Crypto October 2025 Guide: Easily Understand Market TrendsRecommended Articles

TL;DR

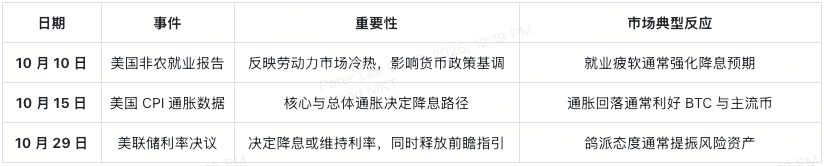

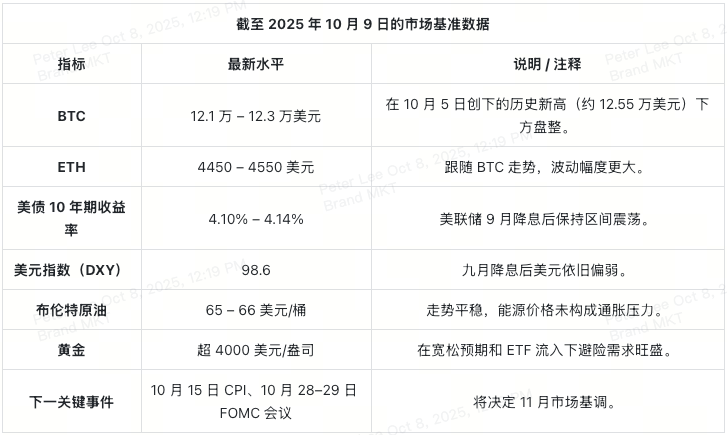

- The most important macroeconomic events this month are the US CPI inflation data on October 15 and the Federal Reserve meeting on October 28-29 , both of which will determine the direction of liquidity and sentiment in global markets.

- Bitcoin is currently fluctuating between $121,000 and $123,000 , just below its all-time high in early October, while Ethereum is stable at around $4,500 . Both remain highly sensitive to inflation data and signals from the Federal Reserve.

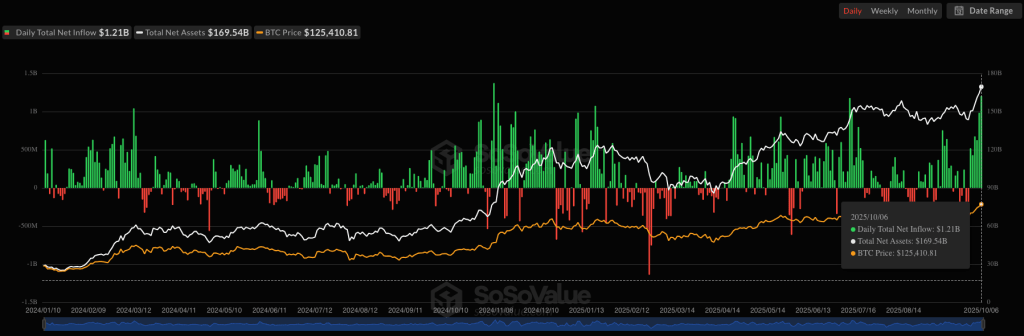

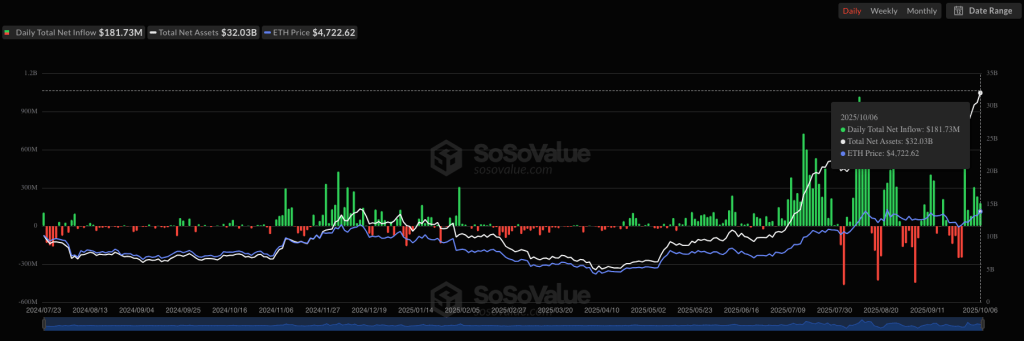

- ETF fund flows are the most intuitive indicator of institutional demand. Early October saw record net inflows of approximately $5.9 billion , demonstrating continued strong market interest in BTC and ETH.

- Projects such as Linea, Aptos, Aethir, BounceBit, Starknet, and Babylon will be releasing tokens this month, potentially creating short-term supply pressure. Knowing the specific release dates ahead of time can help you mitigate volatility risks.

- Control your positions, set stop-loss orders, avoid using high leverage before the data is released, and prioritize high-liquidity trading pairs such as BTC and ETH , so that you can calmly deal with “Uptober”.

Table of contents

1) October Market Outlook: Key Dates to Watch

2) Fund flow signals: ETF, contract funding rates, and position changes

3) Crypto Market Catalysts at a Glance: Token Unlocks, TGEs, and Hot Rising Stars

4) Three market trends and response strategies for October

5) Your October Playbook: Operations, Reminders, and Execution

1) October Market Outlook: Key Dates to Watch

You don’t need to pay attention to all economic data, just focus on the key indicators that can influence interest rate trends . This is because interest rates determine the risk appetite of funds, which often directly affects the sentiment and trends of the crypto market.

Inflation data (CPI) : If inflation cools, central banks will have more room to ease policy. Mild inflation is generally bullish for risky assets, including Bitcoin and Ethereum.

Employment data : If hiring slows or unemployment rises, the market will anticipate lower interest rates. This type of data typically benefits bonds first, followed by stocks and crypto assets.

– Central bank decisions and speeches : Dovish signals can lead to lower real yields and a weaker dollar, which is generally positive for the crypto market. Conversely, hawkish comments can be depressing.

– Earnings season and volatility events : When corporate earnings are stable and market volatility is low, investors are more willing to take risks, which is when altcoins are active.

Keep your schedule simple and just write down these important dates in your phone reminders.

Two small rules

Two small rules

1. The 30-60 minutes after data release is usually the most volatile time window, so please be extra cautious.

2. Set these dates as reminders on your TradingView charts . Having reminders will help you stay on track and make it easier to follow your plans.

2) Fund flow signals: ETF, contract funding rates, and position changes

Think of the flow of funds into spot ETFs as a pipeline for market demand. Inflows into Bitcoin or Ethereum spot ETFs represent new buying; outflows signal short-term pressure. Instead of staring at a pile of charts, just 15 seconds a day is enough.

How to interpret fund flows

– Price increase + net capital inflow : a healthy trend, indicating active buying and trend support.

– Price increase + net capital outflow : Be vigilant, as this may be due to a lack of price growth and a decrease in buying.

– Large single-day subscriptions or redemptions : These can impact market sentiment in the short term, and will be reflected in prices within a day or two. Keep a brief note of these and monitor the price reaction.

Reference indicators: Bitcoin spot ETF net inflows and Ethereum spot ETF net inflows (Source: SoSoValue)

Funding Rate and Futures Basis

– A positive funding rate indicates that longs are paying shorts to maintain their positions, indicating a bullish market. However, if the market stagnates, longs may be squeezed out.

– Rising quarterly contract basis : This indicates strong bullish market sentiment and the participation of profit-taking. A moderate increase in basis is healthy, but an excessive increase can attract arbitrage funds and suppress prices.

Reference Indicator: Crypto Contract Funding Rate (Source: XT.com)

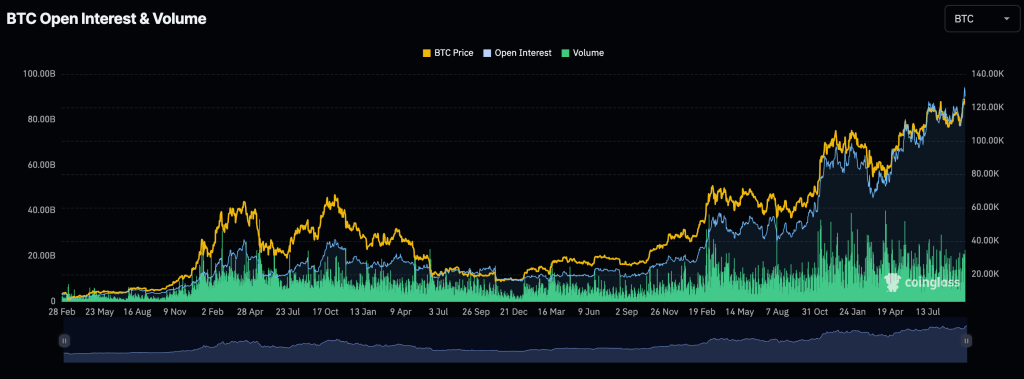

Quick judgment of open interest

– OI rises as prices rise : This indicates that new funds are driving the trend, which is a normal characteristic of a rising market.

– OI rises but price moves sideways : This suggests the market is preparing for a breakout, but the direction is uncertain. However, once a breakthrough occurs, the volatility will be amplified.

Reference indicators: BTC and ETH open interest and trading volume (Source: Coinglass)

15-Second Daily Routine

1. Check ETF fund flows once a day.

2. Quickly browse the funding rates of major currency pairs.

3. If you are involved in a contract, take a look at the open interest .

4. Write a sentence in your notes, such as: “Money is flowing in, prices are rising, the trend is healthy.” or “Money is flowing out, prices are sideways, remain cautious.”

Sticking to these few actions every day is more effective than watching the market all day.

3) Crypto Market Catalysts at a Glance: Token Unlocks, TGEs, and Hot Rising Stars

When locked tokens begin to unlock, the circulating supply in the market increases, which in turn creates selling pressure. However, not all unlocking is cause for concern.

A. Token Unlocks — Just look at two numbers

Newbies only need to focus on two core indicators:

1. Unlocked Amount (USD) — Regardless of the unlocked amount , a $50 million unlock will have a greater market impact than a $1 million unlock.

2. Unlocked shares as a percentage of the total supply – If only half of the supply is in circulation and 5% is released at once, the pressure will be much greater than if “5% of the total supply” is released.

Another thing to figure out is: Who gets these tokens?

- The shares obtained by the team and early investors tend to be sold faster.

- For community or ecological incentive distribution, the selling pressure will be smoother because the holders are dispersed.

Major unlocking events worth noting this month:

- Linea (LINEA) : Approximately 1.08 billion tokens (approximately $29 million, accounting for approximately 6–7% of the circulating supply) were unlocked on October 10.

- Aptos (APT) : Approximately 11.31 million tokens (approximately US$59 million) were unlocked on October 11 and distributed to the team, investors and community.

- Aethir (ATH) : 1.26 billion (approximately over 70 million US dollars) were unlocked on October 12, which is a large amount of cliff unlocking.

- BounceBit (BB) : 44.7 million tokens (approximately US$8-10 million) were unlocked on October 12. The volume is relatively small, but it is still worth noting because it is listed on an exchange.

- Starknet (STRK) : 127 million tokens (approximately US$20 million) were unlocked on October 15, which is a monthly linear release.

- Babylon (BABY) : Unlocked 321 million tokens , accounting for about 24.7% of the released amount. This is a large scale and requires caution.

Reference source: October token unlock (Source: Tokenomist)

B. New Products and TGEs (Token Generation Events) — Catalysts for Self-Driven Momentum

New project launches or TGEs often attract significant initial attention if they offer real products, exchange support, or ecosystem endorsements. However, this hype fades quickly.

Focus on the following four key points:

1. Initial circulation ratio – Projects with too small a circulation ratio are prone to being hyped up and then falling back.

2. Unlocking and vesting rhythm – Large cliff unlocking may cause selling pressure in the later stage.

3. Listing Platform — First-tier exchanges (with deep liquidity) are better than smaller platforms.

4. Project narrative and implementation — Projects with real use cases or partners are more likely to see sustainable growth.

This month’s highlight projects:

– Meteora (MET) : A TGE will be held on Solana on October 23rd, initially unlocking approximately 48% of the circulating tokens, with the remainder to be released linearly over the next 6 years .

Go to: Meteora (MET) Official X Channel

C. Rising Stars — Look for popularity, but also set up safeguards

These projects have seen an increase in trading volume or narrative heat, so you can put them on your watchlist, but don’t blindly chase them.

5 “Guardrail Questions” Before Operation:

5 “Guardrail Questions” Before Operation:

1. What is the catalyst? (Launch, update, collaboration, news?)

2. Does trading volume appear consistently across multiple major exchanges?

3. How thick is the 1% depth of the main trading pairs?

4. Will there be any large unlocks in the next 7–21 days?

5. Have you set a stop-loss or exit plan?

4) Three market trends and response strategies for October

You don’t need a crystal ball, just a simple ” if this, then that ” framework. Below are three possible scenarios commonly used by traders and the actions a novice trader can take in each case.

October Market Scenario Matrix

Risk Response Gadget

Here are some potential landmines to watch out for in October:

– If the CPI on October 15 is higher than expected , it may trigger market panic.

– If oil prices suddenly break through $70 per barrel , inflation expectations will be reignited.

– If ETFs experience consecutive net outflows after record inflows ($5.9 billion in the week ending October 4) , it indicates that institutional sentiment is cooling.

– Major protocols experiencing hacker attacks or large-scale token unlocking may trigger short-term selling pressure.

– Geopolitical shocks (such as war or escalating sanctions) could push up energy prices and exacerbate liquidity risks.

One-Minute Response Plan

– If data continues to weaken: Buy on dips in batches, maintaining a core position in BTC/ETH.

– If inflation unexpectedly strengthens: Reduce leverage and only trade highly liquid assets like BTC/ETH.

– If the Fed turns more dovish: Hold positions with the trend, but take profits in batches during sharp rises.

Let these rules replace your guesswork. The market moves quickly, and a clear plan is your best advantage .

5) Your October Playbook: Operations, Reminders, and Execution

Here’s the real action— six simple steps :

1. Set reminders. Set reminders for the three key dates mentioned in Section 1 (employment data, CPI, and Federal Reserve meeting). Ideally, set reminders 15 minutes before the release date and once upon release.

2. Trade highly liquid currency pairs. Consider reducing your position on the day of important data releases, as market depth can be significantly thinner in the minutes leading up to the release.

3. Set a stop-loss before entering a trade. Write down your stop-loss price before entering a trade, and execute it if it’s broken. You can record it in your trading journal or on a chart, and stick to it.

4. Spend 15 seconds every day monitoring fund flows. If fund flows are consistent with the trend, the market is healthy. If prices are rising but fund flows are weakening, start tightening your risk profile.

5. Pay attention to the unlocking time of your holdings. If the unlocking amount (in USD) is large or represents a high percentage of the circulating supply, it is recommended to reduce your holdings while the market is strong before the unlocking, or hedge your risk with perpetual contracts.

6. Maintain a light position. Survive first, then profit. It’s better to earn less than be wiped out by volatility.

If you’re unsure, hold onto BTC and ETH. Let the market calendar and capital flows guide you, not the fear of missing out. A steady pace is more reliable than any “inside tip.”

Finally, remember

You don’t need to trade every day, nor do you need to catch every market trend.

All you really need is:

– Several clear dates

– Two or three key indicators

– A plan you can follow

In this way, the market in October can become controllable and rhythmic.

Log in to your XT account now, set three reminders for employment data, CPI, and Federal Reserve decision, and print the list and plan above.

As long as you maintain a relaxed pace and simple rules, you can easily cope with this “Uptober” instead of being led by market sentiment.

About XT.COM

Founded in 2018, XT.COM currently has over 7.8 million registered users, over 1 million monthly active users, and over 40 million users within its ecosystem. We are a comprehensive trading platform supporting over 1,000 high-quality cryptocurrencies and over 1,300 trading pairs. The XT.COM cryptocurrency trading platform offers a wide range of trading options, including spot trading , leveraged trading , and futures trading . XT.COM also operates a secure and reliable NFT trading platform . We are committed to providing users with the safest, most efficient, and most professional digital asset investment services.

This article is sourced from the internet: Crypto October 2025 Guide: Easily Understand Market TrendsRecommended Articles

Author|jk Odaily recently conducted an exclusive interview with Spencer, the current head of Moonbirds, to delve into this legendary figure’s journey from fencer to NFT investor to NFT brand revivalist. Spencer was not only once one of the largest holders of Pudgy Penguins, but was also chosen to take over Moonbirds from Yuga Labs and lead its revival. In this in-depth conversation, he shared his unique insights into the NFT market, Moonbirds’ future vision, and how to identify undervalued opportunities in a bear market. During the interview, I was most impressed by Spencer’s quick-witted insights and responsiveness, each of which was imbued with a wealth of alpha perspective. His depth of understanding of product strategy was impressive, encompassing everything from the technological innovation cycle to the evolving value of IP,…