155 Altcoin ETFs Await Approval: Can Institutional Funds Awaken the “Sleeping Bull Market”?

Original translation: AididiaoJP, Foresight News

Bloomberg predicts that following the launch of Bitcoin and Ethereum ETFs, over 200 加密貨幣 ETFs will be launched in the future. Will altcoins receive the same popularity, or face further volatility? Let’s take a deeper look:

- Historical background

- DATs: Collateral Risk and MNAV Observations

- The bullish and bearish arguments for altcoin ETFs

- How did we get here? Key catalysts

- Macro Impact: $300 Billion in Stablecoin Liquidity Will Drive DeFi Bull 市場

- Reverse signal

- What to watch out for during an ETF launch

- Three high-impact ETFs to watch

Historical background

The crypto ETF landscape has evolved dramatically since the launch of the first ETFs. Total net assets in US spot Bitcoin ETFs have surpassed $146 billion, solidifying Bitcoin’s dominance of the crypto market with a 59% share. Ethereum ETFs rank second, holding approximately $25 billion in assets. Cumulative net inflows into spot Bitcoin ETFs have now exceeded $50 billion, and the market continues to see daily inflows.

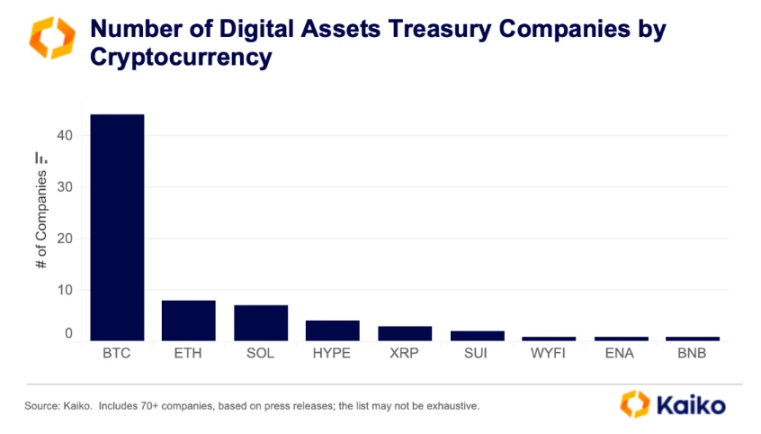

Before the advent of crypto ETFs, traditional finance held exposure to digital assets through instruments like GBTC and MSTR. This approach gave rise to digital asset treasuries (DATs), which accumulate specific altcoins like ETH, SOL, and XRP so that investors can gain exposure through stocks. DATs serve as a bridge between the pre-ETF era and today’s pending altcoin ETFs, and they are also where the risks arise.

DATs: Collateral Risk and MNAV Observations

The market capitalization to net asset value (MNAV) ratio is important because it indicates how easily a DAT can raise capital. When it’s above 1, debt is readily available to purchase more tokens. If it’s consistently below 1, funding is drying up, and reserve sales become a real risk.

Pay close attention to the top DATs’ MNAV and premiums, PIPE unlocking dates, liquidity, and any balance sheet information in 10-Qs or operational updates. Stress can also spread; trouble at a small DAT could affect larger ones, or problems at the top could ripple downward.

The bullish and bearish arguments for altcoin ETFs

Bullish reasons

The rise of altcoin ETFs could soon provide a significant liquidity boost to the market. Take the ProShares CoinDesk 20 ETF, for example; it includes key assets such as HBAR, ICP, XRP, and SOL. In total, 155 ETPs tracking 35 cryptocurrencies are awaiting approval. The influx of liquidity into these ETFs will drive up the prices of the associated altcoins, extending the gains seen in Bitcoin and Ethereum ETFs.

Furthermore, ETF inflows drive market attention to underlying tokens, prompting some allocators to purchase higher-beta DATs. DATs subsequently raise funds and accumulate more tokens, potentially further strengthening the altcoin narrative. More importantly, issuers like BlackRock, Fidelity, VanEck, and Grayscale provide a trusted gateway. This potentially unlocks larger and more stable investments than can be accessed solely through exchanges.

Bearish arguments

Altcoins, on the other hand, are struggling to recapture their usual bull market hype, and this weakened demand could limit their performance. The CoinDesk 20 Index highlights this issue: BTC and ETH dominate with weightings of 29% and 22%, respectively, while altcoins like ICP and Filecoin (FIL) comprise just 0.2% of the basket. This concentration means more capital will flow into mainstream cryptocurrencies, benefiting them more.

Furthermore, if funds were to shift from DAT shares to altcoin ETFs, the DAT’s net asset value (MNAV) could drop below 1, leading to a depletion of funds. This could force the sale of reserves, creating direct selling pressure on those altcoins.

Microstructure at launch: Even with a bullish medium-term outlook, expect some 24-72 hour volatility around the launch of the ETF.

How did we get here? Key catalysts

The growing interest in altcoin ETFs is driven by a combination of factors:

On September 17, the U.S. Securities and 交換 Commission (SEC) introduced the “Universal Listing Standard for Commodity Trust Shares.” This standard shortens the approval time for new ETFs and makes the process more predictable. Thanks to the SEC’s universal listing standard, we may see multiple ETFs approved in a short period of time when the government reopens.

Earlier, in July, the SEC allowed non-Bitcoin crypto ETFs to conduct physical redemptions, bringing them in line with traditional commodity ETFs, reducing liquidity friction and attracting more institutional funds.

The success of Bitcoin and Ethereum spot ETFs has also driven wider adoption, with 59% of institutions allocating more than 10% of their portfolios to digital assets by mid-2025.

Rule of thumb (strict criteria): ISG-regulated spot trading venue, or at least six months of regulated futures trading with data sharing, or 40%+ tracking in an existing listed ETF. This clears the way for many major and mid-cap tokens.

Macro Impact: $300 Billion in Stablecoin Liquidity Will Drive DeFi Bull Market

As of October 2025, there is nearly $300 billion in stablecoin liquidity in circulation globally. This massive infrastructure lays the foundation for ETF-driven capital catalysts, bringing institutional funds into the DeFi ecosystem and amplifying returns.

The synergy between $300 billion in stablecoin liquidity and the expected inflows into altcoin ETFs could create a multiplier effect. For example, the observed inflow-to-market capitalization multiplier for Bitcoin ETFs suggests that every $1 of ETF capital could inflate market capitalization by several dollars. If altcoin ETFs gain traction, this could unlock tens of billions of dollars, pushing total crypto market capitalization to new highs by the end of 2025.

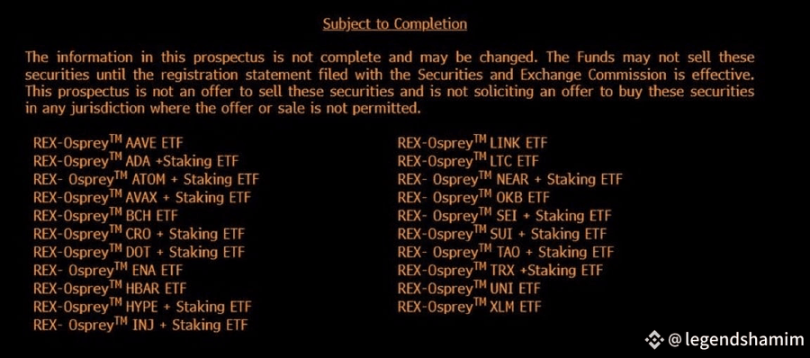

With increased regulatory clarity under Trump-era policies, the influx of institutional capital could significantly boost DeFi protocols, especially those that integrate assets like LINK and HBAR, which bridge traditional finance and blockchain, or collateralized ETFs like REX-Osprey’s application for altcoins such as TAO and INJ.

Furthermore, with the dollar weakening and risk assets near all-time highs, ETFs provide a convenient path for institutions to rotate along the risk curve from BTC to large-cap altcoins and then to mid-cap stocks and DeFi.

Multiple Warning: The impact of inflows on valuation relies on continued net creation and a healthy funded basis. DAT pressure (MNAV

Reverse signal

Ever the contrarian, Jim Cramer recently urged investors to sell cryptocurrencies and move into stocks. Given his track record of being wrong at key turning points, I think it’s time to get even more resolute on holding crypto assets.

Concerns that ETFs will cannibalize DATs and trigger liquidations coexist with unprecedentedly strong market access and clarity, ETF pathways, and approval queues. This mismatch could create a bullish pattern if first-week inflows remain strong. Historically, the combination of heightened concerns about DAT pressure and improved market access has often signaled accumulation phases rather than market tops.

What to watch out for during an ETF launch

- Days 0-3: Anticipate the risks of front-running and the “all good news comes bad news” effect. Focus on net creations and redemptions, as well as the bid-ask spread displayed on the screen.

- Week 1-4: If net inflows remain strong and spot prices remain consistent with perpetual contract prices, the buy-on-dip bias may continue.

- Rotation Signal: Higher weekly highs/lows for other cryptocurrencies relative to BTC indicate expanding demand for altcoins. Failing this signal, it’s tempting to maintain a heavy BTC position.

- Cross-asset clues: DAT premiums improve with ETF inflows, forming a positive feedback loop.

Three high-impact ETFs to watch

- Solana: Beyond BTC and ETH ETFs, Solana is the altcoin with the highest conviction and greatest potential to benefit from diversification. Of the 155 crypto ETFs awaiting approval, 23 target Solana. This strong sign of institutional demand shows where funds may be flowing. Therefore, an ETF tracking Solana is one of the most important ETFs to watch and could potentially deliver significant investment returns.

- ProShares CoinDesk 20 ETF: Tracks 20 top cryptocurrencies, including BTC, ETH, and altcoins like XRP, which can diversify institutional exposure.

- REX-Osprey 21-Asset ETF: Designed to provide exposure to specific cryptocurrencies and offer staking capabilities for tokens like ADA, AVAX, DOT, NEAR, SEI, SUI, TAO, and HYPE.

The fourth quarter could quickly become dominated by the ETF narrative, boosting related sectors like DeFi. Whether or not altcoins can capture the same demand as BTC, the momentum is undeniable. Stay confident and position yourself for the upcoming altcoin ETF narrative.

Related: Gonka Algorithm Series (1) Introduction to PoW 2.0

引言:从无意义计算到有意义的AI工作 在深入探讨 PoW 2.0 的技术细节之前,我们需要先理解其核心设计理念:将原本用于维护网络安全的计算资源,重新定向到具有实际价值的 AI 计算任务中,从而实现计算资源的最大化利用。 1. PoW 2.0完整生命周期:Epoch的精密编排 为了实现计算资源的高效利用,PoW 2.0 采用了基于区块高度的 Epoch 管理机制。每个 Epoch 都有明确的阶段划分和时间安排,确保网络安全维护与 AI 计算服务能够协调进行。 1.1 Epoch架构概览 Gonka 采用基于区块高度的 Epoch 管理机制,每个Epoch的长度以区块数为单位计算。根据实际的网络配置: 数据来源:genesis/genesis-overrides.json#L23-L32 为了更好地理解 Epoch 的运作机制,我们需要先了解其在整个网络中的作用。Epoch 不仅是时间管理的基本单位,更是协调 PoW 计算、验证和 AI 服务的关键框架。 1.2生命周期的关键阶段划分 Gonka 的 Epoch 生命周期分为四个关键阶段,通过精确的时间编排实现算力的高效利用: 阶段1:PoW计算竞赛阶段(60个区块) 在每个 Epoch 中,系统分配60个区块的时间专门用于 PoW 计算竞赛(生产环境配置)。这个阶段决定了节点在后续阶段的任务分配权重。 在这一阶段,节点会执行基于 Transformer 模型的前向传播计算,通过计算结果与目标向量的距离来衡量工作量。距离小于设定阈值的计算结果被视为有效的 PoW 证明。 阶段2:PoC交换阶段(5个区块) PoW 竞赛结束后,节点有 5 个区块的时间提交计算结果。 阶段3:PoC验证阶段(20个区块) 网络对提交的 PoW 结果进行验证,确保计算的正确性。 阶段4:推理服务阶段(剩余时间) 验证完成后,节点根据其在 PoW 阶段的表现获得相应的推理任务分配权重,开始执行推理服务。 1.3时间分配的精确计算 虽然系统基于区块高度管理,但为了便于理解,我们可以将其转换为时间概念: 数据来源:基于实际网络配置和区块链特性计算 这样,每个epoch大约持续24小时,其中PoW阶段约6分钟,剩余时间用于 AI 推理和训练服务。 2. 任务分配的随机性与权重机制 在了解了 Epoch 的生命周期之后,我们需要进一步探讨 PoW 2.0 如何通过权重机制来实现任务的公平分配。这一机制确保了高质量的节点能够获得更多任务,形成良性循环。 2.1权重驱动的随机分配 任务分配遵循随机且按权重比例的原则。节点的权重由多个因素决定: 数据来源:inference-chain/proto/inference/inference/participant.proto 在 Gonka 网络中,节点权重是动态调整的,主要基于节点的历史表现。权重较高的节点有更大的概率被分配到推理任务,从而获得更多的奖励。 2.2基于PoC权重的奖励分配 奖励分配机制是激励节点参与网络维护的重要手段。通过基于 PoC 权重的分配方式,确保了节点的贡献能够得到相应的回报。 数据来源:proposals/tokenomics-v 2/比特幣-reward.md 这种奖励分配机制确保了节点根据其在 PoW 阶段的表现获得相应的奖励,激励节点积极参与网络维护和 AI 计算任务。 3. 奖励机制与惩罚策略 除了任务分配机制外,奖励与惩罚策略也是维护网络健康运行的关键。这些机制共同构成了 PoW 2.0 的激励体系。 3.1统计显著性检验 根据技术设计,节点不会获得奖励的情况包括: •拒绝执行分配的任务 •在统计学上显著数量的任务中提交错误结果 •在 Epoch 内的可用性过低 网络通过统计显著性检验来识别和惩罚不良行为的节点,确保网络的健康运行。 3.2实时统计监控 系统持续监控每个节点的表现指标: 通过实时监控节点的表现,系统能够动态调整节点权重,确保高质量的节点获得更多任务分配。 4. 区块生成与共识机制:独立运行的安全基石 在理解了激励机制之后,我们还需要关注 PoW 2.0 的底层安全机制。区块生成与共识机制是整个系统的安全基石。 4.1连续且独立的区块生成机制 区块生成是一个连续且独立的过程。这个过程与 PoW 计算竞赛、推理任务执行等其他网络活动相互独立,确保了网络的稳定性和可预测性。 区块生成的独立性设计确保了即使 AI 计算任务出现问题,区块链网络仍能正常运行。 4.2基于Tendermint的分层共识设计 Gonka 采用分层共识机制,将区块链安全性与 AI 计算任务分离: 这种分层设计使得区块链的安全性与…