Prediction Market New Infrastructure: An Inventory of Polymarket’s Third-Party Ecosystem Projects

Polymarket has become almost synonymous with prediction markets. Public information shows that Polymarket’s monthly trading volume has repeatedly surpassed $1 billion this year, creating a significant gap between it and second-place Kalshi. The project has not only received tens of millions of dollars in investment from Trump’s eldest son, but is also preparing to return to the US market and secure a new round of funding. Market speculation suggests its valuation could reach $10 billion.

Against this backdrop, a number of third-party ecosystems have emerged around Polymarket, encompassing data/dashboards, social experiences, front-end/terminals, insurance, and AI agents. On September 12th, RootData compiled a collection of representative projects into its “Polymarket Ecosystem Projects” compilation, which we will explore in this article.

Polysights | One-stop analysis panel

Polysights is a one-stop analytics dashboard built around Polymarket. Users can quickly filter topics by topic and expiration, while simultaneously displaying key indicators such as price/volume history, market depth and spread, and capital flows. Built-in AI summaries and arbitrage/trading indicators help identify mispricing opportunities within and across multiple markets. The platform supports self-selected and instant alerts (including Telegram push notifications) and provides trader/market rankings. It condenses topic selection, analysis, and alerts onto a single screen, reducing page switching and manual comparison, making entry decisions faster and cost estimation more intuitive.

Polymarket Analytics|Official Statistics Platform

Polymarket Analytics is the official statistical platform from Polymarket. Users can search for a market or address to view trading volume, open interest, price/trading history, and the address’s profit and loss and position changes. CSV files can also be exported for review. The platform avoids fancy visualizations, excelling in comprehensive fields and consistent caliber. It’s suitable for media writing, investment research comparisons, and monthly/quarterly report production, as well as for data forensics and chart generation.

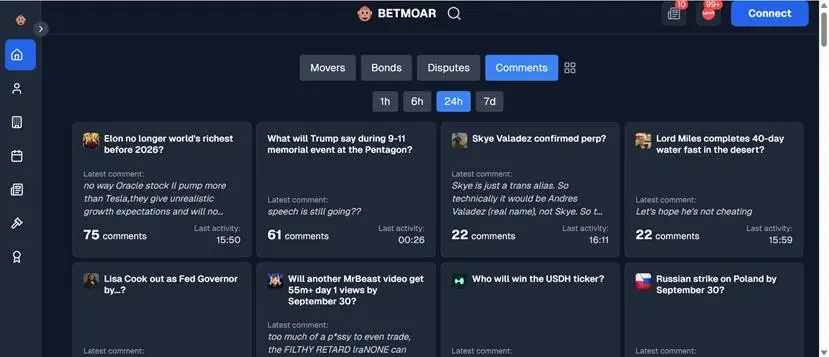

Betmoar | Third-party discovery/monitoring frontend

Betmoar is a third-party discovery and monitoring front-end that aggregates Polymarket’s markets into a dashboard. Its homepage divides the market into four views: Movers (ranking by 1-hour/6-hour/24-hour/7-day price fluctuations and trading volume), Bonds (focusing on deposit/staking trends and risk capital changes), Disputes (collecting markets in the arbitration or adjudication phase), and Comments (summarizing the latest comments and activity across markets). Users can filter with one click or sort by trading volume to quickly identify the hottest/latest events. Orders are still placed directly on the official Polymarket page.

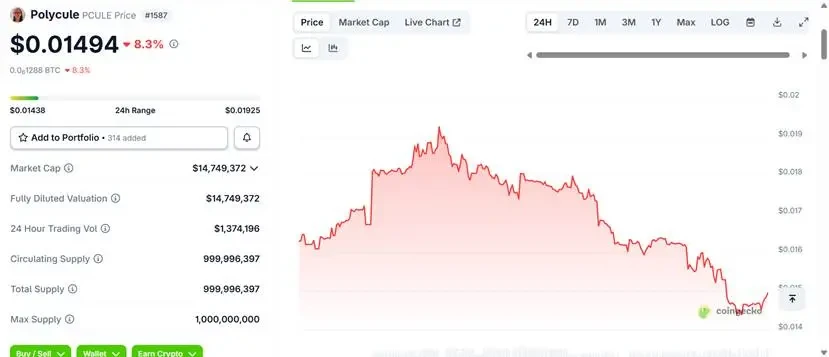

polycule|Polymarket’s Telegram trading bot

Polycule is a Telegram trading bot integrated with Polymarket. Users can search the market, view market information, and directly place YES/NO orders within the chat window, making it ideal for mobile, lightweight entry points. Polycule is user-friendly, featuring a built-in Solana → Polygon bridge (using deBridge) and the ability to automatically convert a small amount of SOL to POL as gas, reducing initial token exchange and preparation costs.

In May 2025, Polycule issued its PCULE token, currently valued at approximately $14.75 million. In June, the team announced a $560,000 investment from AllianceDAO. That same month, X and Polymarket announced an official partnership, boosting the prediction market’s exposure and distribution on mainstream social platforms. This external traffic also indirectly benefited Polymarket’s tool-based products.

Polymtrade | Trading Terminal

Unlike Polycule, Polymtrade is a heavy-duty trading terminal for Polymarket. It features a multi-panel layout, displaying market information, order book/depth, orders, and positions on the same screen. It supports keyboard hotkeys and batch orders. Additionally, its order window displays estimated slippage and fees, and its portfolio view can be sorted by theme or expiration, facilitating hedging and grid management. The project’s value lies in condensing the “view market – place order – adjust position” process into a few steps, bringing the Polymarket experience closer to that of an intraday exchange. Its PM token, launched in July, currently has a market capitalization of approximately $560,000.

fireplace|Socialized trading information flow

Fireplace focuses on the social experience of the Polymarket prediction market, presenting the latest trading dynamics of users’ followed accounts on Polymarket in the form of an information stream, and allowing users to comment, reply and copy any transactions.

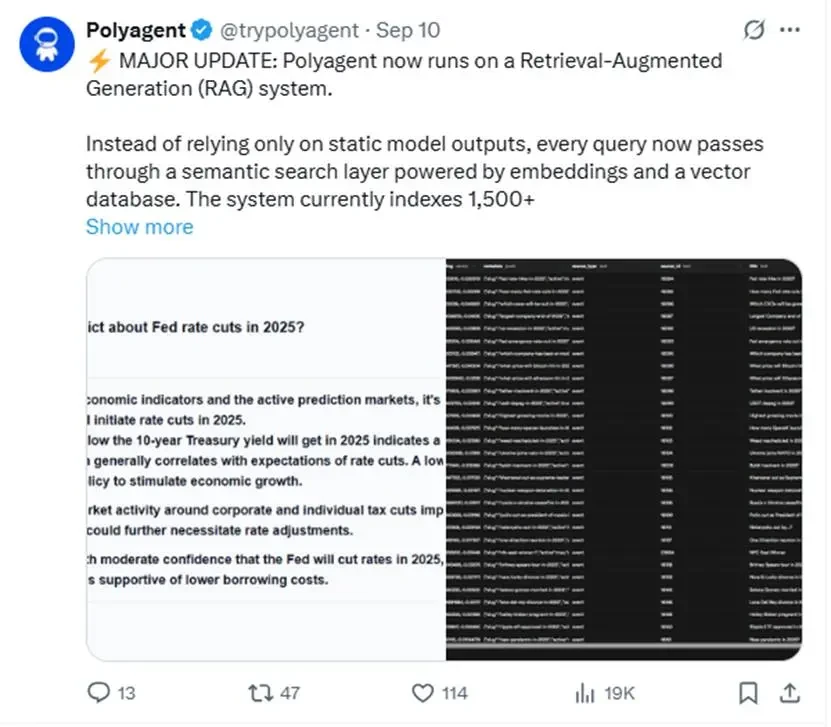

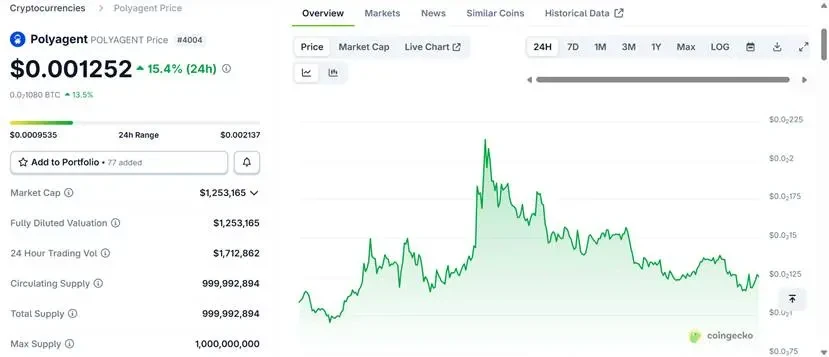

Polyagent | AI Assistant/Research Tool

Polyagent is an AI assistant/research tool based on Polymarket, focusing on intelligence aggregation and analysis. The platform emphasizes the use of models and search to interpret market trends. Officially announced, it has indexed over 1,500 Polymarket markets, providing search and conversation capabilities, and recently launched features such as tag search. Its token, POLYAGENT, launched on September 8th and currently has a market capitalization of approximately $1.25 million.

Polyfactual|Insurance + Arbitrage Dual Line

Polyfactual is a risk control and strategy platform for prediction markets. Currently, the official has split its business into two lines, using part of the funds to help the market cover abnormal risks, and using the other part of the funds to earn the price difference between the two platforms.

Insurance (Project X): Tokens tied to specific event outcomes are issued, and the funds raised flow into a reinsurance/liquidity pool. This capital is used to provide protection for participants in the event of judgment/settlement anomalies in a particular market, effectively adding a buffer to the platform’s judgment layer. Token holders share premiums/returns according to the rules, while also bearing the corresponding risks.

Arbitrage (Project Y): By running a cross-platform bot, the team monitors platforms like Polymarket and Kalshi over a long period of time. Once a price discrepancy is detected between the two platforms for the same event, the team simultaneously buys and sells the same price, locking in the difference. The resulting profits are distributed to holders based on their POLYFACTS holdings and stake ratio. The POLYFACTS token launched on September 2nd and currently has a market capitalization of approximately $4.26 million.

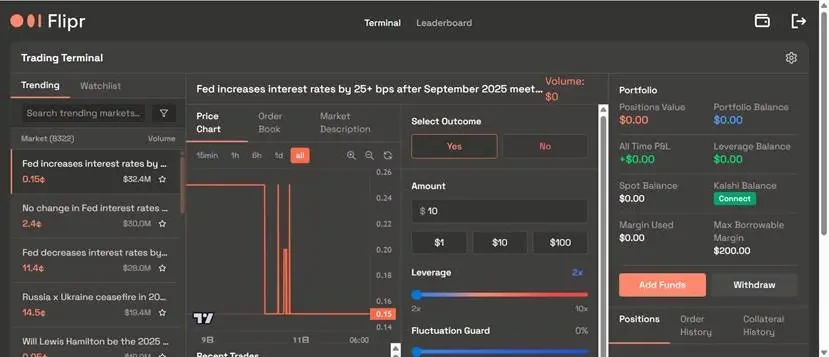

Flipr|Strategic Trading Bot

Flipr is a strategic Polymarket trading bot. Users can configure trigger conditions (price attainment, spread narrowing, volume increase, keyword appearance, etc.) and execution rules (order quantity, slippage limit, batched entry and exit, automatic position reduction before expiration), and it runs continuously in the background. For users who prefer to avoid market monitoring but have clear conditional trading rules, Flipr can turn specific trading ideas into executable strategies. Its token, FLIPR, launched on July 11th and currently has a market capitalization of approximately $4.37 million.

Billy Bets AI|Sports AI Agent

Billy Bets AI is an AI agent focused on sports. After selecting a league or team, the system directly summarizes recent results, injuries, schedule, and market odds, providing win/loss/point spread/over/under probabilities and recommendations, along with links to related Polymarket sports events, allowing users to place orders with a single click. This program’s unique combination of data and betting provides a time-saving combination of pre-game intelligence and execution for high-frequency sports users.

This article is sourced from the internet: Prediction Market New Infrastructure: An Inventory of Polymarket’s Third-Party Ecosystem ProjectsRecommended Articles

Bitcoin is gradually becoming mainstream, rapidly gaining popularity among both retail investors and businesses. Southeast Asia is experiencing particularly rapid growth. Last year, Indonesia’s digital currency trading volume reached $30 billion. By 2023, the Asia-Pacific region accounted for 43% of global cryptocurrency holdings, with markets such as Thailand, Vietnam, and the Philippines also showing strong momentum. Active retail participation has also driven institutional interest in Bitcoin. From Japan and South Korea to Hong Kong and Singapore, capital markets are accelerating their investment in digital assets. According to statistics, crypto asset management revenue in the Asia-Pacific region has reached US$300.4 million and is expected to grow to US$1.46 billion by 2030, with a compound annual growth rate of 25.4%. For example, in Hong Kong, an increasing number of companies listed or…