Cryptocurrency market attracts competition from Wall Street, with Ethereum taking the spotlight

Original title: Wall Street chases encryption, Ethereum ushered in a highlight moment

原作者: 僧侶

原文翻譯:TechFlow

The trading symbol is $ETH.

Wall Street is having a 加密貨幣currency moment.

Traditional finance (TradFi) is running out of growth narratives. Artificial intelligence has become a hot topic in the market, but the attention paid to it has been excessive, and software companies are far less attractive today than they were in the 2000s and 2010s.

On a deeper level, growth investors who raise capital to invest in innovation stories and large addressable markets (TAM) know that most AI-related companies are valued at ridiculous premiums, and other so-called growth narratives are no longer easy to find. The once highly regarded FAANG stocks are gradually transforming into a composite asset of high quality, maximized profits, and moderate annual growth rates.

For example, the median enterprise value to revenue (EV/Rev) multiple for software companies has fallen below 2.0x.

This is when cryptocurrency came on the scene.

Bitcoin ($BTC) broke through all-time highs, the U.S. President touted our asset in a press conference, and a wave of regulatory favorability pushed the crypto asset class back into the spotlight for the first time since 2021.

BTC, COIN, HOOD, CIRCLE vs. SPY and QQQ (Source: Artemis)

This time, the protagonists are no longer NFT and Dogecoin. This time, it is the era of digital gold, stablecoins, tokenization and payment reform. Stripe and Robinhood are claiming that cryptocurrency will be the core focus of their next round of growth; $COIN (Coinbase) successfully joined the SP 500 index; Circle showed the world that cryptocurrency is attractive enough for growth stocks to ignore earnings multiples again.

But how does this all relate to $ETH?

For those of us crypto natives, the field of smart contract platforms looks very fragmented. There’s Solana, there’s Hyperliquid, and there are a dozen emerging high-performance blockchains and Rollups (on-chain scaling solutions).

We know that Ethereum’s leadership has been genuinely challenged and that it faces an existential threat. We also know that it has yet to solve the problem of value capture.

But I highly doubt Wall Street knows any of this. In fact, I would go so far as to say that most Wall Street investors know next to nothing about Solana. If we’re being honest, XRP, Litecoin, Chainlink, Cardano, and Dogecoin are probably more widely known to the outside market than $SOL. After all, these people have been apathetic about the entire crypto asset class for several years now.

What Wall Street knows is that $ETH is a representative of the Lindy Effect (meaning that things that last long are more likely to continue to exist), it is battle-tested, and has been the main beta investment option to $BTC for many years. What Wall Street sees is that $ETH is the only other crypto asset with a liquid ETF. What Wall Street is keen on is the upcoming catalyst vs. classic relative value investment.

Those investors in suits may not know much about crypto, but they know that Coinbase, Kraken, and now Robinhood have decided to “build on Ethereum.” With minimal due diligence, they can find that the Ethereum chain has the largest stablecoin pool. They start calculating “moonshot math” and quickly realize that while $BTC has reached a new all-time high, $ETH is still over 30% below its 2021 high.

You might think that relative underperformance looks pessimistic, but these people have a different approach to investing. They prefer to buy assets that are cheaper but have clear targets, rather than chasing highs that make them question whether they have missed the boat.

I think they are already here. Investment mandates are not a problem, any fund can drive crypto exposure with the right incentives. Although Crypto Twitter (CT) has said it will not touch $ETH for more than a year, the trading symbol has continued to outperform over the past month.

$SOLETH is down nearly 9% year to date. Ethereum’s market dominance bottomed out in May and has since enjoyed its longest uptrend since mid-2023.

If all of Crypto Twitter (CT) is labeling $ETH as a “cursed coin”, why is it still performing well?

The answer: It’s attracting new buyers.

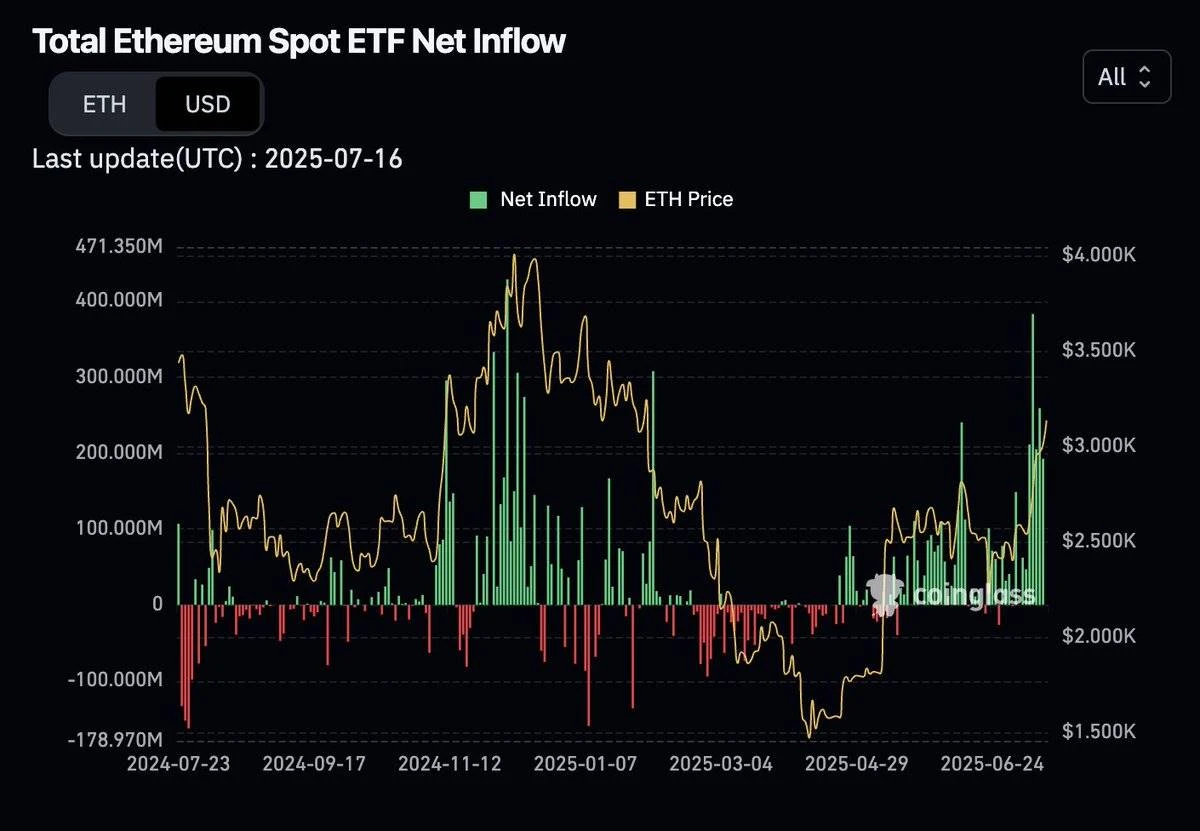

Since March this year, cash ETF fund inflows have been showing a unidirectional growth trend.

來源:Coinglass

Microstrategy Clones similar to $ETH are adding to their positions aggressively, adding early structural leverage to the market.

Perhaps, some cryptocurrency natives realized that they were under-exposed to $ETH and began to readjust their positions, possibly withdrawing from $BTC and $SOL, which have performed well in the past two years, and instead investing in Ethereum.

Im not saying Ethereum has solved its problems. I think whats probably happening at this stage is that $ETH as an asset starts to decouple from the Ethereum network itself.

External buyers are driving a paradigm shift in the $ETH asset, challenging our inherent perception that it can only go down. Shorts will eventually be forced to close their positions. Then, crypto native capital will begin to chase the rally until the market sees some kind of full-blown speculative frenzy for $ETH, ending in a spectacular top.

If this were to happen, a new all-time high (ATH) would not be too far away.

This article is sourced from the internet: Cryptocurrency market attracts competition from Wall Street, with Ethereum taking the spotlight

Related: $50 million OTC crypto scam: Well-known tokens involved, VCs and whales can’t escape

Original author: darwizzynft Original translation: TechFlow An over-the-counter (OTC) cryptocurrency scam involving a variety of well-known tokens was recently exposed. The victimized tokens include SUI, NEAR, Axelar, SEI and dozens of others, but shockingly, almost no one is discussing this matter! The scam is estimated to have defrauded investors of more than $50 million over a period of several months and was only recently widely known. The list of victims even includes venture capitalists (VCs), key opinion leaders (KOLs), and heavyweight crypto whales. The following is a detailed account of the scam, thanks to @AltcoinAlphaOnX for his in-depth research. Phase 1: Building Trust (November 2024 – January 2025) Starting in November 2024, various venture capital groups and private investment pools began to launch seemingly legitimate top OTC transactions in Telegram…