Author | Ethan ( @ethanzhang_ウェブ3)

In the DeFi world, TVL is a crucial metric—it serves as both a symbol of protocol strength and a barometer of user trust. However, a controversy surrounding the fabrication of $12 billion in Reliable Validation Area (RWA) assets quickly eroded user trust.

On September 10, Figure co-founder Mike Cagney took the lead in firing on the X platform, publicly accusing the on-chain data platform DefiLlama of refusing to display its RWA TVL simply because of “insufficient number of fans on social platforms” and questioning the fairness of its “decentralization standard.”

A few days later, DefiLlama co-founder 0xngmi published a long article titled “The Problem in RWA Metrics” in response , revealing the data anomalies behind Figure’s claimed $12 billion scale, pointing out that its on-chain data is unverifiable, the assets lack a real transfer path, and there is even suspicion of evading due diligence .

As a result, a full-scale battle for trust over “on-chain verifiability” and “off-chain mapping logic” broke out.

Timeline of events: Figure initiated the attack, and DefiLlama responded strongly.

The controversy was sparked by a tweet from Figure co-founder Mike Cagney .

On September 10th, he announced on the X platform that Figure’s home equity line of credit (HELOCs) had been successfully listed on CoinGecko. He also accused DefiLlama of refusing to display Figure’s $13 billion TVL on the Provenance Chain . He directly criticized DefiLlama’s “censorship logic,” even claiming that they denied its inclusion on the list due to “X’s insufficient number of followers.” (Odaily Note: Mike Cagney’s reference to $13 billion here is inconsistent with the $12 billion figure reported in 0xngmi’s response later in the article.)

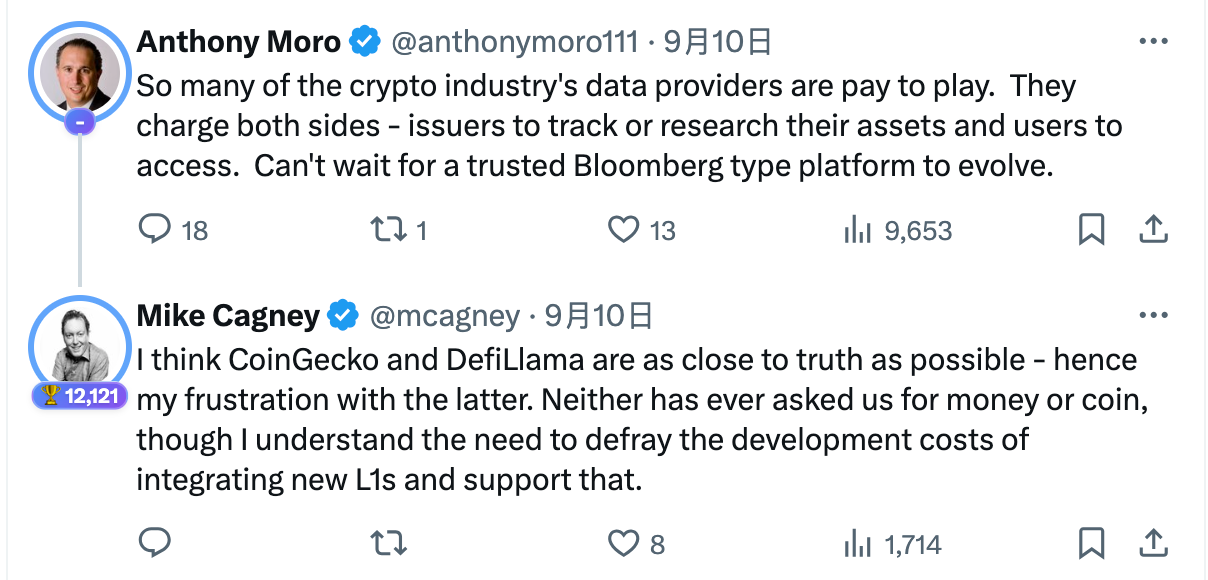

About an hour after this statement was made, Provenance Blockchain CEO Anthony Moro (who, judging by the context, appears to have intervened without fully understanding the background) commented on the same thread, expressing strong distrust of the industry data platform デフィラマ :

Later, Figure co-founder Mike Cagney added that he understood the development costs of integrating the new L1, but also said that Coingecko and DefiLlama had never asked Figure for fees or tokens to clarify their implication of “paying to be on the list.”

On September 12, Jon Ma, co-founder and CEO of L1 data dashboard Artemis (also seemingly without full knowledge of the details of the dispute), publicly extended an olive branch.

During this period, public opinion was clearly inclined towards Figure – many onlookers pointed the finger at DefiLlama’s “credibility and neutrality.”

It wasn’t until September 13th that DefiLlama co-founder 0xngmi published a long article titled ” The Problem in RWA Metrics ,” systematically disclosing his due diligence findings and four questions, that the narrative began to reverse. Immediately afterwards, opinion leaders such as ZachXBT reposted the article in support, emphasizing that ” these indicators are not 100% verifiable on-chain ,” and DefiLlama’s position gained wider support.

DefiLlama’s findings: Data mismatch

でa lengthy article titled “The Problem in RWA Metrics,” 0xngmi published the results of the DefiLlama team’s due diligence on Figure, listing several anomalies:

The scale of assets on the chain is seriously inconsistent with the declared scale

Figure claims that the scale of RWA issued on its chain has reached 12 billion US dollars , but the actual assets that can be verified on the chain are only about 5 million US dollars of BTC そして 4 million US dollars of ETH . Among them, the 24-hour trading volume of BTC is even only 2,000 US dollars .

Insufficient stablecoin supply

The total supply of Figure’s own stablecoin YLDS is only 20 million . In theory, all RWA transactions should be based on this, but the supply is far from enough to support a transaction volume of US$12 billion.

Suspicious asset transfer patterns

Most RWA asset transfers are not initiated by the actual asset holders, but rather through other accounts. Many addresses themselves have almost no on-chain interactions and are suspected to be just database mirrors .

Lack of on-chain payment traces

The vast majority of Figure’s loan processes are still completed using fiat currency, and there are almost no corresponding payment and repayment records on the chain.

0xngmi added: “We’re unsure how Figure’s $12 billion in assets are actually being traded. Most holders don’t appear to be using their own keys to transfer these assets — are they simply mirroring their internal databases onto the chain?”

Community Statement: DefiLlama Receives Overwhelming Support

As the controversy spread, community opinion almost overwhelmingly supported DefiLlama, but in the process, some voices from different perspectives also emerged.

ZachXBT (Chain Detective) :

They bluntly stated that Figure’s actions were “blatant pressure” and made it clear: “No, your company is trying to use indicators that are not 100% verifiable on the chain to publicly pressure participants like DefiLlama who have been proven to be honest.”

Conor Grogan (Coinbase board member) :

He directed his criticism at those institutional figures who were lobbied by Figure and who privately questioned DefiLlama when the controversy was still murky . He wrote: “I have received numerous private inquiries from individuals from large 暗号currency institutions and venture capital firms to contact DefiLlama and our partners. Every one of these people needs to be called out and asked how they can work in this industry if they can’t even verify things themselves.”

Conor’s remarks echoed the thoughts of many people: if even basic on-chain verification cannot be completed independently, then the credibility of these institutions in the RWA and DeFi sectors will be greatly reduced .

Ian Kane (Head of Partnerships, Midnight Network) :

あ more technical suggestion was made, suggesting that DefiLlama could add a new metric, “active TVL,” in addition to the existing TVL tracking, to show the actual transfer rate of RWA over a given period. He gave an example: “For example, two DApps each minted $100 billion in TVL (a total of $200 billion). DApp 1 has $100 billion sitting idle, with perhaps only 2% of its funds flowing, generating $2 billion in active locked value. DApp 2, on the other hand, has 30% of its funds flowing, generating $30 billion in active locked value (15 times that of DApp 1).”

In his opinion, such a dimension can not only show the total scale, but also avoid “stagnant or show-off TVL.”

同時に、 ZachXBT also noticed that Figure co-founder Mike Cagney kept forwarding some “support comments” that were suspected to be automatically generated by AI , and publicly pointed this out, further arousing disgust with Figure’s public opinion manipulation.

Conclusion: The price of trust has just begun to show

The dispute between Figure and DefiLlama may seem like a ranking issue, but it actually hits the core weakness of the RWA track – what exactly counts as an “on-chain asset” .

The core contradiction of this turmoil is actually on-chain fundamentalism vs. off-chain mapping logic .

- DefiLlama insists on only counting TVL that can be verified on the chain, adhering to open source adapter logic, and refusing to accept asset data that fails to meet transparency requirements.

- Figure’s model : While assets may exist in the real world, the business logic relies heavily on traditional financial systems, with the on-chain portion merely being a database echo. In other words, users cannot use on-chain transactions to prove the transfer of assets, which conflicts with the “verifiability” standard held by DeFi natives.

The so-called $12 billion is equal to 0 if it cannot be verified on the chain.

In an industry where transparency and verifiability are the bottom line, any attempt to bypass on-chain verification and use database numbers to impersonate on-chain TVL will ultimately undermine user and market trust.

This controversy may just be the beginning. Similar issues will continue to arise as more RWA protocols emerge. The industry urgently needs to establish clear and unified verification standards, otherwise “virtual TVL” will continue to expand, becoming the next landmine that erodes trust.

この記事はインターネットから得たものです。 A $12 billion false boom? Figure and DefiLlama’s dispute over “RWA data falsification”Recommended Articles

作者 | Golem(@web 3_golem) 9 月 5 日,全球第二大比特币矿企灿谷(Cango Inc.)发布了 2025 年 Q 2 财报(截至 6 月 30 日),这是灿谷完成由一家互联网车企向比特币矿企战略转型后的首份季度报告,颇受外界关注。 财报数据显示,灿谷 2025 年第二季度总收入为 10 亿元人民币(1.398 亿美元),其中比特币挖矿业务收入为 9.894 亿元人民币 (1.381 亿美元),第二季度共挖出 1404.4 枚比特币,传统汽车交易业务收入 1240 万元人民币(170 万美元)。从营业收入构成来看,灿谷历经 9 个月的转型是成功的。 但灿谷 2025 年第二季度仍营业亏损 13 亿元人民币(约合 1.804 亿美元),2024 年同期营业亏损为 1300 万元人民币;2025 年第二季度净亏损达 21 亿元人民币(约合 2.954 亿美元),而 2024 年同期净利润为 8600 万元人民币。 灿谷转型后虽然收入增长,但相比 2024 年同期,营业亏损持续扩大,甚至会计上产生巨额净亏损。难道灿谷的转型“只有面子没有里子”,恐成又一 Web 2 企业进军加密行业的商业失败案例? 转型中的“成长烦恼” 对于上市公司而言,投资者是否对其财报及背后的经营满意,全都反映在股价上。9 月 5 日美股开盘,灿谷(NYSE: CANG)股价当日盘中最高上涨至 5.12 美元,本周一美股开盘后 CANG 继续延续涨势,收盘价为 5.5 美元。 灿谷2025年Q2财报公布后股价表现(截至9月9日) 单从股价表现来看,投资者认为灿谷交出了一份令人满意的答卷。 细扒 Q 2 财报便能发现其中端倪,2025 年第二季度灿谷总运营成本及费用为 23 亿元人民币(约合 3.203 亿美元),除去正常的设备折旧、人力行政开支,最大的成本来自矿机减值产生的账面亏损(18 亿元人民币)。 2024 年 10 月,灿谷选择以股权结算的方式收购 18 E/s 矿机,对应增发股价为每股 ADS 约 2 美元,总价值 1.44 亿美元。但截至 2025 年 6 月 30 日,灿谷股价已涨至 4 美元上方,按现行公允价值评估后形成 2.569 亿美元(18 亿元人民币)账面亏损。 因此,这 18 亿元人民币属于“会计意义上的亏损”。根据股权收购协议,18 E/s 矿机的股权收购是针对八名矿工的私募,并非是公开发行,并且发行后股东有 6 个月的锁定期,即使股价已翻了一倍,股票目前也无法进入二级市场抛售。 此外造成会计意义上净亏损的另一个原因来自原有中国资产处置产生的一次性损失。在原有汽车业务剥离过程中,灿谷原以 3.5194 亿美元的合同对价出售所有中国业务,但最终经第三方专业评估机构评估,相关资产的公允价值低于原账面价值,由此产生了 8258 万美元一次性折损。 可见,灿谷 2025 年 Q 2 实现净亏损的原因并未来自挖矿业务表现不佳,而只是转型中遇到的“成长烦恼”。“我们以短暂的会计波动换取了可持续的竞争优势——规模效应跃升、成本结构极致优化、战略焦点锁定高端计算。随着全新地基夯实、增长路径清晰,我对灿谷的未来,抱有前所未有的笃定与信心。”灿谷 CEO Paul Yu 在…