With a price-to-sales ratio of only 12 times, is HYPE, which just hit a new high, still undervalued?Recommended Articles

Original translation: AididiaoJP, Foresight News

Hyperliquid’s fundamentals continue to improve, but its valuation remains undervalued compared to other L1 stocks.

Hyperliquid’s spot trading volume has seen significant growth, especially compared to centralized exchanges. Over the weekend, an unknown entity deposited and sold approximately 22,100 BTC with Hyperliquid, purchasing approximately 555,000 ETH, valued at over $2.4 billion. This surge in spot trading volume made Hyperliquid the second-highest exchange for BTC spot trading volume on August 24th, with a 12% market share, second only to Binance (38%). This represents a significant increase compared to Hyperliquid’s average daily market share of approximately 1% over the previous 30 days.

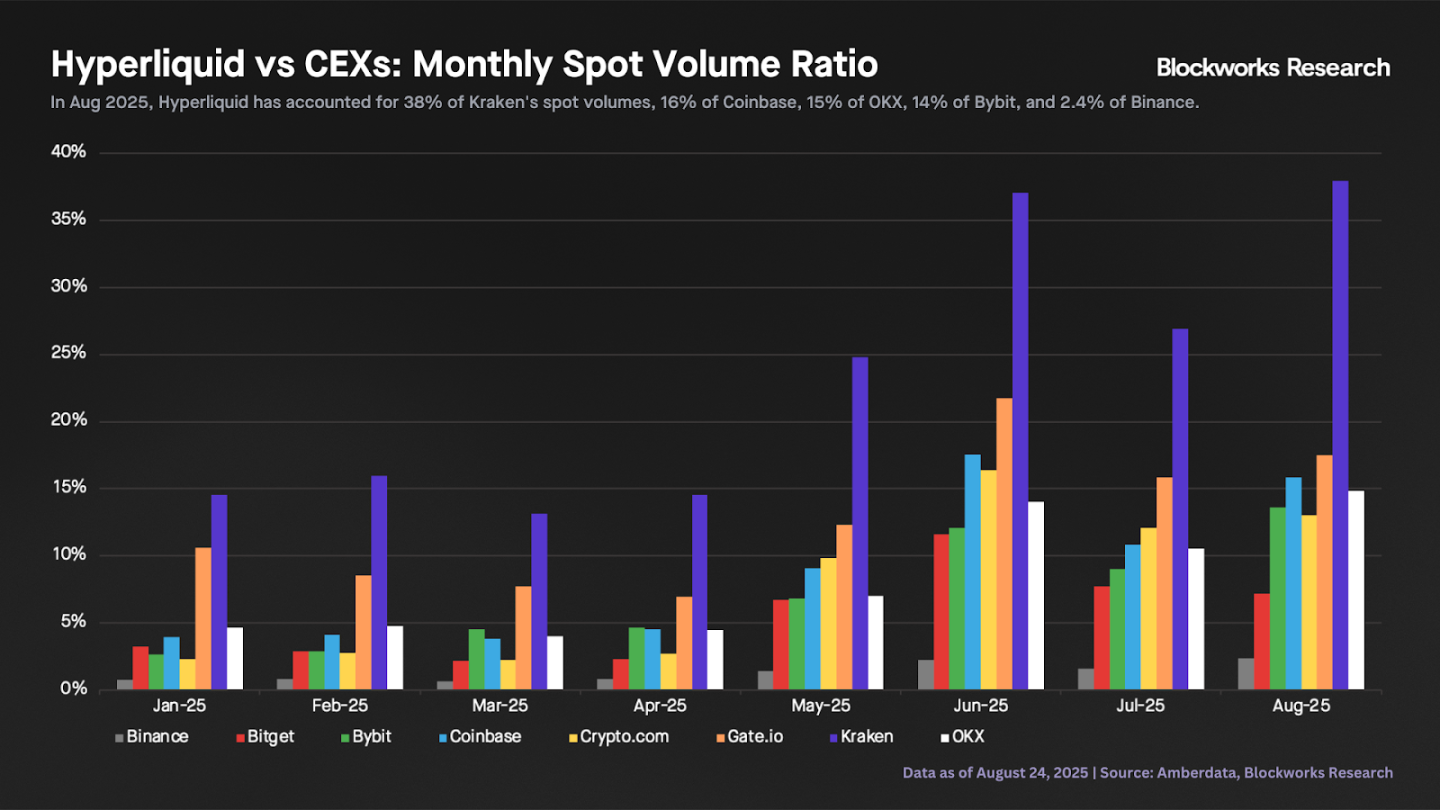

We can compare Hyperliquid’s monthly spot trading volume with that of several CEXs (including all assets, not just BTC). We observe that Hyperliquid’s share of spot trading volume has continued to rise this year. This month, Hyperliquid’s spot trading volume accounts for 38% of Kraken’s, 16% of Coinbase’s, 15% of OKX’s, 14% of Bybit’s, and 2.4% of Binance’s. While all of these figures represent significant increases compared to the beginning of the year, they also indicate that Hyperliquid still has a long way to go to surpass some of the larger CEXs.

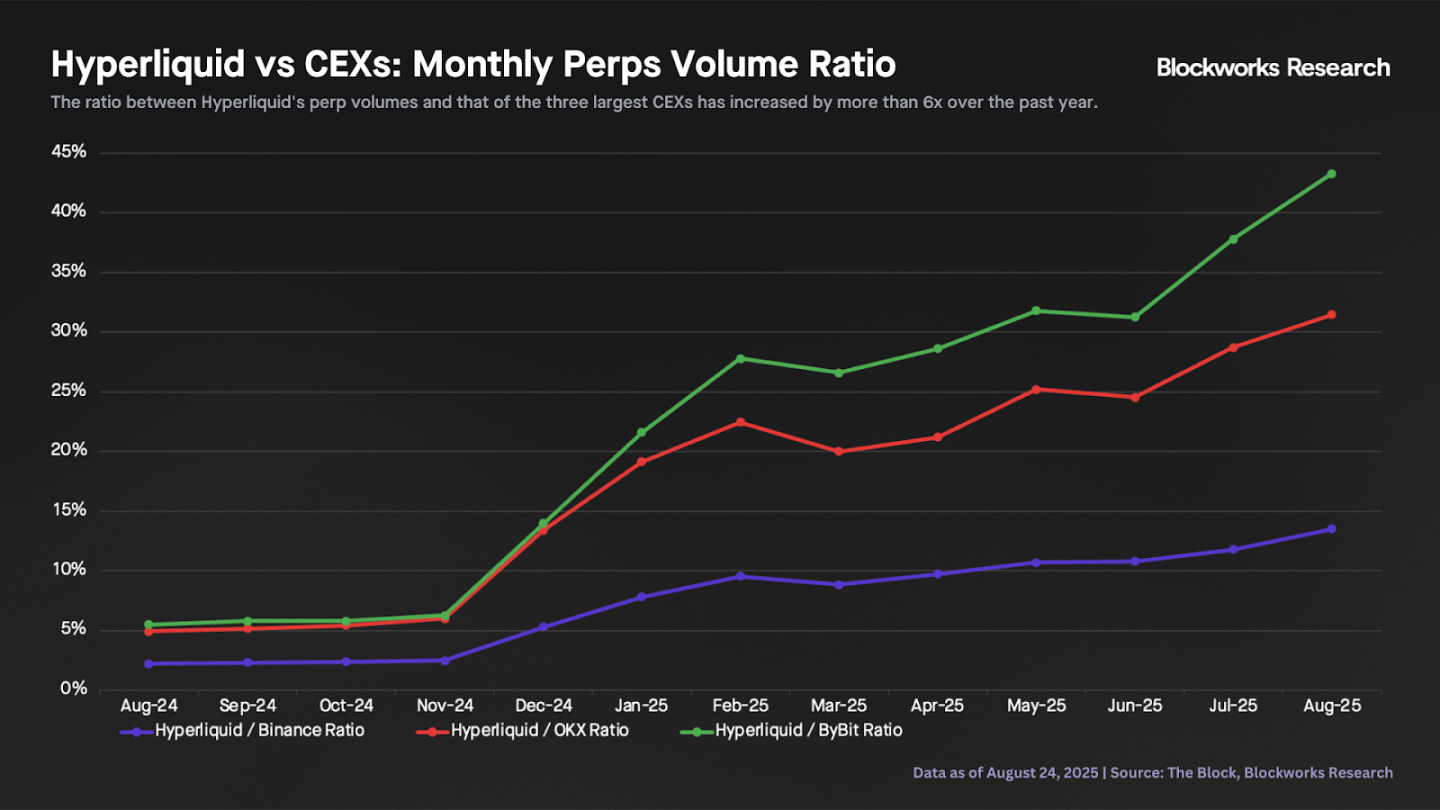

Hyperliquid’s perpetual swap trading volume has grown significantly faster than its centralized competitors. The chart below shows that Hyperliquid’s perpetual swap volume, compared to the three major CEXs, has grown more than sixfold over the past year. Hyperliquid’s monthly perpetual swap volume now accounts for almost 14% of Binance’s futures trading volume, compared to just 2.2% a year ago.

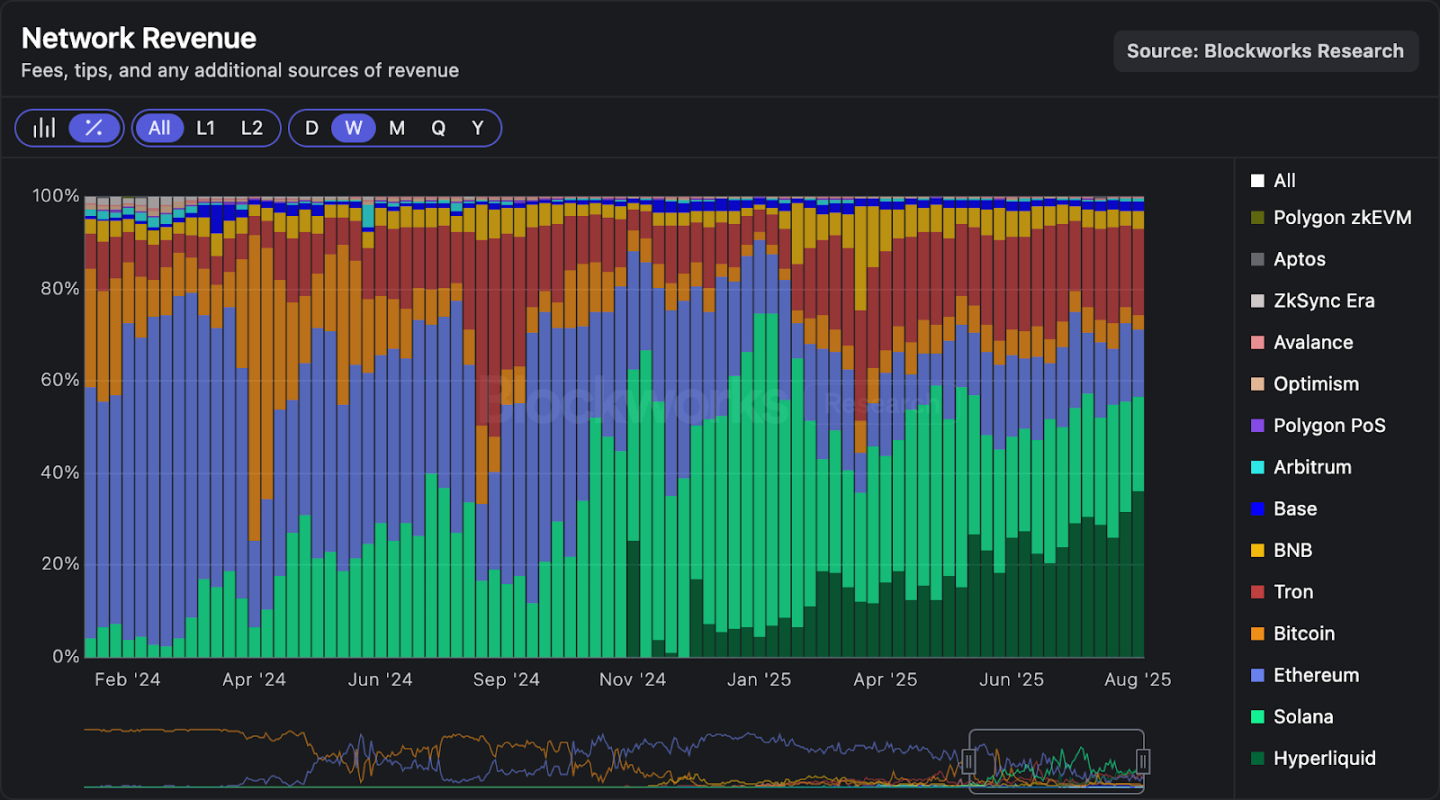

The growth in transaction volume is impressive. But how does revenue compare to other chains? Hyperliquid (HyperCore + HyperEVM) has generated approximately $28 million in weekly revenue for two consecutive weeks, reaching $98 million over the past 30 days. These figures equate to annualized revenue of between $1.2 billion and $1.4 billion. The chart below shows that Hyperliquid has consistently been the chain with the highest weekly revenue for the past two weeks, with market share reaching a record high of 36%.

The chart below shows that HYPE is the cheapest asset among mainstream public chains based on price-to-sales (P/S) ratio. Its P/S ratio of 12 is 90% lower than its peers. Even when calculated on a fully diluted valuation/sales (FDV/sales) basis, HYPE is the cheapest L1. While we debate whether L1s should command a premium or be valued based on revenue, the fact is that based on this metric alone, HYPE’s current price appears more attractive than all other L1s.

What happens if the so-called “L1 premium” disappears? What happens if buying pressure from DATCOs (referring to unknown entities or institutions) abates? Is HYPE undervalued, or are other L1s incredibly overvalued? We can’t know for sure, but these are definitely questions worth pondering.

This article is sourced from the internet: With a price-to-sales ratio of only 12 times, is HYPE, which just hit a new high, still undervalued?Recommended Articles

Related: What happened behind Ethereums 70% surge in a single month?

Ethereum is making history: We are witnessing one of the largest short squeezes in cryptocurrency history. Ethereum’s market cap has surged by $150 billion since July 1 — just days after net short positions hit an all-time high. What happened? This article explains it for you. Take a look at the chart below: According to Zerohedge data, Ethereums net leveraged short position reached a historical peak in July. In fact, the net short exposure is about 25% higher than the level in February 2025. This directly led to Ethereums 70% surge in less than a month. But the story is far from over. President Trump’s World Liberty Financial has been increasing its holdings of Ethereum. The latest trading records show that just 24 hours ago, the institution completed a $5…