Research on the Cryptocurrency Marketing Ecosystem: Focusing on the Korean Market

Recently, a16z 暗号 opened an office in Seoul to provide Go-to-市場 support for its portfolio companies across the Asia-Pacific region, hiring regional background leads to offer comprehensive support for projects.

Following the previous research on “Focus on the Chinese Crypto Market: A Quick Look at the Web3 KOL and Agency Marketing Ecosystem,” this article will focus on the Korean market. Given Korea’s unique economic environment, rapid adoption of digital assets, and emerging regulatory framework, this report on local exchanges, media, institutions, research firms, and blockchain events aims to provide a valuable reference resource for investors, startups, community builders, and relevant parties.

Why is the Korean Market Becoming Increasingly Important in the Crypto Space?

Korea is widely recognized as a global cryptocurrency hotspot, with crypto trading deeply embedded in its financial culture. It has become one of the world’s most dynamic cryptocurrency markets. 2025 is shaping up to be a decisive year for the industry. With over 16 million crypto users, strong mobile adoption, and a tech-savvy populace, Korea’s crypto landscape is booming at an unprecedented pace.

Adoption Analysis

Analysis of Korean Stock and Cryptocurrency Traders (2018-2025)

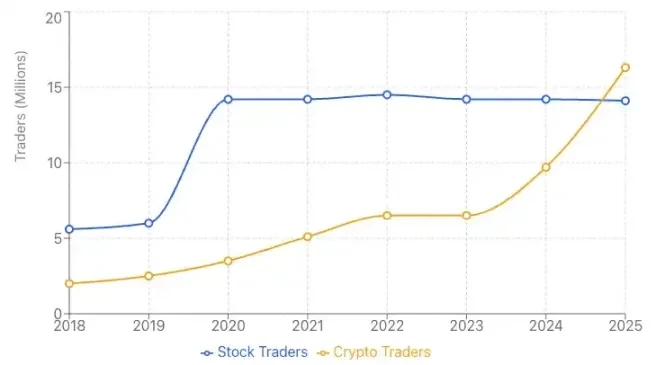

From 2018 to 2025, Korea experienced a significant shift in investment patterns. Stock traders increased from 5.6 million (10.8% of the population) to 14.1 million (27.3%), a 152% growth. More notably, cryptocurrency traders surged from 2 million (3.9%) to 16.3 million (31.6%), marking a 715% increase. By 2025, cryptocurrency traders surpassed stock traders for the first time, reflecting a major shift in retail investment preferences.

Traders Growth Trend (Millions)

Population Penetration Rate (%)

Key Findings

Stock Traders

- Grew from 5.6 million (10.8% of population) in 2018 to 14.1 million (27.3%) in 2025

- Experienced explosive growth (136.7%) during the 2020 COVID-19 pandemic

- Relatively stable at around 14.2 million since 2021

Cryptocurrency Traders

- Surged from 2 million (3.9% of population) in 2018 to 16.3 million (31.6%) in 2025

- An astonishing 715% growth over the period

- Experienced significant acceleration in 2024-2025, adding nearly 7 million new traders

- Surpassed stock traders for the first time in 2025

From 2024 to 2025, Bitcoin’s strong performance, US ETF approvals, and Trump’s pro-crypto stance drove explosive growth. Cryptocurrency traders surged from 9.7 million to 16.3 million, surpassing stock traders for the first time in Korean history, reflecting a fundamental shift in retail investment preferences.

Data sources: Korea Financial Investment Association (KFIA), Korea Securities Depository, Financial Intelligence Unit (FIU), Bank of Korea, Thornburg Investment Management, major crypto exchanges (Upbit, Bithumb, Coinone, Korbit, Gopax), and official government statistics. Stock trader numbers represent unique individual investors with active accounts. Crypto trader numbers represent verified users registered on exchanges. Population data from UN World Population Prospects 2024 Revision and Statistics Korea.

Beyond Stocks: Korea’s Cryptocurrency Adoption Surge and Market Impact

According to FinTech Weekly, by March 2025, Korea already had over 16 million people holding cryptocurrency accounts, surpassing stock investors, with digital asset adoption reaching new highs under post-election momentum. The total number accounts for over 30% of the population. Among them, Upbit’s user distribution is approximately 5.4 million users (53% of the domestic market), Bithumb about 3.8 million users (37% of the domestic market), Coinone about 300,000 to 500,000 users (

In terms of user numbers, Korea’s 16 million+ crypto users served by centralized exchanges (over 30% of the country’s population) account for approximately 3% of the estimated 560 million global cryptocurrency owners/users in 2025. Notably, global data includes all cryptocurrency holders, most of whom use centralized exchanges, while Korean users primarily use regulated local platforms.

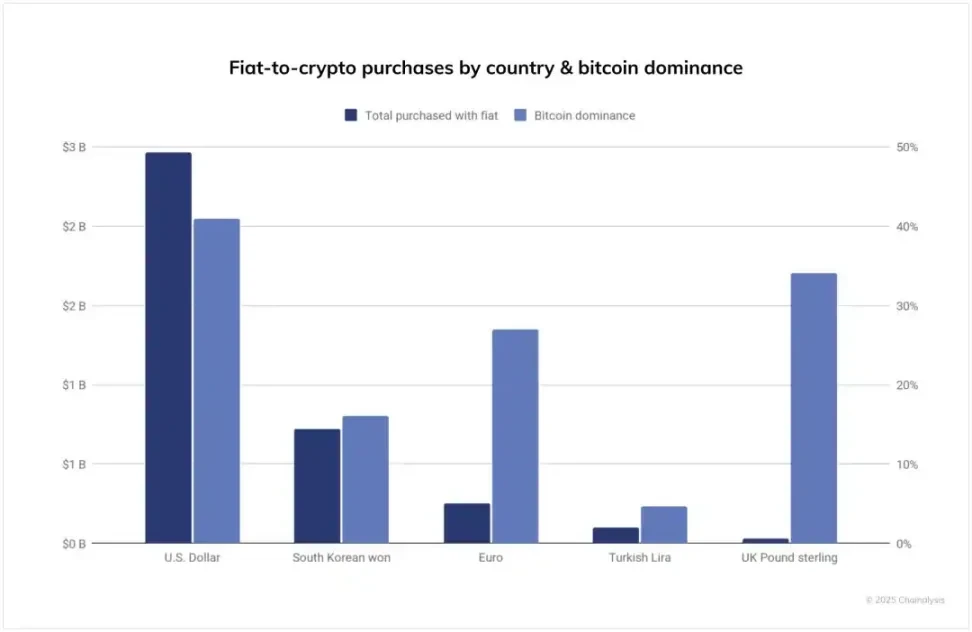

Despite Bitcoin’s dominant holdings, Korea is becoming a major player in the global fiat-to-crypto space. According to blockchain analytics firm Chainalysis’ report on the “2025 Global Crypto Adoption Index,” while the US remains the world’s largest fiat on-ramp with total transaction volume exceeding $2.4 trillion—nearly four times that of the second-highest country—Korea follows closely with an impressive $722 billion in transaction volume. This strong performance highlights the country’s growing importance in the global crypto ecosystem. In contrast, the EU’s fiat-to-crypto transaction volume is slightly below $250 billion, underscoring the scale of the Korean market. Among the top 20 countries in the index, Korea ranks 15th. With its rapid adoption and strategic position as one of the largest crypto hubs, Korea continues to solidify its role as a key player in the global crypto economy.

Source: Chainalysis

交換 分析

The influence of Korean cryptocurrency exchanges is growing not only regionally but also globally. Exchanges like Upbit, Bithumb, and Coinone dominate trading volume and continue to evolve under Korea’s well-established regulatory framework. As of October 2025, local centralized exchanges account for approximately 1.9% of global daily trading volume and about 3% of the total global CEX user base. However, when specifically measuring spot trading, Korea’s share reaches about 16% of global CEX spot trading volume, highlighting the country’s disproportionately large influence in retail-dominated fiat-to-crypto trading despite its smaller share of total users.

Trading Volume Analysis Global Comparison (Q4 2025) (asksurf.ai)

Compared to other major global markets, Korea maintains its leading position as a global fiat-to-crypto gateway and leads in transaction value within the Asia-Pacific region, thanks to exceptionally high per capita adoption (30% vs. global 6.8%) and a highly active retail trading culture.

Korea vs. Major Markets Comparison (Q4 2025) (asksurf.ai)

Regulatory Impact

Korea was among the first countries to establish a clear framework for trading and compliance. The government’s stance has evolved through distinct phases in its regulatory journey, each responding to market developments:

- 2017-2018: Suppression & Stabilization: Viewing crypto as a speculative threat, authorities implemented ICO bans, margin trading bans, and anonymous account bans to safeguard financial stability.

- 2019-2021: Pragmatic Regulation: A shift towards controlled acceptance emerged. Strict AML/KYC frameworks were enforced, culminating in the enactment of the 2020 Act on Reporting and Use of Specific Financial Transaction Information, establishing key reporting standards for Virtual Asset Service Providers (VASPs).

- 2022-2023: Investor Protection Focus: Triggered by major events like the Terra-Luna collapse, this period prioritized consumer safeguards. The government introduced token security ガイドlines and OTC brokerage rules, laying the groundwork for future institutional products.

- 2024-Present: Institutional Integration: Cryptocurrency has become a mainstream political and financial topic. The landmark Digital Asset Basic Act (DABA) passed in June 2025 established a comprehensive regulatory framework covering asset classification, issuance rules, stablecoins, and taxation. This period is characterized by a pursuit of balanced growth, with laws like the Virtual Asset Users Protection Act imposing severe penalties for misconduct.

This evolution reflects the government’s learning process through crisis response, technological maturation, and recognition that cryptocurrency has become a permanent part of the financial landscape. To this day, public figures, companies, and exchanges are also subject to disclosure and strict monitoring. Korea is unlikely to rapidly deregulate but will continue to gradually refine policy standards, striking a balance between investor protection and market growth. Over time, this could lead to expanded institutional participation, including banks offering digital asset services and securities firms engaging in tokenized financial products.

With 16 million users holding approximately $70.3 billion (102.6 trillion KRW) in crypto assets, Korea’s market depth is undeniable. For any crypto project, entering the Korean market is shifting from an option to a strategic necessity, especially before a トークン Generation Event (TGE). In terms of market entry, language and cultural barriers are challenges that cannot be ignored. Therefore, partnering with local crypto players is essential, particularly media, GTM agencies, research firms, and even some Key Opinion Leaders (KOLs).

Marketing Keys to Long-Term Success in the Korean Market

Realistic Success Expectations

Long-term success in Korea depends on coordinated marketing with clear milestones. Agencies emphasize the need for at least 2-3 months pre-listing to build brand awareness and community engagement; expecting rapid trading volume increases within the first two months is unrealistic.

Campaign Duration and User Attention

Campaigns lasting over three months risk losing user attention due to market saturation and fast-moving retail traders. Agencies aim to maintain momentum without letting campaigns drag on too long.

Focus on Brand Awareness and Community Building

Focusing on building brand awareness, engaging KOLs, issuing press releases, and community building, rather than solely on increasing trading volume, can lead to more long-term followers and project token holders.

KOL Engagement

Building strong, meaningful relationships with KOLs requires events, translations, and incentives like whitelist spots, fostering better project understanding and advocacy.

Tailored Marketing for Different Client Types

Marketing services are tailored for pre-TGE (Token Generation Event), post-TGE, and B2B institutional clients:

- Pre-TGE clients need urgent, intensive 2-3 month marketing support to establish market readiness in Korea.

- Post-TGE projects continue marketing to maintain momentum and assess team strength.

- B2B clients focus on institutional outreach, gaining exposure and professional events beyond retail channels.

According to agencies, projects like 0G and Sahara AI benefited from agency support, with agencies contributing up to 40% of their node sales. SUI’s growth from $0.4 to $4 over two years highlights the importance of tight coordination between internal marketing, agency alignment, and market maker strategies. The Korean crypto market features a fragmented landscape of agencies and research firms, with a few dominant players and varying reputations. In the following sections, I will briefly introduce the major local media, agencies, and research companies.

Introduction to Major Media Agencies

Korean crypto media plays a crucial role in helping projects navigate the local market, offering unique advantages due to deep insights into Korean trends, regulatory environments, and cultural nuances. With a highly engaged and tech-savvy audience, Korean crypto media provides tailored content that resonates with retail investors and institutional participants. The combination of extensive reach and localized expertise, along with active community engagement, makes them essential partners for projects seeking successful entry and growth in Korea’s thriving market. This section highlights several leading media agencies to help projects better understand the media landscape in this key market. (Listed in no particular order)

Followin (@followin_io)

概要

Followin is an AI-driven crypto news platform that aggregates the entire crypto internet—news, Twitter/X, KOL opinions, on-chain signals—and transforms them into real-time trading intelligence feeds for retail investors. Founded in 2022, Followin has grown into a leading crypto information infrastructure in Asia, with over 3 million users across Asia-Pacific markets and gaining momentum in Korea. The platform distinguishes itself through a smarter AI news engine and offers trending topics and the fastest market movement signals.

Key Features

- Real-time News: Sub-second market movement news and price-sensitive event alerts

- Alpha Signals: AI-curated early narratives, whale activities, and breakout opportunities

- Social Sentiment Analysis: Tracks X/TG data and top KOL trade notifications to detect sentiment shifts

- Earn & Rewards: Participate in airdrop campaigns, earn token rewards, and engage in missions

Followin’s Services

Leveraging its massive retail traffic and extensive regional resource network, Followin has successfully supported numerous crypto projects in achieving zero-to-one marketing growth in Asia-Pacific markets. Followin provides an integrated Go-To-Market service layer for crypto projects across the Asia-Pacific region, combining real-time media distribution, localized user growth solutions, and deep KOL networks into a unified launch and growth engine.

- PR Services: Breaking news, PR distribution, online events

- APAC User Growth: One-stop solutions with localized marketing strategies

- KOL Services: KOL, community, and exchange relations

Followin emphasizes regional partnerships, co-hosting events, and supporting the Web3 ecosystem. Its collaborations help expand media reach, strengthen crypto brands, and foster community building across Asia. The platform’s PR services, professional KOL connections, and multilingual channel support help crypto projects reach new audiences and enhance brand awareness.

Core Competitive Advantages

- High-Quality Retail Trading Users: 3 million+ users on app and web, 1.7 million+ users on social channels

- Regional & Multilingual Focus: Supports real-time translation in English, Chinese, Korean, and Vietnamese, covering key markets in Korea, Vietnam, Taiwan, and China

- APAC Network: Deep connections with KOLs, media, and communities

Followin is a leading mobile AI aggregator in Asia, leveraging the region’s high mobile penetration and multilingual needs among retail traders. By integrating vast information sources, Followin perfectly caters to traders who prioritize speed over analysis. With strong regional partnerships, the platform demonstrates effective community building and ecosystem support. (📲 App: https://followin.io/download)

Coinness (@CoinNess_)

概要

Founded in 2018, Coinness is Korea’s largest crypto media and community platform by user base, operating as the industry’s primary real-time news wire. The platform serves over 1 million monthly active users, 150,000+ daily active users, and 300,000 registered community members, making it the go-to source for breaking crypto news and project exposure.

Coinness operates a web service while maintaining a mobile app as its core, successfully building a massive app-based crypto news and community platform—an achievement unmatched by Korea’s traditional web-centric media. In terms of mobile app traffic, Coinness ranks just behind the country’s two largest exchanges, Upbit and Bithumb, and leads among non-exchange crypto platforms.

Key Features and Services

- Breaking News: 24/7 real-time news updates on the homepage, ensuring concise and powerful news dissemination

- News Zone PR: Traditional PR articles with in-depth insights, pinned at the top of the news zone for enhanced visibility

- Research: Detailed articles exploring the technical aspects of crypto projects

- Interviews: Text-based interviews conducted in a Q&A format

- Popup Banners: Partners can display promotional banners on the platform to increase visibility

- CoinNess Night Live (CNL): Interactive AMA events held in the Coinness Telegram community, averaging over 1,000 KYC-verified participants

- Price Aggregation: Real-time digital asset prices, including detailed market data like liquidation rates, long/short ratios, funding rates, and open interest

Core Competitive Advantages

- Real-time Asian Market Intelligence: Coinness focuses on sub-minute coverage of Korean exchange activities (like Bithumb, Upbit) and tracks regulatory developments across Asia. This provides traders with a competitive edge, especially for arbitrage and market regulation insights.

- Integrated News-to-Trade Flow: By combining breaking news alerts with real-time trading (spot and futures), Coinness offers a seamless user experience from news discovery to trade execution.

- Deep Korean Market Expertise: With over 7 years of experience focusing on the Korean market, Coinness maintains unparalleled depth in local crypto culture, regulatory nuances, and community preferences, which is difficult for global competitors to replicate.

この記事はインターネットから得たものです。 Research on the Cryptocurrency Marketing Ecosystem: Focusing on the Korean Market

Related: What key signals did the US “sleepless night” reveal to the market?

On November 19th, the US stock and cryptocurrency markets were completely sleepless, as Nvidia, the first AI company to go public, was about to release its earnings report, the performance of which would greatly influence subsequent market fluctuations. The Nasdaq once fell to 22,231, the S&P 500 fell to 6,574, and Bitcoin, from around 4:00 AM on November 19th, plummeted from $93,000 to a low of around $88,600. Fortunately, Nvidia’s financial report brought good news to the market. Nvidia’s Q3 revenue reached $57 billion, exceeding expectations. As the “shovel seller” of the AI era, Nvidia not only supports half of the Nasdaq but has also become a bellwether for global risk assets. Data shows that over the past six months, the correlation between Bitcoin and the Nasdaq 100 Index (NDX)…