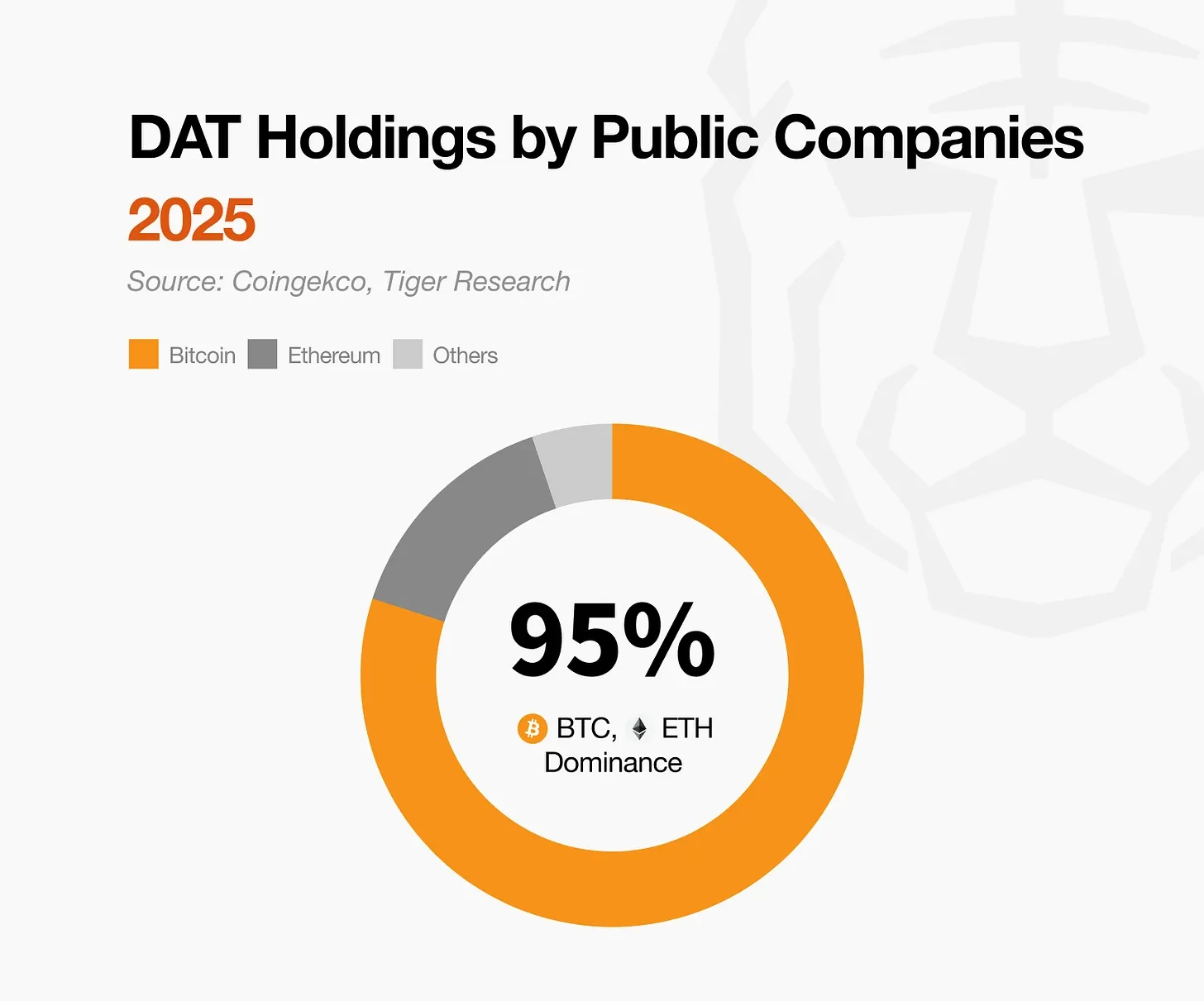

1. Institutional capital continues to remain in Bitcoin

Source: 老虎研究

With institutions dominating the market, capital flows have become more cautious. These investors are avoiding unverified assets, limiting their focus to Bitcoin and Ethereum. This trend is likely to continue. 市场 growth will concentrate solely on assets that meet institutional criteria.

2. Unprofitable projects face market elimination.

Source: 老虎研究

The fact that 85% of new tokens saw their prices fall after TGE exposes the limitations of narrative-driven growth. Projects based on hype will be replaced by new trends at an increasingly rapid pace. The market will shift towards projects that generate real returns and demonstrate solid fundamentals.

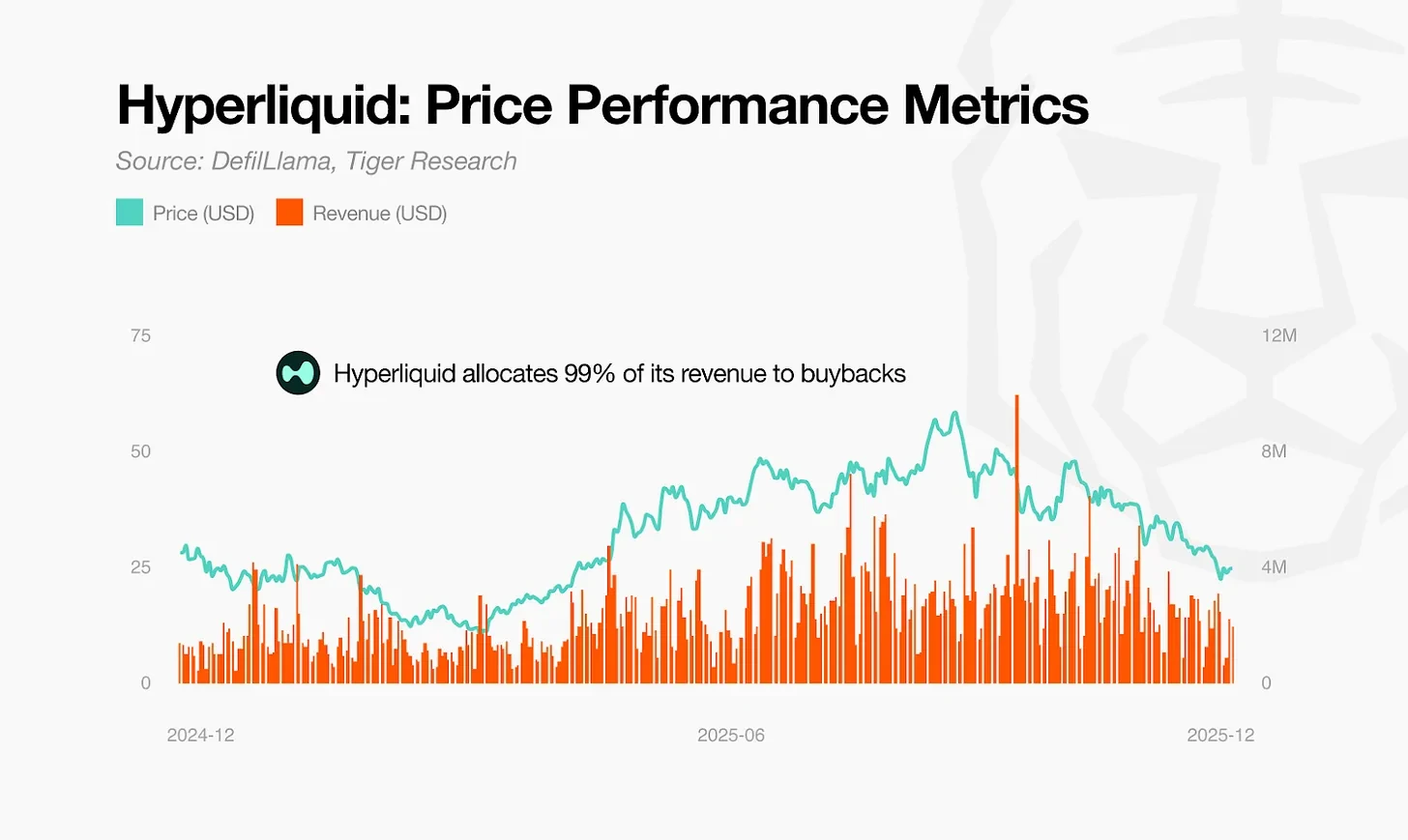

3. If it fails in terms of practicality, repurchase is the only solution.

Source: 老虎研究

Utility-focused token economics has failed. Governance voting rights have failed to attract investors. Complex structures are unsustainable. Markets now demand clear value returns. Models that provide direct returns through buybacks and burns will survive. Structures where protocol growth directly impacts token prices will also survive. New innovative models will emerge from this shift.

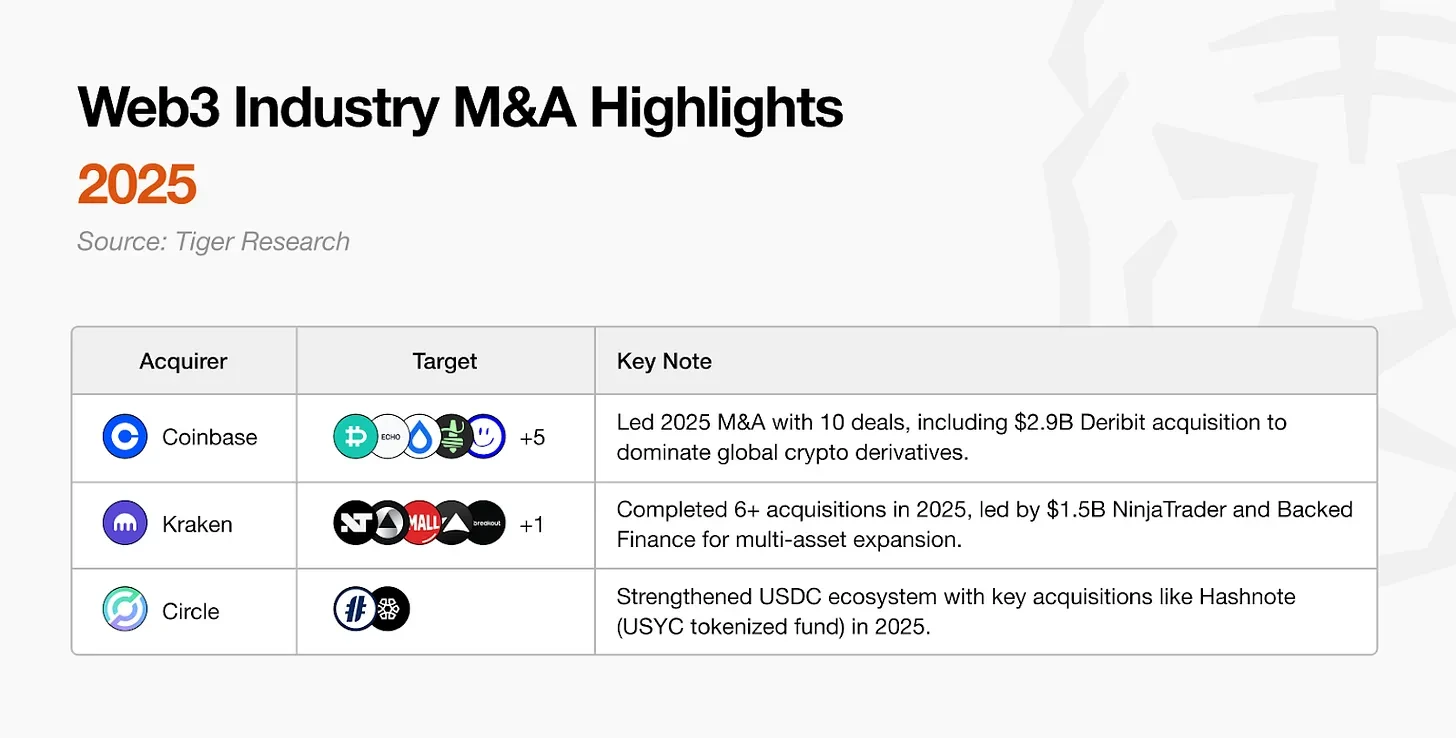

4. Increased opportunities for mergers and acquisitions between projects

Source: 老虎研究

Web3 is maturing. Competition for market dominance is intensifying. Mergers and acquisitions are now the fastest way for companies to scale and enhance their competitiveness. Winners will drive aggressive M&A activity. The market will be reshaped by those businesses that generate real profits.

5. Robotics and 加密currencies will usher in a new era of the gig economy.

Source: figure.ai

The robotics industry is growing. Real-world data for robot training is becoming increasingly crucial. Traditional centralized methods are inefficient at collecting massive amounts of data. Blockchain-based decentralized crowdsourcing solves this problem. It collects vast amounts of data from individuals globally and provides transparent, instant rewards. A new gig economy centered on robotics is emerging.

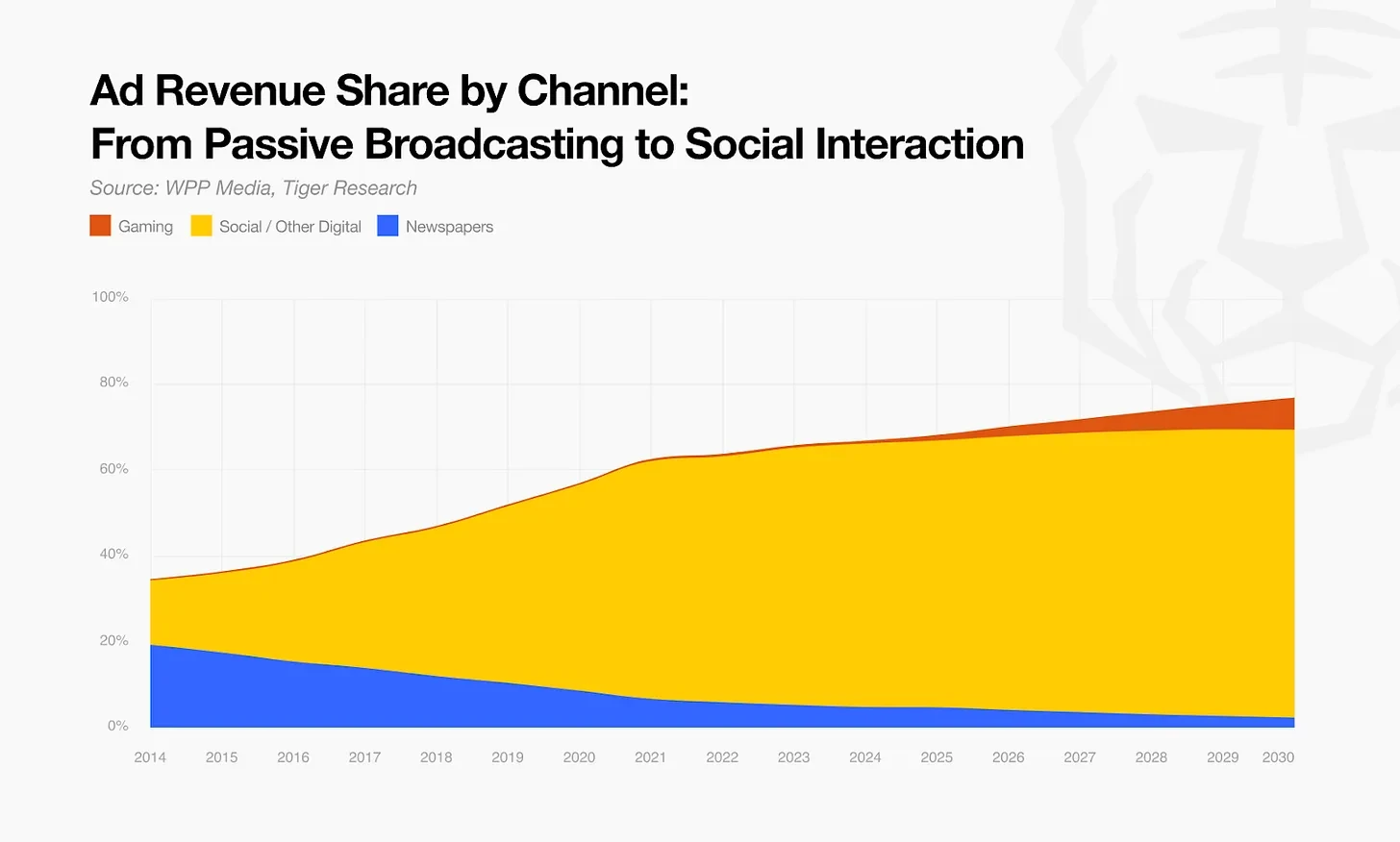

6. Media companies use prediction markets.

Source: 老虎研究

Source: 老虎研究

As traditional revenue models reach their limits, media companies will adopt prediction markets as a survival strategy. Readers will shift from passive consumption to active participation, placing capital bets on news outcomes. This shift will optimize revenue structures while driving deeper audience engagement.

7. Traditional financial institutions are dominating RWA by building their own blockchains.

Source: 老虎研究

Traditional financial institutions are the primary suppliers in the RWA market. Given the need for asset control and security, the benefits of using third-party platforms are minimal. These companies are likely to build their own blockchains to maintain market leadership. RWA projects lacking independent asset supply will lose their competitive edge and face elimination.

8. ETH staking ETFs will drive BTCFi growth.

Source: 老虎研究

The launch of Ethereum-staking ETFs will prompt Bitcoin ETF holders to seek returns. BTCFi fills this gap. As large amounts of capital flow into Bitcoin, the demand for asset utility will increase. This pursuit of returns will drive the next wave of growth for BTCFi.

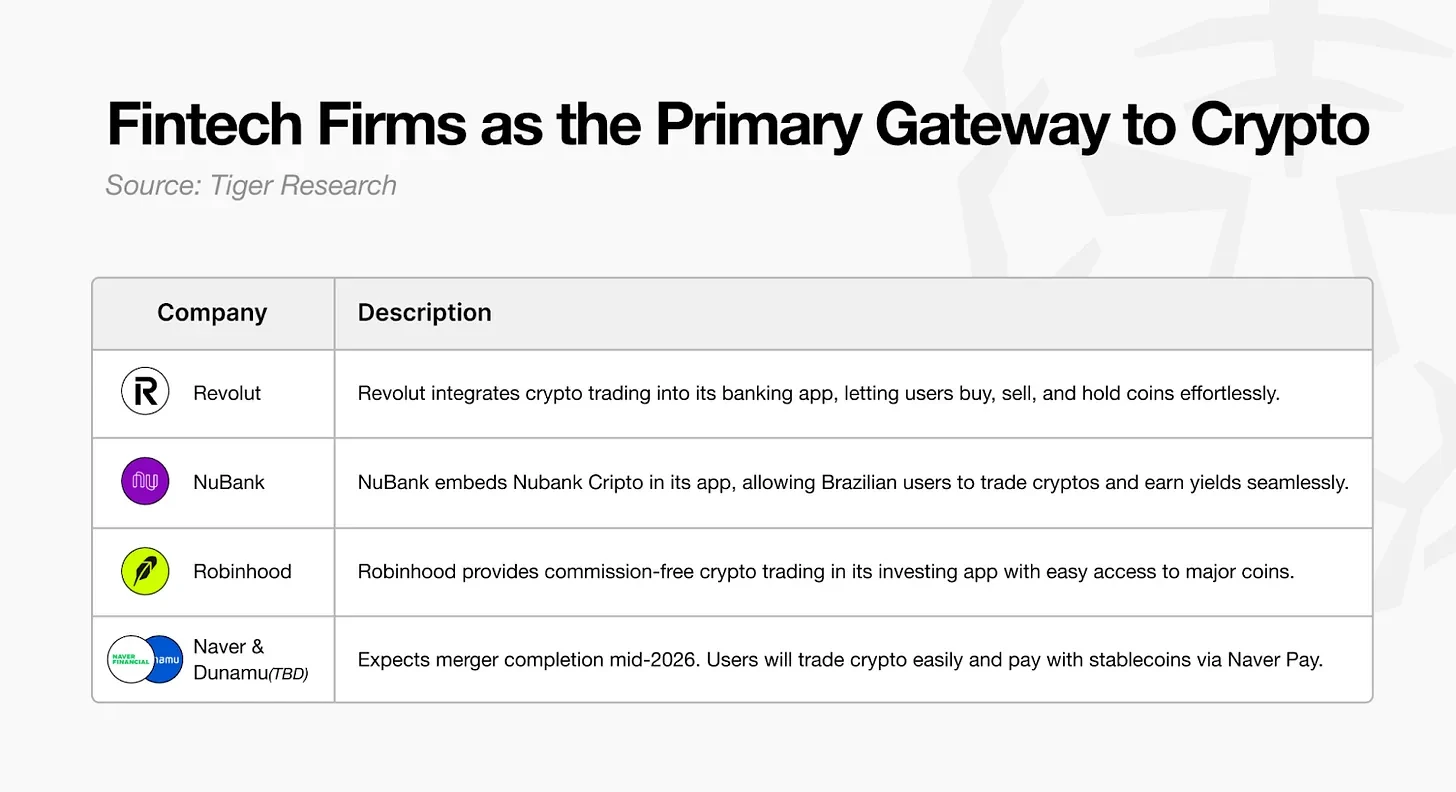

9. Fintech will surpass exchanges as the primary channel for deposits.

Source: 老虎研究

With clearer regulations, fintech apps have become the preferred choice for cryptocurrency trading. New users no longer need to use cryptocurrency exchanges; they can buy and sell directly through their everyday apps. The next wave of growth will be led by these fintech tools.

10. Privacy technology is becoming a core institutional infrastructure.

Source: 老虎研究

On-chain transparency exposes transaction plans. This is a vulnerability for large institutions. High-net-worth participants must conceal their movements to ensure security. Privacy technology is a key tool for these institutions to enter the market. Only when transaction data is secure will large sums of capital flow in.

本文来源于互联网: Tiger Research: Top 10 Changes in the Cryptocurrency Market in 2026

Author | Ethan ( @ethanzhang_网页3 ) RWA sector market performance According to the rwa.xyz data dashboard, as of December 9, 2025, the total on-chain value (Distributed Asset Value) of RWA stabilized significantly this week after experiencing sharp fluctuations last week due to adjustments in statistical methods. Data shows that the total value slightly increased from $18.41 billion on December 2nd to $18.44 billion, an increase of approximately $0.3 billion, a very small rise. Simultaneously, the represented asset value increased from $391.55 billion to $391.66 billion, indirectly confirming the resilience of the broader RWA market. User growth remains strong, with the total number of asset holders jumping from 555,428 to 561,558, an increase of 6,130 in a single week, representing a growth of approximately 1.1%. In the stablecoin market, the total…