Listed companies follow the trend and buy cryptocurrencies. What are the potential returns and risks?

Original author: kushagra

原文翻訳: ルフィ、フォーサイトニュース

Every day we see new 暗号currency treasury strategy tools being created. This article will analyze Bitcoin’s performance as a corporate treasury strategy and key trends in crypto strategies based on private equity (PIPE).

Each region will launch its own Bitcoin strategy, but I am concerned about the right tail assets that may adopt similar strategies. Bitcoin is great as a reserve asset, but what if it is your favorite L1 or L2? It makes no sense. After all, who will be the marginal buyer of the 50th zkEVM L2? Not to mention, the tail assets have the problem of low circulation, and the paper gains seen by market participants may not be realized. So, my friends, be careful.

How it works

There are three main paths to building such a treasury tool:

-

Business transformation: Bankrupt companies turn to crypto financial services companies and execute crypto strategies (such as Solana staking);

-

Mergers and acquisitions: Merging private companies into small and medium-sized companies listed on NASDAQ/NYSE;

-

SPAC Mergers: Re-strategize business and treasury through mergers with special purpose acquisition companies (SPACs).

Regardless of the path taken, all strategies require financing through private investment in equity (PIPE) and convertible bonds. The following is a typical operation of PIPE:

-

Targeting shell companies: usually SPAC vehicles or failed small and medium-sized companies publicly traded on NASDAQ or NYSE

-

Work with the company to create reserves for Bitcoin or any other crypto asset

-

Requires investment banks to issue/structure two instruments: i) traditional PIPE and ii) convertible bonds

-

Traditional PIPE: The sale of common or preferred stock directly to accredited investors at a fixed price (usually at a discount).

-

Convertible bonds: Convertible bonds or convertible preferred stocks are issued, which investors can convert into the issuing companys common stock at their discretion within a certain period of time or if specific conditions are met. These usually provide downside protection and partially reduce upside returns.

For example, Trump Media Technology (DJT) has the following structure:

-

Raised $1.44 billion by selling nearly 56 million shares at $25.72 per share;

-

Issued $1 billion of 0% convertible senior secured notes due 2028 at a conversion price of $34.72 per share.

-

This is a hybrid structure of stock dilution and senior convertible debt, combining features of both a PIPE and a convertible bond.

Note: PIPEs are less regulated by the SEC than other offering methods, but may result in dilution of existing shareholders. These shares come with registration rights, meaning the company must file a registration statement with the SEC that allows PIPE investors to resell shares to the public after a lock-up period.

Investor Framework

You may ask, why are investors willing to participate in such issuances? The reasons can be summarized into three points:

-

Team intellectual property: The industry influence of the chairman or core team is crucial. For example, the ETH strategy launched by Joe Lubin (co-founder of Ethereum) can easily be compared to the Ethereum version of Microstrategy. After witnessing the success of MSTR (Microstrategy), investors actively participated in the ETH strategy because of Joes industry status. After all, ConsenSys has always been crucial to the development of the Ethereum ecosystem.

-

Asset quality: The choice of reserve assets is critical. It is expected that there will be a wave of tail assets (such as the top 50 tokens by market capitalization) being included in the treasury of small companies. However, these tail asset strategies are riskier because their volatility is generally higher than that of Bitcoin.

-

Crypto premium: The reason why such PIPE tools can raise large amounts of funds is not because the value of Bitcoin or Ethereum in corporate strategies has skyrocketed 3-4 times overnight, but because traditional hedge funds and crypto-native institutions have poured in due to the fear of missing out (FOMO) of the current primary/secondary market arbitrage opportunities. It is true that these strategies may achieve returns or leverage effects through staking and lending, but can this support a premium of 3 times the net asset value? I am afraid not.

Overview of corporate crypto treasury transactions in the past two months

The most controversial treasury transaction to date is the case of Trump Media. This also raises questions about strategic Bitcoin (or digital asset) reserves – how to deal with potential conflicts of interest? At least in the short term, inspired by Microstrategy (MSTR) and Metaplanet (3350.T), both private and public investors expect such financing to bring high returns in the short and medium term.

MSTR initially used Bitcoin as a store of value and inflation protection tool; todays crypto PIPEs are more actively managed and generate income through staking and lending. Private investors demand for crypto PIPEs is almost fanatical because once such transactions are announced, the stock price often rises 2-10 times at the launch.

Performance of corporate crypto treasury strategies

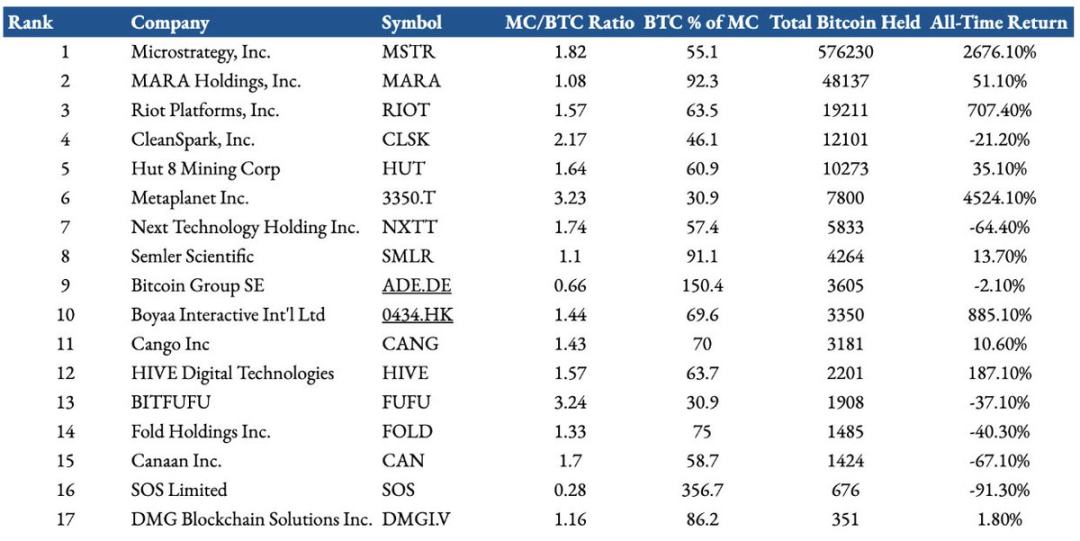

Although history cannot predict the future, there is a lot of data available for Bitcoin strategies to analyze. Below is a study of the performance of pure Bitcoin treasury strategies for companies. I studied 17 public companies:

The list includes 17 listed companies whose Bitcoin holdings account for more than 30% of the companys market value and hold more than 300 BTC.

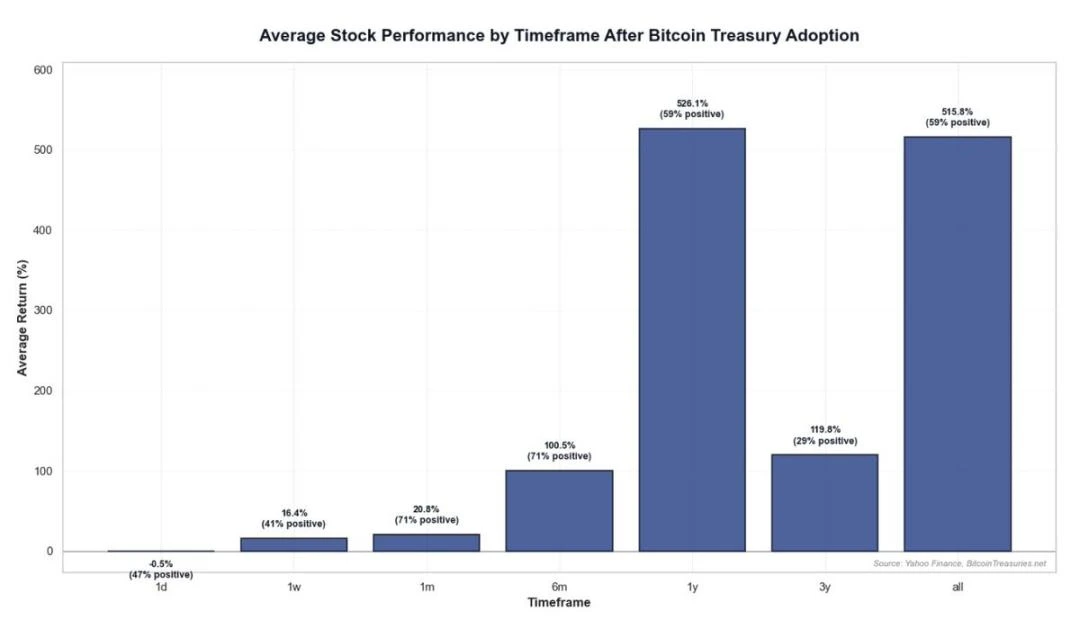

The most successful company to date with this strategy is Microstrategy, which was one of the earliest to venture into enterprise Bitcoin strategies. But as Bitcoin ETFs and new treasury strategies are launched, its Bitcoin/市場 Cap premium may gradually fade. In the short term, announcements of Bitcoin treasury strategies tend to increase the likelihood of short-term and even long-term returns. Returns vary widely, even across different time frames. However, performance declines over time:

-

1-year average return: 526% (59% of companies were profitable);

-

3-year average return: 119% (only 13.64% of companies were profitable);

-

Historical average return: 515% (59% of companies are profitable).

Note: The median return is significantly lower than the mean, indicating that extreme values have pulled up the overall average. Bitcoin outperformed most asset classes from 2020 to 2025 and was the core driver of these companies’ high returns.

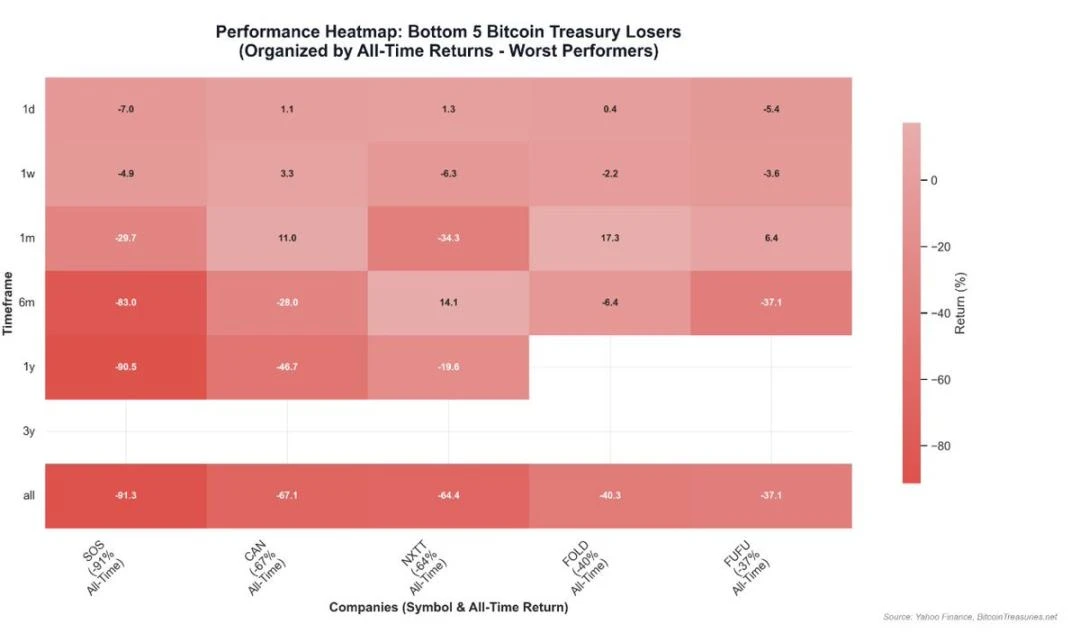

Bitcoin strategy performance heat map

-

Success stories: Companies with strong community consensus, the ability to increase Bitcoin per share and create financial engineering opportunities have performed well.

-

Failure cases: For example, SOS Limited (formerly a crypto mining company transformed into a commodity trading company) lagged behind due to difficulties in its main business and poor execution of its Bitcoin strategy. It can be seen that companies with a pure Bitcoin strategy are more recognized by the market than companies with a small allocation.

-

Risk Warning: Bitcoin-related companies may face extreme volatility and drawdowns, but when the companys net asset value (NAV) exceeds the market value, there may be opportunities for a turnaround. Note: For companies on the verge of bankruptcy, simply holding a small amount of Bitcoin on the balance sheet will not reverse the decline.

結論は

With the success of Circles IPO as a pure stablecoin company, the stock market and the crypto market are accelerating their integration. It is expected that more high-quality crypto companies will be listed in the future, and more crypto strategy tools will emerge. Given the recent market enthusiasm for crypto strategies, investors can capture opportunities through the following framework: team influence, asset quality, crypto premium sustainability, and in-depth analysis of specific projects.

However, when the strategy involves tokens outside the top 20 in market cap, great caution must be exercised. These tokens not only lack the hard asset attributes of Bitcoin, but also often lack sustained net buying demand. From a structural perspective, investors must be clear about: 1) what the underlying business strategy is that the company is implementing; 2) the capital structure of the transaction (debt, convertible bonds, PIPE); and 3) the net asset value per share.

This article is sourced from the internet: Listed companies follow the trend and buy cryptocurrencies. What are the potential returns and risks?

関連している: エアドロップ Weekly Report | Farcaster will airdrop NFTs to the first 10,000 Pro subscribers next week; Skate will open airdr

オリジナル | Odaily Planet Daily ( @OdailyChina ) 著者: Golem ( @ウェブ3_golem ) Odaily Planet Daily has reviewed the airdrop projects that can be claimed from June 2, 2025 to June 8, 2025, and also sorted out important airdrop information during this period. For detailed information, see the text. Skate Project and air investment qualification introduction Skate is a universal application layer that enables applications to run on thousands of chains with a single state. The Skate official foundation announced the opening of the SKATE token airdrop query on June 6, and users can pre-deposit their token allocation to @bitgetglobal or @kucoincom and claim it directly on June 9, but the pre-deposit window ended at 10 am (UTC) on June 7. Skate Park participants, Range Protocol/SkateFi users, Discord participants, Kaito…