Base strongly supports it, and Binance adds more investment! ZORA soared 800% in seven days, and the on-chain data canno

作者:Wenser( @wenser 2010 )

After 3 months, Zora returned to the spotlight of the market after the coin airdrop. According to Coingecko data , the price of ZORA soared from the lowest of $0.011 on July 20 to around $0.1 (July 27), with the highest increase exceeding 800%; as of press time, the price of ZORA was temporarily reported at $0.09, with a 24-hour increase of 28.74%. Odaily Planet Daily previously introduced the development of the Zora platform and TGE in detail in the article “After 5 years of waiting, Zora finally issued a coin. Is the leading coin of the Base ecosystem going to change?” In this article, we will systematically introduce and analyze the Zora platform, the development of the Base ecosystem, and the surge in ZORA.

Base Ecosystem Focus Shifts: From L2 Network to ALL-IN-ONE Application

Looking closely at the reason behind ZORA’s explosive growth, the most direct reason is the strong support of the Base ecosystem.

In mid-July , Coinbase officially released Base App based on the original Coinbase Wallet application. The application integrates social networks, mini applications, instant USDC payment and transaction functions, relying on the Ethereum Layer 2 network Base ecosystem, supporting Farcaster protocol social feeds, Zora content tagging and rewards , real-time transaction viewing and on-chain token exchange. Base App has built-in multiple mini applications and encrypted messages, and launched the smart wallet Base Account and the new checkout service Base Pay.

As the L2 network narrative of “Onchain Summer” gradually becomes ineffective, Base officials have once again chosen a development route that is closer to the traditional Internet – leveraging more user resources and market attention through a “one-stop APP”, thereby preparing for the so-called Mass Adoption.

Some people believe that an important reason for the significant increase in the price of Zora Protocol’s native token ZORA is that Base App integrates Zora’s content tokenization infrastructure. The former supports content minting, referral fee payment and ecological incentives, thus becoming a key basic component of the latter’s ecology.

It is worth mentioning that Coinbase has previously acquired token management companies Liquifi , Zora and the Uniswap Foundation. Well-known cryptocurrency companies such as OP Labs and Ethena have used the platform to track cryptocurrency holdings, distribute tokens after the vesting period, and manage complex tax withholding processes. It can be said that as a startup project of Coinbase executives, Zora itself is “one of the orthodox Coinbase systems.” The launch of the Base APP is just a “closer” move with Zora.

At the same time, as the price of ZORA tokens rises, there are discussions on its value support in the market. Some people believe that the Zora platform, ZORA tokens and platform-created assets have no real use cases, and are similar to the Pump.fun platform, PUMP tokens and platform Meme coins, which are all zero-sum PVP games. In this regard, Jesse Pollak, head of the Base ecosystem, strongly opposes.

The head of Base Ecosystem supports Zora: Pump.fun should not get involved in projects with fundamentals

In response to community users’ questions about the creation of tokens on the Zora platform, Base co-founder Jesse Pollak first responded from the perspective of “commercial value of content”: “Content is valuable. Creators are valuable. That’s why trillions of dollars of commercial value are created around them (and they basically don’t get any of it). Tokens are the most powerful technology for our industry to achieve the free flow of value. We should let creators use them.”

Later, he proposed again: “There is definitely room for improvement in market structure, but at the same time, everything you describe can be superimposed on a simple token primitive. I also firmly believe that content itself is valuable. The things you described can be superimposed as a way to monetize that value. But the content itself is valuable.” Finally, he emphasized: “The @zora model of matching content tokens with creator tokens is a brand new innovation,” and bluntly stated that “we are working hard to build a better system.”

Later, in response to other users’ questions, Jesse wrote again, “It is a logical fallacy to regard the assets on Pump.fun and Zora as equivalent. Not all tokens are the same, and fundamentals are the key factor.”

Jesse emphasizes project fundamentals

It can be seen that Jesse still can’t hide his idealistic demeanor. He has been committed to promoting the development of the creator economy and using tokens as a tool and means to establish the creator economy ecosystem. He wants to integrate the traditional attention economy and the Internet creator economy, and then realize “on-chain transformation” and build a new blockchain creator economy ecosystem, which naturally cannot be separated from the support of infrastructure construction such as Zora. Zora, which has multiple roles such as blockchain network, social network and content tokenization platform, can also enjoy ecological dividends, feed back the token economic system, and then build an “economic flywheel” that can operate in a cycle. However, is this really the case?

The cruel reality of Zora: poor ecology and a sharp decline in on-chain activity

The premise of the on-chain creator economic flywheel is the positive development of the Zora platform ecology and the continuous rise of the ZORA token. However, according to the existing information, the support from both aspects is short-term speculation without actual support.

Zora platform development encounters obstacles: on-chain indicators decline across the board

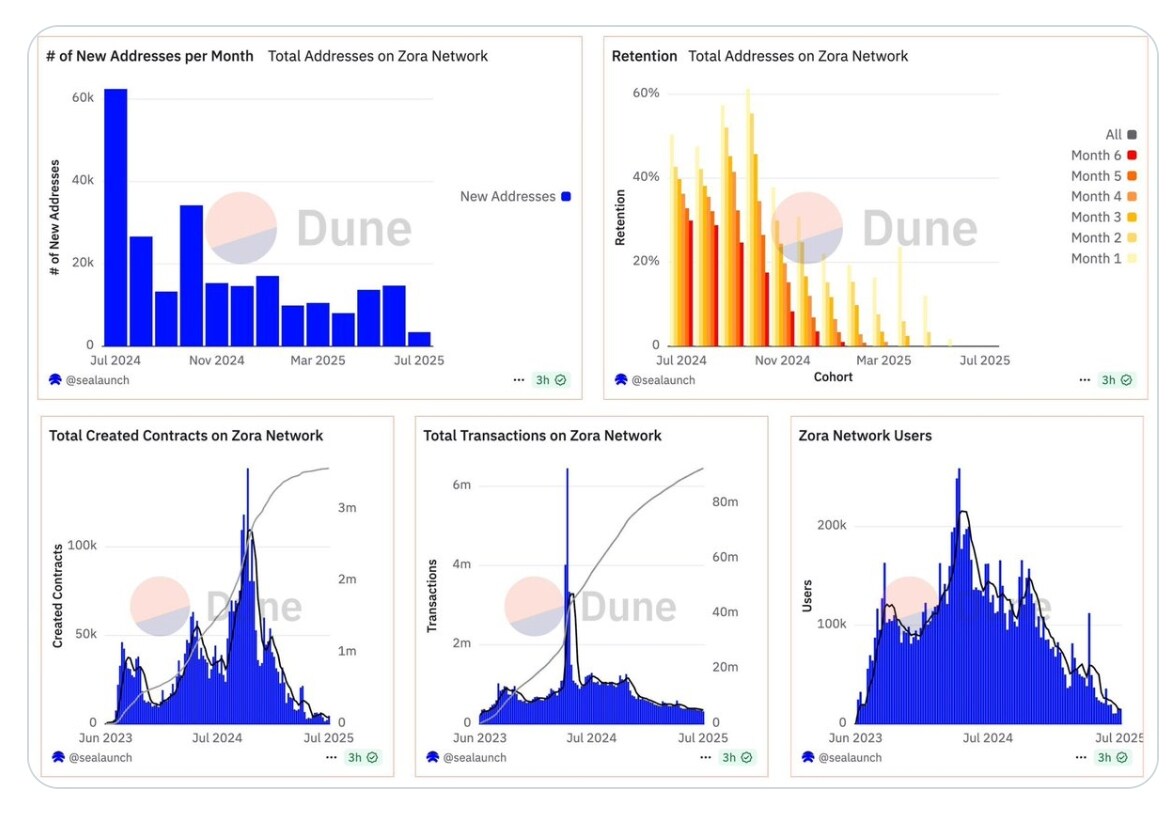

Trader Axel Bitblaze 写道 although ZORA is currently experiencing a surge (monthly increase of over 800%), the changes in its on-chain data indicators do not match its market trend. Specifically:

1. The number of new addresses added monthly by Zora has dropped from more than 60,000 when it was launched to less than 10,000;

2. User retention rate is declining, and most new users can only stay for 1-2 months;

3. The number of contracts created per day once reached more than 100,000, but now it has basically dropped to zero;

4. The number of daily transactions has dropped from nearly 6 million per month to less than 1.5 million;

5. The number of active users has dropped sharply from more than 200,000 at its peak to around 50,000 at present.

Zora On-Chain Metrics: Christmas Tree Shape

There is no doubt that unlike Pump.fun, whose market share was eroded by the Letsbonk.fun platform, Zora’s development can be described as “a poor family has been hit even harder.” Many “Christmas tree-shaped” on-chain data indicators also indirectly show the difficulty of the NFT casting platform’s transformation and the huge difference in user interaction activity before and after the project’s coin issuance.

On the other hand, the price increase of ZORA may be attributed to the launch of CEX contracts.

Binance launches ZORA contract, which may be the main reason for the price surge

On July 25, Binance officially launched the ZORA/USDT perpetual contract, supporting up to 50 times leverage. Subsequently, ZORA once again staged a strong surge. This may be the important reason why ZORA was selected by the “wild dealer” and became the “most beautiful boy in the market.”

Clues from the data also point to this conclusion. According to a post by Ai Yi, an analyst on the chain, ZORA has increased by 931% in one month, as if it has emerged from an independent copycat market. However, there are no single transaction records of more than $500,000 on the chain recently, which is suspected to be operated by funds in CEX. According to statistics, Coinbase, the top 1 spot trading volume of ZORA, has a 24-hour trading volume of $82.6 million, while Binance, the top 1 contract trading volume, has a 24-hour trading volume of $1.354 billion, which is 16.4 times that of spot.

The circulation ratio of ZORA is 35%, and some tokens will be released to investors/treasury/team starting from October this year . The market maker is GSR Markerts.

Therefore, pushing up the price to sell off may also be one of the foreshadowings for the subsequent token unlocking.

Conclusion: The best outcome for Zora is to be acquired by Coinbase

In summary, the development of the Zora platform can hardly be called smooth, and it is far from the on-chain creator economic carrier imagined by Jesse, the head of the Base ecosystem. For Zora, which has changed its positioning several times, perhaps its best outcome is to be acquired by Coinbase and become a “mascot” to support the latter’s market value.

After all, for many crypto projects, disappearing into history in obscurity is a worse outcome.

This article is sourced from the internet: Base strongly supports it, and Binance adds more investment! ZORA soared 800% in seven days, and the on-chain data cannot hide the decline of the ecosystemRecommended Articles

相关:Matrixport Market Observation: Can BTC withstand geopolitical shocks and start a new round of rebound?

Last week (June 11-June 16), the market fluctuated violently due to geopolitical tensions. BTC rebounded quickly after falling, showing resilience. From June 12 to 13, due to the escalation of the situation in the Middle East and the uncertainty of Trumps tariff policy, the market risk aversion increased, and BTC fell to $102,664.31, with the largest drop of 7% during the week. But then BTC rebounded quickly and returned to the range of $104,000-105,000. On the 16th, driven by positive market news and the continuous inflow of BTC spot ETFs, BTC reached a high of $107,715 and is currently stable at around $106,615. The overall trend of ETH keeps pace with BTC, with a maximum volatility of 15.35% during the week and a current price of about $2,576 (Binance, June…