Why is ETH Treasury more likely to rise than Strategy? How to choose between SBET and BMNR?

This article comes from: Kevin (@kevinlhr 88), Co-Investment Director of Penn بلاکچین

Odaily Planet Daily کے ذریعہ مرتب کردہ ( @OdailyChina ); Translated by Azuma ( @azuma_eth )

Although the کرپٹو community has long been enthusiastic about bringing traditional assets on-chain in the form of tokenization, the most significant recent progress has actually come from the reverse integration of crypto assets into traditional securities. The recent public markets pursuit of crypto asset treasury stocks perfectly illustrates this trend.

Michael Saylor pioneered this strategy with MicroStrategy (MSTR), which has helped his company reach a market cap of over $100 billion, outperforming even Nvidia in the same period. We have analyzed this in detail in our special report on MicroStrategy (a great learning resource for newcomers to the treasury field). The core logic of this type of treasury strategy is that public companies can obtain low-cost, unsecured leverage that ordinary traders cannot achieve.

Recently, the market’s attention has expanded from BTC treasuries to ETH treasuries, such as Sharplink Gaming (SBET) led by Joseph Lubin and BitMine (BMNR) helmed by Thomas Lee.

But is the ETH treasury really justified? As we demonstrated in our MicroStrategy analysis, treasury companies are essentially trying to arbitrage the difference between the long-term compound annual growth rate (CAGR) of the underlying assets and the cost of capital. In an earlier مضمون , we outlined our views on the long-term CAGR of ETH: as a programmable scarce reserve asset, ETH plays a fundamental role in maintaining the economic security of the chain as more assets migrate to the blockchain network . This article will explain the bullish logic of the ETH treasury in the general direction and provide operational recommendations for companies that adopt this strategy.

Liquidity Access: The Cornerstone of Treasury Companies

One of the main reasons why tokens and protocols seek to create these treasury companies is to open up ways for tokens to access traditional financial (TradFi) liquidity – especially in the context of shrinking altcoin liquidity. These treasury companies mainly obtain liquidity in three ways to increase their holdings. It is worth noting that these liquidity/debts are all unsecured, that is, they cannot be redeemed early.

-

Convertible bonds : Financing through the issuance of debt that can be converted into shares, with the proceeds used to purchase more cryptocurrencies;

-

Preferred equity : Financing is done by issuing preferred stock that pays a fixed annual dividend;

-

At-the-بازار (ATM) issuance : Sell new shares directly on the open market to obtain flexible, real-time funding for purchasing cryptocurrencies.

Advantages of ETH Convertible Bonds

As we pointed out in our previous research on MicroStrategy, convertible bonds offer two major benefits to institutional investors:

-

Downside protection and upside opportunity: Allowing institutions to gain exposure to underlying assets (such as BTC or ETH) with the inherent protection characteristics of bonds;

-

Volatility-driven arbitrage opportunities: Hedge funds often profit from the volatility of the underlying asset and its securities through gamma trading strategies.

Among them, gamma traders (hedge funds) have become the dominant force in the convertible bond market. Compared with BTC, ETH has higher historical volatility and implied volatility. The convertible bonds (CBs) issued by ETH Treasury can naturally reflect this high volatility in the capital structure, making them more attractive to arbitrageurs and hedge funds. More importantly, this volatility allows ETH Treasury to issue convertible bonds at a higher valuation and obtain more favorable financing conditions.

Odaily Note: Comparison of historical volatility of ETH and BTC.

For convertible bond holders, higher volatility means increased opportunities to profit through gamma strategies. In short, the more volatile the underlying asset, the more profitable the gamma trade, which makes the ETH Treasurys convertible bonds more advantageous than the BTC Treasury.

Odaily Note: Comparison of historical volatility of SBET, BMNR and MSTR.

However, it is important to note a key premise: if ETH cannot maintain long-term annual compound growth, the appreciation of the underlying assets may not be enough to meet the conversion conditions before maturity. At this time, the Treasury Company will face the risk of full debt repayment. In contrast, BTC has a lower probability of this happening to its convertible bonds due to its more mature long-term performance. Historical data shows that most convertible bonds under this strategy have eventually achieved conversion.

Odaily Note: Comparison of four-year CAGR of ETH and BTC.

The special value of ETH preferred shares

Unlike convertible bonds, preferred stocks are designed for fixed-income investors. While some convertible preferreds offer mixed upside potential, yield is still the primary consideration for most institutional investors. These instruments are priced based on credit risk — whether the treasury company can reliably make interest payments.

The key advantage of MicroStrategys strategy is the use of ATM issuance to pay interest. Since this is usually only 1-3% of market capitalization, the dilution risk is minimal, but the model still relies on the market liquidity and volatility of BTC and MicroStrategys underlying securities.

ETH can generate native income through staking, re-staking and lending, which provides greater certainty for preferred stock interest payments and should theoretically receive a higher credit rating. Unlike BTC, which relies solely on price appreciation, ETHs returns combine long-term annual compound growth expectations with native returns at the protocol layer.

Odaily Note: Annualized return of ETH native staking.

The innovative idea I propose is that ETH preferred shares can be used as a non-directional investment tool to allow institutions to participate in network security maintenance without taking on ETH price risk. As we emphasized in the ETH report, maintaining at least 67% of honest validators is critical to network security. As more assets are added to the chain, it becomes increasingly important for institutions to actively support the decentralization and security of Ethereum.

Many institutions may not be willing to go long on ETH directly, but ETH Treasury can act as an intermediary – absorbing directional risks while providing institutions with returns similar to fixed income. The on-chain preferred shares issued by SBET and BMNR are fixed-income pledge products designed for this purpose. They can be bundled with protocol layer incentives to make them more attractive to investors who seek stable returns but do not want to bear all market risks.

ATM issuance has unique advantages for the ETH Treasury

The key valuation metric for treasury companies, mNAV (market value to net asset value ratio), is conceptually similar to the price-to-earnings ratio and reflects the markets pricing of future growth in assets per share. ETH treasuries naturally enjoy a higher mNAV premium due to their native income mechanism – these activities can generate continuous income or increase the number of ETH corresponding to each share without additional capital. In contrast, BTC treasury companies must rely on synthetic income strategies (such as issuing convertible bonds or preferred stocks), and it is difficult to justify any income when the market premium is close to NAV.

More importantly, mNAV is reflexive — higher mNAV enables treasury companies to raise capital more incrementally through ATM issuance. They issue shares at a premium and increase their holdings of underlying assets, increasing the asset value per share and forming a positive cycle. The higher the mNAV, the greater the value capture, which makes ATM issuance particularly effective for ETH treasury companies.

Access to capital is another key factor. Companies with deeper liquidity and broader access to financing naturally command higher mNAVs, while companies with limited market access tend to trade at a discount. As a result, mNAV often reflects a liquidity premium — a reflection of the market’s confidence in a company’s ability to effectively access additional liquidity.

Screening Treasury Companies Based on First Principles

ATM issuance can be viewed as financing to retail investors, while convertible bonds and preferred stocks are typically targeted at institutional investors. Therefore, the key to a successful ATM strategy is to build a strong retail base, which often requires credible and charismatic spokespersons, as well as continuous and transparent strategic disclosure to win the long-term trust of retail investors. In contrast, convertible bonds and preferred stocks require a sound institutional sales channel and relationship with the capital markets sector. Following this logic, I believe SBET has a more retail-driven advantage (thanks to Joe Lubins leadership and the teams continued transparency in increasing its holdings per ETH), while BMNR has easier access to institutional liquidity thanks to Tom Lees deep connections in the traditional financial world.

The ecological significance and competitive landscape of the ETH Treasury

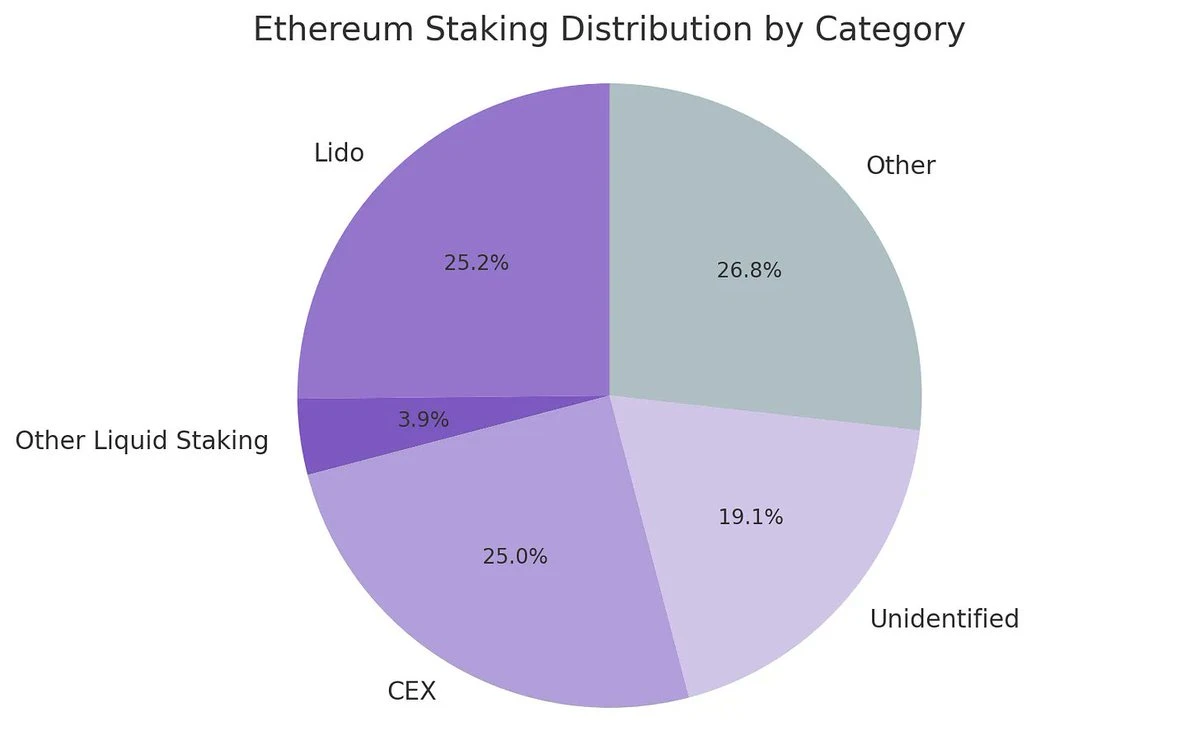

One of the biggest challenges facing Ethereum is the increasing concentration of validators and staked ETH (mainly in liquid staking protocols such as Lido and centralized exchanges such as Coinbase). The ETH Treasury can help offset this trend and promote the decentralization of validators. To enhance long-term resilience, these enterprises should spread ETH across multiple staking providers and operate their own validator nodes when possible.

Odaily Note: Distribution of Ethereum’s staking categories.

اس تناظر میں، I believe that the competitive landscape of ETH treasury companies will be fundamentally different from that of BTC treasury companies. The Bitcoin ecosystem has formed a winner-takes-all situation (MicroStrategys holdings are more than 10 times that of the second largest corporate holder), and it has dominated the convertible bond and preferred stock markets with its first-mover advantage and strong narrative control. The ETH treasury started from scratch, with no single dominant entity and multiple projects developing in parallel. This state of no first-mover advantage is not only healthier for the network, but also fosters a more competitive and accelerated development environment. Given the similar ETH holdings of the leading companies, SBET and BMNR are likely to form a duopoly.

Odaily Note: Comparison of ETH Treasury Company holdings.

Valuation Framework: A Combination of MicroStrategy and Lido

In a broad sense, the ETH Treasury model can be seen as a fusion of MicroStrategy and Lido designed specifically for traditional finance. Unlike Lido, ETH Treasury companies can capture a larger proportion of asset appreciation due to holding underlying assets, and are far superior to the former in terms of value accumulation.

Here is a rough valuation reference. Lido currently manages about 30% of ETH pledges, with an implied valuation of over $30 billion. We believe that within a market cycle (4 years), SBET and BMNR are likely to surpass Lido in total size, driven by the speed, depth and reflexivity of traditional financial capital flows (as demonstrated by MicroStrategys growth strategy).

To add another background data, the market value of Bitcoin is 2.47 trillion US dollars, and Ethereum is 428 billion US dollars (accounting for 17-20% of Bitcoin). If SBET and BMNR reach 20% of MicroStrategys 120 billion US dollar valuation, the long-term value is about 24 billion US dollars. At present, the combined valuation of the two is less than 8 billion US dollars. As the ETH treasury matures, there is still huge room for growth.

نتیجہ

The emergence and development of digital asset treasuries is a major evolution in the further integration of the crypto market and traditional finance, and ETH treasuries are becoming a strong new force. Ethereums unique advantages (including higher convertible bond volatility and native returns on preferred stocks) create differentiated growth space for treasury companies, and its ability to promote decentralization of validators and stimulate competition further distinguishes it from the BTC treasury bond ecosystem.

The combination of MicroStrategy’s capital efficiency and ETH’s embedded returns can unlock tremendous value and push the on-chain economy deeper into traditional finance. Rapid expansion and growing institutional interest portend a transformative impact on crypto and capital markets in the coming years.

متعلقہ پڑھنا

Sharplink narrative bubble burst? ETH version of Strategy still undecided

This article is sourced from the internet: Why is ETH Treasury more likely to rise than Strategy? How to choose between SBET and BMNR?

Related: Countdown to Powells stay or departure: A global financial crisis caused by renovation?

Original author: Fairy, ChainCatcher Original editor: TB, ChainCatcher Can “renovation” also remove the Chairman of the Federal Reserve? Trump began to bombard Powell during the election, and now he is using the renovation controversy to force the palace. This seemingly outrageous political drama is pushing global market sentiment to a critical point. What kind of pressure is Powell under now? If he is really forced to leave office, what kind of storm will it cause? Trump and Powell: Seven years of love-hate relationship The conflict between Trump and Powell boils down to one sentence: one wants to cut interest rates, the other refuses to do so. The two have been deadlocked since 2018 over this core disagreement. Interestingly, Powell’s appointment was actually appointed by Trump. In February 2018, Powell officially…