重點

-

– Completely different origins and concepts: Bitcoin (BTC) was born in 2009 and is known as “digital gold”, focusing on scarcity and security; Ethereum (ETH) was launched in 2015 and is positioned as a “global computer”, focusing on programmable finance and various decentralized applications.

-

– Technical trade-offs: Bitcoin uses a robust PoW consensus, which has the highest degree of decentralization but limited throughput; Ethereum has switched to PoS since the “merger”, and coupled with the Layer-2 solution, it can process on-chain transactions faster and more flexibly.

-

– Differences in ecological applications: Bitcoin is a value storage tool favored by mainstream institutions and retail investors (spot, ETF, corporate treasury), while Ethereum is the engine of DeFi and GameFi, with an active developer community.

-

– Looking to the future: Bitcoin’s roadmap focuses on Lightning, privacy, and more ETF approvals; Ethereum focuses on sharding and Rollup to promote richer DeFi/Web3 applications, but both face competition and regulatory challenges.

比特幣 和 以太坊 jointly 德菲ne the current 加密貨幣 space, but they serve very different purposes. Which one is more worth buying? is a question that every investor is concerned about. This article will expand on six dimensions: historical origins, technological differences, ecology and applications, market performance, risk profile, and future path to help you make good asset allocation between BTC and ETH.

Table of contents

Historical Origins and Core Foundations

Differences in technical protocols

Ecosystem and application scenarios

Market Performance and Investment Indicators

Risk factors and volatility characteristics

Historical Origins and Core Foundations

Origin and Positioning

In January 2009, Bitcoin (BTC) was born. It was initially positioned as peer-to-peer electronic cash. It was quickly regarded as digital gold due to its decentralization and scarcity, and its price soared from a few cents to tens of thousands of dollars.

In July 2015, 以太坊(ETH) was launched with the goal of providing a general public chain for smart contracts and dApps to enable richer on-chain applications.

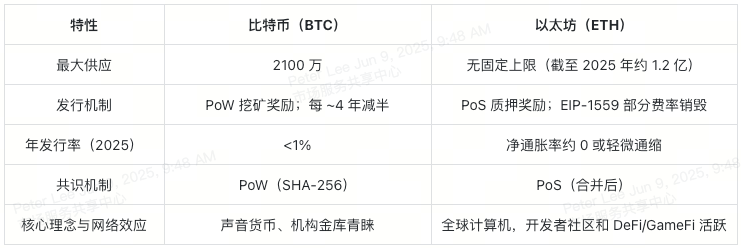

Monetary policy and supply mechanisms

-

– Bitcoin: The total supply is capped at 21 million, and the block reward is halved approximately every four years. After the halving in April 2024 , the annual issuance will drop to less than 1% of the total supply, further strengthening scarcity.

-

– Ethereum: Initially, there was no fixed upper limit, and new coins were minted as mining rewards; after the EIP-1559 upgrade in 2021, part of the transaction fees began to be destroyed. After the “merger” to PoS in 2022, the new issuance amount was basically the same as the burn amount, and the inflation rate approached zero.

Core Concepts and Network Effects

Bitcoin advocates sound money, is censorship-resistant and highly liquid, and is favored by institutional treasury and long-term value investors, so it is widely regarded as digital gold .

以太坊 is positioned as a world computer and is committed to empowering innovative scenarios such as DeFi, NFT and games. As on-chain activities increase, its issuance will be more closely linked to actual demand rather than uncontrolled issuance.

Technology and protocol differences

共識機制

Bitcoin uses Proof of Work (PoW), where miners package blocks by continuously solving SHA-256 algorithm puzzles. This method is extremely secure, but it also consumes a lot of electricity.

After the merger in September 2022, Ethereum switched to Proof of Stake (PoS), reducing energy consumption by more than 99%. ETH holders verify blocks and earn income by staking. Bitcoin itself does not support staking, and users who want to earn passive income usually use financial management platforms like XT Earn.

Block time, throughput and transaction fees

-

– Bitcoin: On average, one block is generated every 10 minutes, and transaction throughput is limited; during peak periods (such as when BTC/USD coin-based contracts are actively traded), the memory pool is congested and transaction fees will rise sharply.

-

– Ethereum: A new block is generated every 12-15 seconds, with higher throughput, but transaction fees still soar during the NFT or DeFi boom. Through Layer-2 Rollup such as Optimism and Arbitrum, transactions are packaged off-chain and then put on-chain, which can significantly reduce costs.

Security and decentralization

Bitcoins huge computing power network makes 51% attacks extremely costly, and upgrades like Taproot further enhance resistance. Ethereums PoS security depends on the amount of ETH staked, and malicious validators face the risk of having their funds confiscated. It is promoting a sharding scheme that aims to improve scalability while maintaining decentralization. Both main chains have deep spot market liquidity, and traders will also combine on-chain data with the macro calendar in June to optimize strategies.

Ecosystem and application scenarios

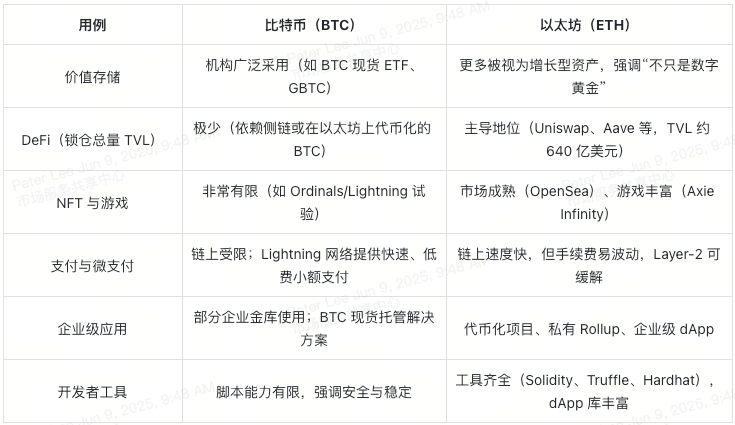

Bitcoins value storage and payment scenarios

Institutional Applications

Bitcoin has become the preferred value storage tool for institutions and retail investors . Many companies and pension funds have included BTC in their financial allocations, and products such as GBTC and BTC spot ETFs allow investors to participate in investments without having to keep their private keys. Observing the market conditions of BTC/USDT spot 和 BTC/USD coin-based contracts often reflects market sentiment; the steady rise in prices means that the markets confidence in the long-term value of Bitcoin is constantly increasing.

On-chain payments and the Lightning Network

Although Bitcoin is still in the development stage for daily small payments, the emergence of the Lightning network makes micropayments feasible. On-chain transaction fees may soar during peak periods, and Lightning can provide a faster and cheaper transfer experience, especially for areas with underdeveloped banking services.

Ethereums smart contracts and dApp ecosystem

NFT and Games

In addition to DeFi, Ethereum is also the main battlefield for NFT and blockchain games. 市場s such as OpenSea are booming, and games such as Axie Infinity allow creators to monetize digital artworks and game assets.

Enterprise and Layer-2 Solutions

Enterprises often use Layer-2 Rollup or Polygon sidechains such as Optimism and Arbitrum to reduce gas fees and increase throughput. These expansion solutions provide feasible solutions for scenarios such as real asset tokenization and cross-border settlement.

Developer Community and Speed of Innovation

Ethereums huge developer community revolves around Solidity, Web3.js, and a rich library of development. Regular hackathons, various funds, and tools (Truffle, Hardhat) continue to help fast iterations – although complexity also brings occasional smart contract vulnerabilities. In contrast, Bitcoin usually takes a steady upgrade route (Taproot, privacy enhancement), focusing more on security rather than frequent updates. Therefore, although the brand and stability are impeccable, it lacks native DeFi and complex smart contract support.

Earning Opportunities (XT Earn)

Financial services like XT Earn bridge the gap between “simple coin holding” and “passive income”. Whether through the wrapped BTC staking solution or directly participating in ETH staking , users can make idle crypto assets generate income, combining value storage strategies with income generation.

Market Performance and Investment Indicators

Historical Price Trends and Correlations

Bitcoins cyclical bull run is legendary. In 2013, the price of BTC rose from less than $100 to more than $1,100 in November; in 2017, it soared from about $1,000 to nearly $20,000 in December; in the 2020-21 cycle, BTC rose from about $6,438 in March 2020 to an all-time high of nearly $69,000 in November 2021. As of June 2025, the price of Bitcoin is about $104,500.

Ethereums growth is also impressive, closely related to ecological milestones. At the end of 2016, the price of ETH was around $8; it rose to $200 in June 2020 and reached $600 in August; the NFT craze in early 2021 pushed it to $4,800 in May. By June 2025, the price of Ethereum is about $2,600.

Market capitalization and liquidity

Bitcoin remains the largest crypto asset by market capitalization, with deep order books and extremely low slippage; Ethereum follows closely behind, with equally ample liquidity, but spreads may widen slightly when the network is congested.

On-chain metrics and network health

比特幣

-

– Daily Active Addresses: ~1.1 million, showing good usage.

-

– Hash rate: Close to all-time highs (>300 EH/s), indicating strong miner confidence.

-

– “Days Destroyed” metric: Movement of long-term unmoved coins often signals price volatility.

以太坊

-

– Daily transactions: Over 1.2 million, driven primarily by DeFi and NFTs.

-

– Staking ETH: Over 35 million ETH are locked in the beacon chain, reflecting trust in PoS and expected returns.

-

– Smart contract deployments: about 2,000 to 3,000 new smart contracts are added each week, reflecting developer activity.

Institutional and retail adoption indicators

比特幣

The Bitcoin-based ETF ecosystem continues to expand. Major issuers such as Grayscale, BlackRock, and Fidelity have an average monthly net inflow of about $500 million. Custodian platforms also report increasing holdings in home offices and corporate vaults, further consolidating BTCs position as digital gold. At the same time, more and more investors are beginning to use professional Bitcoin tax filing software to manage their returns .

以太坊

The first batch of Ethereum spot ETFs in the United States will be launched in mid-2024, attracting about $80 million per month. The average daily trading volume of ETH futures on CME is about $3 billion, providing institutions with a compliant trading channel. In terms of DeFi, the total value locked in Ethereum (TVL) has stabilized at about $65 billion, highlighting its real use value. If you want to formulate a strategy, please refer to the June economic calendar to reasonably allocate the investment ratio of BTC and ETH.

Risk factors and volatility characteristics

Volatility Indicators

Cryptocurrency volatility remains, but Bitcoin and Ethereum prices are more stable than ever. As of the end of May 2025, Bitcoins 30-day realized volatility has fallen to about 1.8% (about 2.4% for 60 days), while Ethereums 30-day volatility is about 2.5% (about 3.0% for 60 days), reflecting residual DeFi and network sensitivity. Looking back at the adjustment cycle in early 2025: Bitcoin fell from $109,000 at the end of May to $84,000 in mid-March, and then fluctuated and consolidated, returning to $95,000 in June; Ethereum fell 55% from its high of $4,500 in November 2024, and began to pick up as the sharding testnet neared completion.

Regulatory and security risks

-

– Although Bitcoin enjoys the reputation of “digital gold”, stricter mining regulations (such as power rationing in North America) and the EU MiCA regulations (effective in mid-2025) may increase compliance costs and even affect miners’ site selection.

-

– Ethereum faces the risk of smart contract vulnerabilities – for example, a DeFi project suffered a $100 million attack in February 2025; if the full network sharding (Q3 2025) does not go smoothly, it will also bring technical and trust challenges. In addition, there is still uncertainty as to whether the US SEC will classify Ethereum pledge products as securities, adding a layer of regulatory risk.

Network congestion and soaring transaction fees

Bitcoins memory pool is usually relatively quiet, but when Ordinals (BTC NFT) is hot, the single transaction fee can temporarily soar to more than $10, making small payments almost impossible. Ethereum, thanks to Layer-2 Rollup, the average gas fee on the main network is about 25 Gwei (≈ $2-3 per transaction), but the launch of popular DeFi projects or NFT airdrops will still cause short-term surges in transaction fees, temporarily squeezing out ordinary users. To avoid these fluctuations, you can refer to the June economic calendar to adjust your asset allocation strategy.

Competition and the risk of technological obsolescence

Bitcoins position as a store of value remains solid, but the RWA public chain, which focuses on the tokenization of real assets, continues to attract institutional pilots. Ethereum faces more intense competition: high-performance public chains such as Solana, Avalanche, and Aptos are rapidly expanding in the DeFi and GameFi fields. If Ethereums sharding or Rollup route is delayed or not as expected, developers and liquidity may switch to other chains, weakening ETHs network effect. If you want to profit from high volatility and save taxes, you can pay attention to professional Bitcoin tax filing software solutions .

Future prospects and roadmap

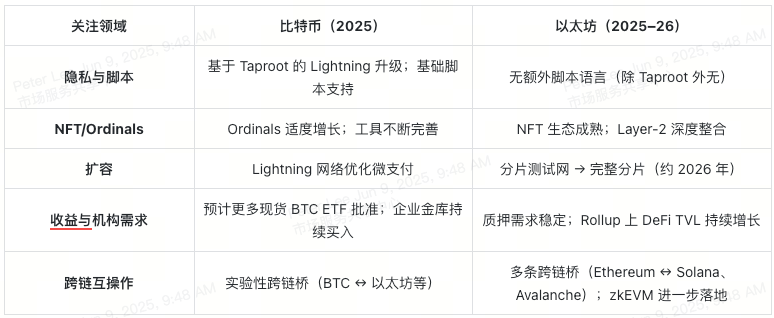

Bitcoin’s Upcoming Developments

Taproot Enhancements

In 2025, based on Taproot privacy and script upgrades, Lightning network improvements will be launched to achieve faster and cheaper micropayments; at the same time, a test cross-chain bridge will allow BTC to communicate with other public chains under the premise of security and controllability.

Ordinals and Limited NFTs

Ordinals engraving brings certain NFT-style applications, but the overall scale is still far less than Ethereum. There will be more friendly minting and tracking tools in the future, but the transaction volume will remain moderate.

Institutional support

As US regulators slowly allow spot Bitcoin ETFs, more capital is expected to flow in. The demand for BTC hedging and hedging in corporate treasuries continues to rise, and new allocation announcements are expected.

Ethereum expansion and protocol upgrade

Sharding Roadmap

Multiple sharding testnets will continue to run until the end of 2025, with full sharding activation planned for early 2026, with throughput expected to increase from ~15 transactions/second to tens of thousands transactions/second while maintaining PoS security.

Layer-2 Evolution

Rollups such as 樂觀 , 仲裁 , 和 零克同步 continue to reduce gas fees. In 2025, the average Rollup fee has dropped by more than 60%, and the DeFi and GameFi experience is smoother; one-click cross-chain and wallet integration are also continuously optimized.

DeFi and cross-chain innovation

It is expected that more bridge solutions (such as 以太坊 ↔ 索拉納 , Ethereum ↔ 雪崩 ) and early zkEVM Rollup will emerge, taking into account Ethereum-level security and lower transaction fees. As regulatory compliance requirements for DeFi tokens become clear, protocol parties will gradually adopt standard token models.

Macro and Technology Catalysts

Inflation and Monetary Policy

When central bank interest rates change, investors tend to view Bitcoin as digital gold, while Ethereum benefits from the demand for on-chain financial services. To allocate assets, refer to the June economic calendar .

Web3 Ecosystem Growth

More wallet options, DAO tools, and real asset tokenization (RWA) continue to create new demands, and each new scenario is adding value to ETH.

Competitive Threats

The new generation of Layer-1 public chains such as 阿普托斯 和 隋 are seizing the market with faster final confirmation and lower handling fees, challenging the position of Ethereum. The promotion of central bank digital currencies (CBDC) in various countries may also reshape the digital asset ecosystem, and both BTC and ETH communities need to adjust accordingly.

This article is sourced from the internet: Investment decision: Buy Bitcoin or Ethereum?

Original | Odaily Planet Daily ( @OdailyChina ) Author | Asher ( @Asher_0210 ) This morning, a16z led the investment in the social protocol Towns, which has a total financing amount of up to 35.5 million US dollars, and announced in X that it will launch the TOWNS token in the second quarter of 2025. The total supply of TOWNS is 10 billion, and the initial airdrop ratio is 10%. Towns confirms that it will issue tokens this quarter According to on-chain data , as of April 10, the total number of registered users on Towns exceeded 400,000, of which 200,000 users had points, and the total number of spaces was 328,000. In addition, the number of users with more than 5,000 points was less than 50,000, only 48,500. Therefore,…