Review of the performance of 8 mainstream public chains in the past three months: Ethereum returns as the king, while Ba

Original author: Frank, PANews

In the past three months, the crypto market has experienced a significant rebound. The performance of mainstream public chains has become the focus of the market. Ethereum has staged a comeback with the dual boost of ETF funds and listed companies. The prices of Solana, Sui, Hyperliquid, etc. have also risen sharply. Judging from the price trend, the market seems to be entering a long-lost copycat season. But behind the price, what is the development status of these public chains?

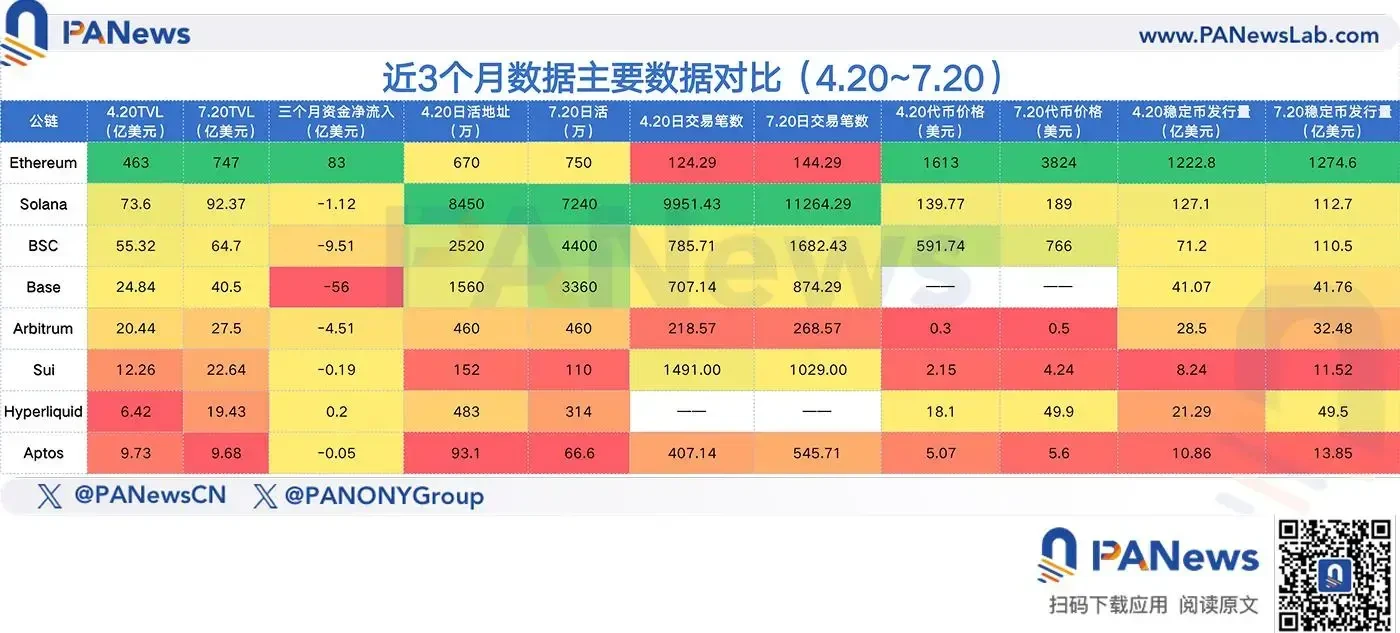

This article sorts out the core indicators of 8 major public chains with high TVL amounts and popularity in the past three months – price, TVL, capital flow, on-chain activity and ecological progress – in an effort to outline the real situation of this round of public chain competition. The data period is from April 20 to July 20.

Ethereum: Capital-catalyzed return of the king

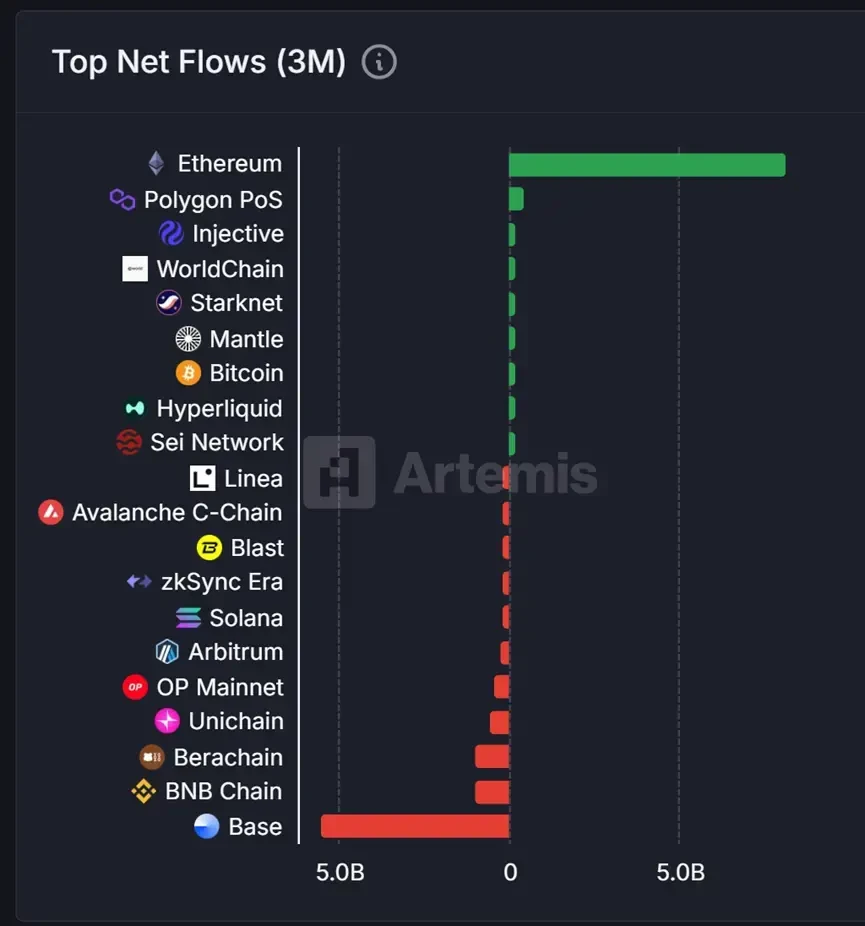

Ethereum has seen a significant increase in all data recently, which is also in line with its price performance. In the past three months, the price of Ethereum has increased from US$1,600 to a maximum of more than US$3,800, an increase of more than 130%. Behind the soaring price, the TVL of the Ethereum ecosystem has also increased by 61.34% over the same period. The net inflow of funds on the chain has reached US$8.3 billion in the past three months, once again becoming the public chain with the largest inflow of funds. However, the growth of TVL is mainly due to the increase in the price of ETH tokens. In terms of the number of ETH, the amount of ETH in the Ethereum ecosystem has been on a downward trend recently, from 28.39 million in April to about 22.28 million at present, and the amount of ETH has decreased by 21%.

In terms of daily activity and transaction volume on the chain, they have increased by 11.94% and 16% respectively in the past three months, which is not a particularly significant increase. In addition, Ethereums spot ETF has shown significant growth during these three months, with a net increase of about US$5 billion. In addition, many US-listed companies have followed MicroStrategys example and used Ethereum as a reserve token, which has also provided Ethereum with more buying and positive market sentiment. Overall, capital drive may be the main factor for the significant increase in Ethereum prices.

Solana: Market value recovery but lower activity challenges

Unlike Ethereum, the price of SOL has also increased significantly recently, rebounding from $139 to $189. However, judging from the data of the Solana ecosystem, many data have not only not increased significantly, but have a downward trend. Among them, the net outflow of funds on the chain was about $112 million in three months, and the number of daily active addresses also decreased by 14%. The issuance of stablecoins also decreased slightly, by about $1.5 billion.

The TVL amount increased during this period, from $7.3 billion to $9.237 billion. From the perspective of performance within the ecosystem, Pump.fun is still the platform with the largest transaction volume in the Solana ecosystem, contributing a transaction volume of $234 billion in the past month. In addition, among the top DEXs, OKX DEX ranked in the top ten with a monthly transaction volume of $4.6 billion, which was also unexpected.

In terms of MEME coins, the current Solana daily issuance of new tokens is about 40,000 to 50,000, which is a significant decline from the 90,000 to 100,000 levels in January this year. However, it is still relatively stable overall and has not seen a cliff-like drop.

Currently, Solana鈥檚 staking rate is about 66%, but it is obvious that the number of validators is declining, which also means that large validators on Solana are gradually replacing small validators.

BSC: Alpha activity ignites on-chain revival

The data effect of BSC seems to be completely opposite to that of Solana. From the perspective of token prices, BNB has not changed significantly in the past three months, rebounding by nearly 30%. However, there has been a significant increase in daily activity, number of transactions, and issuance of stablecoins on the chain. First, the number of daily active addresses increased from 25.2 million to 44 million, an increase of 74.6%; the number of daily transactions increased from 7.85 million to 16.82 million, an increase of about 114%; the issuance of stablecoins increased from US$7.12 billion to US$11 billion, an increase of 55%. From these data, BSC has achieved relatively obvious data changes in the past three months, which may be due to the promotion of Alpha activities.

Although the activity on the chain has increased significantly, in terms of on-chain capital inflow, BSC has a net outflow of US$950 million in the past three months. How to convert active users attracted by the event into deposited funds may be the next problem that BSC needs to solve.

Base: Rapid expansion that provides blood transfusion for Ethereum

Bases on-chain data performance is also quite eye-catching. TVL increased from US$2.4 billion to US$4 billion in three months, an increase of 63%. The number of daily active addresses increased from 15.6 million to 33.6 million, an increase of 115%, and the number of daily transactions increased by 23%. In general, Bases on-chain data has improved significantly, but the funds on the chain have flowed out significantly, with a net outflow of US$5.6 billion in three months, becoming the public chain with the largest net outflow. Data shows that these funds eventually flowed to Ethereum. Base has also become the largest source of funds for the Ethereum mainnet in the near future.

In addition, the Base chain has launched Flashblocks technology, which reduces the block generation time from 2 seconds to 200 milliseconds, making it the fastest EVM chain. At the same time, Coinbase launched the Base App to create a one-stop social and trading platform, which will further promote the development of the Base ecosystem.

Arbitrum: Maintaining the L2 runner-up position and accumulating strength

Arbitrums data has not changed much overall. In addition to a 34% increase in TVL, the number of transactions has increased by 22%. The number of daily active addresses has hardly changed, and it is 4.6 million three months ago and now. However, the price of ARB has rebounded by 66% recently, which is relatively strong among several major public chains. This may be due to the driving effect of the rise in Ethereum prices. Although Arbitrums data has not changed much, it still firmly maintains the second place in Ethereum L2.

Sui: TVL and coin price both take off

The price of SUI has seen a sharp rise recently, from $2.15 to $4.24, an increase of 97%, almost doubling. Behind this surge, there are also some underlying data support. Mainly TVL data, from $1.2 billion in April to $2.2 billion, an increase of more than 84%. In addition, the issuance of stablecoins has also exceeded $1 billion. In terms of the number of daily active addresses, from May to June, Suis daily activity experienced a roller coaster ride, first from 1.5 million per day to 400,000 per day, and then rebounded to about 1 million in early July. However, it has not yet returned to its previous peak.

Hyperliquid: A rocket-like rise after the trust crisis

Hyperliquid is almost the public chain with the best growth in the past three months. The token price has soared from US$18 to US$49.9, and the market value has exceeded US$15 billion, ranking 13th among all tokens.

Reflecting on-chain data, TVL has also increased from $640 million to $1.943 billion, an increase of 202%. Stablecoin issuance has increased from $2.1 billion to $4.9 billion, quickly becoming the fifth largest public chain in terms of issuance. After experiencing the previous decentralized trust crisis, Hyperliquids treasury HLP revenue has also climbed again recently and exceeded $68 million, setting a new historical high. After entering July, the number of new users of Hyperliquid has also risen to more than 3,000 per day.

Aptos: The lurker in the data stall

Compared with other public chains, Aptos seems to be somewhat unsatisfactory in terms of both on-chain data and price. The price has risen by 10% in 3 months, while multiple key data such as TVL, capital inflow, and daily active addresses are negative. The biggest change may be that the number of daily transactions has increased by 34%, and the issuance of stablecoins has increased by 300 million US dollars. Compared with Sui, which also uses the MOVE language, Aptos seems to have fallen behind in multiple data dimensions.

In general, the recent performance of public chain data is not as intense as the markets response to token prices. Although Sui, Hyperliquid, Base and other networks have also seen significant improvements in data driven by the market, the magnitude of this improvement is obviously lower than the increase in token prices. Obviously, this is a round of recovery in which funds are ahead of the ecosystem. Behind this recovery, whether the price performance of tokens can be transformed into the ecological prosperity of various public chains, or even drive actual application tracks such as DeFi and chain games like the previous bull market, may be the core factor for this round of copycat season to last longer. Therefore, although the current price and on-chain data do not seem to be in sync, in the subsequent development, these data may also become the decisive factor in price.

This article is sourced from the internet: Review of the performance of 8 mainstream public chains in the past three months: Ethereum returns as the king, while Base and Hyperliquid data soar

1. Popular currencies on CEX CEX top 10 trading volume and 24-hour rise and fall: BTC: +0.02% ETH: +0.34% SOL: +0.55% XRP: +0.10% PEPE: -0.97% UNI: +2.00% SUI: +0.32% BCH: +8.90% DOGE: +0.51% TRX: +0.70% 24 H increase list (data source: OKX): RADAR: +20.80% T : + 19.48% SNT: +18.51% LQTY: +11.00% POR : + 9.72% HUMA: +9.29% OKB: +9.17% BCH: +8.86% X : + 7.04% IP : + 6.02% 2. Top 5 popular memes on the chain (data source: GMGN ): NI USBC CRCL Intel SECRET 3. 24-hour hot search currencies GOR, according to the project owner, aims to build a cross-chain bridge protocol anchored 1:1 with Solana (SOL), maintaining price stability and deflation model through pre-minting and burning mechanisms. It attracted market attention due to the response from…