEC, its market dominance has begun to waver. On the other hand, USDC, a stablecoin jointly launched by compliance companies Circle and Coinbase, has not only been successfully listed on the US stock market, but has also been favored by the capital market as the first stablecoin stock with an excellent stock price trend. With good transparency and regulatory adaptability, USDCs trading volume continues to soar.

According to the latest report released by Kaiko, USDCs trading volume on centralized exchanges (CEX) increased significantly in 2024, reaching $38 billion in March alone, far higher than the monthly average of $8 billion in 2023. Among them, Bullish and Bybit are the two platforms with the largest USDC trading volume, and the two together account for about 60% of the market share.

The love-hate relationship between Bullish and EOS

If I were to describe the relationship between Bullish and EOS in one sentence, it would be former and current.

Although the price of A (formerly EOS) rose by 17% after Bullish announced that it had secretly submitted an IPO application, in fact, the relationship between the EOS community and Bullish is not good, because after Block.one abandoned EOS, it turned around and embraced Bullish.

Back in 2017, the public chain track was in its golden age. Block.one launched EOS with a white paper, a super public chain project with the slogan of millions of TPS, zero handling fees, which attracted a large number of investors from all over the world. Within a year, EOS raised $4.2 billion through ICO, breaking the industry record and igniting the fantasy of Ethereum Terminator.

However, the dream started quickly and collapsed quickly. After the EOS mainnet was launched, users soon discovered that this chain was not as invincible as advertised. Although there was no handling fee for transfers, CPU and RAM had to be pledged, and the process was complicated and the operation threshold was high. The node election was not the democratic governance imagined, but was quickly controlled by large users and exchanges, and problems such as vote buying and mutual voting occurred.

But what really accelerated the decline of EOS was not just technical issues, but more of a problem with resource allocation within Block.one.

Block.one originally promised to invest $1 billion to support the EOS ecosystem, but it actually did the exact opposite: it bought large amounts of U.S. Treasury bonds, hoarded 160,000 bitcoins, invested in the failed social product Voice, and used the money to speculate in stocks and buy domain names…very little of the money was actually used to support EOS developers.

At the same time, power within the company is highly concentrated, and the core executives are almost all composed of Block.one founder BB and his relatives and friends, forming a small circle of family business. After 2020, BM announced his departure from the project, which also became a precursor to the complete split between Block.one and EOS.

What really ignited the anger of the EOS community was the appearance of Bullish.

Block.one founder BB

In 2021, Block.one announced the launch of the crypto trading platform Bullish, and claimed that it had completed $10 billion in financing, with a luxurious list of investors, including PayPal co-founder Peter Thiel, Wall Street veteran Mike Novogratz and other first-tier capital support. This new platform focuses on compliance and stability, and builds a bridge for crypto finance for institutional investors.

But Bullish has almost nothing to do with EOS, from technology to brand. It does not use EOS technology, does not accept EOS tokens, does not acknowledge any connection with EOS, and does not even express the most basic thanks.

For the EOS community, this is tantamount to an open betrayal: Block.one used the resources accumulated from the establishment of EOS to start a new love, while EOS was completely left in its place.

Thus, the counterattack from the EOS community began.

At the end of 2021, the community launched a fork uprising in an attempt to cut off Block.ones control. The EOS Foundation, as a representative of the community, came forward and began negotiations with Block.one. But within a month, the two sides discussed multiple options but failed to reach an agreement. In the end, the EOS Foundation joined 17 nodes to revoke Block.ones power and kicked it out of the EOS management. In 2022, the EOS Network Foundation (ENF) initiated legal proceedings, accusing it of betraying its ecological commitments; in 2023, the community even considered using a hard fork to completely isolate the assets of Block.one and Bullish.

After EOS and Block.one separated, the EOS community engaged in a years-long lawsuit with Block.one over the ownership of the funds raised, but to date Block.one still has ownership and use rights to the funds.

Therefore, in the eyes of many people in the EOS community, Bullish is not a new project, but more like a symbol of betrayal. Bullish, which secretly submitted an IPO application, has always been the new love who exchanged their ideals for reality – glamorous, but shameful.

In 2025, in order to cut off the past, EOS officially changed its name to Vaulta, built Web3 banking business based on the public chain, and also renamed the token EOS to A.

How much money does Block.one, which is extremely wealthy, have?

We all know that Block.one raised $4.2 billion in the early days, becoming the largest financing event in the history of cryptocurrencies. In theory, this amount of money can support the long-term development of EOS, support developers, promote technological innovation, and enable the ecosystem to continue to grow. When EOS ecosystem developers begged for funding, Block.one only threw out a check for $50,000 – this amount was not enough to pay Silicon Valley programmers for two months salary.

“Where did the $4.2 billion go?” the community asked.

On March 19, 2019, BM wrote an email to Block.one shareholders, revealing part of the answer: As of February 2019, Block.one held assets (including cash and invested funds) totaling $3 billion. Of this $3 billion, about $2.2 billion was invested in U.S. government bonds.

Where did the $4.2 billion go? Generally speaking, it went to three major directions: $2.2 billion to buy government bonds: low risk, stable returns, to ensure wealth preservation; 160,000 bitcoins: now worth more than $16 billion; a small amount of stock speculation and acquisition attempts: such as the failed Silvergate investment and the purchase of the Voice domain name.

What many people don’t know is that EOS’s parent company Block.one is currently the private company with the largest number of Bitcoins, with a total of 160,000 BTC, 40,000 more than the stablecoin giant Tether.

Data source: bitcointreasuries

Based on the current price of $109,650, these 160,000 BTC are worth about $17.544 billion. In other words, Block.one has earned more than $13 billion on paper from the appreciation of this Bitcoin alone, which is about 4.18 times the amount of ICO financing that year.

From the perspective of cash flow is king, Block.one is very successful today. It can even be said to be a more forward-looking company than MicroStrategy, and one of the most profitable project parties in the history of cryptocurrencies. However, it does not rely on building a great blockchain, but on how to maximize the preservation of principal, expand assets, and exit smoothly.

This is the other side of the irony and reality of the crypto world: in the cryptocurrency world, the one who wins in the end may not be the one with the best technology or most passionate ideals, but the one who understands compliance best, is best at judging the situation, and is best at keeping money.

This article is sourced from the internet: Bullish: The parent company bought 160,000 BTC and made billions in 6 years

Original author: Yiping Original source: IOSG Ventures Challenges Facing Crypto Infrastructure 시장 fatigue and falling valuations The cryptocurrency infrastructure space is experiencing significant market fatigue. After years of explosive growth, infrastructure project valuations are shrinking and investors are becoming more discerning. This trend reflects an increasingly mature market where technological innovation alone is no longer enough to earn high valuations. Innovation issues Today’s infrastructure projects face a critical dilemma: most offer similar functionality with minimal differentiation. Despite advances in technology, we have yet to see groundbreaking use cases that enable entirely new categories of applications. The ecosystem struggles to provide a compelling value proposition for established Web2 platforms (like X or Instagram) to migrate to the blockchain. Beyond decentralization, these platforms have little reason to radically change how they operate.…