Lighter’s upcoming TGE: A comprehensive overview of timing window, on-chain signals, and market pricing.

著者 | アッシャー ( アッシャー )

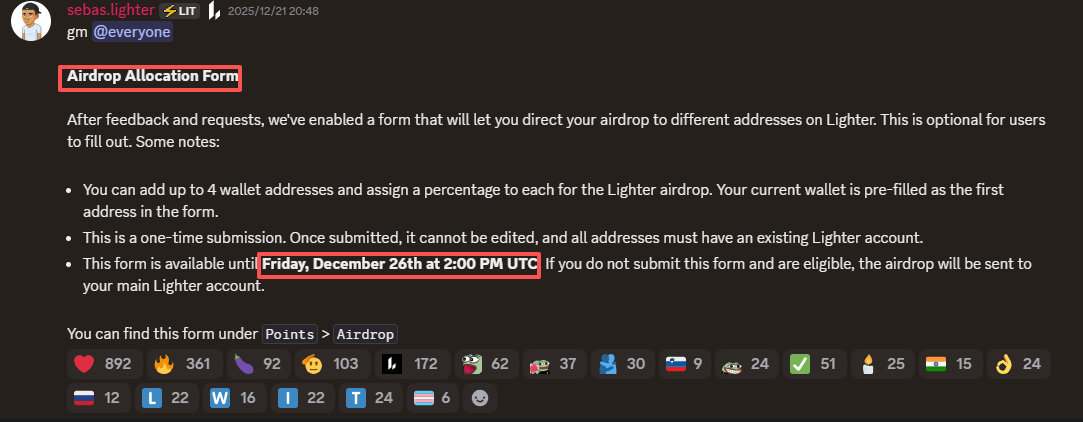

On December 13th, コインベース 市場s announced on its X platform that Lighter would be included in its listing roadmap ; on December 21st, the official Lighter account posted an announcement on Discord, requiring users to register their airdrop addresses by December 26th ; and on December 23rd, Binance launched pre-market trading of Lighter (LIT) perpetual contracts. With these key milestones occurring in quick succession, market expectations for Lighter’s upcoming TGE (Trading on Coin) have rapidly increased.

On-chain data further confirms this assessment. On December 20th, the Lighter token contract transferred 250 million LIT to a new address ( 0x98e7769167194A8Cf272B649319676bE84052b5f ); this morning, this address distributed varying amounts of tokens to 20 addresses, with the largest single transaction being approximately 3.1 million tokens and the smallest approximately 9,820 tokens, currently holding approximately 230 million LIT. Although the official purpose of these tokens has not yet been disclosed, the community generally speculates that they may be used for airdrop-related distributions.

It is worth noting that the 250 million LIT tokens account for exactly 25% of the total token supply, which is highly consistent with the previous community speculation that “25% of the share is used for airdrops,” and further strengthens the market’s judgment that Lighter is about to complete TGE.

The Lighter token contract transferred 250 million LIT to a new address.

Regarding timing expectations, feedback from members who participated in Lighter Japan’s AMA suggests that the TGE (Time for the Geographical Event) may fall between December 24th and January 1st of next year . Among the predictions on Polymarket regarding “when Lighter will hold its TGE,” December 29th has the highest probability, currently around 75%.

Polymarket predicts “When will Lighter hold TGE?”

Lighter ranked first in perpetual contract trading volume on the PerpDEX track over the past 30 days.

Lighter is a perpetual contract trading platform built on Ethereum Layer 2 (L2) with the goal of combining the speed and liquidity of centralized exchanges (CEXs) with the security and transparency of decentralized exchanges (DEXs).

According to DeFiLlama data , in the past 30 days, Lighter led the Perp Dex track with a perpetual contract trading volume of approximately $232.3 billion, surpassing Aster ($195.5 billion) and Hyperliquid ($182 billion).

Perp Dex Perpetual Contract Trading Volume Ranking

In addition, Lighter TVL has continued to rise in recent months, and its TVL has now exceeded $1.4 billion , surpassing Aster ($1.27 billion).

Lighter TVL data

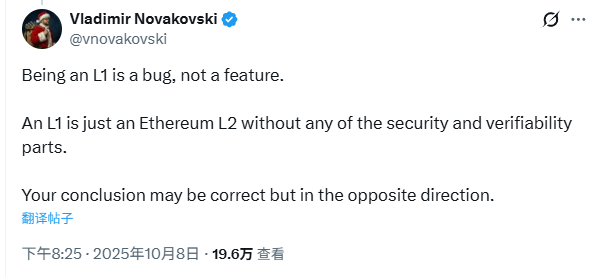

If Aster is backed by Binance, then Lighter is backed by Ethereum. As Lighter CEO Vladimir Novakovski previously stated in a commentary on the X platform, “Being an L1 is a bug, not a feature.”

Lighter CEO comments on Lighter’s choice to pursue a modular L2 architecture.

Unlike HyperLiquid, which adopts a closed, self-built L1 architecture, Lighter focuses on “Ethereum-native composability”: LLP tokens can circulate on the mainnet and collaborate with DeFi protocols like Aave, thus enjoying a low-cost, low-latency, and verifiable execution environment within an open ecosystem. In other words, Lighter’s goal is to allow any protocol to reuse its matching engine and capital system. Lighter does not aim to replace Ethereum, but rather to evolve alongside it, becoming the underlying engine for high-performance on-chain finance.

Lighter Valuation and Pre-Market Pricing

According to Binance’s pre-market trading of perpetual contracts, the price of LIT has slowly declined from its initial price of $3.9 to $3.2. Based on the current price, Lighter’s fully diluted valuation (FDV) is approximately $3.2 billion.

If 25% of the total token supply is used for future airdrops, and assuming a total of 12 million points, then each point corresponds to approximately 20.8 LIT. Based on the current pre-market price, each point is worth approximately $66 .

Market participants’ valuation range judgment

Crypto KOL ingalvarez.sol ( @ingalvarezsol ) predicts Lighter’s valuation based on factors such as Polymarket, OTC point prices, and the pre-market price of the LIT token:

- $1.5 billion : The lowest valuation under a pessimistic scenario, corresponding to a 暗号currency price of approximately $1.5.

- $3-4.2 billion : the baseline range for a bear market, corresponding to a cryptocurrency price of approximately $3 to $4;

- $7.5-12.5 billion : an optimistic scenario, corresponding to a cryptocurrency price of approximately $7.5 to $12.5.

Another early Lighter user, Chuk ( @chuk_xyz ), also made predictions based on Lighter’s TVL, transaction volume, revenue, and other data:

- Bear Market Range ($1.5 billion – $4.2 billion FDV): If the price moves within this range after TGE, it can be considered an opportunity zone. Holding short-sold items carries the lowest psychological pressure and offers the clearest risk-reward ratio.

- Benchmark Range (USD 4.2 billion – USD 7.5 billion FDV): If Lighter can stabilize its TVL and maintain its leading position, this range can be considered its fair value zone. Once the price enters this range, it’s suitable to take profits to break even while retaining a portion of the position.

- Bull Market Range ($7.5 billion – $12.5 billion + FDV): This range means that the core catalysts have been fully priced in by the market, including the strengthening of RWA momentum and the consensus formed on the distribution narrative (fintech/brokerage alignment). This stage is more suitable for continuously reducing positions during the upward trend.

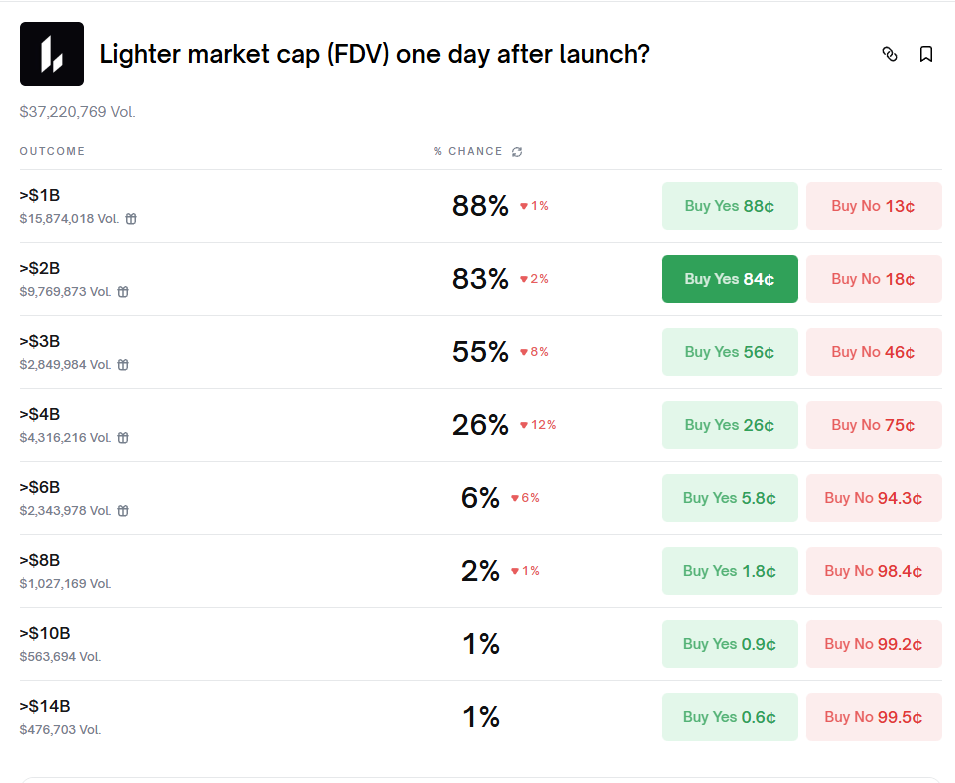

Polymarket predicts that in the “Lighter FDV one day after opening” event , there is an 88% probability of over $1 billion in FDV and an 83% probability of over $2 billion in FDV.

The “Lighter FDV One Day After Opening” incident on Polymarket

Overall, the market’s minimum expected valuation for Lighter at launch is $1.5 billion in FDV, corresponding to a token price of $1.50. Therefore, if the launch price falls, $1.50 would be an ideal short-term buying opportunity.

Don’t celebrate halfway through; stay informed with official updates.

Early adopters of Lighter should not celebrate prematurely; points are not considered a gain until they are converted into actual LIT tokens. According to Lighter’s latest announcement on its official Discord page, “We are now in the final stage of the second season of the points program and are currently conducting data analysis to remove points earned from witch addresses, self-trades, and wash trading exchanges. All points that have been reduced (including those already removed) will be redistributed to the community.”

The latest announcement from Lighter on the official Discord

この記事はインターネットから得たものです。 Lighter’s upcoming TGE: A comprehensive overview of timing window, on-chain signals, and market pricing.

Related: One-week token unlock: ZRO unlocks 7.3% of circulating supply.

Layerzero Project Twitter: https://x.com/LayerZero_Core Project website: https://layerzero.network/ Number of tokens unlocked this time: 25.71 million Unlocked amount: Approximately US$37.28 million LayerZero is a full-chain interoperability protocol designed for lightweight cross-chain messaging. LayerZero provides trusted and guaranteed messaging with configurable trustlessness. The specific release curve is as follows: Soon Project Twitter: https://x.com/soon_svm Project website: https://www.soo.network/ Number of tokens unlocked this time: 15.21 million Unlocked amount: Approximately US$37.26 million SOON is a rollup based on the Solana Virtual Machine (SVM) and focuses on high-performance blockchain solutions. Compared to traditional public chains, SOON is committed to providing more efficient and lower-cost infrastructure to support the large-scale deployment of Web3 applications. The specific release curve is as follows: ZKsync Project Twitter: https://x.com/zksync Project website: https://zksync.io/ Number of tokens unlocked this time: 173 million Unlocked…