AI automatically adjusts portfolios to earn 50% annualized benefits. Analysis of the latest points gameplay in the DeFAI

المؤلف | آشير ( @أشير_0210 )

Last weekend, Almanak, a project under the DeFAI sector, announced that it had completed US$8.45 million in financing. Investors included Delphi Labs, HashKey Capital, BanklessVC, NEAR Foundation, RockawayX, Matrix Partners, AppWorks, Sparkle VC and Shima Capital.

In addition, Almanak became the first cooperative project under the ACM (Attention Capital سوقs) mechanism launched by Cookie DAO ( for more information about Cookie DAO’s new ACM activity, please read: Odaily Exclusive Interview with Cookie DAO: Using the ACM Mechanism to Reward True Believers ).

Next, Odaily Planet Daily will introduce you to the Almanak project, how to earn points on the platform, the token redemption event during TGE, and how to participate in the ACM event for the launch of Cookie DAO.

مقدمة المشروع

Almanak is a DeFi platform designed to leverage financial agents to create and deploy automated financial strategies. Unlike traditional DeFi automation that adheres to static rules, Almanak is building a framework that analyzes market patterns and manages risk through AI-assisted decision-making.

Strategic problems, solved with one click by AI

In DeFi, strategies are often more challenging than capital. Writing code, building protocols, and backtesting often keep most people out. Almanak’s AI Swarm system automatically screens, tests, and deploys strategies, allowing users to enter “automatic income mode” with just a few clicks, completely eliminating the tedious process.

Keep your funds at hand, safer and more transparent

Unlike many custodial platforms, Almanak does not take control of users’ assets. Funds are always kept in personal wallets, and all transaction records are clearly traceable and publicly recorded on-chain. This allows users to enjoy the efficiency of automated strategies without worrying about the platform’s control over their funds.

Strategies can also be “assetized”

A more imaginative design would be to turn strategies themselves into tradable assets. On Almanak, strategies can be tokenized, reused by others, and even combined into more complex financial modules. In the future, they could even be traded or used as collateral. This makes strategies no longer just tools, but new financial building blocks.

Season 1 points activity is still in progress and ends on September 21

According to official documentation, Almanak points are a way to recognize and reward users for participating in the Almanak ecosystem, so TGE is or will airdrop tokens to early participants of these platforms.

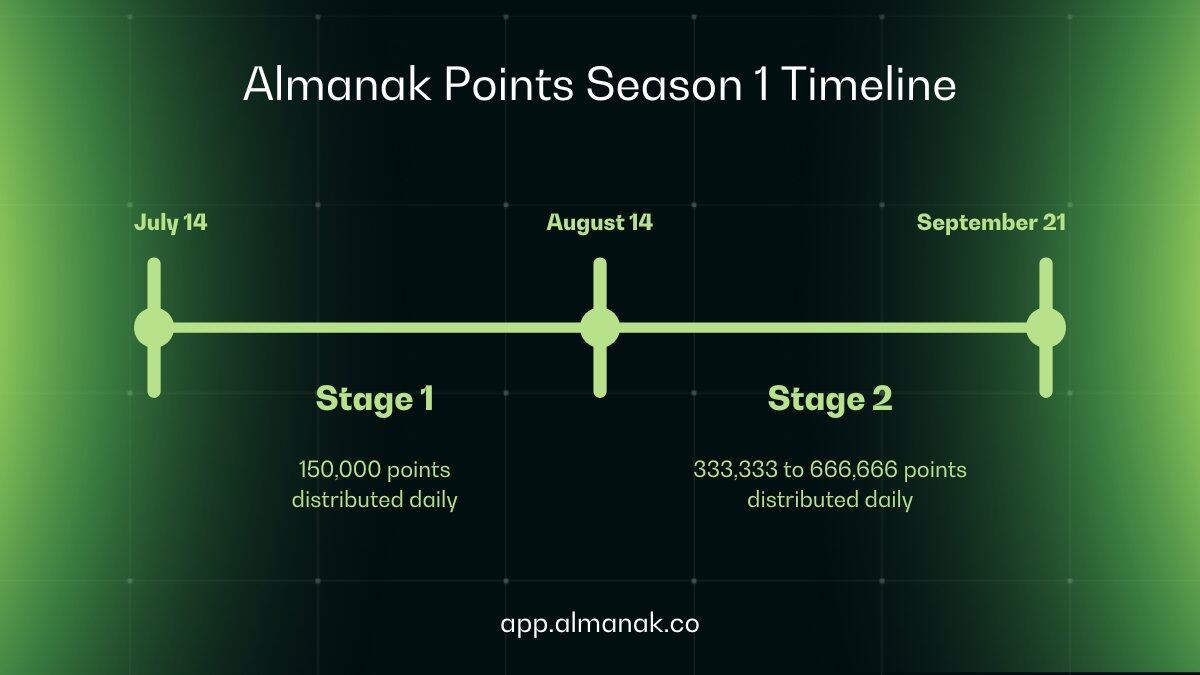

The preseason event began on January 27th and concluded on June 30th of this year, awarding a total of 1 million platform points. The first season of the event is still ongoing, with this current season starting on July 14th and running until September 21st. During the first phase of the season (July 14th to August 14th), 150,000 points will be awarded daily, while the second phase (August 14th to September 21st) will award between 333,333 and 666,666 points daily.

Season 1 Points Activities

How to earn points?

Currently, all users can earn points by depositing USDC, the Ethereum stablecoin, into the platform’s Autonomous Liquidity USD treasury (link: https://app.almanak.co/vaults ). The treasury is a tokenized AI-powered yield optimization strategy designed to achieve the best risk-adjusted returns on stablecoin investments. At its core is the Stable Rotator Agent, which scans the entire DeFi ecosystem in real time, identifying yield opportunities across different protocols and dynamically adjusting capital allocation within set risk parameters to maximize available returns.

Currently, the Autonomous Liquidity USD treasury has an annualized yield of over 50%, which includes nearly 10% of USDC stablecoin deposit income and 40% of the potential income from future conversion of points into tokens (estimated at a market value of US$90 million).

Autonomous Liquidity USD Treasury

حالياً، the TVL of Atonomous Liquidity USD treasury has exceeded 26 million US dollars.

Almanak is the first cooperative project after Cookie DAO launched the ACM mechanism

ACM (Attention Capital Markets) is a new and innovative mechanism launched by Cookie DAO, designed to closely integrate social influence with on-chain capital investment. Unlike the traditional InfoFi model, which rewards users solely for posting and engaging with the platform, ACM prioritizes users who both generate attention and provide financial support for the projects they promote.

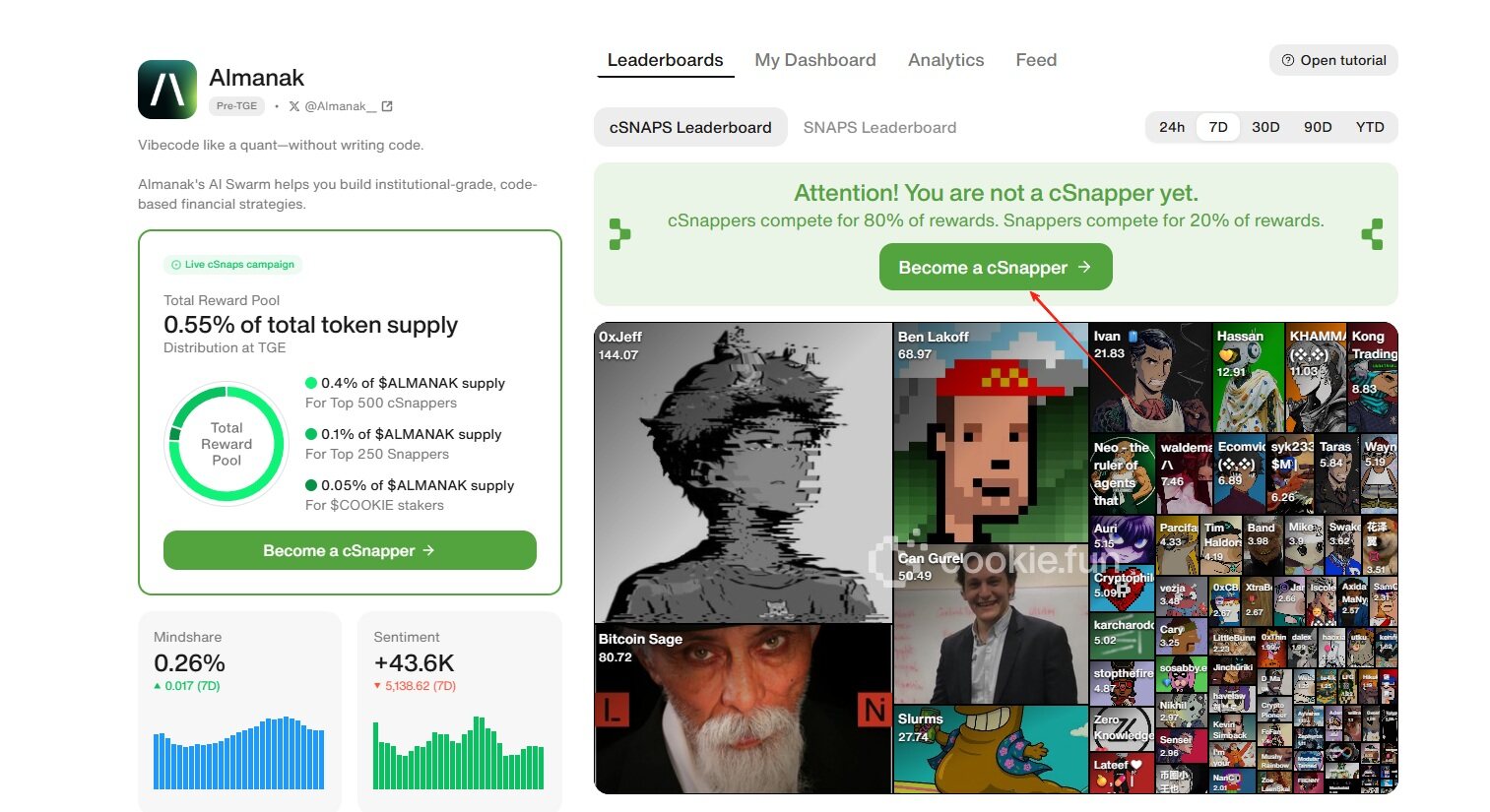

In this event, the total prize pool of 0.55% of the total supply of ALMANAK tokens will be distributed to Cookie DAO users , of which 0.4% will be distributed to the top 500 users on the cSNAPS list; 0.1% will be distributed to the top 250 users on the SNAPS list; and 0.05% will be distributed to COOKIE token stakers.

The SNAPS leaderboard interacts with the same principles as the previous Cookie Snaps project: users write project-related content on the X platform and earn points based on metrics like readership. The cSNAPS leaderboard is a new leaderboard based on the ACM mechanism. When users support Almanak with funds, the SNAPS earned from posting Almanak-related content on X will be upgraded to cSNAPS, unlocking eligibility for the cSnappers leaderboard . Users can earn cSNAPS bonuses by depositing more than $500 into Almanak’s Autonomous Liquidity USD treasury, staking COOKIE tokens, and participating in the Almanak token sale.

How to participate?

Unlike Cookie DAO’s previous Cookie Snaps, ACM activities require rebinding account information (participation link: https://www.cookie.fun/tokens/almanak ). The specific steps are as follows:

STEP 1. Enter the interactive website, log in using the X platform, and click “Become a cSnapper”.

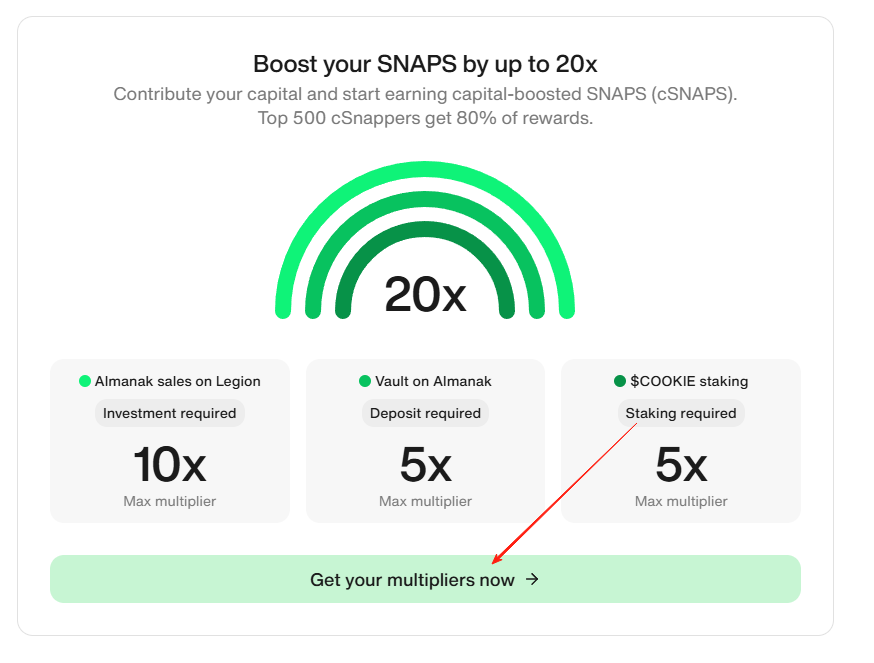

STEP 2. Click “Get your multipliers now” at the bottom of the page to get your points multiplier.

STEP 3. Ways to earn multipliers include staking COOKIE tokens, depositing USDC into Almanak’s Autonomous Liquidity USD treasury (minimum deposit: $500 USD), and participating in the community token sale (coming soon). Click “Verify your wallets” below to participate.

هذا المقال مصدره من الانترنت: AI automatically adjusts portfolios to earn 50% annualized benefits. Analysis of the latest points gameplay in the DeFAI project Almanak.Recommended Articles

Related: It’s getting strong, it seems that NFT is pushing up the price?

Original | Odaily Planet Daily ( @OdailyChina ) Author: Azuma ( @azuma_eth ) The NFT track, which has long been cold, seems to be showing some signs of warming up after a long time. CoinGecko data shows that the total market value of the NFT sector has rebounded above US$6 billion and is now reported at US$6.417 billion, up 23.2% in 24 hours; the growth in trading volume is even more exaggerated, with total trading volume of approximately US$40 million in the past 24 hours, an increase of approximately 318.3%. Among the mainstream NFT projects, CryptoPunks, Moonbirds, Pudgy Penguins and others performed particularly well. CryptoPunks is because a whale spent millions of dollars to buy 45 of them last night (the whale also bought several Chromie Squiggles). According to statistics…