$112 million breakthrough: Polymarket returns to the United States through QCX backdoor listing

Polymarket is finally coming home, said Shayne Coplan, the American founder of Polymarket, who could not hide his excitement and expressed his feelings many times on social media.

If there are any projects that have emerged from the تشفيرcurrency circle in this cycle that have subverted and changed the traditional form and have not yet issued a coin, Polymarket is تحديnitely the most important one. This prediction platform that influenced the US election recently acquired the small derivatives trading platform QCX for US$112 million. With the help of QCXs license, Polymarket can finally legally reopen services for US users.

Polymarket founder Shayne Coplan is excited about officially returning to the US market

Looking back over the past three years, Polymarkets journey in the United States has not been smooth. In 2022, due to failing to obtain a derivatives compliance license, Polymarket was sued by the CFTC and fined $1.4 million, and was forced to promise to withdraw from the US market and block US users.

The 2024 US election was also the year when Polymarket rose to fame. With its accurate prediction of Trumps victory and explosive trading volume, it became the on-chain public opinion sought after by the media. But because of this, the platform once again became the focus of investigation by the US Department of Justice (DOJ) and CFTC, and even the founder Shayne Coplans apartment in New York City was raided by federal authorities and all his laptops were confiscated. Although no charges were filed in the end, this high regulatory pressure once put Polymarket on the brink of life and death.

The situation did not turn around until 2025. With the Trump administration taking office, the crypto industry received a strong signal of policy relaxation. The U.S. Department of Justice and CFTC successively announced the official end of all investigations into Polymarket, paving the way for its return to the United States.

Polymarket founder Shayne Coplan got his phone back

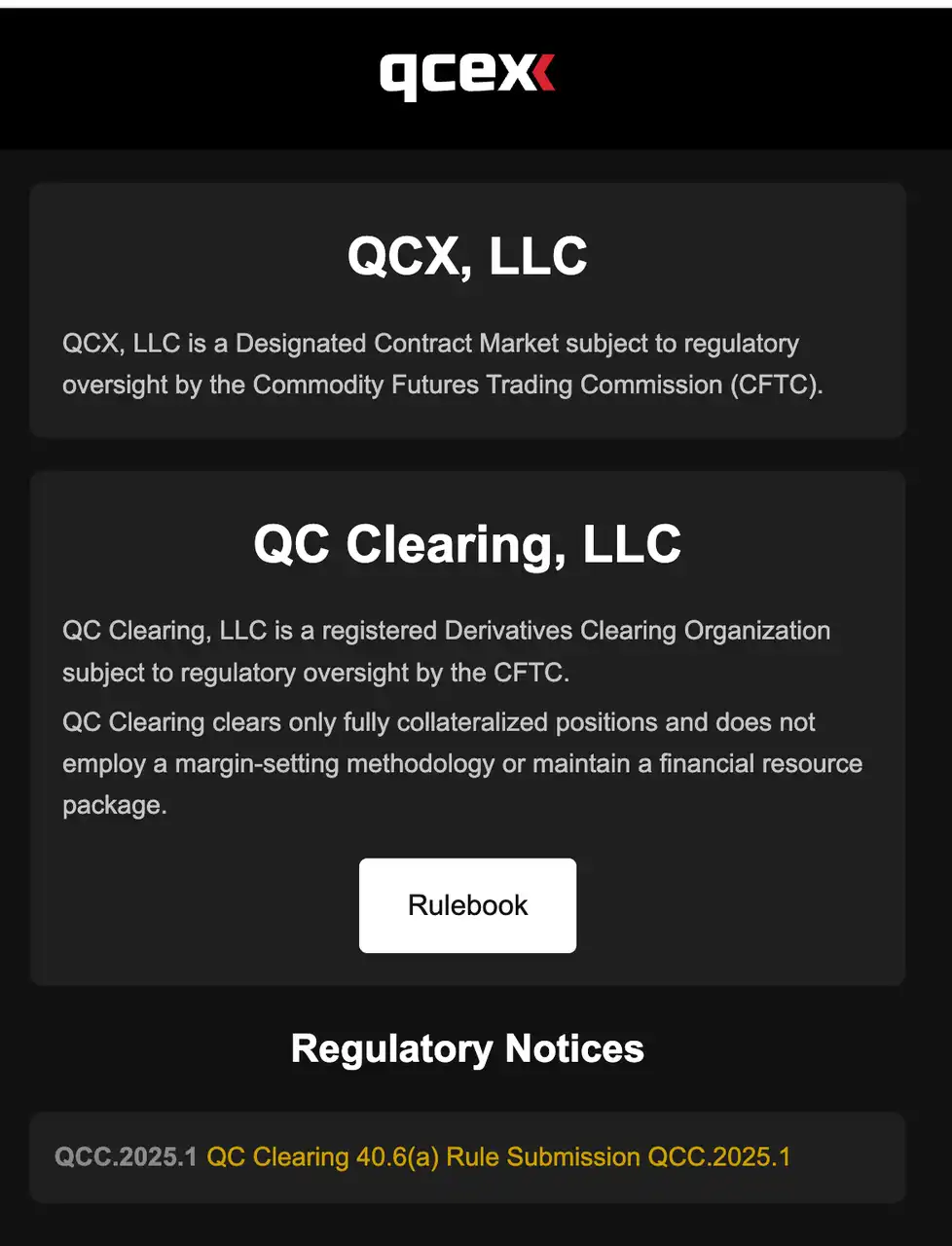

Instead of slowly building your own compliance application and waiting three to five years for approval, it is better to just buy a ready-made one. This is the most common compliance shell method in the cryptocurrency circle.

There is not much public information about QCX on the Internet, and it is little known. In the limited information, it can be found that this small derivatives trading platform began to apply for DCM (designated contract market) and DCO (clearing organization) dual licenses in 2022, and was not officially approved until July 9, 2025. This set of compliant shells can be called a scarce resource in the US digital asset industry-only platforms with DCM/DCO licenses can truly open up US dollar recharge, settlement and legal forecast contract trading channels for local US traders, brokers and large capital users.

Polymarket spent $112 million to complete the acquisition, which is almost the ultimate demonstration of trading money for time. Compared with the uncertainty of long-term self-construction + regulatory game, this move directly opens the door to the mainstream market in the United States, allowing the platform to transform from an illegal gray industry to a U.S. compliance giant overnight.

According to data from Similarweb, 25% of visitors to the Polymarket website come from the United States, followed by Canada (6.3%), the Netherlands (6%), Vietnam (5.9%), and Mexico (5%). Before the CFTC settlement, the U.S. market share was between 34% and 54%. Although Polymarket has banned U.S. users, in fact, the market demand has always been there, but the gameplay is more underground. For example, users can still use Polymarket through a virtual network. Another workaround is to use a Telegram bot based on Polymarket, which can also bypass KYC.

After purchasing QCX, Polymarket was immediately listed on the front row of the app store, and the community was extremely enthusiastic, which seemed to indicate that another round of explosion in the decentralized prediction market was about to come.

The suit scandal is not over yet, how does Polymarket plan to change its algorithm?

Unlike traditional centralized prediction platforms, Polymarket uses a decentralized settlement method. Although it has greatly improved innovation and efficiency, this settlement method also has some drawbacks, especially after the suit incident of Ukrainian President Zelensky on Polymarket this month.

The reason why the prediction of Will Zelensky appear in a suit before July is so popular is that Zelensky usually wears camouflage uniforms, and his wearing a suit would be seen as a signal event. After the actual meeting, the question of whether Zelensky wore a suit that day actually caused huge controversy.

Why? Because Zelensky was wearing a dark jacket with a shirt and tie that day, which looked formal, but not completely in line with the traditional sense of a suit, and there were discrepancies in media reports: some said he wore a suit, while others thought it was not. As a result, the two groups of users on Polymarket who bet on wearing a suit and not wearing a suit each looked for evidence, news, and argued endlessly on social media. Since the settlement of this type of market relies on the UMA optimistic oracle (i.e. community proposal + voting ruling), the final decision on the market outcome is the voting results of a group of UMA token holders.

However, the voting process of this incident caused serious disagreements – most ordinary participants believed that Zelensky was not wearing a traditional suit, but because UMAs voting rights were very concentrated, whale accounts (large accounts) held the majority of voting rights, and they voted together to conclude that Yes, Zelensky was wearing a suit. Now, users who bet on not being able to wear a suit were furious, questioning the unfairness of the ruling, and some even accused voting manipulation or bribery.

UMA officially acknowledged that such highly subjective on-chain predictions require a higher-dimensional security and multiple decision-making mechanism. رمز مميز voting and simple Schelling Points are indeed easily influenced by capital forces. As for how to make prediction market decisions more fair and effective, the Polymarket team seems to be continuously promoting upgrades.

Currently, Polymarket has launched an annualized reward of 4% for holdings in the 2028 US election, and said that it expects to launch a new reward and oracle solution system later this year.

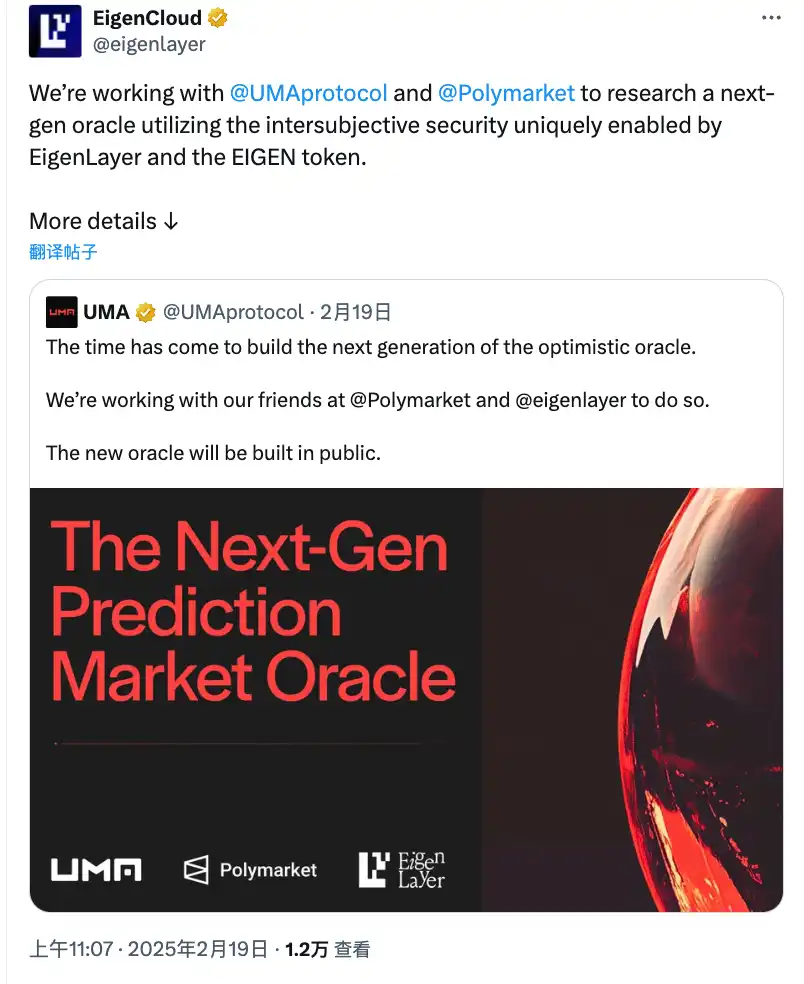

According to UMAs announcement earlier this year, UMA and Polymarket are using EigenLayer to build the next generation of prediction market oracles, we can see that UMA, Polymarket and EigenLayer are studying further methods to identify bribes as inter-subjective truth. This will enable the next generation of oracles to handle more subjective prediction market parsing tasks while also benefiting from the additional inter-subject security brought by EigenLayer and EIGEN tokens to prevent bribery.

UMA Oracle (Optimistic Oracle) is one of the few solutions in the industry that can handle complex issues and disputes. Its mechanism is: first someone (or AI) gives an answer, then it is open to the community and people holding UMA tokens to vote. If anyone has doubts, they can raise objections and enter arbitration.

The arbitration process uses a Schelling Point theory to allow voters to spontaneously choose the answer that is most likely to be the answer that the majority thinks is right in order to maximize their interests. UMAs optimistic oracle has a high advantage in efficiency, but the disadvantage of bribery attack is also very obvious. For example, some big players privately bribe voters to make false decisions together. This is also a point that Polymarket has been criticized for a long time.

From the article, we can see several directions:

The first is Dynamic Bonding and Variable Challenge Periods. As the name implies, it means that we will no longer set a one-size-fits-all deposit amount and dispute handling standard for all markets, but will flexibly adjust it according to the actual activity, risk and betting amount of each market. For example, in a market with high controversy, great impact and high betting amount such as election results, we will give everyone enough time to investigate and appeal. Higher deposits and longer arbitration periods prevent malicious operations. For small markets such as will it rain tomorrow or the price of Bitcoin, the deposit and arbitration time can be lower, more efficient, and the cycle can be compressed or even automatically settled.

Not only that, with the development of AI technology, Polymarket is also actively trying to let AI robots participate in the decision-making process. AI can quickly and automatically capture multiple information such as mainstream media, news, pictures, etc., make preliminary judgments on the facts or assist in collating evidence, and help community members reduce a lot of repetitive verification work. At the same time, AI can also monitor potential abnormal voting behaviors or data fluctuations, issue early warnings, and assist humans in making more rational and scientific judgments. Although AI does not directly determine market results at present, its assisted decision-making ability has quietly changed the decision-making process and promoted the entire prediction market to evolve in a more efficient and intelligent direction.

Preventing big players from bribing and manipulating results is another thorny issue in decentralized governance. In the past, if whale players bribed voters to commit fraud collectively, it was entirely possible to hijack market fairness. To this end, Polymarket introduced the re-staking mechanism of EigenLayer, a new Ethereum ecosystem project. Simply put, any voter who wants to participate in the resolution must take out mainstream assets such as ETH as a deposit and agree that if they are found to have committed evil or conspired to cheat, these deposits will be directly confiscated. Through this high economic cost, the system has greatly increased the threshold for cheating, making it difficult for attackers to launch a manipulation at a huge cost, and ordinary users have gained a sense of security and trust. EigenLayer is also studying the so-called subjective security, that is, through more dimensional community participation and multiple deposit assets, even highly controversial or subjective market issues can better converge to the greatest common divisor on-chain truth.

In short, it is difficult to hijack the entire prediction result by holding only one token, UMA. In the future, Polymarket may introduce other coins such as ETH that are more difficult to be manipulated by large investors as a synthetic asset. Many netizens here speculate that there may be Polymarket鈥檚 own community coin.

This also leads to a discussion about Polymarket鈥檚 next capital route: issuing coins, or going public through an IPO?

Is issuing coins a better way out?

Why not just issue coins as incentives? This voice is actually very typical. Some people think that after going through synthetic assets, oracle profit sharing, and staking, they cant get around the most direct coin issuance-airdrop-incentive. Why not lay out the cards from the beginning? However, from the perspective of governance and security, there are still many people who value the value of new mechanisms. For example, through mechanism design, the influence of a single large household can be dispersed, and the platforms native currency and external tokens (such as UMA, ETH) can be involved in the decision-making and staking. The multi-currency structure is written into the underlying rules, so that every market and every participant can have a sense of belonging and voice. Doing so is both a security redundancy and a guarantee of community vitality.

If Polymarket really chooses to issue coins, the changes it brings are actually more than just economic. First of all, the mechanism itself is much more flexible than single-chain governance, supporting different markets to vote and arbitrate with different currencies. The community can adjust the voting weights and thresholds, making the diversity in the Web3 scenario an advantage. Secondly, issuing coins can directly drive community consensus, stimulate more real users to be active, contribute content, and participate in governance, and roll up DAO and on-chain gamification operations together to form a self-reinforcing positive feedback flywheel. The dividends of the capital market are naturally indispensable. Whether it is users, LPs, market makers or developers, they are willing to hold coins to participate, promote liquidity, and make the ecosystem stronger and stronger.

More importantly, after issuing the token, Polymarket can seamlessly connect infrastructure such as DeFi, liquidity pools, and cross-chain protocols, and can easily embed various new ways of playing in Web3 native finance, such as staking, lending, synthetic assets, and even multi-chain governance. This means that on-chain is the global market, and there is no need to worry about which countrys securities laws are holding it back. Community autonomy, distributed governance, and financial innovation can all run at the same time. A more flexible incentive and profit-sharing model can also directly return platform revenue to token holders, which can not only mobilize governance enthusiasm, but also attract long-term capital for the protocol.

But from another perspective, if Polymarket takes the IPO route, the benefits are actually not small. The biggest advantage is naturally legality and compliance. It can obtain the pass of major financial markets such as the United States and Europe, attracting mainstream institutions and large funds to enter the market, and the endorsement and credit rating will also rise. Cooperating with banks, securities companies, and leading trading platforms will no longer be restricted by identity, and can even directly enter the main battlefield of traditional financial traffic. The financing stability brought by listing should not be underestimated. The money raised through IPO does not have to worry about the collapse of currency prices and fluctuations in market sentiment affecting the survival of the platform. In addition, the value of equity has always been relatively stable in the minds of mainstream investors, and the risk of bubble is much smaller than that of the currency circle.

The advantages of listed companies governance are also outstanding. The board of directors, accountability system, and professional senior management team, which are standard features in the traditional financial world, are all plus points for long-term strategy, risk control, and team upgrades. Not to mention that tax policies and regulatory rules are clearer and more transparent, and expansion to all parts of the world can be compliant and follow rules, truly minimizing the risk of black swans.

Of course, the cost of going public is also clearly visible. The first is a significant decline in the speed of innovation and the flexibility of the mechanism. All the companys product innovations, protocol upgrades, and incentive model adjustments, even if it is just a small change, must go through a long legal and compliance process. Compared with the DAO decision-making on the chain, the speed is much slower. Many new ways of playing in DeFi, DAO, and even on-chain governance and multi-currency voting will be stuck in compliance review as soon as they are introduced, and the sensitivity of the market will gradually decrease. The more realistic problem is that after the listing, the sense of co-construction between Polymarket and the Web3 community will be diluted. Under the traditional listing model, it is difficult for users to participate in protocol profit sharing and daily governance like holding coins, and the vitality and self-organization power of the community are also easily weakened. For emerging community users who like the fast pace, strong interaction, and co-creation atmosphere on the chain, traditional listing is actually not attractive enough, and the market penetration speed may not be faster than that of pure Web3 projects.

However, we can also imagine that after the crypto circle gradually becomes a mainstream in the financial market, the dual hybrid route such as Token+IPO may also be realized on Polymarket.

This article is sourced from the internet: $112 million breakthrough: Polymarket returns to the United States through QCX backdoor listing

Related: SignalPlus Macro Analysis Special Edition: Escalate to De-Escalate?

Geopolitical tensions escalated further over the weekend when U.S. bombers launched swift and precise strikes on three deep-seated nuclear facilities in Iran. The U.S. reported extensive damage to the facilities, but has yet to officially confirm whether the nuclear material had been destroyed or evacuated in advance. The market instinctively sold risky assets, and cryptocurrencies, as the only asset class that continued to trade on weekends, were naturally the first to be hit. When the attack began, BTC fell about 4% from over 102k to around 99k. It should be noted that in the eyes of traditional financial investors, cryptocurrencies continue to be regarded as cutting-edge/high-risk assets. The market had originally worried about a sharp risk reaction at the start of Mondays trading due to the escalation, but such concerns…