Core Takeaways

- Projects that solve real, concrete problems can maintain resilience even during market downturns.

- Hyperliquid, Canton, and Kite target different problem areas, but they share a common trait: offering practical and realistic solutions, not abstract narratives.

- To assess this realism, analysis should focus on three factors: the problem the project aims to solve, the structure of the solution, and the team’s practical execution capabilities.

1. Survival Conditions in a Bear 市場: Does It Work in Practice?

ソース: Tiger Research

Bitcoin has fallen below $70,000. Among the top 100 暗号currencies by market cap, only 7 remain above their 200-day moving average. In contrast, 53 components of the Nasdaq 100 index are still trading above this threshold.

Market conditions are undeniable. Despite this, some crypto assets manage to survive even in the harshest environments.

Their resilience cannot be simply attributed to artificial market making or random rallies. A closer look at their development trajectories reveals a different explanation.

These projects no longer rely solely on vague visions or technical complexity. Instead, they share a common characteristic: solving core market problems with solutions rooted in practical reality. Their approaches typically align with three directions:

- Do they solve a problem the market currently faces?

- Are they prepared for practical application in the near term?

- Are they building infrastructure the industry will rely on long-term?

Ultimately, the ability to solve real problems in practice remains the most powerful fundamental.

2. Three Directions Chosen by the Market

Projects that can answer the above questions have successfully survived. Their approach is: 1) clearly identifying a market problem; 2) proposing a practical solution that matches a specific timing.

2.1. Hyperliquid: Solving Immediate Trading Friction

Centralized exchanges have traditionally been viewed as responsible intermediaries. However, in practice, when issues arise, they often fail to align with investor interests. Decentralized exchanges emerged as an alternative, but poor user experience and performance have led many investors to steer clear.

In this context, Hyperliquid introduced the concept of a perpetual contract decentralized exchange (perp DEX). Through its HLP mechanism, it brings the features investors value in centralized exchanges—such as high leverage, fast execution, and stable liquidity—into an on-chain environment.

Early usage was partly driven by demand for the $HYPE token airdrop. However, sustained engagement post-airdrop reflects user satisfaction with the platform’s performance.

Ultimately, Hyperliquid’s resilience stems from solving a persistent, real-world problem: dissatisfaction with centralized exchanges.

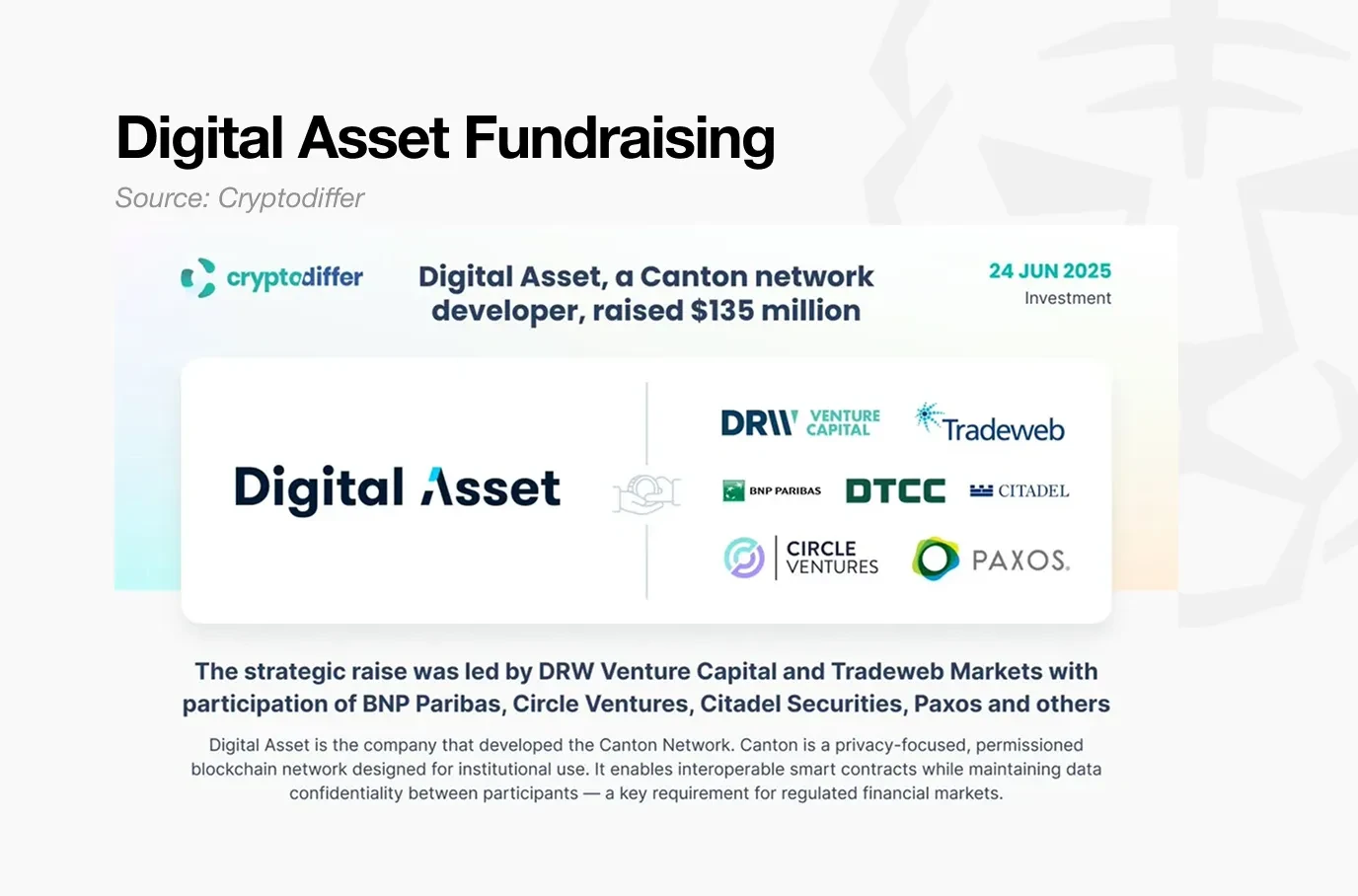

2.2. Canton Network: Preparing for the Era of Institutional Finance

Canton proposes a solution for the near future. As interest in real-world assets (RWA) continues to rise, institutions are beginning to view blockchain as financial infrastructure, not a public network. In this context, what institutions need is not complete data transparency, but a selective privacy model that supports regulatory compliance and confidentiality.

Enter the Canton Network. Through DAML, Canton enables configurable data disclosure for each participant.

This allows institutions to maintain transaction confidentiality while sharing information only as necessary. Rather than imposing a provider-driven design, Canton builds infrastructure that aligns with institutional needs.

Another key factor is that Canton has, from the outset, scaled its ecosystem with real-world deployment in mind, supported by early partnerships with financial institutions.

Most notably, its partnership with DTCC has established a pathway for assets managed by traditional financial systems to extend into a Canton-based environment. DTCC processes approximately $3.7 quadrillion in transactions annually, underscoring the practical feasibility of the Canton Network’s approach.

Ultimately, the Canton Network provides a structural solution designed to meet three institutional requirements simultaneously: privacy protection, regulatory compliance, and integration with existing financial systems.

2.3. Kite AI: Building the AI Economy That Has Yet to Arrive

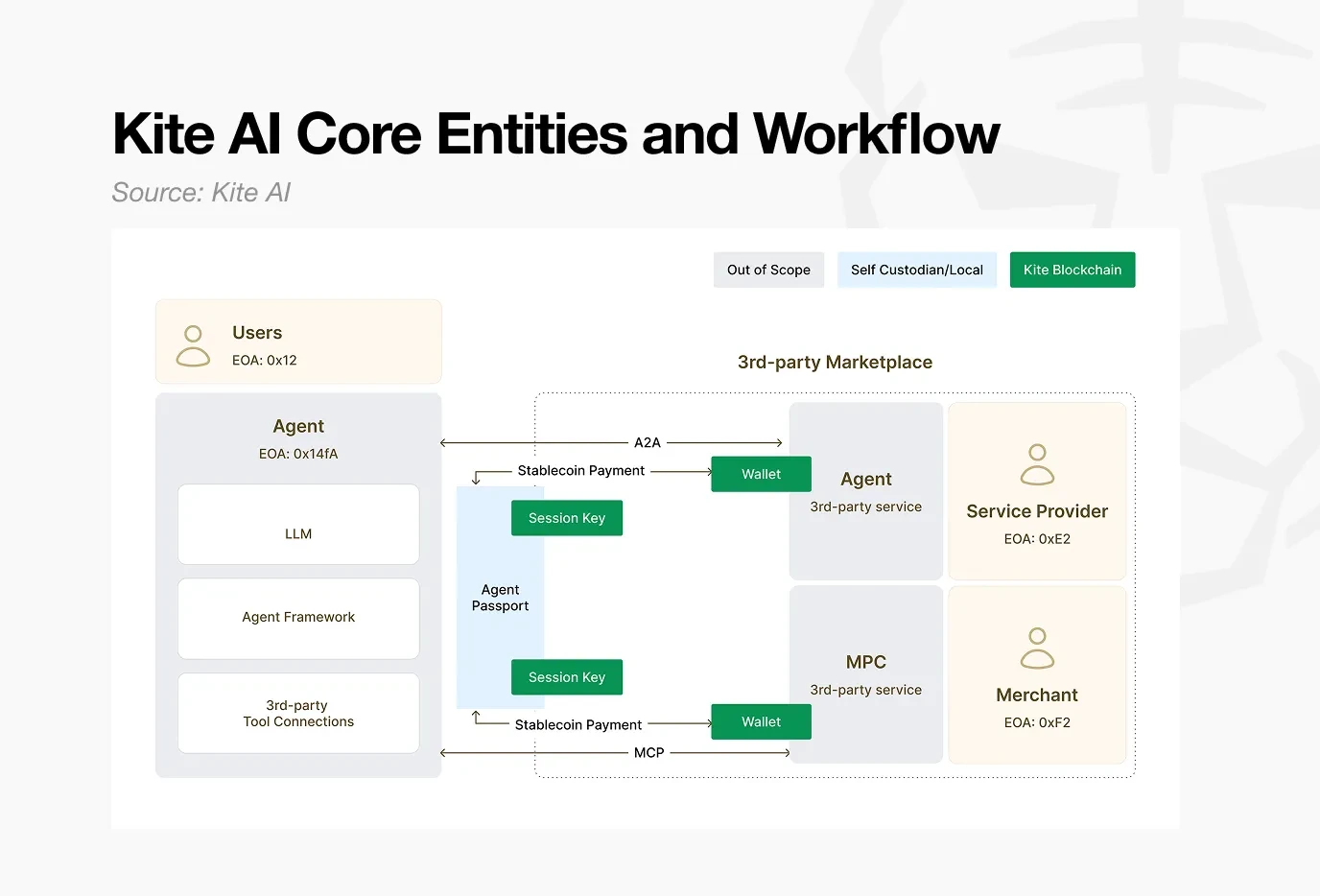

Unlike the previous two examples, Kite AI currently has limited practical application. However, from the future perspective of AI agents operating as economic actors, its structural logic remains compelling.

There is broad consensus across both Web2 and Web3 about an agent-driven future. Few question scenarios where AI agents handle tasks like booking hotels or buying groceries on behalf of users.

However, such a future requires infrastructure that allows AI agents to independently initiate and execute payments. Existing transaction systems are designed for human-to-human transfers and efficiency among human participants.

Therefore, enabling AI agents to function as autonomous economic entities requires new mechanisms, including identity verification and automated payment frameworks.

Kite AI is building payment infrastructure for this environment. Its core components include an “Agent Passport” for identity verification and the x402 protocol functionality for enabling automated payments.

The vision proposed by Kite AI cannot be deployed at scale today, simply because the future it targets has not yet materialized.

Nonetheless, the project’s realism stems from a broader premise: when this widely anticipated future arrives, the underlying technology it is developing will be necessary. This alignment with a widely accepted development trajectory lends the project structural credibility, despite its current limited use.

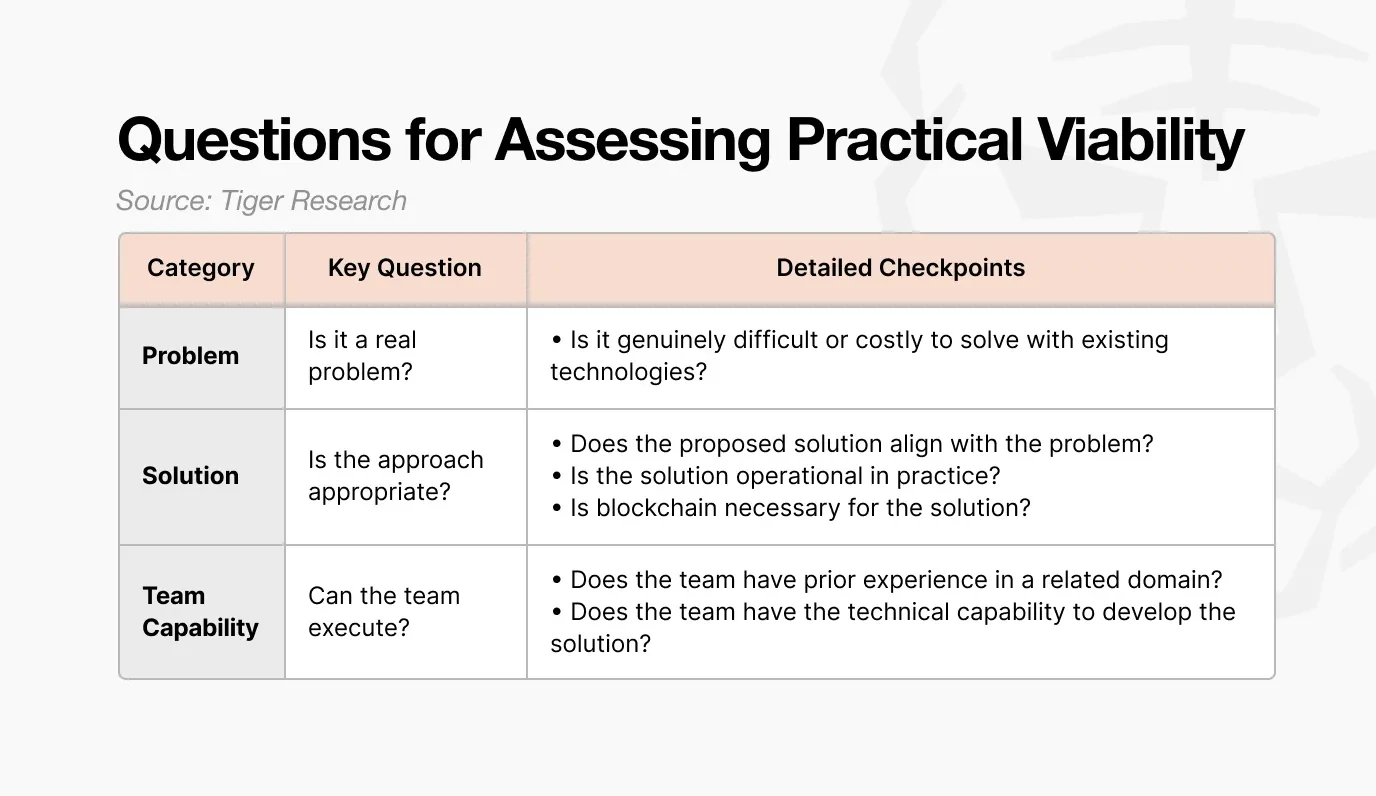

3. Three Key Questions for Assessing Practical Feasibility

Although these three projects have different timelines, they share a common characteristic: real-world feasibility.

Evaluations of the same project often diverge. Some believe it solves a real problem, while others see it as overhyped. To bridge this interpretation gap, at least three core questions must be asked:

ソース: Tiger Research

- それはどんな問題を解決するのでしょうか? Is the problem the project targets real and is there market demand for its solution?

- How does it solve it? Is the proposed solution structurally sound and executable?

- Who is executing it? Does the team possess the capability and resources to translate the vision into reality?

Since most projects promote optimistic future narratives, answering these questions correctly requires time and effort. Filtering out misleading or incomplete information is not easy. Projects that cannot confidently answer these three questions may experience short-term price increases, but when the next downturn arrives, they are likely to disappear.

The current state of the cryptocurrency market is clearly unfavorable. But that doesn’t mean it’s the end. New experiments will continue, and the task is to evaluate what these efforts truly represent.

What matters most now is realism.

この記事はインターネットから得たものです。 Tiger Research: Realism is the Only Answer in the Cryptocurrency Downturn

Related: The Key Value of Munger and Buffett’s Long-Term Thinking Model for Web3

1. The Key Value of Munger and Buffett’s Long-Term Thinking Model for Web3 Munger and Buffett have repeatedly emphasized: The value of a company stems from the discounted present value of the free cash flow it can consistently generate in the future, not from temporary price anomalies caused by market sentiment, narratives, or consensus. Although the valuation logic and risk style of the tech industry differ completely from the rhythm of traditional sales sectors, their ultimate core essence is the same. Mapping this long-term framework to Web3 reveals three crucial judgment criteria: 1. Does the public chain/application have genuine long-term demand? Around 2026, many new projects fell into a misconception: allocating significant budgets to marketing for short-term stimulation and airdrop tasks. Coupled with exchanges using platforms like Twitter for listing…