Original translation by: Block unicorn

Foreword

Nowadays, most people buy Bitcoin and then never use it at all.

They hold Bitcoin, calling it digital gold, and proudly proclaim that they are “focused on long-term investment.” There’s nothing wrong with that, after all, Bitcoin has indeed earned that reputation.

This massive holding has created one of the largest pools of idle funds in the crypto ecosystem today. Approximately 61% of Bitcoin has not moved in over a year, and nearly 14% has remained untouched for over a decade. Despite Bitcoin’s market capitalization exceeding $2 trillion, only 0.8% of Bitcoin is currently involved in any form of decentralized finance (DeFi) activity.

In other words, Bitcoin is the most valuable asset in the cryptocurrency market, but it is also the least used asset.

Now, let’s compare these with other aspects of cryptocurrency:

- Stablecoins facilitate large-scale settlements and payments globally.

- Ethereum provides support for smart contracts, decentralized autonomous organizations (DAOs), wallets, and the entire economic system.

- Layer 2 (L2) networks run a complete ecosystem that includes lending, trading, gaming, and thousands of applications.

At the same time, Bitcoin, as the largest, safest, and most widely held asset, cannot achieve any of the above.

In contrast, it has trillions of dollars in value sitting idle, generating neither returns nor liquidity, and contributing nothing to the overall economy except for security and price increases.

As people attempted to solve this problem, various solutions introduced new issues. Wrapped BTC, while once popular, required trusting a custodian. Cross-chain bridges allowed transferring Bitcoin to another chain, but this also introduced security risks. Bitcoin holders wanted to use their Bitcoin, but the infrastructure never provided a secure and native way to do so.

But this situation has finally changed. In the past few years, a brand new ecosystem has been forming around Bitcoin, attempting to unleash all this “dormant capital” without forcing people to seal their Bitcoin, trust intermediaries, or transfer it to the custody of others.

Why has Bitcoin reached this point?

Bitcoin’s transformation into a passive asset is no accident. Its entire architecture has evolved in this direction. Long before decentralized finance (DeFi) emerged, Bitcoin made a clear trade-off: prioritizing security above all else. This decision shaped its culture, its developer environment, and ultimately influenced the types of economic activity that have flourished around it.

The result is an extremely immutable blockchain, which, while facilitating fund transfers, severely hinders innovation. Most people only see the surface symptoms: low liquidity, high dormancy rates, and the monopoly held by Bitcoin, but the root of the problem runs much deeper.

The first limitation is Bitcoin’s scripted model. It deliberately avoids complexity, thus maintaining predictability at the underlying level and making it difficult to exploit. This means there is no general-purpose computing power, no native financial logic, and no on-chain automation. Ethereum, Solana, and all modern L1 blockchains are built on the assumption that developers will develop them. Bitcoin, on the other hand, is built on the assumption that developers shouldn’t develop it.

The second limitation is Bitcoin’s upgrade path. Any change, even a minor functional alteration, requires coordination across the entire ecosystem. Hard forks are virtually impossible at the societal level, while soft forks can take years. Therefore, while other cryptocurrencies iterate and update their entire design paradigms (e.g., automated market makers, account abstraction, secondary networks, modular blockchains), Bitcoin has almost stagnated. It became the settlement layer, but never truly became the execution layer.

The third limitation lies at the cultural level. Bitcoin’s developer ecosystem is inherently conservative. This conservatism protects the network but also stifles experimentation. Any proposal that introduces complexity is met with skepticism. This mindset helps protect the underlying infrastructure but also ensures that new financial infrastructure cannot emerge on Bitcoin as readily as it would elsewhere.

Furthermore, there is a structural limitation: Bitcoin’s value has grown faster than the surrounding infrastructure. Ethereum had smart contracts from the beginning; Solana was designed for high throughput from the outset. Bitcoin’s value inflated into an asset class before its “usable applications” expanded. Thus, the entire ecosystem ultimately presents a paradox: you have trillions of dollars in capital, but virtually nowhere to deploy it.

The final limitation lies in interoperability. Bitcoin’s unique isolation prevents it from interoperating with other blockchains and lacks native bridging. Until recently, there was no way to connect Bitcoin to an external execution environment while minimizing trust. Therefore, any attempt to make Bitcoin usable must completely abandon its security model, such as encapsulation, bridging, custodial minting, multisignature, and consortiums. This approach can never scale for an asset built on distrust of intermediaries.

The first workaround: wrappers, sidechains, and cross-chain bridges

As it became apparent that Bitcoin’s underlying infrastructure could not support meaningful activity, the industry, as always, developed various workarounds. Initially, these solutions seemed progressive, allowing Bitcoin to enter the burgeoning DeFi space. However, upon closer examination, they all shared a common flaw: using these solutions required abandoning a part of Bitcoin’s trust model.

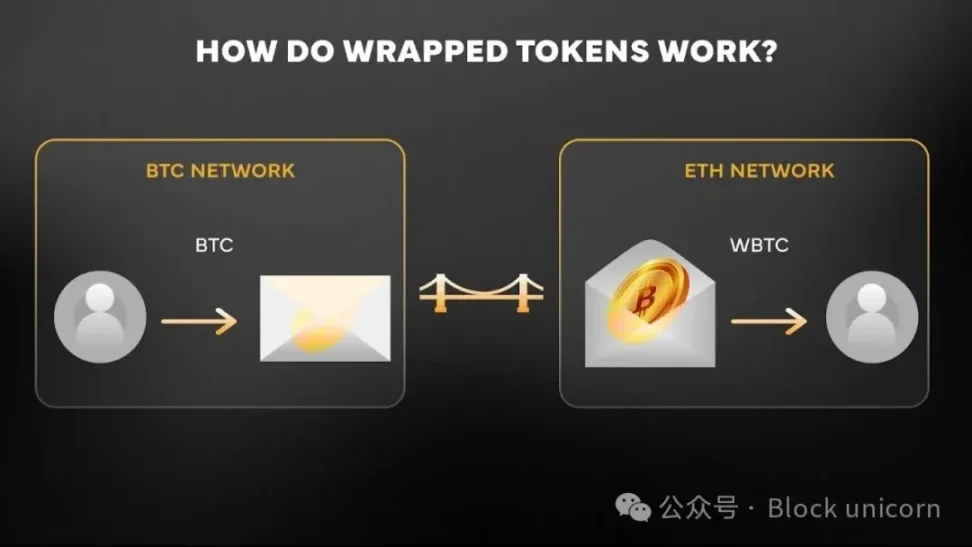

The most striking example is Wrapper Bitcoin. It once served as the default bridge between Bitcoin and Ethereum, and for a time, this model seemed to work. It released liquidity, enabling Bitcoin to be used as collateral, traded in Automated Market Makers (AMMs), used for collateralized lending, cyclical trading, and re-collateralization—essentially achieving everything Bitcoin itself couldn’t. However, the cost was that Wrapper Bitcoin’s existence presupposed that the actual Bitcoin was held by someone else. This meant custody, reliance on external institutions, operational risks, and a guarantee system unrelated to Bitcoin’s underlying security mechanisms.

Federated systems attempt to alleviate this trust burden by distributing control among multiple entities. Unlike a single custodian, Bitcoin, backed by an underlying asset, is collectively held by a group. This is an improvement, but far from eliminating trust entirely. Users still rely on a coordinated set of operators, and the strength of the anchoring effect depends solely on their incentives and integrity. This is not a perfect solution for communities that prefer trustless systems.

Cross-chain bridging technology has introduced a series of new problems. Users no longer rely on custodians but instead on a set of external validators, whose security is often weaker than the chain the user leaves. While cross-chain bridging technology enables cross-chain transfers of Bitcoin, it has also become one of the biggest security vulnerabilities in the cryptocurrency space. Multiple analyses indicate that cross-chain bridging vulnerabilities are one of the largest sources of financial losses in the cryptocurrency industry.

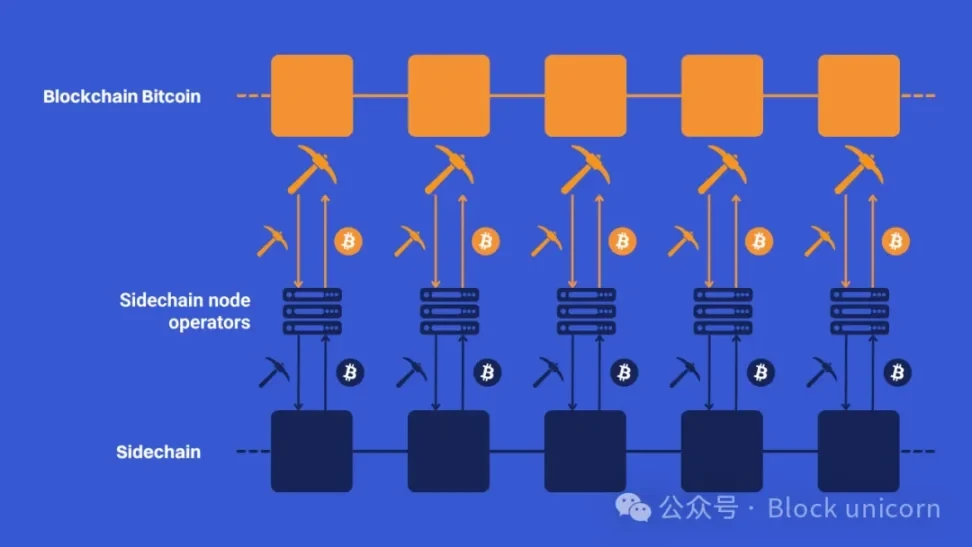

The emergence of sidechains has added further complexity. They are chains independent of Bitcoin, connected through various anchoring mechanisms. Some sidechains employ multi-signature control, while others use Special Purpose Vehicle (SPV) proofs. However, none of them inherit Bitcoin’s security. They operate their own consensus mechanisms, validator sets, and risk assessment systems. The label “Bitcoin sidechain” is often more of a marketing gimmick than a fact. Liquidity has indeed increased, but security guarantees have not.

What all these approaches have in common is that they all push Bitcoin outward, detaching it from its underlying architecture and placing it in an environment where rules are enforced by others. This solves the usability problem in the short term, but creates a much bigger problem: Bitcoin suddenly begins to operate under a trust model that it itself intended to avoid.

These shortcomings are obvious:

- Wrapped Bitcoin grew simply because people tolerated custodians as a temporary solution.

- While sidechains exist, they remain confined to a niche market due to their failure to inherit Bitcoin’s security features.

- Cross-chain bridges connect Bitcoin to other chains, but they also introduce entirely new attack methods.

Each workaround solves one problem, but introduces another.

Breakthrough Moment: Bitcoin Finally Has a New Primitive

For a long time, Bitcoin’s limitations have been considered irreversible. The underlying architecture remains unchanged, upgrades are slow, and any proposals aimed at enhancing its expressive power are rejected as unnecessary risks.

But in the past few years, this assumption has begun to waver.

1. Bitcoin has gained the ability to “verify without executing”: The most important breakthrough is the emergence of a new type of verification model that allows Bitcoin to check the results of calculations performed elsewhere without running the calculations itself.

This breakthrough made BitVM and subsequent similar systems possible. These systems did not change Bitcoin’s functionality, but rather utilized Bitcoin’s ability to enforce results through anti-fraud proofs.

This means you can build logic, applications, and even entire execution environments outside of Bitcoin, while Bitcoin still ensures their correctness. This is a stark contrast to Ethereum’s “everything executes at Layer 1” philosophy. Bitcoin can finally make decisions. This is precisely why the following doors are finally opened:

- A summary of Bitcoin-backed guarantees (Rollup)

- Trust-minimized cross-chain bridge

- Programmable Bitcoin Vault

- Off-chain computation, on-chain verification

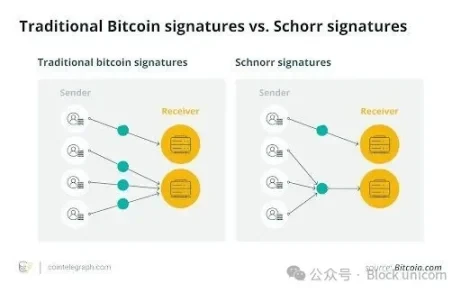

2. Upgrades like Taproot have quietly expanded the scope of Bitcoin’s applications: Taproot wasn’t initially promoted as a DeFi upgrade, but it provided the necessary cryptographic foundation for BTCFi: lower-cost multisignature, more flexible key path spending, and better privacy protection. More importantly, it enabled architectures such as Taproot Assets (for stablecoins) and more advanced vault systems.

3. The emergence of Bitcoin native assets: With the advent of Taproot and newer proof systems, projects began to launch assets based on or with security derived from Bitcoin, without needing to encapsulate BTC.

By combining Taproot, Schnorr signatures, and new off-chain verification technologies, developers can now build assets on top of Bitcoin itself, or directly inherit assets with Bitcoin’s security.

This includes the following:

- Taproot Assets (Tether mints USDT directly on the Bitcoin/Lightning Network stack)

- A Bitcoin-native stablecoin that does not rely on Ethereum, Solana, or Cosmos

- Synthetic assets not backed by BTC and not pegged to custody

- Programmable vaults and multi-signature structures that were previously impossible to implement

For the first time, assets issued with Bitcoin can be used without leaving Bitcoin. Moreover, assets issued with Bitcoin do not require Bitcoin to be taken out of self-custody.

4. Bitcoin Yields Become Possible: Bitcoin itself has never yielded returns. Historically, the only way to “earn” returns on Bitcoin was by packaging it, sending it to a custodian, lending it on a centralized platform, or bridging it to other blockchains. All of these methods are risky and completely deviate from Bitcoin’s security model.

BTCFi introduces a completely new way to earn Bitcoin. How does it work? By creating a system that allows Bitcoin to contribute to cybersecurity. This leads to three types:

Bitcoin staking (for other networks): BTC can now be used to secure PoS networks or application chains without leaving the Bitcoin chain.

Bitcoin re-staking: Similar to Ethereum’s ability to protect multiple protocols through shared security mechanisms, Bitcoin can now be used as collateral to support external chains, oracles, DA layers, and more.

Lightning Network-based yield systems: Protocols like Stroom allow BTC used in Lightning Network channels to earn yield by providing liquidity, without the need for sealing or relying on custodian bridges.

None of this would have been possible before BTCFi.

5. Bitcoin finally has an execution layer: Recent advances in off-chain verification enable Bitcoin to enforce computations it wouldn’t otherwise perform. This allows developers to build rollups, cross-chain bridges, and contract systems around Bitcoin that rely on Bitcoin for verification rather than computation. The base layer remains unchanged, but the outer layer can now run logic and prove its correctness to Bitcoin when needed.

This gives Bitcoin unprecedented capabilities: it can support applications, contract-like behavior, and new financial infrastructure functions without transferring Bitcoin to a custodian system or rewriting the protocol. This is not a “smart contract on Bitcoin,” but a verification model that maintains Bitcoin’s simplicity while allowing for more complex systems to exist around it.

BTCFi Overview: What is it actually building?

With the maturation of underlying verification and portability tools, the Bitcoin ecosystem has finally begun to expand in a way that no longer relies on custodians or encapsulated assets. What has emerged is not a single product or category, but a series of interconnected layers that, for the first time, give Bitcoin a fully functional economic system. The simplest way to understand this is to observe how these components complement each other.

Infrastructure Layer: The first significant change is the emergence of secure execution environments for Bitcoin. These environments are not L1-level competitors, nor are they attempts to turn Bitcoin into a smart contract platform. They are external systems that handle computation, relying solely on Bitcoin for verification. This separation is crucial. It creates a space where lending, trading, collateral management, and even more complex underlying functions can exist without any changes to Bitcoin’s foundational layer. It also avoids the pitfalls of the old model, where using Bitcoin meant entrusting it to a custodian or relying on multi-signature agreements. Now, Bitcoin itself remains unchanged; computation revolves around it.

Asset and Custody Layers: Meanwhile, a new generation of Bitcoin cross-chain bridges is emerging. These are no longer the trust-dependent, custodian-based bridges of the previous cycle, but rather bridges built around verifiable results. These systems no longer require users to trust a set of operators, but instead employ challenge mechanisms and fraud proofs to automatically reject erroneous state transitions. As a result, users can more securely transfer Bitcoin to external environments without relying on the fragile trust assumptions of previous designs. More importantly, this type of bridge aligns with Bitcoin holders’ inherent perception of security: minimal trust, minimal dependence.

Protocol Layer: As asset liquidity becomes more secure, the next phase of innovation focuses on the role Bitcoin can play in these environments. Yield markets and security markets emerge in this context. For much of Bitcoin’s history, earning any yield with Bitcoin required depositing it with an exchange or encapsulating it in another blockchain. Today, staking and restaking models allow Bitcoin to contribute to the cybersecurity of external networks without escaping its control. Yields do not stem from credit risk or re-collateralization, but rather from the economic value of maintaining consensus or verifying computation results.

At the same time, native Bitcoin assets began to emerge. Instead of simply wrapping Bitcoin in Ethereum, developers started using technologies like Taproot, Schnorr signatures, and off-chain verification to issue assets on Bitcoin or anchor them to Bitcoin’s security mechanisms. This included stablecoins minted directly on the Bitcoin infrastructure, synthetic assets independent of custodians, and vault structures that allowed for more flexible spending conditions. All of these expanded Bitcoin’s utility without introducing a different trust model.

These advancements are interesting on their own. Together, they mark the birth of the first coherent Bitcoin financial system. Computation can be performed off-chain and enforced on Bitcoin. Bitcoin can be securely transferred without custody. It can earn yields without leaving its own custody. Assets can exist natively, without relying on the security guarantees of other ecosystems. Each advancement addresses a different aspect of the liquidity trap that has plagued Bitcoin for over a decade.

My opinion?

I believe the simplest way to look at BTCFi is this: Bitcoin finally has an ecosystem commensurate with its scale. For years, people have tried to build the Bitcoin ecosystem using tools that were originally incapable of supporting trillions of dollars in liquidity. No serious Bitcoin holder would bet their Bitcoin on custodial anchors, unverified cross-chain bridges, or makeshift sidechains, and they certainly haven’t.

This wave is different because it embraces Bitcoin entirely according to its own rules. The security model is fully preserved, self-custody is fully preserved, and the surrounding systems are finally robust enough to support meaningful capital. The impact will be profound if even a small fraction of dormant BTC begins to circulate because the infrastructure finally makes them worthy of it.

This new wave differs from previous ones because it addresses the challenges in Bitcoin’s own way. The security model remains unchanged, the self-custody mechanism is fully preserved, and the system surrounding Bitcoin is finally robust enough to support substantial capital flows. Even if only a small fraction of dormant Bitcoin begins to circulate due to the infrastructure’s maturity, the impact will be significant.

This article is sourced from the internet: Bitcoin’s dormant capital has finally awakened.

Related: a16z: Arcade Token, the most undervalued token type.

Original translation by Blockunicorn We recently compiled a new, comprehensive classification system for token types, including network tokens, collectible tokens, and meme tokens. Of the seven types we identified, arcade tokens are the least known and most undervalued: tokens with relatively stable value within a specific software or product ecosystem, typically managed by the issuer (such as a company). Essentially, arcade tokens are blockchain-based assets, similar to familiar assets such as frequent flyer miles, credit card points, and in-game digital coins. What they have in common is that they are currencies that circulate and underpin the market economy: for example, frequent flyer miles and reward points can enhance brand loyalty and can be used to purchase airline tickets and upgrades; digital coins allow you to buy and sell items in…