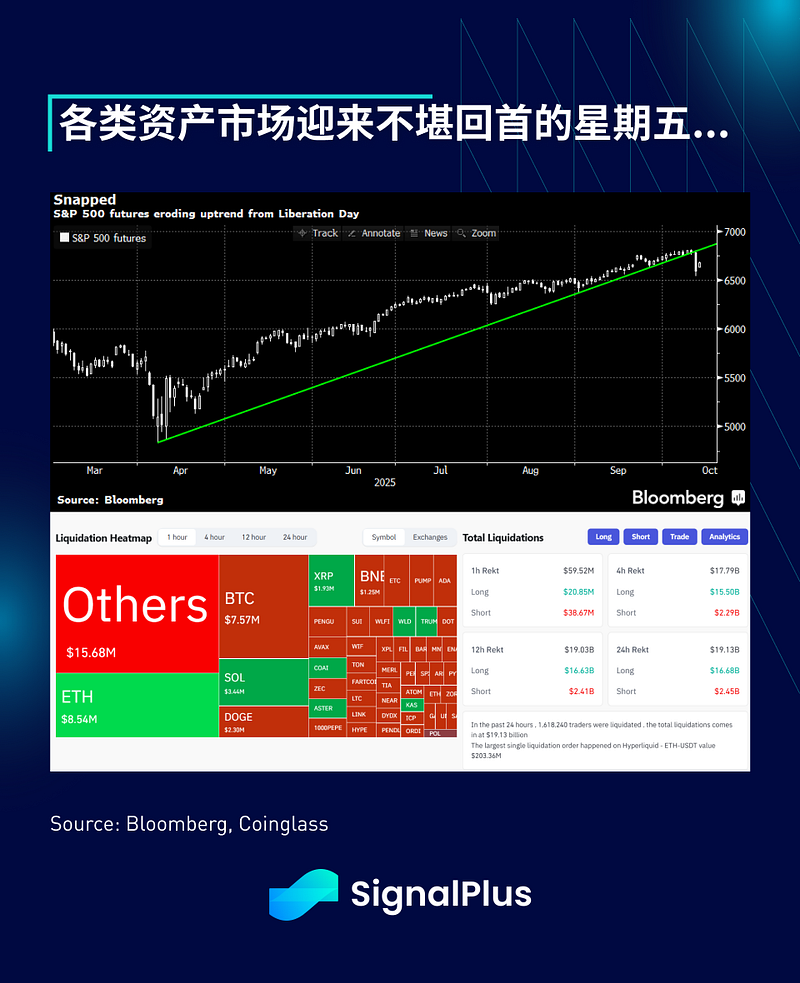

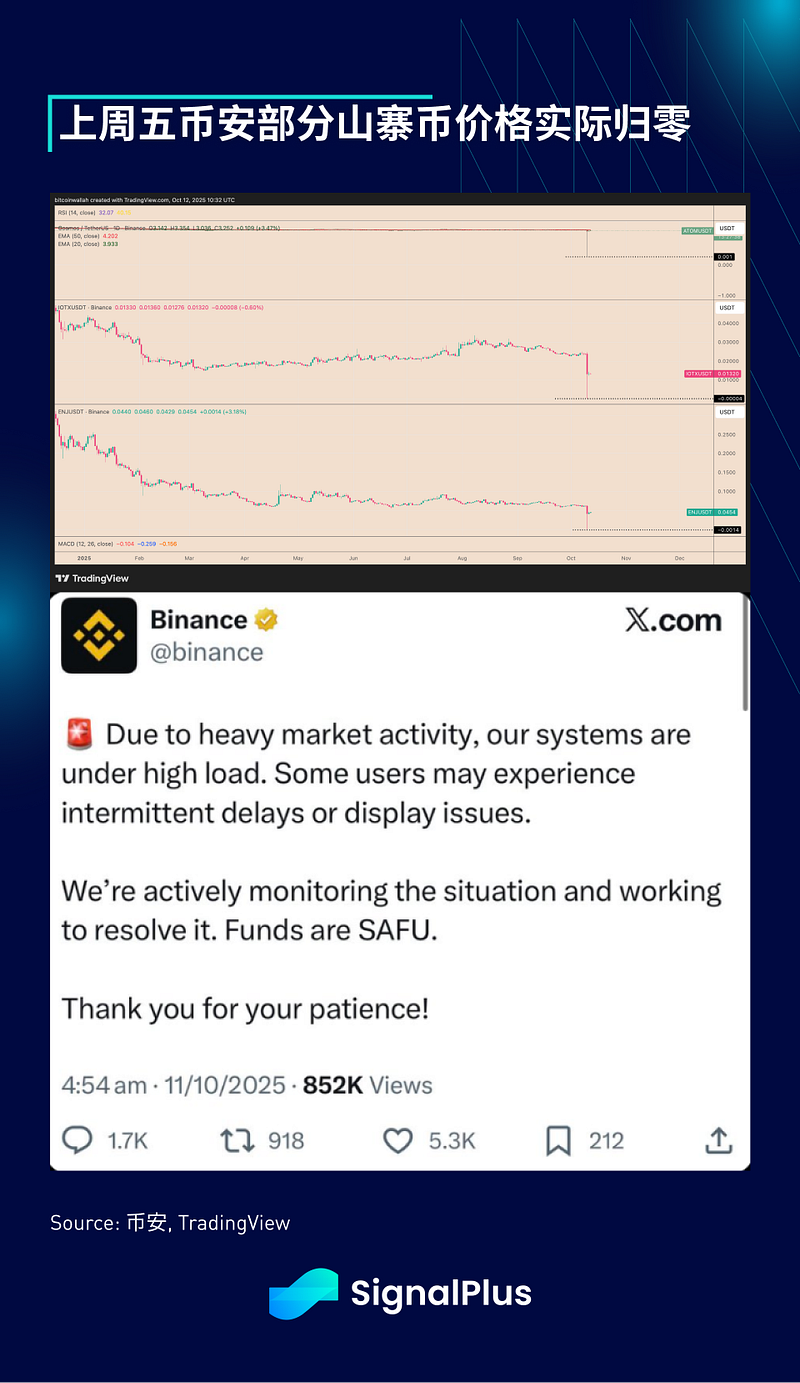

It was the worst day of liquidation since the FTX debacle… centralized exchanges’ automated deleveraging algorithms wiped out $19 billion (or far more) in profits and losses, while market makers retreated, driving altcoin prices to near zero… The brutal Friday close for crypto traders and macro investors needs no elaboration.

The Sino-US trade truce has come to an abrupt end. President Trump’s fiery response to China’s latest export control measures has shaken the market. The unprecedented complexity and comprehensiveness of these measures have shaken the market. Coinciding with the long weekend in the US and Japan, the market experienced a flash crash before the close of Friday, causing the Nasdaq to drop 4% in a single day and sending numerous altcoins plummeting to zero.

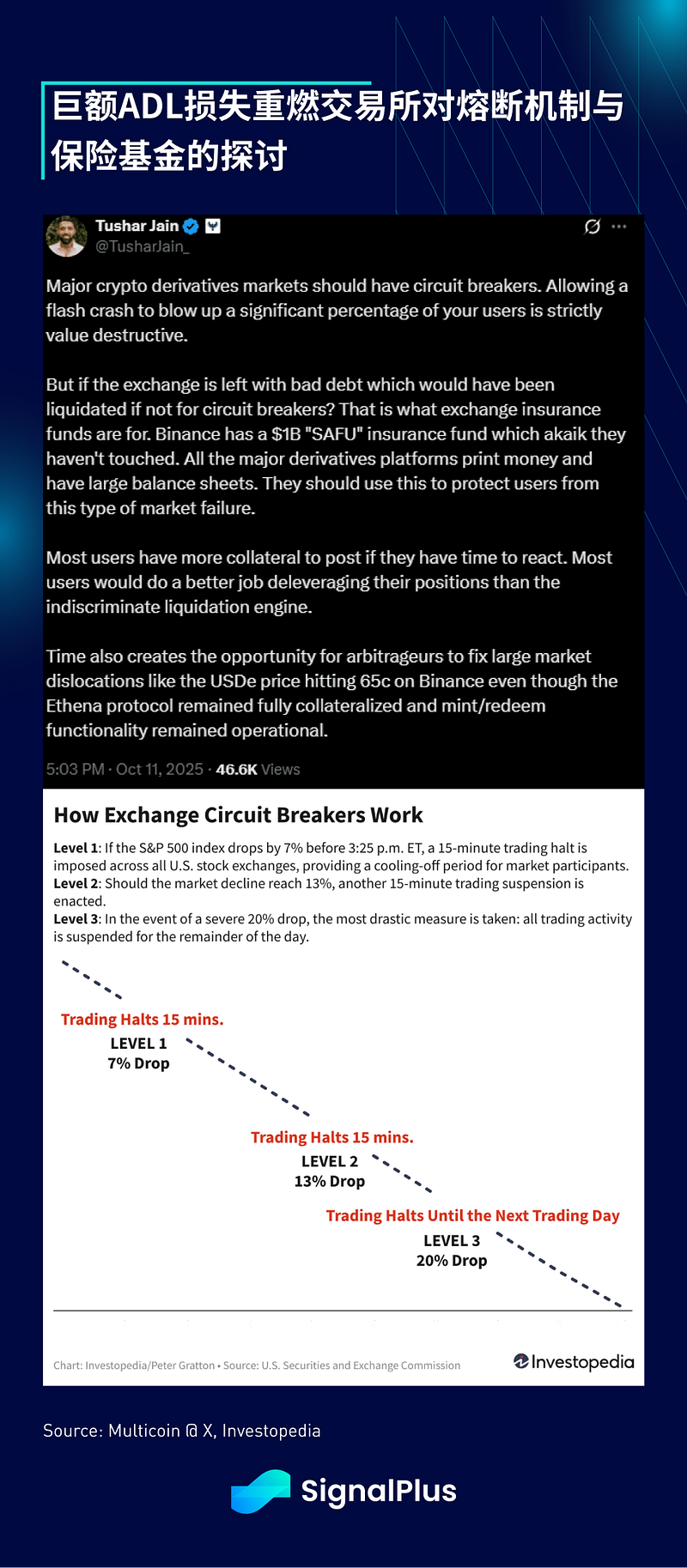

This crisis has given the cryptocurrency community a deep understanding of the ADL mechanism (automatic deleveraging), commonly known as the margin maintenance system in traditional finance. While theoretically sound, automatic stop-losses are ineffective in gapping markets characterized by dwindling liquidity. When a vacuum forms in the order book, prices plummet to zero. Traders often overlook the fact that in a one-way market, market makers disappear en masse, effectively negating the price discovery mechanism. In such situations, the automatic deleveraging system simply executes liquidations, forcing positions to close regardless of the buy price, creating a “reflexive spiral” of accelerating price declines.

To make matters worse, the surge in data processing volume overloaded exchange systems, further disrupting automated liquidation mechanisms through delayed data transmission and order congestion. This devastation affected not only major centralized exchanges but also decentralized exchanges—Hyperliquid led the liquidation list, with $10 billion in liquidated value lost on-chain within 24 hours. Liquidity black holes don’t care whether your assets are stored on-chain or off-chain.

Traditional finance can mitigate such crises through circuit breakers, shifting some of the losses to exchanges. This requires establishing a reserve/insurance fund similar to the Federal Deposit Insurance Corporation. However, this move would increase trading costs on centralized exchanges, leading to a reduction in leverage (one reason why cryptocurrency exchanges offer higher leverage than CME Group). It also undermines the 24/7 continuous trading nature cherished by the crypto market. As with everything, there are trade-offs. We expect this margin call incident to trigger a re-evaluation of infrastructure development within the industry if the cryptocurrency market is to continue its institutionalization.

Looking ahead, Monday’s technical rebound was driven by the lack of further escalation between the US and China, coupled with the long weekend effect in the US and Japanese markets. While the prevailing view is that the recent dispute is merely a bargaining chip ahead of the Trump-Xi meeting (currently in doubt), we believe this has accelerated the macro decoupling theme. The upgraded rare earth ban is far from an ordinary provocation, highlighting the waning effectiveness of US tariff retaliation.

The short-term consensus is that both sides will de-escalate the situation (signs of which were already evident over the weekend), potentially allowing asset prices to respite. However, given the deep damage to profit and loss structures during this round, and the fact that many native investors were left out by the Bitcoin-led market this year, we remain cautious about whether altcoins can achieve a meaningful rebound.

With the US government shutdown still ongoing and economic data releases entering a semi-halted period, we expect continued market volatility this week, with views subject to sudden shifts. As systematic traders and momentum funds remain heavily invested in the market, caution should be exercised against the potential for institutional sell-offs triggered by rising implied volatility. Of course, a sudden tweet or statement from either government could instantly reverse the situation, so it is recommended to minimize risk exposure in the coming days. Take care, everyone.

You can use the SignalPlus Trading Vane feature for free at https://t.signalplus.com/crypto-news/all , which integrates market information through AI to clearly understand market sentiment.

If you want to receive our updates in real time, please follow our Twitter account @SignalPlusCN, or join our WeChat group (add the assistant WeChat: Logicrw), Telegram group and Discord community to communicate and interact with more friends.

SignalPlus Official Website: https://www.signalplus.com

This article is sourced from the internet: SignalPlus Macro Analysis Special Edition: Margin CallRecommended Articles

Related: Hyperliquid Stablecoin is about to be hammered: Why did the new team Native Markets acquire USDH?

Recently, Hyperliquid, a decentralized derivatives trading platform, has been the scene of a highly anticipated stablecoin battle. On September 5th, the official announcement of the upcoming ticker auction for its native stablecoin, USDH, instantly ignited the market. Numerous institutions, including Paxos, Ethena, Frax, Agora, and Native Markets, submitted proposals to compete for the right to issue USDH. As a leading player in the popular perp DEX market, Hyperliquid has become a strategic opportunity that institutions must enter, even if it “doesn’t make money.” Currently, Native Markets leads with a 97% lead, virtually securing victory. Native Markets’ Strategy Native Markets’ concept is for USDH reserves to be jointly managed by BlackRock (off-chain) and Superstate (on-chain), ensuring both regulatory compliance and issuer neutrality. Its mechanism is unique: interest earned on the reserves…