The market capitalization exceeded US$150 million within 3 days of its launch.

By Golem ( @web3_golem )

The market does not want people in the cryptocurrency circle to have a peaceful National Day holiday. The US government shutdown and Bitcoin’s new high may not make you clearly feel that you have missed something, but if you missed the Mid-Autumn Festival outbreak of the BSC chain Meme, you will really be anxious.

Under CZ’s call, three popular meme coins have been born on the BSC chain in recent days, namely: Binance Life, PALU and 4.

Meme Coin 4, deployed on October 1, currently has the highest market value of $250 million. PALU is a community mascot that has been retweeted many times by Binance officials and CZ. Due to its unexpected listing on Binance Alpha on October 7, its market value rose from approximately $3 million to $60 million, a 2000% increase in one hour.

However, from the perspective of popularity and attention, Binance Life currently has the greatest influence. This meme originated from the “Apple Android Theory” of Chenfeng, a popular internet celebrity account that was blocked on Douyin. It compared Binance to the “Apple” of the cryptocurrency circle and created the community hot meme of “Drive a Binance car, live in a Binance community, and enjoy Binance life.”

At 6:00 PM on October 7th, Binance Life successfully launched on Binance Alpha, becoming the first Chinese meme to be listed on Binance Alpha and the highest-valued Chinese meme coin ever. Its market capitalization soared from $0 to a peak of $150 million in just three days. With the launch of Binance Life on Binance Alpha, the “Binance + xx” Chinese meme coin has truly blossomed on-chain. Binance employees, the Binance team, Binance bulls, the Binance model, the Binance community, the Binance mindset, the Binance era, the Binance spirit…

In addition to the “ambiguous interaction” between CZ and He Yi, the leaders on the chain also contributed greatly to the influence and achievements of Binance Life today.

The leading players on the chain reunited, with a floating profit of over $6 million

In the meme world, on-chain leaders hold immense appeal. On the one hand, they can indeed generate substantial buying power, and on the other, their influence can further propel meme coins. However, as the meme market evolves and matures, many of the Trump-era on-chain leaders have abandoned or reduced their public on-chain operations. However, Binance Life has seen a rare gathering of these prominent figures in the Chinese-language community, including 0xSun, Leng Jing, Wang Xiaoer, Shenzhen University’s top student, and Laser Cat.

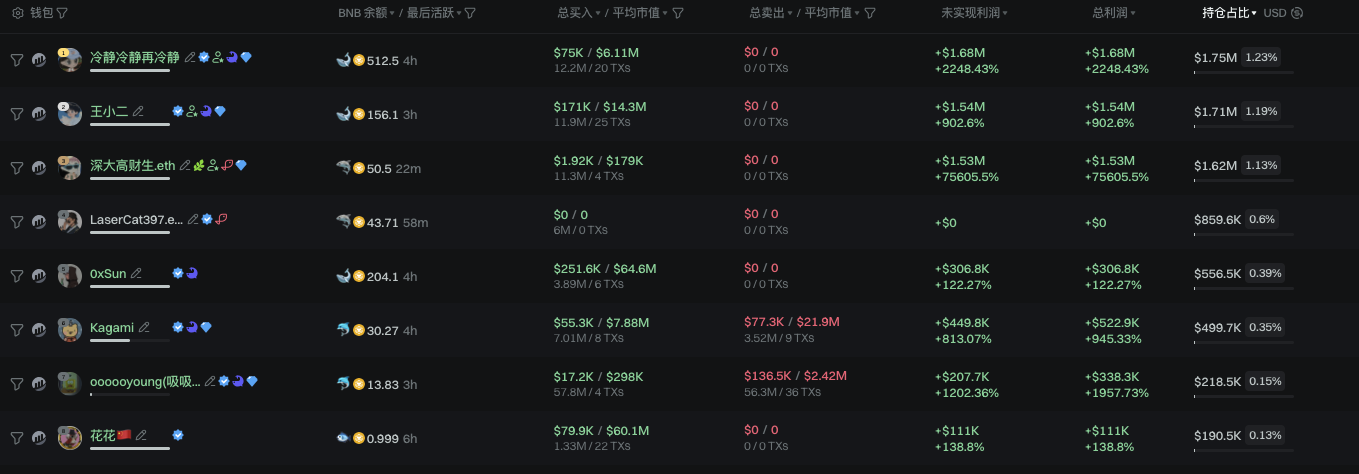

According to GMGN data, Leng Jing bought a total of US$75,000, holding 1.23% of the position, with a current floating profit of over US$1.65 million and no sales; Wang Xiaoer bought a total of US$171,000, holding 1.19% of the position, with a current floating profit of over US$1.54 million and no sales; Shenzhen University Gaocaisheng bought a total of US$1,920, holding 1.13% of the position, with a current floating profit of over US$1.53 million and no sales; 0xSun bought a total of US$251,600, holding 0.39% of the position, with a current floating profit of over US$300,000 and no sales.

As shown in the chart above, the top five blockchain makers currently have a combined floating profit of over $6 million . However, those who haven’t made that much shouldn’t worry too much. With on-chain liquidity at only around $500, floating profits are currently just that. Nevertheless, the on-chain boom is reminiscent of the meme-fueled bull run earlier this year, except that Solana was the main player back then, while Binance and BSC have now become the new players.

Binance Life Sparks Chinese Meme Trend

This isn’t the first time Chinese meme coins have exploded in popularity. Solana has previously seen several waves of Chinese meme crazes, including Spring Festival Gala mascots, the Nezha (Mowan) movie IP, and the Black Myth Wukong IP. However, these memes have been short-lived and have low market capitalization. Besides their narrow narratives, another key factor is that, in the eyes of most investors, Chinese memes are virtually impossible to list on CEXs and gain greater liquidity.

Because the “Binance Life” meme is closely associated with Binance, and has been repeatedly addressed and referenced by CZ and He Yi, some steadfast optimists believe it is highly likely to be launched on Binance Alpha. As expected, Binance Alpha launched “Binance Life,” and its market capitalization exceeded $100 million. More importantly, it dispelled the common investor perception that Binance would not, or could not, launch Chinese memes.

As the first Chinese meme coin to be listed on Binance, “Binance Life” successfully broke the ceiling for Chinese meme coins, sparking a complete and global Chinese meme craze on BSC. The community also joked that in the past, Chinese people could only buy foreign “junk,” but now they are expected to take over the Chinese meme market.

The huge wealth effect of “Binance Life” has made overseas Meme communities salivate, and they all want to integrate into the Chinese community. The well-known overseas KOL Ansem also posted a message asking to join the BSC Chinese community.

Some overseas smart money and meme players finally thought of monitoring the wallets of the Chinese chain on Chetou, and asked about it on Twitter.

Foreigners ask for the wallet address of Chinese KOLs

In recent days, the cryptocurrency community has made outstanding contributions to spreading Chinese culture and the influence of the Chinese language…

Binance stands in the heart of the bull market

It’s undeniable that Binance is poised for a bull market in 2025. The sooner we realize this, and the sooner we follow CZ and He Yi’s lead, the sooner we’ll start making money. Binance’s position as the world’s largest crypto liquidity hub, its founders’ unparalleled crypto IP power, its exceptional product and market operations, its positive impact on the public good, and its focus on community trends have all enabled it to thrive in this bull market, achieving significant success in the wallet market, L1, and Prep DEX.

Binance Wallet was launched at the end of last year and was controversial when it first went online. However, since the launch of Binance Alpha, Binance Wallet has now firmly ranked first among crypto wallets in terms of transaction volume and user activity. According to Dune data , Binance Wallet has occupied 90% of the crypto wallet market share.

Under the leadership of Binance founder CZ, BSC has flourished this year, particularly in the meme coin space. Solana’s competitor, not Ethereum, is BSC, a testament to CZ and BSC’s high standards. According to DeFiLlama data , BSC’s 24-hour DEX trading volume surpassed Solana’s, reaching $4.141 billion, making it the largest on the network. Furthermore, BSC’s 24-hour fees surpassed Tron’s, reaching $2.48 million, maintaining its top position on the network.

In the Prep DEX field, Aster, which was highly praised and highly expected by CZ, directly created a round of Prep DEX market. The transaction volume and revenue of Aster platform once surpassed Hyperliquid to become the leader of Prep DEX.

It is precisely because of Binance’s continued success, and its reputation and brand power continue to grow, that the community has used Douyin influencer Hu Chenfeng’s “Apple vs. Android Theory” on Binance (odaily note: “Apple vs. Android Theory” refers to the blogger attributing all excellent, elite, and superior things to Apple, and inferior, cheap, and bad things to Android).

But just as Hu Chenfeng’s popularity backfired after his breakout, Binance’s influence is becoming increasingly “invincible,” and meme coins and projects with a clear Binance logo and symbol receive more resources. This can ultimately backfire. A few years ago, the Ethereum ecosystem collectively embraced Vitalik Buterin, creating a seemingly prosperous startup, only to see Ethereum fall apart. Now, with the entire cryptocurrency community trending towards Binance/CZ startups, will Binance eventually face a similar backlash? And when that happens, how will Binance navigate this situation?

This article is sourced from the internet: The market capitalization exceeded US$150 million within 3 days of its launch. What does the launch of Binance Alpha on Binance Life mean?Recommended Articles

Related: Weekly Editor’s Picks (08:30-09:05)

因此,我们编辑部将于每周六从过去 7 天发布的内容中,摘选一些值得花费时间品读、收藏的优质文章,从数据分析、行业判断、观点输出等角度,给身处加密世界的你带来新的启发。 下面,来和我们一起阅读吧: 投资与创业 ArkStream Capital:加密 VC 重生指南,为何难以跑赢 BTC 这一轮回报下行,不仅是加息周期的流动性结果,更反映出加密一级市场的底层范式正在转变:从估值驱动转向价值驱动,从广撒网转向重确定性,从追叙事转向赌执行力。理解并适应这种范式变化,或将成为未来周期中实现超额回报的必要前提。 Delphi Digital:以史为鉴,降息如何影响比特币的短期走势? 比特币可能会在 FOMC 会议前出现一波上涨,但上涨幅度可能难以突破新高。下一轮上涨可能形成较低的高点(大约在 11.8 万至 12 万美元区间)。 韩国交易所上币指南:数据解码韩国交易所的上币黑箱 韩国市场体量与活跃度全球领先;政策与市场情绪双重驱动上币节奏;Bithumb 与 Coinone 均在上币节奏中发挥“桥梁效应”,部分代币先于两所上市,再进入交易量更大的 UPbit;对于项目方来说,应根据代币特性、社区结构和推广预算,匹配交易所类型与上线顺序,以提高投入产出比;韩国市场推广需本地化与多渠道结合。 2025 年 Hyperliquid KOL 影响力报告 另推荐:《老外 KOL 割韭菜姿势大赏:集群、造势与隐瞒》《加密 KOL 自述:我们的时代已经落幕》。 稳定币 稳定币公链元年:巨头下场,稳定币的下一战 当价值分配、技术限制、用户体验、监管合规与竞争的矛盾叠加在一起,自建一条链就成为了必然选择。 空投机会和交互指南 刷量、博弈与幻灭:加密空投是否已走到尽头? 一位老空投人的唏嘘。 后撸毛时代:10 个 A 7 级别项目参与指南 Based、Liminal、Legion、Fogo、Backpack、Axiom、预测市场(Polymarket、Limitless、Myriad)、Kinetiq。 另推荐:《本周精选交互项目:Poseidon 录音赚积分;Kaia 新产品 Superearn 白名单申请;新“嘴撸”项目 Edgen》。 比特币生态 专访 UniSat 创始人:单月收入较巅峰下滑 90%,但储备可支持十年研发 以太坊与扩容 以太坊的「金主们」是谁,普通人还有机会吗? ETH 的“持仓再分配”才刚刚开始。如果说过去 ETH 的估值逻辑是“技术 + 叙事”,那么未来更多是“资金 + 流动性”。这样的格局,意味着 ETH 可能比任何时候都更接近“机构化资产”。 以太坊 DAT 财库策略公司:何时会抛售 ETH 盯住三大指标:建仓成本、CEO/CFO/董事会人事变动,和 mNAV 长期低于 1。(下篇预告帖) 本篇主讲,以太坊 DAT 的 6 种结局:好结局,落袋 or 移情别恋;普通结局,对冲出货 or 无人问津;坏结局,资金压力 or 止损。 2025 以太坊趋势:协议越成功,生态风险越高?后 Pectra 时代深度解析 以太坊核心工程取得巨大成功的两个推手是:2024 年初 Dencun 升级引发的经济变革;今年五月完成的 Pectra 升级带来的治理进化。 但应注意:Restaking 赛道的成熟与其内生的系统性风险,以及 L 2 生态繁荣带来的严重碎片化。 另推荐:《Tom Lee 最新播客:我们正在见证 ETH 的“1971 时刻”,6 万美元才是合理估值》。 CeFi & DeFi Hyperliquid 热潮背后:Perp DEX 的五大陷阱如何破? 流动性假象:成交量高≠流动性好。买卖价差、滑点和吃单手续费会导致价格影响与执行损耗,但相关指标可能因激励机制而被人为抬高。 隐性成本:订单簿模式需大量做市商补贴,自动做市商(AMM)的流动性提供者(LP)则难以规模化,二者均面临经济层面的挑战。 黑箱清算:需优先保障系统安全而非用户便利性,因此需要未平仓合约(OI)风险控制、多来源清算机制及可验证证明,但盘前交易场景下风险尤为突出。 交易排序牺牲:在优先服务散户还是高频交易(HFT)之间存在权衡,这本质是公平性与效率的选择。 低效保证金:需搭建动态高效的保证金体系,融入生息抵押品、借贷整合及对冲识别功能,以匹配中心化交易所的效率。 如果 Polymarket 不发币,预测市场还能炒什么? 2 个月百倍的社交预测市场 Flipr、预测市场的基础设施之王…