原作者: BitMEX

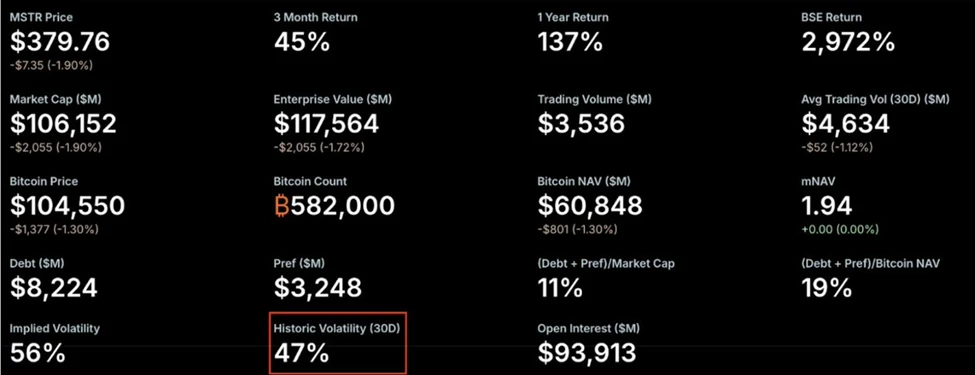

As Bitcoin has once again become the focus of global investors, listed companies holding Bitcoin – commonly known as Bitcoin treasury stocks – have also seen a surge in valuations. Japans Metaplanet (stock code MTPLF) is currently trading at a premium of about 7 times mNAV (market value/net asset value), far exceeding the approximately 1.8 times of the old American Bitcoin treasury MicroStrategy (MSTR) . Does this number mean that Metaplanet really has stronger asset operation and financing capabilities, or is it a product of investor sentiment? This article will dismantle the logic behind Metaplanets valuation for readers from three aspects: financing structure, Bitcoin hoarding efficiency and risk.

1. Floating exercise price warrants: old wine in new bottles, or institutional breakthrough?

If traditional listed companies want to quickly raise funds to purchase 暗号currencies, they often use a combination of convertible bonds + additional stock issuance. However, once the convertible bonds are triggered to convert into shares, they often cause a significant dilution to the original shareholders, and the stock price is under pressure. Metaplanet pioneered the introduction of moving-strike warrants in Japan.

The core innovation of Metaplanets moving-strike warrants is that the exercise price is not locked in once, but is dynamically adjusted according to stock price performance and preset indicators. The company set the initial exercise price at 1,388 yen, 1.83% higher than the closing price of the previous trading day. This premium design reflects the managements firm confidence in the companys intrinsic value. More importantly, in the highly volatile cryptocurrency-related stock environment, this dynamic adjustment mechanism can effectively weaken the vicious cycle of selling-dilution-reselling.

Metaplanet has demonstrated extreme focus and strategic clarity in its use of funds. The company invested 96% of the raised funds directly in Bitcoin purchases, with the remaining small amount used for bond redemptions and income-generating strategies (such as selling put options). This highly concentrated allocation strategy reflects managements firm belief in Bitcoin as a strategic asset to hedge against Japans long-term negative interest rate environment and the weakness of the yen.

In terms of risk control, the company has set up multiple safety thresholds:

-

Minimum exercise price protection: Set a minimum exercise price of 777 yen to provide shareholders with a last line of defense in extreme market conditions and avoid the risk of unlimited dilution

-

Execution rhythm control: Tokyo Stock 交換 rules limit the number of options exercised per month to no more than 10% of the outstanding shares, and reserve the right to suspend the exercise of options to avoid instantaneous market shocks

-

Institutional endorsement: The shares will be sold to EVO FUND, a Cayman Islands fund that has previously supported Metaplanet’s multiple rounds of financing

This design allows Metaplanet to raise funds at a high premium when stock prices are high, and hold coins at a low price when Bitcoin adjusts, achieving moving-strike returns through time differences. When stock prices perform strongly, the exercise price of moving-strike warrants will be adjusted accordingly, and the company will be able to issue new shares at a higher price; and when Bitcoin prices fall back, the company can use the funds previously raised to increase its holdings of Bitcoin at a lower price.

The effectiveness of this strategy has been verified by the market. Metaplanets stock price has risen by more than 275% so far this year, while its Bitcoin portfolio value has exceeded $1 billion, achieving a return of 225.4% so far this year. This double leverage effect – rising stock prices bring better financing conditions, and Bitcoin appreciation increases investment returns – creates significant value growth for shareholders.

From the perspective of institutional innovation, Metaplanets moving-strike warrants are not simply old wine in new bottles, but a major breakthrough based on traditional warrants, providing companies with a new financing tool paradigm in the field of high-volatility asset allocation.

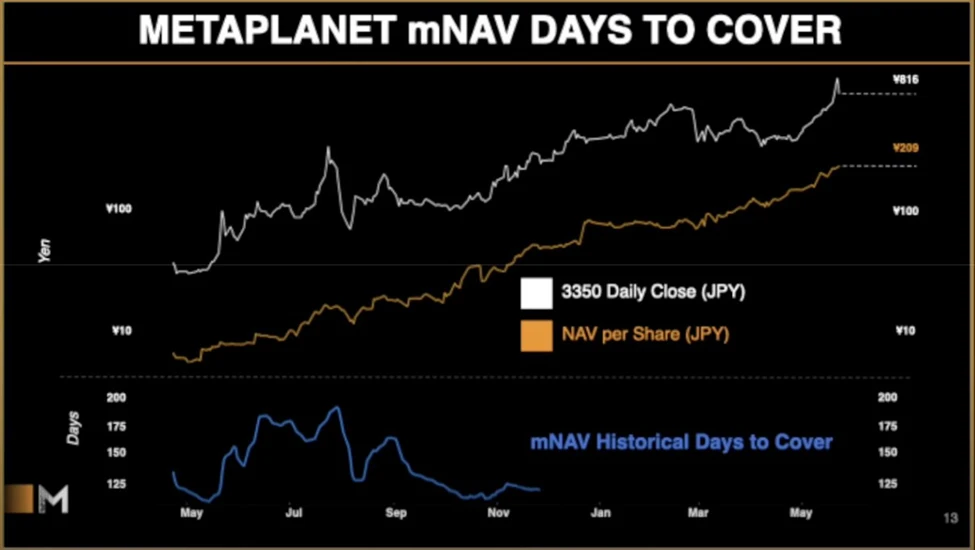

2. MetaPlanet’s coin hoarding efficiency is high: Premium replenishment only takes 120 days

The key to measuring whether the premium of treasury shares can be landed is the speed at which the company converts the premium into physical Bitcoin. The commonly used indicator Days-to-Cover is calculated as follows:

Days-to-Cover = Current Premium ÷ Daily Hodling Rate of Return

-

Metaplanet: The average daily coin hoarding yield is about 1.4% -1.5% , and the Days-to-Cover is about 120 days.

-

MicroStrategy: The average daily coin hoarding yield is only about 0.12% , and the Days-to-Cover is as long as 626 days.

In other words, if there are no external variables, Metaplanet can theoretically fill the market value premium with newly added Bitcoin in just four months, while MSTR needs nearly two years. The efficient pace of hoarding coins is the core reason why the market is willing to give a higher mNAV.

3. Metaplanet uses volatility to “squeeze out” Bitcoin – This train can run fast, but please fasten your seat belts

Capital formation and premium creation are the two keys to rapidly accumulating Bitcoin. Metaplanet explicitly uses its extreme stock price volatility, which is 2-3 times higher than Bitcoin , to issue additional shares at high levels when the market is soaring and exercise warrants at favorable times, thereby maximizing financing efficiency.

This “volatility harvesting” strategy allows Metaplanet to:

-

Financing at a high valuation during the most powerful phase to lock in a premium;

-

Buy Bitcoin at a low point when the price falls or fluctuates.

In essence, it sets the self-reinforcing flywheel of higher volatility → higher premium → more volatility in motion by capturing market imbalances and sentiment cycles. The higher the volatility, the better for such stocks – because the spread between high-premium financing and low-price hoarding is larger, and the accumulation of Bitcoin is faster. The only prerequisite is that investors must be willing to pay for extremely high premiums during the frenzy, and this sentiment does not last for every complete market cycle.

To understand that the higher the volatility, the more beneficial it is to Metaplanet, we must first understand how the company converts the sharp rise and fall of stock prices into real assets. Metaplanets financing tool is a floating exercise price warrant, which allows the sale of new shares or the triggering of exercise at a level higher than the market price in a short window when the stock price rises. Because the issue price is higher, the company only needs to dilute fewer shares to raise the same amount of funds; the equity loss of old shareholders is significantly compressed, and the company has more cash in hand.

Next, Metaplanet will immediately convert about 96% of the new funds into Bitcoin. If Bitcoin subsequently experiences a pullback, the company is equivalent to using the premium obtained from selling stocks at a high price to buy coins at a low price, locking in a price difference. When this operation occurs repeatedly, the more violent the stock price fluctuations, the larger the price difference, and the company quickly solidifies the stock bubble into visible Bitcoin assets on the books, so the net asset value (NAV) rises faster.

At the data level, the high volatility of stock prices also shortens the Days-to-Cover indicator. Days-to-Cover measures how long it takes for a company to use newly added Bitcoin to digest the existing market value premium. High volatility means that the company can raise and convert more money into Bitcoin every day, so the number of days required becomes shorter. For investors, this means that the premium will be realized faster and the bubble will be supported by assets faster.

Of course, the core assumption of this logic is that market sentiment is still willing to pay a high premium to take over newly issued stocks when stock prices are high; once sentiment cools or regulation tightens, the financing window will close, the flywheel will stop, and the high volatility of stock prices may backfire on the company. Therefore, Metaplanets model is like an engine fueled by emotions: volatility provides fuel, high premiums accelerate the engine, asset conversion converts kinetic energy into physical Bitcoin, and once emotions are exhausted, the engine will stall.

In short, Metaplanet uses violent fluctuations as a two-level lever for financing and hoarding coins: the more the stock price rises, the higher the financing price; the faster Bitcoin falls, the lower the cost of buying coins. As long as the sentiment cycle can continue, it can swing the double-edged sword of high volatility to the favorable side as much as possible.

IV. Conclusion: Value and bubbles coexist, the key lies in the companys execution

Metaplanet’s 7x mNAV is not just a theory:

-

It is supported by institutional innovation (floating exercise price) and high-frequency fundraising + closed-loop hoarding of coins ;

-

At the same time, it is also extremely sensitive to market fluctuations and execution efficiency .

For investors who want to capture the opportunity of the second MSTR, Metaplanet does provide higher leverage and faster cashing capabilities – but with higher uncertainty. Simply put, if you believe that Bitcoin will continue to be highly volatile and upward in the future, and Metaplanet can continue to execute its flywheel of financing-hoarding-releasing premium, the companys high premium is reasonable; otherwise, you should carefully evaluate the risk of sudden braking in the gap between volatility and regulation.

The core of investment is never to use high leverage to bet on the rise, but to identify and manage the costs behind the benefits. Metaplanet uses volatility as fuel to help the rapid expansion of hoarding coins; you must also use the same equal risk management to get out of this high-leverage game unscathed.

This article is sourced from the internet: BitMEX Alpha: The investment logic behind Metaplanet’s 700% premium

Related: Leaping over the Ethereum Madhouse

Original author: Yanz Liam Original editor: Liam “I’m really selling it this time!” On April 22, the ETH/BTC exchange rate briefly fell to 0.01766, setting a new low since 2020. Lin Feng, who had been investing and holding Ethereum for four years, could no longer bear it and posted a heartbreaking statement on WeChat Moments. Compared with a simple loss, this was more like a collapse of faith and a farewell to a dream. On the same day, institutional investors also took action. Galaxy Digital swapped ETH for SOL, and crypto VC Paradigm also transferred 5,500 ETH (about 8.66 million US dollars) to the brokerage platform Anchorage, presumably in preparation for sale. The most ironic thing is that another organization, the Ethereum Foundation, has joined the army of selling coins.…