One-week token unlock: KAITO unlocks nearly 3% of the circulating supply

Kaito

Project Twitter: https://x.com/KaitoAI

Project official website: https://www.kaito.ai/

Number of tokens unlocked this time: 127 million

Unlocked amount: approximately US$14.9 million

Kaito is an AI-powered Web3 information platform designed to address the fragmented nature of information in the crypto industry. By aggregating data from social media, governance forums, and other sources, Kaito leverages AI technology to provide real-time search, sentiment analysis, and trend tracking.

The specific release curve is as follows:

Plasma

Project Twitter: https://x.com/Plasma

Project official website: https://www.plasma.to/

Number of unlocked tokens this time: 15.61 million

Unlocked amount this time: approximately US$5.93 million

Plasma is a Layer 1 blockchain purpose-built for global stablecoin payments. It combines high throughput, native stablecoin functionality, and full EVM compatibility, providing the infrastructure for developers to build the next generation of payments and financial applications. It also supports customizable gas tokens, zero-fee USDT transfers, and private payments.

The specific release curve is as follows:

Soon

Project Twitter: https://x.com/soon_svm

Project official website: https://www.soo.network/

Number of unlocked tokens this time: 95.99 million

Unlocked amount this time: approximately US$30.91 million

SOON is a rollup stack based on the Solana Virtual Machine (SVM), focusing on high-performance blockchain solutions. Compared to traditional public chains, SOON is committed to providing more efficient and lower-cost infrastructure to support the large-scale implementation of Web3 applications.

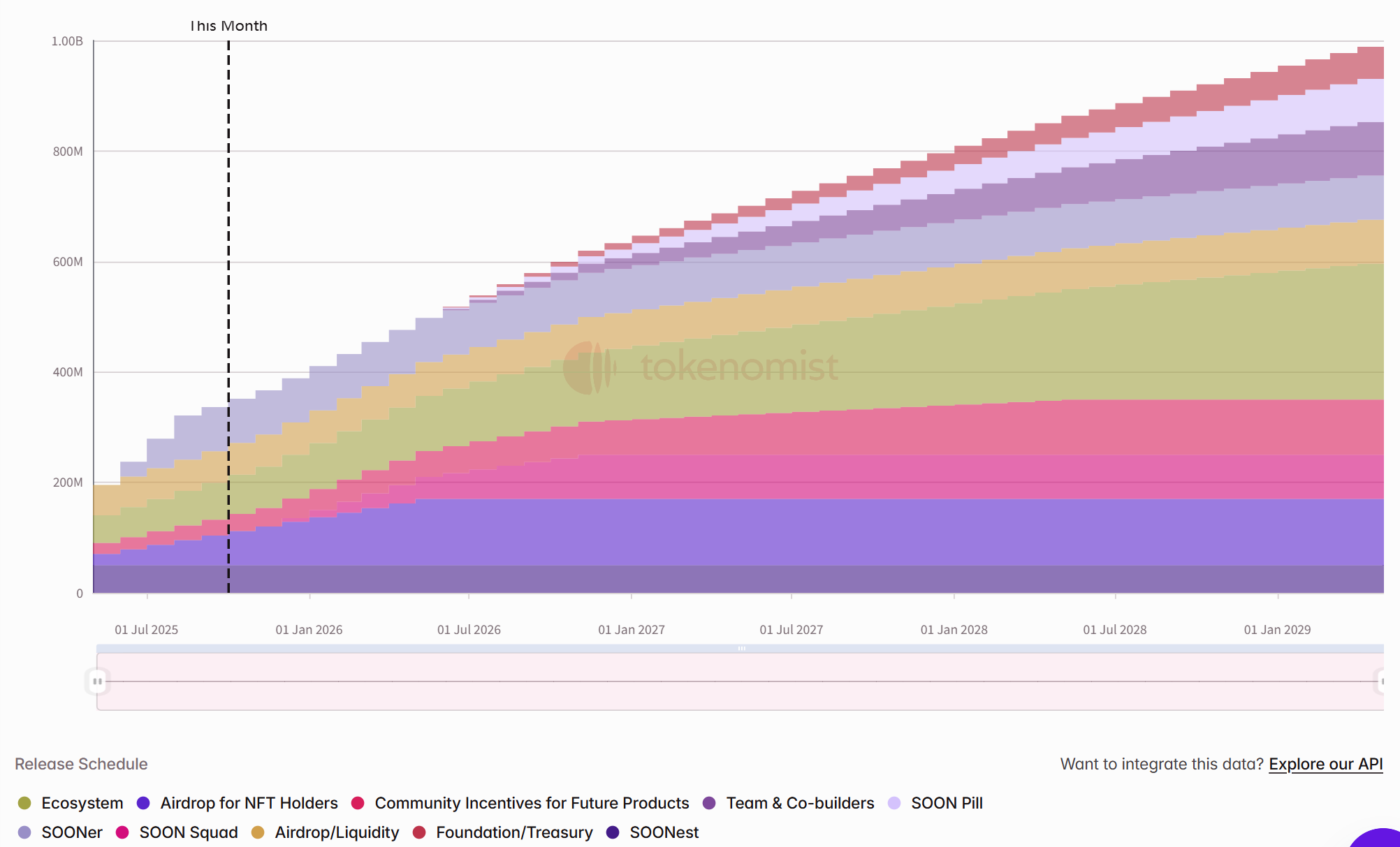

The specific release curve is as follows:

This article is sourced from the internet: One-week token unlock: KAITO unlocks nearly 3% of the circulating supplyRecommended Articles

Related: Fidelity Ethereum Report: Three Future DestiniesRecommended Articles

Original translation: Aki Wu talks about blockchain This article does not constitute any investment advice. Readers are advised to strictly abide by local laws and regulations and not participate in illegal financial activities. Fidelity’s latest Ethereum report provides a detailed analysis of Ethereum’s current status, strengths, weaknesses, technical roadmap, governance structure, fundamentals, and market competition. Based on this analysis, it also deduces the competitive risks Ethereum faces under different scenarios. The report points out that Ethereum, as a pioneering decentralized smart contract platform, possesses significant network effects and reliability. Its smart contracts and decentralized nature provide high transparency and censorship resistance. However, Ethereum’s modular scaling path and proof-of-stake mechanism sacrifice some value capture at Layer 1 and present technical, regulatory, and governance risks. Investors should continue to monitor Ethereum’s technological…