Original translation: Saoirse, Foresight News

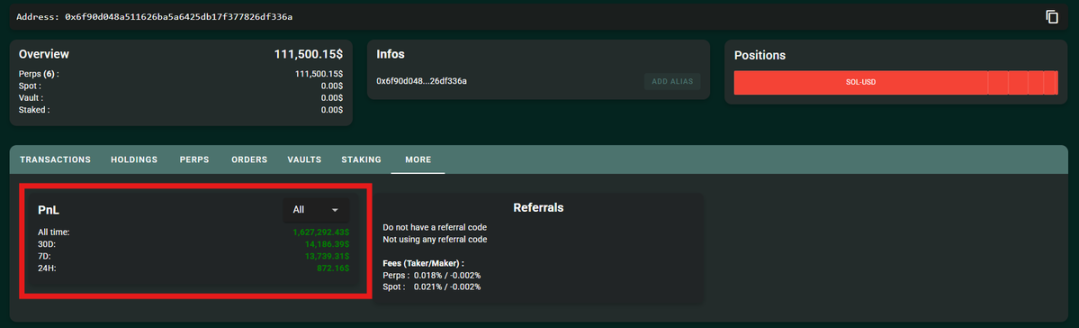

This is a perfect example to illustrate the importance of “learning programming” – with the help of programming, you can increase the value of $6,800 to $1.5 million on the 加密貨幣currency exchange Hyperliquid platform in just two weeks.

A while ago, a Hyperliquid trader did just that.

Even more astonishing is that this trader took virtually no risk. He neither bet on market trends nor hyped up popular assets. Instead, he relied solely on a sophisticated market-making strategy—one whose core logic revolved around market maker rebates, combined with automated operations and strict risk management.

Hyperliquid platform’s market-making mechanism

Before delving into this strategy, we need to first understand the market-making logic of the Hyperliquid platform. Hyperliquid is an order book exchange where users can place two types of orders:

- Buy order: This is a “buy order” (e.g., “I want to buy SOL tokens at $100”)

- Sell order: This is a “sell order” (e.g., “I want to sell SOL tokens at $101”)

These pending orders together constitute the “order book.” Traders who place buy or sell orders are called “market makers.”

- The core role of a market maker is to “provide liquidity”: by placing limit orders in advance, the market is replenished with tradable orders.

- In contrast, there are “Takers”: these traders directly execute orders already in the order book (for example, “market buying” a token at the current best ask price).

市場 makers are crucial to the market: they provide liquidity, keeping the bid-ask spread low. Without them, traders may face issues like unreasonable pricing and large slippage losses.

Key Point: Market Maker Rebates

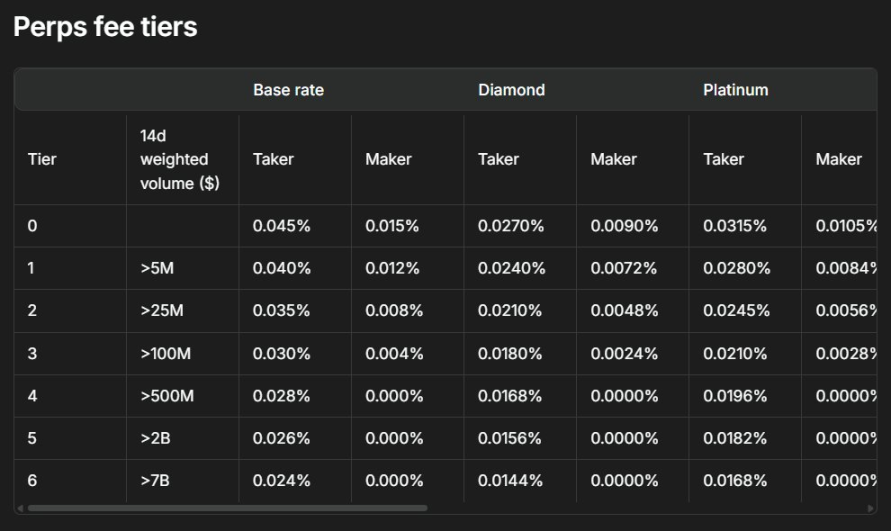

The core of the exchange is “liquidity” – in order to encourage users to become market makers and supplement market liquidity, Hyperliquid will provide market makers with “transaction rebates”: every time a market maker’s order is executed, the platform will return a small rebate.

On the Hyperliquid platform, the rebate rate for each transaction is approximately 0.0030% – that is, for every $1,000 traded, you can get $0.03 in rebates.

It was this seemingly meager rebate that enabled the trader to achieve the leap from $6,800 to $1.5 million. The core of his strategy was “one-sided quoting”: placing limit orders on only one side of the order book (either only buy orders or only sell orders); if the market price moved, he would quickly cancel the original order or switch to quoting on the other side.

Simply put, his operating logic is to provide liquidity on only one side to earn rebates, while using robots to adjust order directions in real time to avoid the risk of exposed positions. Ultimately, thanks to the huge trading volume generated by “automated high-frequency trading,” small individual rebates accumulate into large profits.

The core pain points of traditional market makers

Most market makers place orders on both the “buy” and “sell” sides of the order book.

For example: you place two orders at the same time – a buy order to buy 1 SOL at $100, and a sell order to sell 1 SOL at $101.

If both orders are executed, you will earn a price difference profit of $1 by “buying low and selling high”.

But this model has a key problem: holding risk.

- If the buy order is executed but the sell order is not executed: you will passively hold SOL tokens;

- If the sell order is executed but the buy order is not executed: you will passively hold stablecoins (such as USDT).

Once the market price fluctuates in a direction unfavorable to you, these passively held assets will face substantial losses.

This is why the Hyperliquid trader opted for a “one-sided quote”: by placing orders on one side, he can more strictly control his positions and avoid passively holding unnecessary assets. However, this model comes at the cost of a higher risk of being arbitrageured.

What does “arbitrage” mean?

Let’s take a specific scenario: you place a buy order for SOL at $100 on the order book. Suddenly, bad news breaks, causing the price of SOL to plummet to $90.

- Your “buy $100” order is still in the order book and has not been cancelled;

- The faster trader will immediately sell you SOL for $100 (i.e., fulfill your buy order);

- The final result: You spent 10% more to buy SOL, and even if you can get platform rebates, you will still suffer huge losses.

This situation is called “adverse selection”, which is what we often call “arbitrage”.

Therefore, when adopting the “one-sided quotation” strategy, “accuracy” and “speed” are the key to success or failure – the effectiveness of the entire strategy depends entirely on the robot’s response efficiency and operation accuracy.

High-frequency trading infrastructure

To avoid being arbitrageured, the trader built an “ultra-fast execution system,” the core of which included:

- Hosting service: The trading server is physically deployed close to the Hyperliquid platform server to minimize network latency;

- Automated operation: The robot can adjust quotes thousands of times per second, achieving “real-time price following”;

- Real-time risk control: Automatically close or adjust positions before risk gets out of control.

Building this type of infrastructure requires both high costs and extremely high technical complexity – this is why only a few professional market makers can deploy such systems.

Judging from the technical details, his trading robot is likely written in C++ or Rust (these two languages are known for their “fast running speed” and “low latency”); the server is hosted close to Hyperliquid’s “order matching engine” to ensure that his orders can be matched first.

The robot obtains real-time order book data through WebSocket or gRPC protocol, and completes the operations of “placing an order – canceling an order – switching the quotation direction” within milliseconds – ensuring that rebates can be continuously earned while avoiding orders from being “invalidated” due to price changes.

How to maintain “Delta Neutral”?

What’s most impressive is that the trader remained “Delta Neutral” throughout: despite his total trading volume reaching billions of dollars, his net position risk was always kept below $100,000.

How did he do it?

- The robot tracks the changes in SOL token holdings in real time;

- Set strict risk limits (net position risk never exceeds $100,000);

- Once the position risk approaches the upper limit, the robot will immediately stop the current transaction and switch to the opposite side quotation to achieve position rebalancing through reverse transaction.

He did not adopt the “spot and futures arbitrage” model, but operated entirely in the “perpetual contract” market – since all transactions are completed in the same market, position hedging and risk control will be simpler.

However, this strategy requires extremely high “discipline” and “precision”: even the smallest operational error may lead to huge losses.

The mathematical logic behind it

The profit calculation logic of the entire strategy is actually very clear:

- In two weeks, the trader’s total trading volume reached $1.4 billion;

- The market maker rebate rate is 0.003% per transaction;

- Profit from rebates alone = $1.4 billion × 0.003% ≈ $420,000.

On this basis, he also adopted a “profit reinvestment” strategy – immediately reinvesting every rebate into trading, amplifying the returns through the “compound interest effect.” In the end, the total profit reached $1.5 million.

And the starting point of all this is just $6,800 in initial trading capital.

Why can’t you just copy this strategy?

You might be thinking, “Well, if that’s the case, can’t I just copy his trades and make the same amount of money?” But the reality is that this strategy is almost impossible to replicate for several key reasons:

- You don’t have his “execution speed”: the combination of professional hosting servers + low-latency code is difficult for ordinary traders to achieve;

- You don’t have the same “capital scale” as him: although the initial capital is only $6,800, as the profits compound, the later trading scale has reached professional level;

- You don’t have “precise code and robots”: His robots have been repeatedly debugged and can adapt to every tiny fluctuation in the order book, which is difficult for ordinary developers to replicate;

- You don’t have “24/7 infrastructure and monitoring”: The cryptocurrency market is traded 24/7 and requires a real-time monitoring system to respond to sudden risks.

In short, this is a “professional-grade high-frequency trading system” that cannot be easily replicated by ordinary retail investors.

Potential risks of this strategy

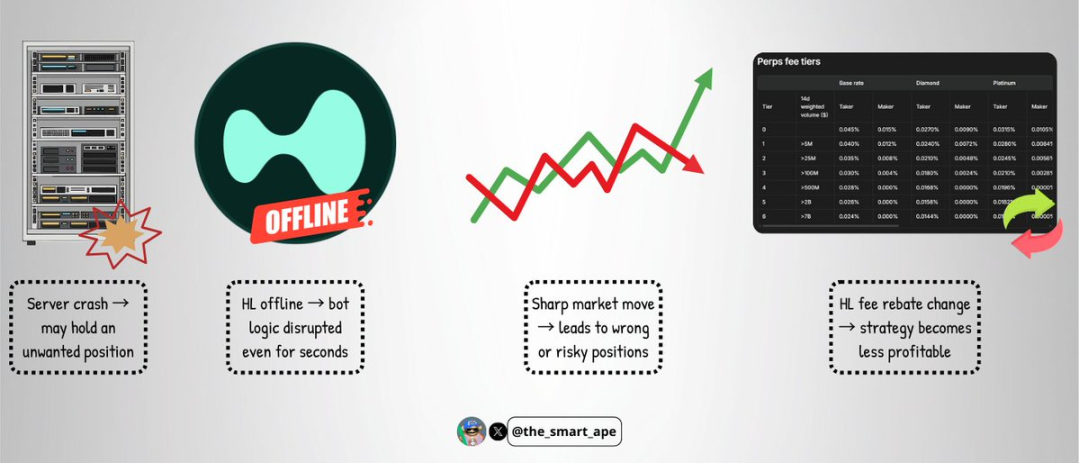

Even for such a highly sophisticated robot, there are still risks that cannot be ignored:

- Server failure: If the server crashes, the robot may be unable to cancel orders in time, and passively hold a large number of risky positions;

- 交換 failure: While rare, a downtime or malfunction on the Hyperliquid platform could disrupt the bot’s trading logic within seconds.

- Extreme market volatility: Severe market fluctuations may disrupt the balance of “one-sided quotes”, causing strategy failure and resulting in losses;

- Fee Structure Changes: If Hyperliquid adjusts the market maker rebate ratio or trading fees, it may immediately and significantly reduce the profitability of the strategy.

Although this strategy is ingenious, it is not “impenetrable”.

綜上所述

Increasing the value from $6,800 to $1.5 million in two weeks may sound like “taking a chance with 模因幣,” but in fact, it is based on solid technical capabilities, strict discipline and sophisticated system design.

This is an excellent case study that shows how to “scale market maker rebates”, “maintain delta neutrality”, and minimize “directional risk”.

The core lesson from this case is that trading isn’t just about predicting prices. Sometimes, the most profitable strategy lies in thoroughly understanding market structure and building a system that creates value in areas others overlook.

本文源自網路: Hyperliquid’s market-making bot generates 220x profit in two weeksRecommended Articles

In the history of Wall Street financial innovation, few have excelled like Michael Saylor, transforming personal beliefs into corporate strategy and, in turn, reshaping the financing model of an entire industry. The chairman of Strategy (formerly MicroStrategy) is driving an unprecedented financial experiment: replacing traditional equity and debt financing with perpetual preferred stock to fund his aggressive Bitcoin accumulation strategy. According to Bloomberg, Strategy has successfully raised approximately $6 billion in capital from the market through four rounds of perpetual preferred stock issuance this year. The latest round, “Stretch” (STRC), raised $2.5 billion. Michael Saylor described STRC as Strategy’s “iPhone moment,” emphasizing its potential to provide Bitcoin vaults with scalable and low-volatility access to capital markets. This previously obscure business intelligence software company has leveraged such massive capital simply through…