ZEC’s surge fueled NEAR’s intention layer, but why is the mainnet still struggling with growth?

NEAR Intents activity has surged recently, with daily transaction volume soaring to over $200 million and transaction fees exceeding $400,000 at one point. Based on this data, its transaction volume is only lower than that of three popular public chains: Ethereum, Solana, and BSC, and its fee level ranks among the top five of all public chains.

This surge in “data” has not only brought the long-dormant NEAR back into the mainstream narrative, but also raises the question: will NEAR rise again as a result? However, what exactly is this $400,000 “fee”? And can it truly support NEAR’s “rise”?

The Rise of NEAR Intents: The Data Explosion Driven by Privacy Coins

To understand this surge in data, we must first clarify what exactly “NEAR Intents” are.

NEAR Intents is a new type of transaction infrastructure launched by the NEAR protocol in November 2024. NEAR Intents is one of the three core technical components of the NEAR chain abstract architecture. As a decentralized cross-chain system, NEAR Intents allows users to simply express their desired outcome (such as “exchange token A for token B at the optimal price”) without specifying technical details. The solver network then competes to satisfy these intents optimally, handling complex cross-chain operations in the background.

This product changes the traditional cross-chain process, which requires users to be familiar with multiple on-chain operations, accurately calculate transaction fees, and find the best exchange. It can also be integrated with AI agents to optimize transactions, greatly simplifying the cumbersome cross-chain operations and saving transaction fees.

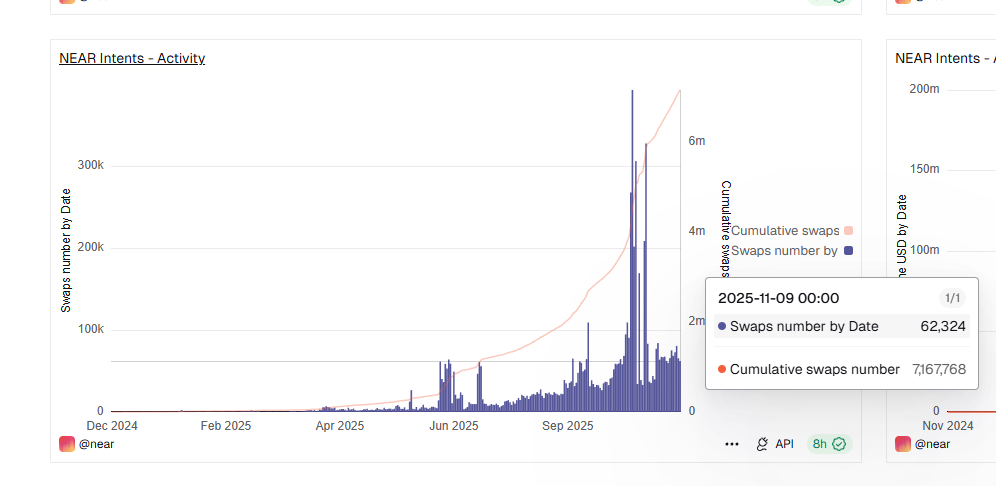

In terms of actual performance, NEAR Intents maintained a daily trading volume of several million US dollars from its launch until September of this year. Entering October, with the explosion of the privacy coin sector, a large amount of capital flowed into ZEC. People found that NEAR Intents seemed to be the best channel to ZEC, and trading ZEC became the primary use case for NEAR Intents.

On-chain data shows that transaction volume on the ZEC chain for NEAR Intents began to surge in October, reaching $5.9 million on October 1st, second only to Ethereum. By November 4th, this figure had grown to $23.9 million, and by November 7th, it had reached $40 million, contributing nearly one-third of the total transaction volume. At the same time, cross-chain transaction volume on the Ethereum chain also increased significantly, jointly driving the ever-increasing transaction volume of NEAR Intents.

Of all the channels, SwapKit undoubtedly stood out, contributing a total of $4.32 million in fees, accounting for over 70%. SwapKit is a B2B aggregator integrated into large wallets such as Trust Wallet. However, this $4 million in revenue only came from the solver behind SwapKit.

“Bustling-out shops” and “deserted shopping malls”

The rise of NEAR Intents seems to have brought new hope to NEAR. Many believe that if NEAR Intents can maintain its current revenue level and return or buy back tokens using a model similar to Hyperliquid, it will greatly improve the current economic narrative of the NEAR token.

But that doesn’t seem realistic.

First, in terms of relationships, NEAR, as an L1 public chain, is the underlying infrastructure, while NEAR Intents is a protocol layer built on top of NEAR L1, providing “chain abstraction” services through the NEAR L1 infrastructure. This relationship is similar to a very popular store opening in a shopping mall, but essentially, the store’s revenue cannot be directly included in the mall’s revenue.

Furthermore, the vast majority of NEAR Intents’ revenue is captured by third-party “solvers” and market makers (MMs). The NEAR mainnet, on the other hand, only charges gas fees for on-chain transactions, which are related to the number of transactions and not to the transaction amount.

As of November 9th, NEAR Intents had generated 7.16 million transactions. Based on NEAR’s current gas prices, the gas fees from these transactions would likely be only slightly over $2,000. Furthermore, according to NEAR’s fee agreement, 70% of these fees will be burned.

This explains why NEAR Intents is so popular on one hand, while NEAR’s on-chain fees remain at around several thousand dollars per day on the other.

While “AI narrative” has shown initial success, NEAR remains mired in a downward trend.

If this $400,000 fee is almost irrelevant to NEAR’s revenue, then is the rise of NEAR Intents “meaningless”? Objectively speaking, its significance lies not in the current direct revenue, but in strategic validation and future potential.

First, at the strategic level, the rise of NEAR Intents is a powerful validation of NEAR’s vision of “chain abstraction.” It proves that the technology is feasible and that there is a huge real market demand for a “frictionless” multi-chain experience. Although the current use case for NEAR Intents is still in the 暗号 DeFi field, its long-term goal, as seen from its vision, is to expand into Web2 or the real world, such as “book me a plane ticket” or “buy a pizza” (official examples), with a “solver” network finding the optimal solution and executing it. This vision is essentially similar to the currently popular X402 protocol narrative. AI, as the main narrative of the NEAR ecosystem in recent years, has finally created a truly blockbuster product that has the potential to become an industry leader.

Looking at NEAR’s other performance metrics, its current performance seems somewhat lacking. Its mainnet TVL ranks 42nd with only $133 million, and has been declining in recent years. Daily active users are currently around 2.9 million, a significant decrease from 4 million at the beginning of the year. Given the low on-chain activity, NEAR’s token performance has consistently hovered in a low-end range.

Perhaps in an effort to boost market sentiment, in October, the NEAR Foundation and several ecosystem members launched a new proposal to lower the maximum inflation rate from 5% to 2.5%. However, as of now, the proposal has only received support from about 60% of nodes. According to NEAR’s governance rules, the proposal needs to achieve a support rate of more than 80% to pass.

However, some industry experts remain optimistic about NEAR from a technical standpoint. Andy, founder of the well-known cryptocurrency podcast The Rollup, tweeted that he is optimistic about the future development of Starknet, NEAR, and ZEC, and is extremely bullish on the prospects of zero-knowledge proofs, intent architectures, and privacy technologies.

Even if the current popularity of NEAR Intents may only be a drop in the bucket in terms of actual revenue, it has certainly generated considerable buzz and discussion surrounding NEAR. For the NEAR ecosystem, traffic and attention are perhaps the most important resources at present.

この記事はインターネットから得たものです。 ZEC’s surge fueled NEAR’s intention layer, but why is the mainnet still struggling with growth?Recommended Articles

A quick background on the Plasma project Just yesterday, September 25th, I’m sure many of you saw the wealth-generating effect of XPL (XPL) through various consulting and social media platforms, giving its issuer, Plasma, a strong start to its TGE. If you missed out on the early rounds of XPL, don’t worry. Since its mainnet launch, Plasma has provided short-term, high-subsidized returns for various stablecoin interest-earning scenarios. I believe these scenarios offer low risk, simple operations, and very substantial returns, making them suitable for DeFi novices. Therefore, I’d like to quickly summarize some information and precautions that readers may need to consider before participating. First, let’s quickly introduce the Plasma project. In short, it’s a Layer-1 blockchain with strong investor backing, specifically designed for stablecoin payment systems. It aims to…