The New Force of Stablecoins: Analysis of Eight Potential Projects and a Comprehensive Overview of Profit OpportunitiesR

The following is BlockBeats’s inventory of the stablecoin projects that are currently worth paying attention to.

cap

cap (@capmoney_) is a new stablecoin protocol on the Ethereum mainnet, officially launched on August 18. The project announced in April this year that it had completed an $11 million financing round, with participation from Franklin Templeton and Triton Capital.

The stablecoin protocol features $cUSD, a USD-denominated stablecoin minted using USDC, and $stcUSD, a yield-bearing stablecoin issued by staking $cUSD. The first phase of the protocol’s “Caps” points system has begun with the launch of the protocol, allowing users to earn Caps points by minting $cUSD for two weeks.

Currently, its official website shows a TVL of approximately US$15.5 million.

USD.AI

USD.AI (@USDai_Official), a stablecoin protocol that provides credit for AI hardware (AI companies obtain loans by pledging GPUs), will officially launch today. The project announced on August 14th that it had closed a $13.4 million Series A funding round led by Framework Ventures, with participation from Bullish, Dragonfly, and Arbitrum.

The stablecoin protocol features the USD-denominated stablecoin $USDai, minted through USDC, and the yield-bearing $sUSDai, issued by staking $USDai. Along with the launch of the protocol on the Arbitrum network today, the protocol points activity “Allo” is also available.

This activity is divided into two parts: one is to mint $USDai to obtain future ICO quota, and the other is to stake $USDai to obtain future airdrops. Although staking can obtain interest and airdrops, it also has a 30-day lock-up period.

The protocol currently has a total deposit cap of $100 million. During the previous Beta phase, deposits reached $50 million, leaving $50 million remaining in this public round. The Allo campaign, valued at $300 million in value, will continue until the protocol’s total payouts reach $20 million.

Level

Level (@levelusd) is a stablecoin protocol fully backed by USDC and USDT, issuing $lvlUSD. By staking $lvlUSD, users can earn $slvlUSD and use it to generate returns in DeFi applications like Curve and Pendle. On March 18th, the protocol closed a $2.4 million funding round from investors including Flowdesk, Native Crypto (a 加密貨幣 fund under Echo Group), Festy Collective (a venture capital arm of Path), and other angel investors.

In August last year, the protocol developer Peregrine Exploration completed a $3.6 million financing round led by Polychain Capital and Dragonfly, with participation from Robot Ventures, Pier Two, EIV and Global Coin Research, as well as angel investors such as Balaji Srinivasan, Jeff Fang, Julian Koh, and Sidney Powell.

The protocol has a points system called “XP”, which can be earned by depositing $lvlUSD or Curve LP tokens into the “XP Farm”, providing Level assets as collateral on Morpho, and other means.

OpenEden

OpenEden (@OpenEden_X) is not only a stablecoin protocol, but also a RWA platform. Its stablecoin $USDO can be minted using USDC and $TBILL, and its reserves are collateralized by tokenized US Treasury bonds and money market funds.

$TBILL is also OpenEden’s own token, each backed by short-term U.S. Treasury bills and U.S. dollar reserves. On June 20, 2024, credit rating agency Moody’s assigned an “A” rating to the licensed fund issuing tokenized U.S. Treasury bills issued by OpenEden, a Treasury bond investment platform. This makes OpenEden’s TBILL token the world’s first tokenized U.S. Treasury bond product to receive an “investment grade” credit rating.

The project has received investment from Yzi Labs, and $TBILL’s TVL is now approaching $300 million. On August 14th, OpenEden announced the launch of its native token, $EDEN. 7.5% of $EDEN will be distributed to participants in the “Bills” campaign. Bills points can be earned through a series of $USDO and $cUSDO-related activities.

Falcon Finance

Falcon Finance (@FalconStable) is a synthetic USD stablecoin protocol launched by DWF Labs. Currently, the protocol’s TVL has reached $1.4 billion.

The protocol has a points system called “Miles”, which allows users to earn badges by participating in various Falcon Finance activities, or to earn points by participating in a series of $USDf and $sUSDf related activities.

Perena

Perena is the stablecoin infrastructure protocol for the Solana ecosystem. On December 11th of last year, Perena, founded by Anna Yuan, former head of stablecoins at the Solana Foundation, completed a pre-seed funding round of approximately $3 million, led by Borderless Capital. On July 3rd of this year, Perena announced the completion of a new funding round, which attracted over 350 backers, including Susquehanna, Native CryptoX, and Hermeneutic Investments.

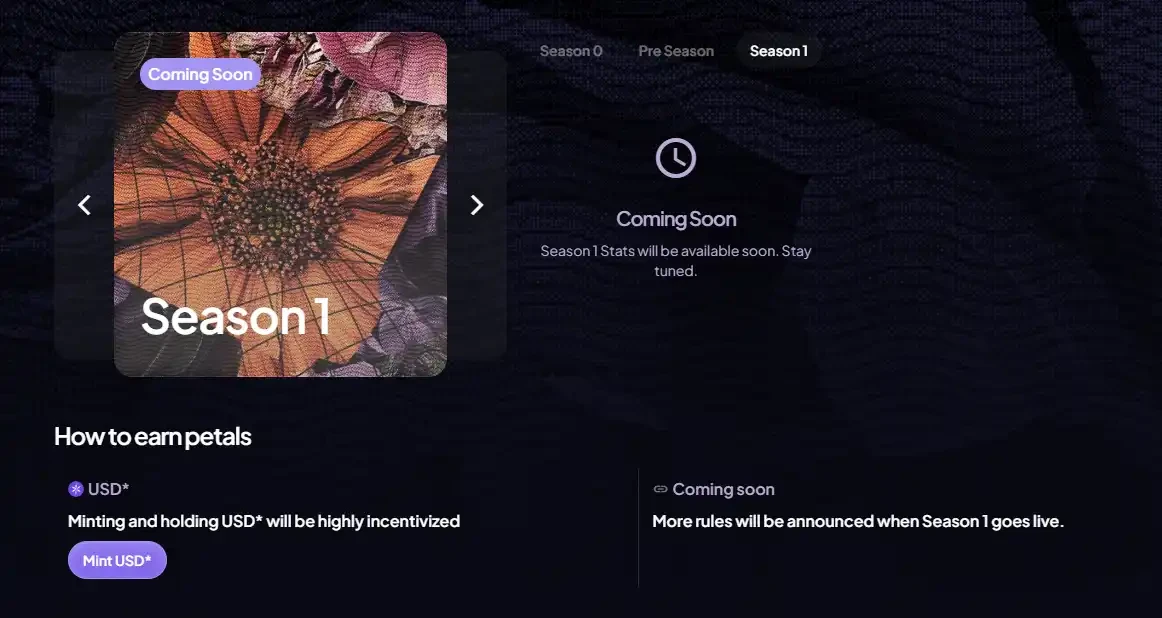

The $USD* of the protocol is backed by USDC, USDT, and PYUSD. When users deposit USDC, USDT, or PYUSD into the Perena seed pool, they can receive $USD* in return.

The protocol has a points system called “petals”. The first two phases of activities have been completed, and the new round of activities has not yet started. However, the project team has pointed out that obtaining and holding $USD* will be the main incentive content of the new round of activities.

Noble

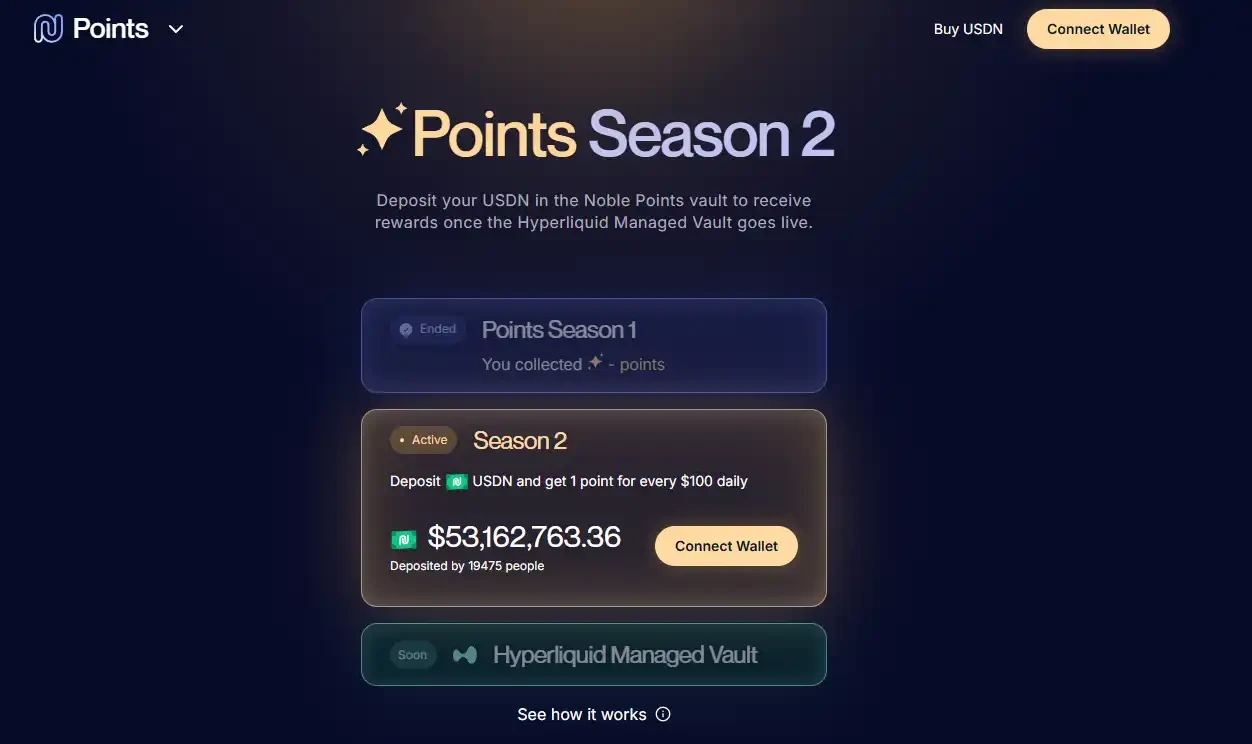

On November 19, 2024, Fortune reported that stablecoin company Noble completed a $15 million Series A funding round, led by Paradigm. This project is a chain built specifically for stablecoins and RWAs, but also launched its own stablecoin, $USDN.

The project has a points system, currently in its second season, where points are earned by depositing $USDN into the official points pool. Currently, over $53 million in $USDN has been deposited into earned points.

Resolv

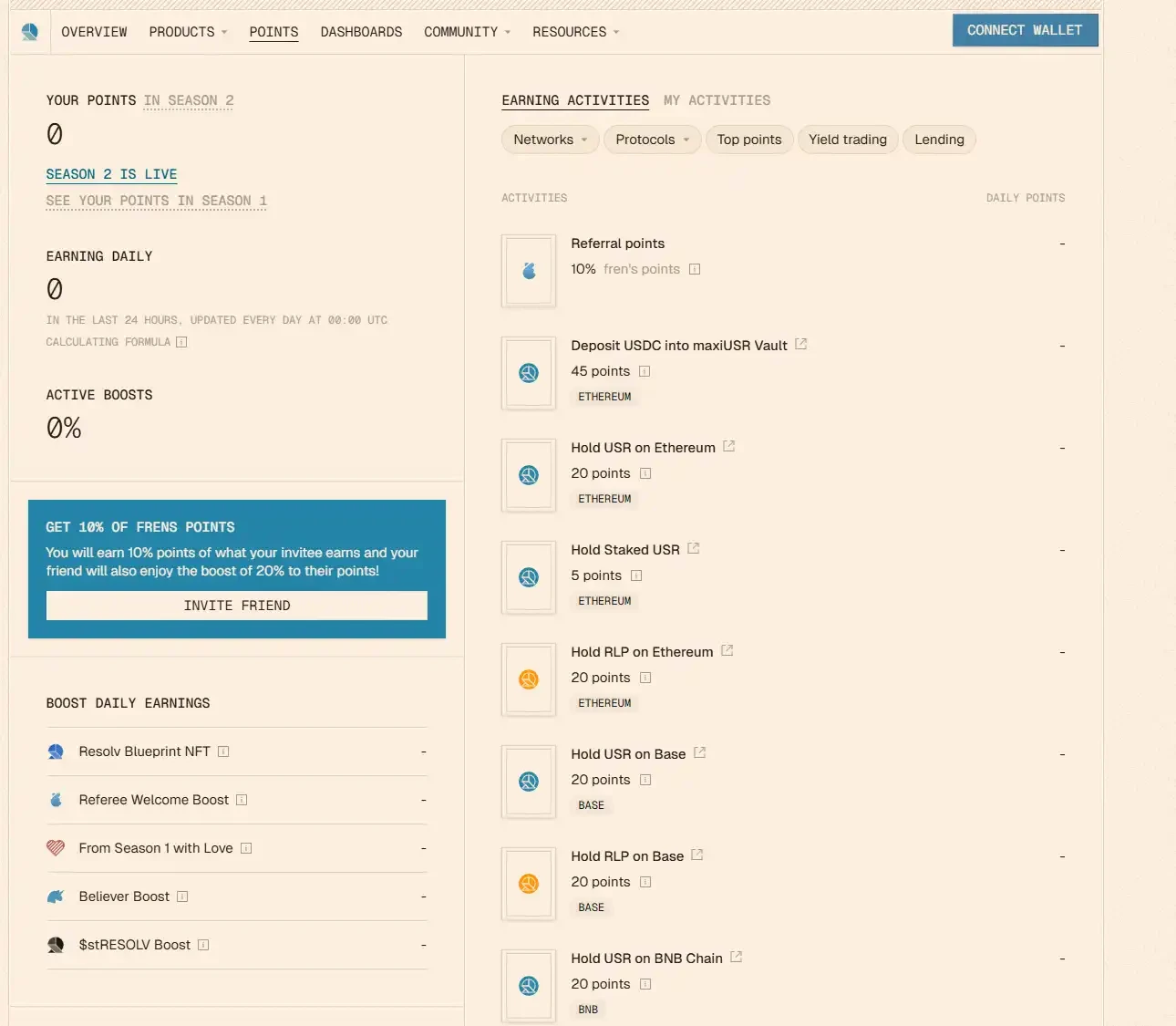

Resolv is a stablecoin protocol that issues $USR, a stablecoin pegged to the US dollar and fully backed by ETH, using perpetual futures to hedge against ETH price fluctuations. On April 16, CoinDesk reported that Resolv Labs announced the completion of a $10 million seed round of funding, co-led by Cyber.Fund and Maven 11, with participation from Coinbase Ventures, Susquehanna, Arrington Capital, and Animoca Ventures.

The agreement has a points system, and the points activity has now entered its second season. Points can be obtained by completing a series of tasks given by the project party.

結論

In addition to the aforementioned stablecoin projects with direct points systems for participation and interaction, there are many other, even more prominent, stablecoin projects worthy of attention. For example, Tether’s own backing, Bitcoin L2 Plasma, a “fee-free stablecoin chain”; Tether-backed L1 Stable, backed by Bitfinex and USDT’s unified liquidity protocol, USDT 0; and Arc, a new public chain dedicated to stablecoins, announced by Circle, the “first stablecoin stock,” in its Q2 2025 financial report.

In addition, Tempo, a high-performance, payment-focused blockchain jointly built by Paradigm and Stripe, is also under development. The Trump family company WLFI has also issued a compliant stablecoin USD 1 on BNB Chain.

As the next “battlefield” in terms of compliance and popularization, the stablecoin track deserves more attention.

Related: One-week token unlocking: Layerzero unlocks 23.1% of the circulating supply

Layerzero has its first token unlock, accounting for 23.1% of the circulating supply, amounting to US$57.3 million. Layerzero Project Twitter: https://x.com/LayerZero_Core Project website: https://layerzero.network/ Number of unlocked tokens this time: 25.71 million Amount unlocked this time: Approximately 57.33 million US dollars LayerZero is a full-chain interoperability protocol designed for lightweight messaging across chains. LayerZero provides trusted and guaranteed messaging with configurable trustlessness. The specific release curve is as follows: Venom Project Twitter: https://twitter.com/VenomFoundation Project website: https://venom.network/ Number of unlocked coins this time: 5062 Amount unlocked this time: Approximately 12.99 million US dollars Venom is a Turing-complete proof-of-stake blockchain that uses a Byzantine Fault Tolerant consensus algorithm for block validation and creation as well as network security, using dynamic sharding to increase its transaction throughput and network capacity. The specific release…