Five major organizations outline a new blueprint for encryption in 2026: Is an encrypted “super app” on the horizon? Is the “four-year cycle” coming to an end?

Odaily Planet Daily Golem が編集 ( @ウェブ3_ゴーレム )

As 2025 draws to a close, major 暗号 research institutions are releasing reports and making predictions about industry trends for the coming year, forming a new consensus: the pure speculative cycle is fading, replaced by structural maturity, driven no longer by short-term profits, but by liquidity convergence, infrastructure construction, and integration.

Odaily Planet Daily has compiled the core predictions for 2026 from five research institutions: Coinbase, A16Z Crypto, Four Pillars, Messari, and Delphi Digital:

- The four-year cycle is coming to an end : Research institutions unanimously agree that the speculative halving cycle that occurs every four years is fading. It is being replaced by structural maturation, with value flowing to “ownership tokens” with revenue-sharing models and projects with practical applications, rather than being driven by short-term gains.

- The rise of the agent economy : Major research institutions (Delphi Digital, a16z, Coinbase) predict that AI agents will become major economic players. 市場 focus may shift to KYA (Know Your Agent) identity protocols and machine-native settlement layers.

- Super Apps : As US regulatory policies become clearer (Four Pillars, Messari), the complex cryptocurrency experience will be simplified into user-friendly “super apps” and privacy-preserving blockchains, thereby abstracting the technology and enabling large-scale applications.

Delphi Digital 2026 Outlook

Delphi Digital bases its analysis on the macroeconomic assumption of “global convergence.” They predict that by 2026, the divergence in global central bank policies will end, leading to a unified cycle of interest rate cuts and liquidity injections. With the Federal Reserve ending quantitative tightening (QT) and global liquidity improving, market conditions will favor hard assets such as gold and Bitcoin.

Agency Economy

A major expansion of infrastructure is the rise of the “agent economy.” AI agents will no longer be just chatbots, but will be able to proactively manage funds, execute complex DeFi strategies, and optimize on-chain yields without human intervention.

Social trading and the “pump and dump” economy

In terms of consumer applications, Delphi highlighted the user stickiness of platforms like pump.fun and predicted that “social trading” will mature. This trend will evolve from simple Meme coin gambling to complex copy trading, with strategy sharing becoming a tokenized product.

Institutional liquidity

The market structure will change as ETFs become more widespread, with liquidity from traditional finance flowing into the cryptocurrency market not only as a hedging tool but also as a standard portfolio allocation driven by loose macro liquidity.

Full report link: https://members.delphidigital.io/reports/the-year-ahead-for-infra-2026

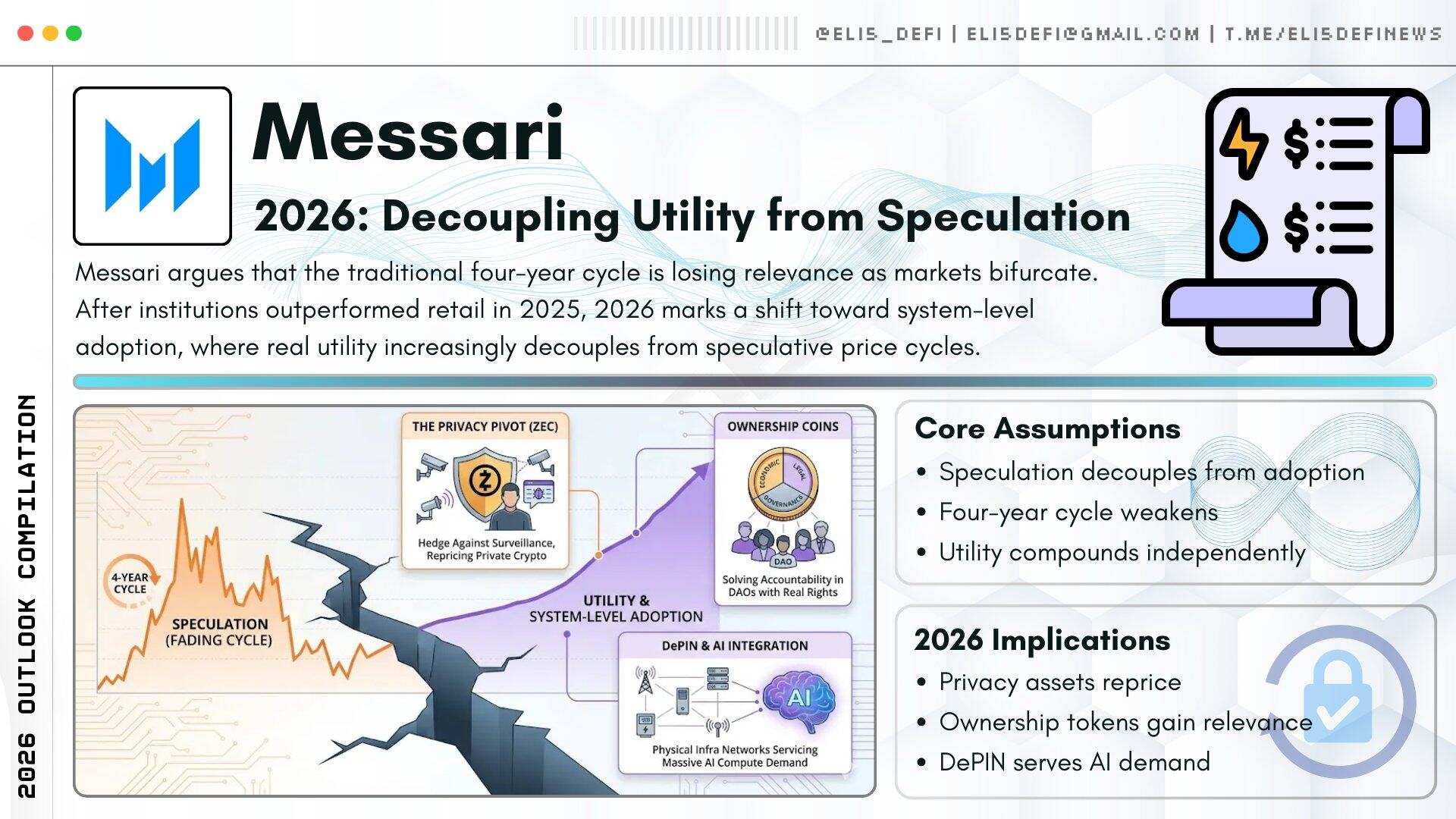

Messari’s 2026 Outlook

Messari’s core argument is the “decoupling of utility from speculation.” They argue that the relevance of the “four-year cycle” model is declining as markets diverge. They hypothesize that 2025 will be a year of victory for institutional investors and struggles for retail investors, laying the groundwork for “systematic adoption” rather than just asset price speculation in 2026.

Privacy coins are on the rise ($ZEC)

The resurgence of privacy is a trend that expands in reverse. Messari emphasizes that Zcash (ZEC) and similar assets are not only “privacy coins,” but also necessary hedging tools against increasing surveillance and corporate control, and predicts that “private cryptocurrencies” will be repriced.

Ownership Coin

A new category will emerge in 2026 – “ownership coins” – tokens that combine economic, legal, and governance rights. Messari believes that ownership coins can address the accountability crisis in DAOs and have the potential to spawn the first billion-dollar projects in this specific space.

DePIN and AI integration

This theory focuses on DePIN (Decentralized Physical Infrastructure Network), anticipating that these protocols can find practical product-market fit by meeting the massive computing and data demands of the AI field.

Full report link: https://messari.io/report/the-crypto-theses-2026

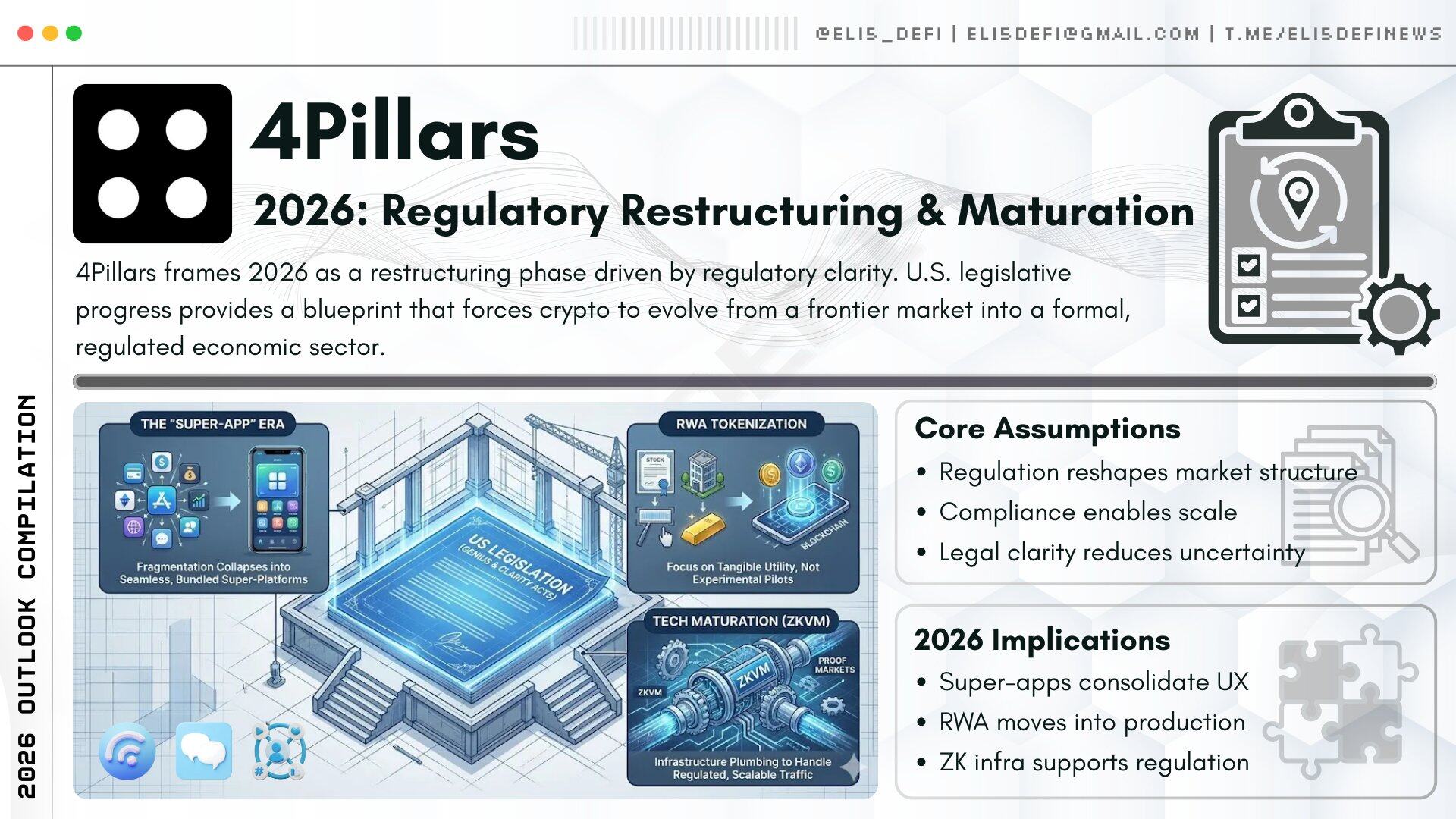

Four Pillars 2026 Outlook

Four Pillars’ outlook centers on “regulatory restructuring.” Their core assumption is that U.S. legislative initiatives (specifically mentioning the GENIUS Act and the CLARITY Act in their forecast) will provide a blueprint for comprehensive market reform.

This regulatory clarity is a catalyst for transforming markets from a “wild west”-like wilderness into a formal economic sector.

The era of “super apps”

Four Pillars predicts that the fragmentation of crypto applications will eventually merge into “super apps”—platforms powered by stablecoins that seamlessly integrate payment, investment, and lending functions. The complexity of blockchain will be completely eliminated.

RWA tokenization

The restructuring will drive the tokenization of stocks and traditional assets, but the focus is on practical utility rather than experimental pilot projects.

Mature encryption technology

On the technical front, they delved into the role of the Zero-Knowledge Virtual Machine (ZKVM) and proof markets on Ethereum, viewing them as essential infrastructure for handling the scale of this new type of regulated institutional traffic.

Full report link: https://4pillars.io/en/articles/2026-outlook-restructuring-100ys-perspective

Coinbase 2026 Outlook

A Coinbase report predicts the “end of the four-year cycle.” They explicitly state that 2026 will mark the end of the traditional Bitcoin halving cycle theory. Instead, the market will be driven by structural factors: macroeconomic demand for alternative stores of value and the formalization of cryptocurrencies as a medium-sized alternative asset class.

トークン Economics 2.0

The protocol is shifting from tokens intended for governance only to a revenue-linked model. It will increasingly implement buy-and-burn or fee-sharing mechanisms (in compliance with new regulations) to align token holder incentives with the platform’s success.

DAT 2.0 (Digital Asset Trading)

The trend is toward professional trading and the procurement of “sovereign block space,” viewing block space as a key commodity in the digital economy.

AI and Crypto converge

Coinbase anticipates a significant increase in AI agents using cryptocurrency payment tracks. They predict that the market will need a “crypto-native settlement layer” capable of handling continuous microtransactions between machines, which traditional payment tracks cannot support.

Full report link: https://www.coinbase.com/en-sg/institutional/research-insights/research/market-intelligence/2026-crypto-market-outlook

a16z Crypto 2026 Outlook

a16z crypto envisions “the internet becoming the bank.” Their fundamental belief is that value is beginning to flow as freely as information. They consider the friction between the “off-chain” and “on-chain” worlds to be the main bottleneck, which they believe will be eliminated by 2026 through more sophisticated infrastructure.

KYA (Verify Your Agent)

A key extension is the shift from KYC (Know Your Customer) to KYA. As AI agents become major economic players, they will require cryptographically signed credentials to conduct transactions, thus creating a new layer of identity infrastructure.

“Native Bonds” vs. Tokenization

a16z predicts that in the future, off-chain assets will no longer be tokenized as in the past (e.g., purchasing treasury bonds and putting them on-chain), but rather debt and assets will be initiated directly on-chain to reduce service costs and increase transparency.

Privacy technology moat

They believe that in the era of open-source code, privacy technology (and the ability to protect state privacy) will become the most important competitive moat for blockchains, creating a powerful network effect for blockchains that support privacy features.

Wealth Management for All

The combination of AI and cryptocurrency infrastructure will make complex wealth management (such as asset rebalancing and tax loss recovery) that was previously only available to high-net-worth individuals accessible to the general public.

Full report link: https://a16zcrypto.com/posts/article/big-ideas-things-excited-about-crypto-2026/

この記事はインターネットから得たものです。 Five major organizations outline a new blueprint for encryption in 2026: Is an encrypted “super app” on the horizon? Is the “four-year cycle” coming to an end?

Author | Dingdang ( @XiaMiPP ) ZEC’s 137% monthly increase is no longer impressive; ORE’s monthly increase is a staggering 5063%. This project, which surged from $10 to $540 and its market capitalization soared from $4 million to $200 million, entered the mainstream spotlight almost overnight. We can’t help but ask, what kind of project is this, and what is the foundation of its explosive growth? Project Origin: Transplanting the Bitcoin Spirit to Solana ORE is a Proof-of-Work (PoW) mining protocol on the Solana blockchain. Its core concept is to transplant Bitcoin’s “fair launch, no pre-mining, and no allocation mechanism” to the high-performance Solana network, creating true “digital gold.” The project was developed anonymously by its founder, Hardhat Chad, and this anonymity, low profile, and idealism seem to align with…