$50 million OTC crypto scam: Well-known tokens involved, VCs and whales can’t escape

Original author: darwizzynft

Original translation: TechFlow

An over-the-counter (OTC) 加密currency scam involving a variety of well-known tokens was recently exposed. The victimized tokens include SUI, NEAR, Axelar, SEI and dozens of others, but shockingly, almost no one is discussing this matter!

The scam is estimated to have defrauded investors of more than $50 million over a period of several months and was only recently widely known.

The list of victims even includes venture capitalists (VCs), key opinion leaders (KOLs), and heavyweight crypto whales. The following is a detailed account of the scam, thanks to @AltcoinAlphaOnX for his in-depth research.

Phase 1: Building Trust (November 2024 – January 2025)

Starting in November 2024, various venture capital groups and private investment pools began to launch seemingly legitimate top OTC transactions in Telegram groups.

These exchanges claim to sell tokens of high-profile projects such as Graph (GRT), Aptos (APT), SEI, SWELL, etc. at discounts of up to 50% off the market price, and promise a lock-up period of 4-5 months.

Source: @AltcoinAlphaOnX

This is the bait phase of the scam.

The initial transactions were duly fulfilled, and investors received their tokens as promised. This semblance of legitimacy quickly established trust.

Early successful cases and smooth operations attracted more and more investors, who even increased their investment amounts.

Phase 2: Scaling the scam (February 2025 – June 2025)

By February 2025, the coverage of OTC transactions will expand rapidly.

A new round of transactions has poured into the Telegram group, with larger scale and a wider range of tokens, including SUI, NEAR, GRASS, Axelar, etc.

The deal structure remains the same: a deep discount and a fixed lock-up period.

These attractive conditions further attracted more investors, strengthened the credibility of the scam, and allowed the scam to expand at an unstoppable pace.

Source: @AltcoinAlphaOnX

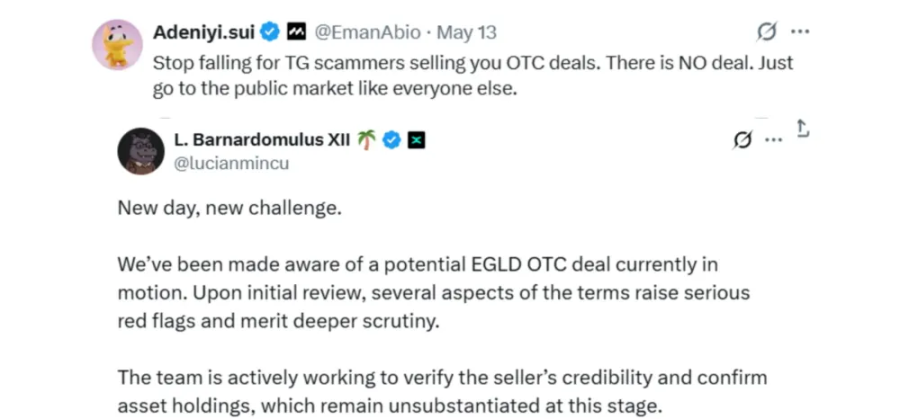

Phase 3: Ignoring warnings (May 2025)

By May 2025, the scam began to show cracks.

Industry leaders are issuing public warnings.

Eman Abio of the SUI team warned users on the X platform to beware of fake Telegram OTC transactions, and made it clear: There is no such transaction!

Likewise, Lucian Mincu of MultiversX (formerly Elrond) issued a similar warning.

Source: @AltcoinAlphaOnX

Yet, despite these warnings, the community continues to turn a blind eye to the red flags.

Investors continue to pile into new deals, attracted by past investment returns, success stories and seemingly credible group involvement.

Phase 4: Scam exposure and collapse (June 2025)

The turning point came on June 1st.

The last known transaction was launched, involving Fluid tokens.

At the same time, the distribution of tokens for early OTC transactions suddenly stopped.

Investors seeking updates were only given vague excuses such as travel delays, exchange issues, and KYC (identity verification) problems.

On June 19, Aza Ventures, the venture capital group that led these transactions, publicly announced that they themselves had become victims of the scam.

Aza Ventures accused its main trader Source 1 of running a Ponzi scheme. According to Aza, the early transactions were real, but the later transactions relied entirely on funds from new investors to fulfill the previous promises – this is a typical Ponzi scheme model.

Source: @AltcoinAlphaOnX

To make matters worse, Aza Ventures further disclosed that their other deal sources, “Source 2” and “Source 3”, actually also obtained deals through “Source 1”.

The situation quickly deteriorated and became extremely chaotic.

List of tokens involved

Early stage deals (November 2024 – January 2025)

Aptos, Sei, Swell, Coti, Kava, Fluid, OG, Aethir

Late-stage transactions (February 2025 – June 1, 2025)

SUI, NEAR, Aptos, Sei, Highstreet, Altlayer, Kava, Grass, Movement, Bio, Sandbox, Graph, Ronin, Axelar, Celestia, LayerZero, Renzo, Beam, Conflux, Wormhole, Arkham, Adventure Gold, Immutable, Vana, Berachain, Virtuals, EGLD, Fluid, and more.

Identity of the mastermind: Who is “Source 1”?

Aza Ventures claims to have mastered the identity of Source 1.

According to insiders, Source 1 is suspected to be of Indian nationality and is said to be the founder of a project currently listed on Binance. However, Aza Ventures chose not to disclose his identity for the time being, but instead privately pressured him to return the stolen funds.

@AltcoinAlphaOnX has released more updates on the identity of “Source 1” on the X platform.

This scam not only reveals the potential risks of the crypto industry, but also reminds investors to be wary when faced with deals that are too good to be true.

Losses and Impact

The total losses from the scam are estimated to be over $50 million.

Many investors reportedly invested more than $1 million in a single transaction.

Victims include individual retail investors, large whales in the crypto space, project teams, and venture capital firms (VCs).

Some victims have suffered life-changing financial losses, and there have even been reports of some experiencing severe emotional breakdowns as a result of the incident.

Source: @AltcoinAlphaOnX

Next steps

Aza Ventures claims that they are in active negotiations with Source 1 to try to recover the funds and have set a deadline of the end of the month. Meanwhile, the broader crypto community is working hard to track down the relevant wallet addresses, identify accomplices, and dig up more evidence to bring those responsible to justice.

Source: @AltcoinAlphaOnX

This incident sounded the alarm for the crypto industry, reminding people of the huge risks faced when conducting unregulated over-the-counter (OTC) transactions through informal channels such as Telegram, Discord, etc.

Despite early warning signs and public warnings, trust, greed, and so-called social proof became powerful weapons in the hands of scammers.

The community is now waiting with bated breath, hoping that justice will be served and the victims will finally receive a refund.

This article is sourced from the internet: $50 million OTC crypto scam: Well-known tokens involved, VCs and whales can’t escape

Related: Binance launch path research: Alpha, IDO, Futures, Spot full analysis

Original author: Xinyang, IOSG Ventures TL;DR: This study analyzes the token lifecycle performance of Binance’s four major listing channels – Alpha, IDO, Futures and Spot – and tracks their subsequent listings on Bitget, Bybit, Coinbase and Upbit, focusing on return performance, listing rhythm, track preference and FDV range. Performance Review The median 14-day FDV of most channels is negative, reflecting that most projects are valued at their peak when they are launched; Binance Alpha has the most explosive performance (average 220%), but is also highly volatile. Binance IDO has a good balance of short-term gains and high conversion rates (to Futures and Spot); Binance Spot has the weakest performance in the short term, possibly because it has become an exit point for early investors; Bitget and Coinbase performed well in…

我是一个骗局的受害者,我损失了很多钱,高达 $170,000 我想对 Innovations recovery Analyst 表示感谢,感谢他们为我从一家外汇经纪商那里追回资金提供了卓越的帮助。他们在处理复杂过程中表现出的专业知识和专业精神确实值得称赞。通过他们的指导和不懈努力,我成功追回了 $170,000 美元的资金,为我提供了急需的救济。我强烈推荐他们:INNOVATIONSANALYST@ GMAIL.COM 或 WhatsApp + 1 424 285 0682 向所有面临类似挑战的人推荐他们,因为他们帮助客户的奉献精神和承诺确实令人印象深刻。感谢他们为解决此事提供的宝贵支持。.

良好