WealthBee Monthly Report: The Fed will start cutting interest rates in 2025, this time it will be “fuel” rather than “sp

The Federal Reserve officially began a cycle of interest rate cuts in September 2025. This macroeconomic policy turning point is creating an unprecedentedly favorable environment for 暗号 assets. Despite short-term market volatility, the cheap liquidity brought about by the rate cuts, institutional investment demand, and the global desire for alternatives to traditional finance are forging a new cornerstone for the crypto market.

In August, the US core PCE still reached 2.7%, significantly above the policy target. However, pressured by a cooling job market, the Federal Reserve initiated a precautionary interest rate cut in September. On September 17, 2025, the Fed made the long-awaited decision to cut interest rates by 25 basis points, lowering the target range for the federal funds rate from 4.25%-4.50% to 4.00%-4.25%, thus officially starting the 2025 rate cut cycle. This marks the second time the Fed has adopted an accommodative monetary policy, following three rate cuts in 2024.

In its latest meeting statement, the Federal Reserve removed the key phrase “labor market conditions remain solid,” instead emphasizing that “job growth has slowed and the unemployment rate has risen.” This shift indicates that within its dual mandate of inflation and employment, the Fed is formally shifting its policy focus toward protecting the job market.

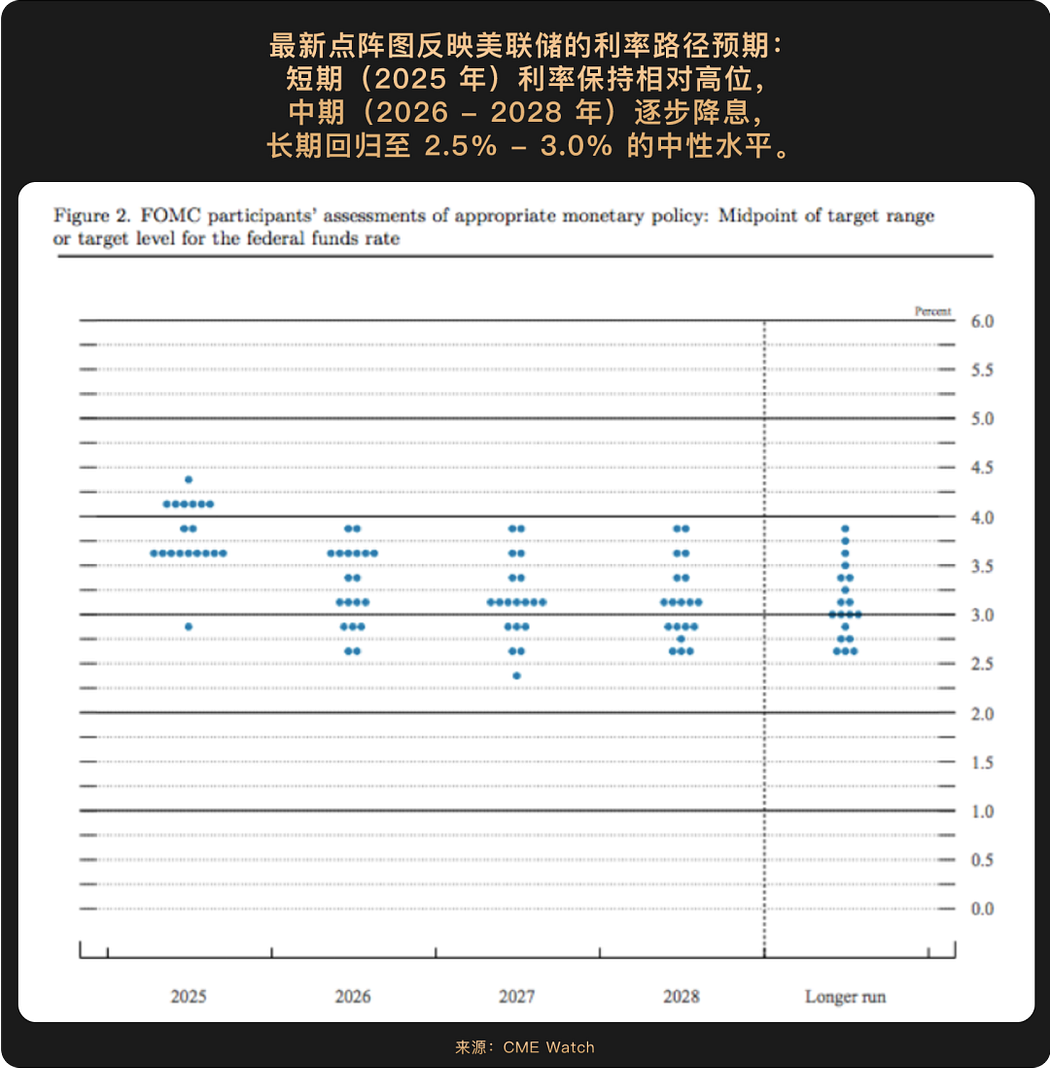

At the press conference, Powell admitted that ” there is no risk-free path ,” highlighting the cautious approach taken in this round of preventative rate cuts. A new dot plot shows that Fed officials’ median forecast for the interest rate is 3.6% by the end of 2025, suggesting room for two more rate cuts this year. The market reacted strongly. According to CME Watch, the probability of an October rate cut has risen to 91.9%, and the probability of a third rate cut in December exceeds 60%. While there are slight discrepancies between the dot plot guidance and market expectations, the easing tone has been largely established . The market had already priced in a small number of rate cuts this year, but this price-in has risen further since the meeting.

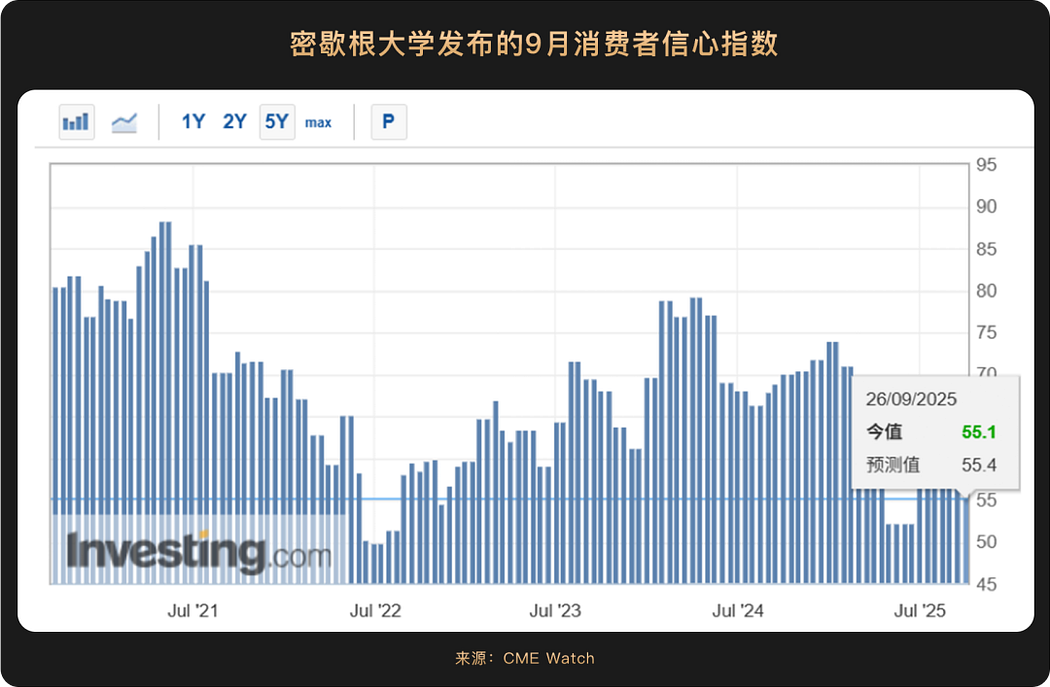

Furthermore, the University of Michigan released its final Consumer Confidence Index for September at 55.1, down approximately 5% from 58.2 in August and below market expectations of 55.4. It also plummeted 21.4% from the same period last year, reaching its lowest level since May 2025. Recent data has shown signs of a cooling labor market (one of the factors behind the Federal Reserve’s decision to cut interest rates in September). The market is closely watching the upcoming September non-farm payroll data, as any signs of weakness could reinforce expectations of a Fed rate cut .

Overall, the current U.S. macroeconomic situation presents a picture of strong economic growth but insufficient consumer confidence, and a policy outlook full of uncertainty . The Federal Reserve will continue to carefully balance the dual goals of employment support and inflation control under a data-dependent framework, and every interest rate decision is like walking a tightrope.

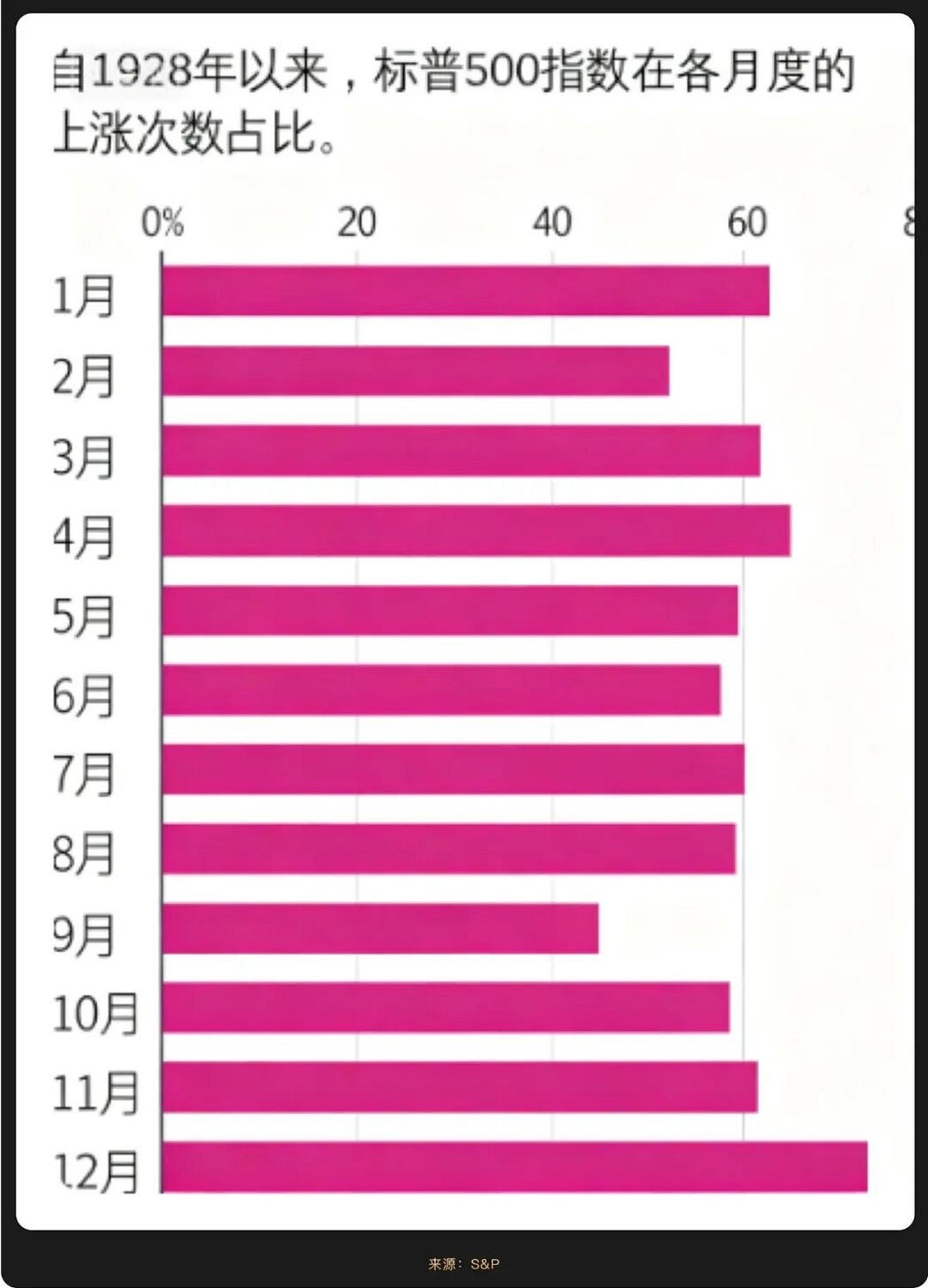

Historical data shows that US stocks tend to perform weakly in September, often referred to as the “September curse.” However, driven by news of interest rate cuts, the Nasdaq, S&P 500, and Dow Jones Industrial Average all rallied in September, reaching record highs. Technology stocks performed particularly strongly, with Intel (NASDAQ: INTC) surging over 22% in a single day. AI-related sectors continued their leading performance since the beginning of the year.

This round of rise benefited from dual driving forces: on the one hand, the start of the interest rate cut cycle has significantly increased risk appetite, which is in line with the historical pattern that equity assets are the first to benefit from the precautionary interest rate cut cycle; on the other hand, the AI industry has ushered in substantial performance growth. Cases such as Nvidia’s (NASDAQ: NVDA) $100 billion investment in OpenAI have provided solid support for the valuation of technology stocks.

Interestingly, the multi-billion dollar deal between Nvidia, OpenAI, and Oracle (NASDAQ: ORCL) seems to have created a new valuation framework for Silicon Valley : Nvidia’s $100 billion investment will be gradually implemented as OpenAI deploys its 10-gigawatt computing power data center. Each gigawatt of computing power requires 400,000 to 500,000 GPUs, and the total of 10 gigawatts is equivalent to Nvidia’s annual shipments. This means that the investment funds will eventually flow back to Nvidia through OpenAI’s GPU orders, and Nvidia can also obtain a share of OpenAI’s profits through equity. Oracle’s participation further strengthens the closed loop. It first spent $40 billion to purchase Nvidia chips and build the “Stargate” data center for OpenAI, and then exported computing power to OpenAI through a $300 billion cloud service contract, forming a closed-loop capital flow chain of “OpenAI→Oracle→Nvidia→OpenAI”.

This model will drive a restructuring of tech stock valuations. By tying up with core downstream customers, Nvidia strengthens its pricing power and performance visibility in the AI chip sector; Oracle leverages this to overtake its competitors in the cloud services market; and OpenAI secures funding and computing power for continued growth. This powerful alliance further exacerbates the Matthew effect in the AI industry , with resources continuing to concentrate on leading companies. This not only increases business certainty and collaborative efficiency for all parties, but also reデフィnes the competitive paradigm among tech giants in the AI era and provides investors with a new framework for analyzing the value of tech stocks.

However, Federal Reserve Chairman Powell has also explicitly warned that US stock market valuations are currently “extremely high,” a statement that is particularly crucial given the record highs. With both the S&P 500 and Nasdaq up over 20% year-to-date, valuations of AI-related stocks have already partially overestimated future performance, and any hawkish signals could trigger profit-taking. Notably, Powell emphasized that this rate cut “does not mark the beginning of an aggressive easing cycle,” suggesting that the release of liquidity will remain gradual.

Looking ahead, US stocks continue to face multiple challenges. Resilient inflation is the primary constraint. August’s core PCE rose 2.7% year-on-year, still significantly above the policy target. A rebound in subsequent data could force the Federal Reserve to slow its pace of rate cuts. Furthermore, internal disagreements within the Fed regarding its policy path, coupled with the risk of a government shutdown delaying the release of key data, will exacerbate market volatility.

Although Bitcoin experienced a pullback in September, falling below $110,000 at one point, it maintained strong support in the $90,000 to $105,000 range, reaffirming the institutional behavior of “buy on anticipation, hold on volatility.” For example, on September 25-26, amidst macroeconomic risk aversion among some investors over the possibility of a US federal government shutdown due to budgetary issues, coupled with profit-taking by long-term Bitcoin holders and the market decline triggering liquidations of highly leveraged assets, funds withdrew from risky assets like Bitcoin. However, institutional investors viewed this as a buying opportunity. On September 25, the day of the price drop, US spot Bitcoin ETFs saw a net inflow of $241 million. BlackRock’s IBIT fund alone received nearly $129 million, bringing its total holdings to 768,000 BTC (approximately $85.2 billion).

Historical data also shows that after the Federal Reserve launched a “preventive rate cut” in 2019, Bitcoin experienced an initial nearly half-year of volatility. As the long-term effects of the low-interest rate environment gradually emerged, Bitcoin stabilized at $7,000 at the end of 2019, and continued its upward trend in 2020. By the end of 2020, the price exceeded $29,000, an increase of more than 200% compared to the initial high of $10,000 at the beginning of the interest rate cut in July 2019; if calculated based on the low of $7,000 at the end of 2019, the increase was more than 300%.

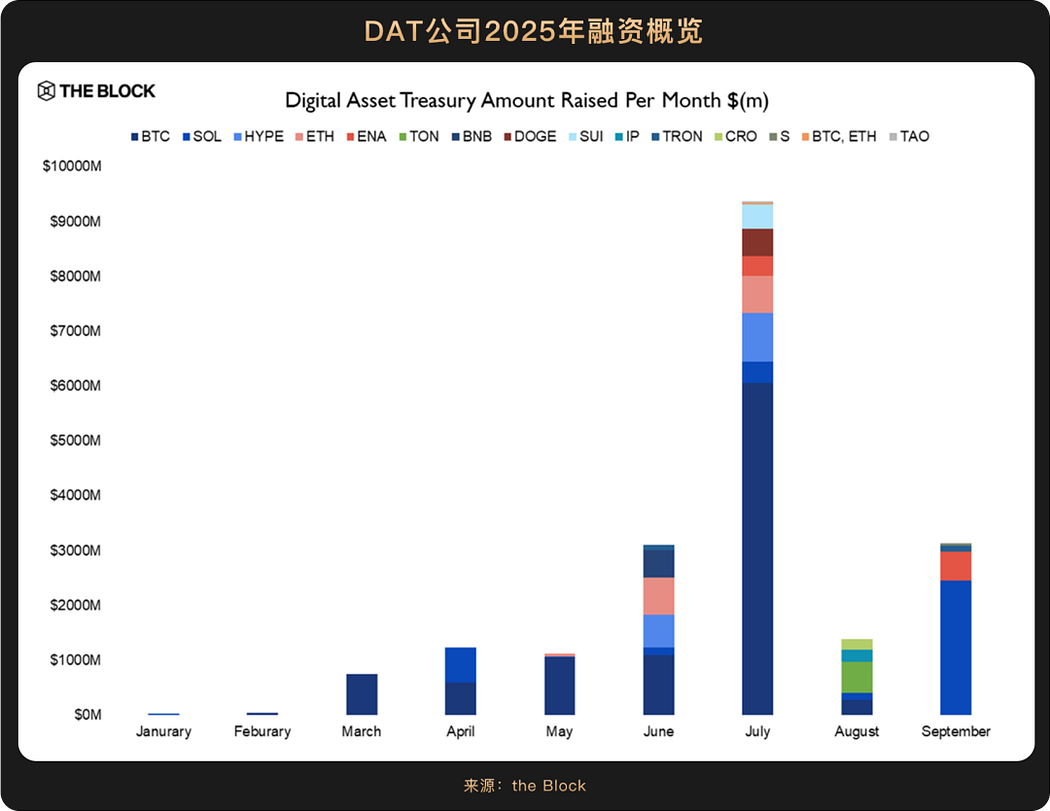

The start of a cycle of interest rate cuts signifies a decline in interest rates in traditional financial markets . In this environment of low financing costs, companies are naturally more willing to invest in assets with high growth potential, and institutional investors’ actions will become more decisive . However, unlike the 2019 rate cuts, the current cycle has seen a significant new variable: the allocation of cryptocurrencies to listed companies’ treasuries.

Furthermore, these companies are shifting their treasury allocations of crypto assets from early, marginal experiments and tentative holdings to long-term, strategic investments. In September, the board of directors of Nasdaq-listed Jiuzi New Energy (Jiuzi Holdings) (NASDAQ: JZXN) approved a $1 billion investment plan in crypto assets. Management emphasized that it “is not pursuing short-term trading gains,” but rather views crypto assets as a “long-term store of value to hedge against macroeconomic uncertainty,” highlighting the long-term and strategic nature of this allocation. On the regulatory front, also in September, the US SEC and FINRA announced investigations into over 200 public companies that announced crypto treasury plans, focusing on unusual stock price fluctuations prior to the announcements. While this move presents short-term challenges, in the long term, weeding out “fake treasury” companies that attempt to manipulate market capitalization using the “crypto narrative” will help the market identify the true and the false, fostering a healthier environment for truly strategic treasury allocation models. For market participants, treasury dynamics will become another reliable window into the direction of the industry.

In short, the evolution of crypto treasury allocation reflects the overall crypto market’s transformation from fringe to mainstream, from speculation to practical application, and from individual to institutional. As the interest rate cut cycle continues, driven by a low interest rate environment and technological innovation, corporate crypto allocations are expected to deepen and diversify. Companies that add crypto assets to their balance sheets are demonstrating their confidence in the future of crypto assets in the most direct and concrete way possible . This confidence, with interest rate cuts providing ample ammunition, is likely to become a key driver of the next wave of growth.

Looking ahead, at least three factors are creating a favorable environment for crypto assets, making them a more attractive option:

Macro fuel: 2-3 more rate cuts expected this year;

The political cycle is intensifying — the Trump administration’s pro-crypto policies and the challenges to the Federal Reserve’s independence have highlighted the safe-haven properties of decentralized assets.

The global economy is “real and virtual” – the rise in gold prices suggests recession concerns, and crypto assets combine the value storage properties of gold with the growth potential of technology, making them a better configuration option during the interest rate cut cycle.

この記事はインターネットから得たものです。 WealthBee Monthly Report: The Fed will start cutting interest rates in 2025, this time it will be “fuel” rather than “spark”Recommended Articles

Related: Foreigners support the platform, the alternative business of the cryptocurrency circle

During the Bitcoin Asia event in Hong Kong, Binance founder CZ and Trump’s son Eric Trump appeared one after another… This conference should have been only for elites and big names in the cryptocurrency circle. However, what really stole the show was a white T-shirt with four Chinese characters printed on it: “Laowai Stands on the Platform.” The person wearing it has a Western face. As he took a photo with Zhao Changpeng in the crowd, the camera peppered him with questions: Who is he? And what kind of business is this “foreigner endorsement” business? Foreigners in the cryptocurrency world This eye-catching foreigner is named Dane , the founder of the cryptocurrency agency 4 am global. After graduating from Oxford University with a degree in computer science, a trip led…