ETH unstacking waiting time hits a new high, are Ethereum holders about to call each other stupid?

Bản gốc | Odaily Planet Daily ( @OdailyTrung Quốc )

Tác giả: Wenser ( @wenser 2010 )

As the price of ETH rebounded and broke through $3,800 and then fell again to above $3,500, ETH officially entered the holders SB moment – on the one hand, institutions and listed companies continued to increase their holdings of ETH, or held the currency for appreciation, or established strategic reserves; on the other hand, the waiting time for ETH POS to be unpledged exceeded 11 days, breaking the historical high, and the total amount of ETH to be unpledged exceeded 637,000. In comparison, the total amount of ETH to be pledged was about 321,000, which was only about 50% of the total amount of ETH to be unpledged. As a result, the market was in a panic that institutions were unpledged and dumped the market. However, is the truth of the matter really like this? Odaily Planet Daily will analyze this article in combination with the main market views for readers reference.

Behind the record high waiting time for ETH unstaking: After 7 months, ETH returns to above $3,800

Dựa theo OKX market data , the price of ETH once broke through US$3,800 this week, rising to US$3,858.88. In contrast, the last time the price of ETH was above US$3,800 was 7 months ago, around December 19, 2024.

The rebound in ETH prices naturally caused a turbulence in the mật mã market. Many whales, institutions and even retail investors who had previously bought the bottom of ETH chose to take profits, resulting in the total amount of ETH unstaked breaking a new high, and the waiting time for unstacking naturally increased.

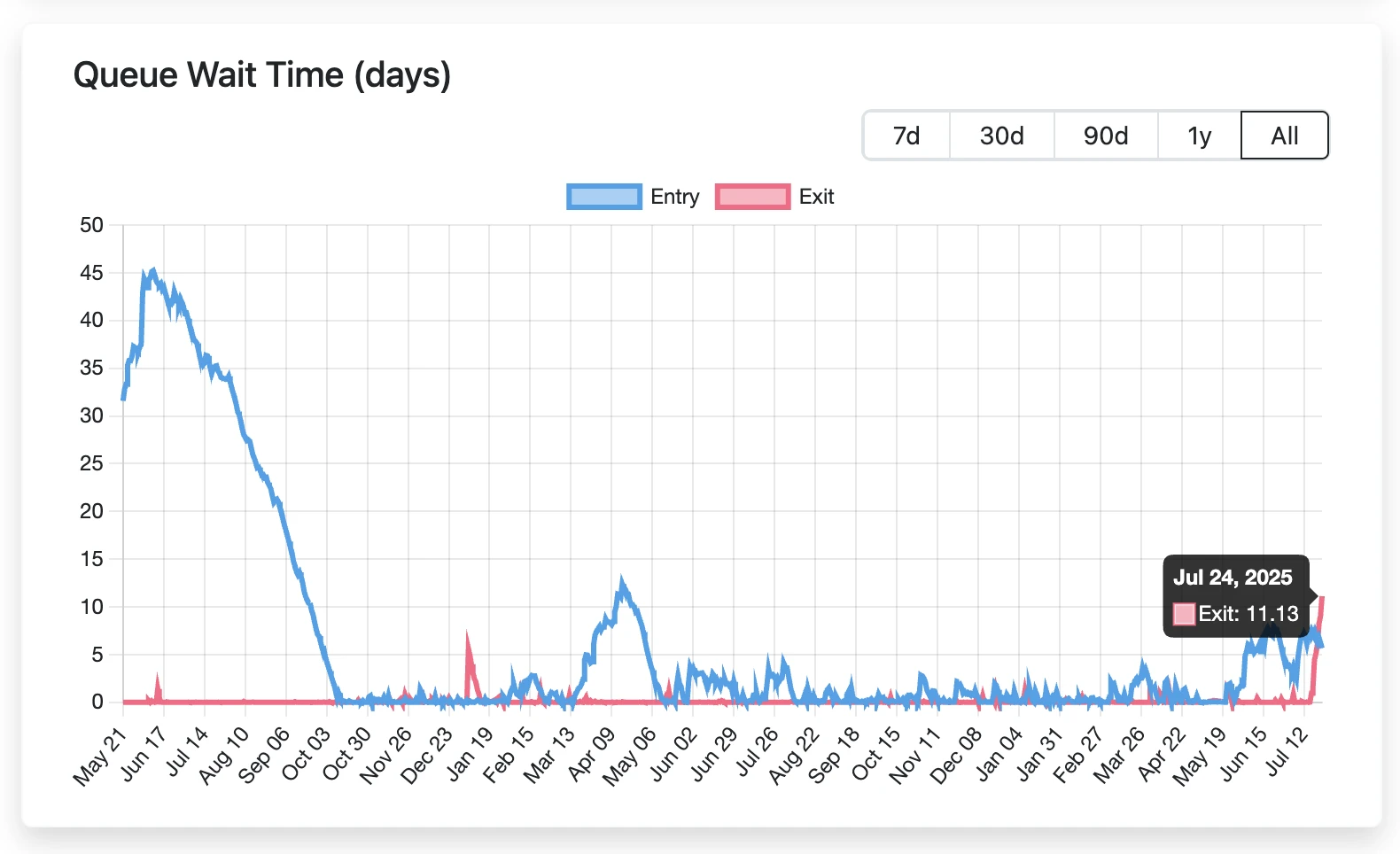

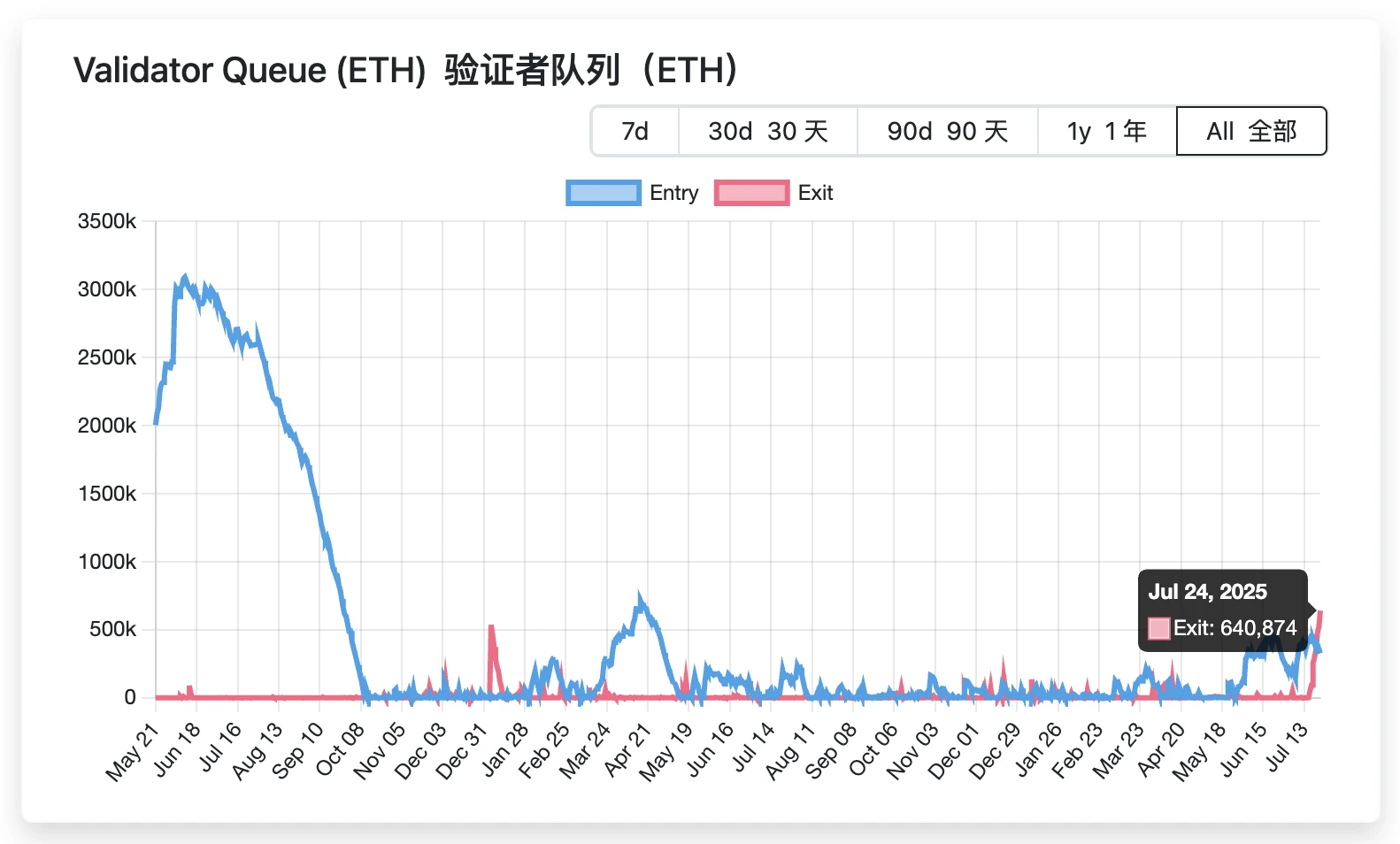

According to the latest data from the validatorqueue website , as of July 24, the total amount of ETH waiting to be unstaked is 637,450, and the waiting time has been extended from about 9 days to 11 days and 2 hours; the total amount of ETH waiting to be staked is about 321,000, and the waiting time in the market is about 5 days and 14 hours.

ETH staking related information

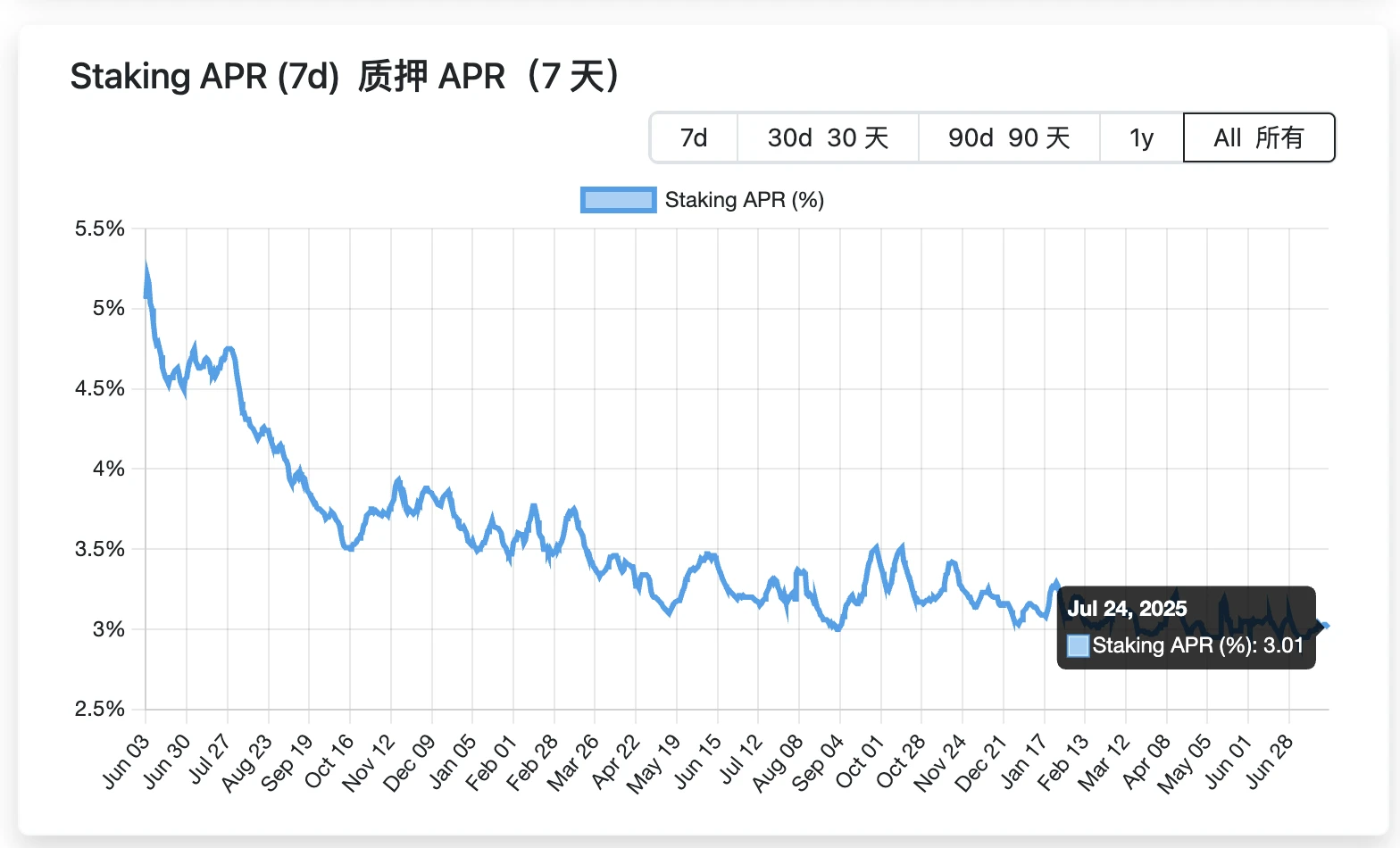

In addition, the total amount of ETH staked is currently about 35.6 million, accounting for about 29.46% of the total ETH, and the APR yield is about 3%.

Apart from the overall information, it is worth mentioning separately the information such as the waiting time for unstaking, the clearing delay time, the node validator queue and the 7-day staking income APR.

First, in terms of the waiting time for unstaking, on July 24, the time hit a record high of 11.13 days; in contrast, the previous record high occurred on January 5, 2024. According to crypto KOL Chen Jian (@jason_chen 998) , Celsius was in urgent need of money for bankruptcy liquidation at that time, and more than 500,000 ETH were unstaked in an instant, with a waiting time of up to 5.6 days.

But what is different from that time is that there was not enough demand for ETH staking, and the waiting time for ETH staking was 0 days; now, this number is about 5.67 days, which fully demonstrates that the demand for ETH staking in the market is still extremely strong.

ETH unstaking waiting time

Secondly, the sweep delay time. Here we need to briefly explain the sweep action, that is, how long it takes for the node pledge funds to be withdrawn to the corresponding address after passing through the exit queue. According to the above picture information, this time is currently about 9.5 days. In other words, the market still needs to wait for a certain period of time before it can usher in a real dumping test.

Again, in terms of node validator queue data, the number of validators exiting the queue has been growing exponentially in the past week. On July 24 alone, the number of node validators exiting ETH exceeded 640,000, while the number of node validators entering ETH was 326,800. Here we borrow the analysis of crypto KOL @0x_Todd and relevant information from the validatorqueue website to explain. In short, at present, each Epoch (32 blocks, each block takes 12 seconds to produce) can add/reduce a maximum of 8 nodes. If calculated according to 32 ETH per node (the current ETH staking node threshold), that is, 256 ETH/epoch in the above figure, the overall waiting time for unstaking and staking queues can be calculated. Subsequently, with the progress of the Prague upgrade, the upper limit of ETH deposited in a single ETH node has been increased from 32 to 2048. With the increase of large nodes, the staking and unstaking time will be greatly shortened.

Number of node validators in queue

Finally, the 7-day APR income change of ETH staking. Overall, the ETH staking yield is showing a gradual downward trend, which is also in line with the increase in the total amount of ETH and the increase in the total amount of staking, thereby diluting the staking income. From 5.2% in early June 2023, the current figure has dropped to 3.01%. Of course, compared with other cryptocurrencies, ETHs POS staking income is still a rare stable income, which is also the business of many US-listed companies that are determined to become ETH version of Strategy-Sharplink Gamings official information released yesterday shows that its Ethereum holdings are 360,807, and it has generated 567 ETH income through staking.

ETH staking 7-day return APR data

For more on-chain changes regarding ETH staking and unstaking, readers can also directly check https://beaconcha.in/ .

Exploring the reasons for the large-scale unpledging of ETH: Institutional intervention, or the Aave platform revolving loan turmoil?

Regarding the reasons behind the large-scale unstaking of ETH, the current mainstream views in the market mainly include the following three:

Reason 1: HTX and other institutions have released large-scale pledges

On-chain data shows that in the past week, two wallets of HTX have redeemed a total of 110,000 ETH, with a total value of over $400 million. According to on-chain analyst Yu Jin鈥檚 giám sát , since ETH broke through $3,000 on July 11, ETH has continued to flow from HTX to Binance. As of now, the cumulative inflow has reached 320,600, with a total value of approximately $1.123 billion based on the current average price, and an average transfer price of $3,504. Other institutions such as Abraxas Capital Mgmt have also carried out pledge redemption.

Reason 2: Aave platform revolving loan incident

According to the analysis of crypto blogger darkpool cited by on-chain data analyst Aunt Ai, the batch unpledging of 620,000 ETH may be related to the massive withdrawal of ETH deposits on the Aave platform, which led to a surge in borrowing interest rates.

The specific reasons are: Aave ETH deposits were withdrawn in large quantities in a short period of time, causing the borrowing interest rate to soar. Revolving loan players went from profiting from the interest rate spread to losses, and were forced to redeem stETH to deleverage, leading to the current situation. Aave ETH borrowing APR once soared to 10%, and the exit waiting period of Lido stETH has been extended to 21 days (normally within a week); the on-chain stETH is still exchanged for ETH at a discount of nearly 0.4%. Regarding the implementation of revolving loans, Aaves collateral rate for ETH is 93%, which means that arbitrage players can even use up to 14 times leverage to obtain interest rate spread income. Under normal circumstances, the annualized rate of return on the principal can reach 7%.

In other words, the rise in ETH has led to a large amount of ETH borrowing on the Aave platform, causing a surge in borrowing interest rates; revolving loan players have found that the leverage spread they once had has turned into a leverage loss, and have had to redeem stETH to reduce leverage, which has led to a surge in ETH pledge demand. For a more detailed explanation of this reason, please refer to the relevant article The real reason why ETH worth $1.9 billion is collectively queuing to unstake is… compiled by Galaxy on Odaily Planet Daily.

Reason 3: Institutional demand for increased holdings

This reason is my personal speculation.

According to SoSoValue data, the total net inflow of Ethereum spot ETFs on July 22 was $534 million, the third highest in history. Considering the recent ETH version of Strategy dispute that has attracted the demand for coin hoarding from listed companies and institutions such as SBET, BMNR and The Ether Machine, the unstaking of hundreds of thousands of ETH is undoubtedly the masterpiece of ETHs large holding clusters. It is very likely that part of the funds will be used for ETHs OTC and exchange inflows.

Dựa theo the monitoring of on-chain analyst Yu Jin, the address 0x8eE previously increased its holdings of 32,368 ETH (worth $116 million) through FalconX. Since July 19, the address has hoarded 138,345 ETH (worth $503 million), with an average price of $3,644; a whale/institution that hoarded ETH through Kraken increased its holdings of 8,223 ETH (worth $29.4 million) today. Since July 14, the address has accumulated a total of 58,156 ETH (worth $211 million), with an average price of $3,564.

In summary, demands such as ETF net inflows and ETH strategic reserves provide an outlet for large-scale unpledging of ETH, and the market demand for ETH remains strong.

Conclusion: The market has entered the ETH holders call each other SB moment

In stark contrast to the market in late June and early July, the current crypto market has entered a mutual SB moment, especially for ETH holders.

Unlike the previous one-sided ETH price continued to be weak when the market mocked ETH with contempt or ETH price gradually rose when the E guards were proud, as the BTC market broke through the historical high and then fell back to below $120,000, the market entered a state of divergence again, just like the people who are now divided into the ETH unstaking camp and the waiting camp. Now that Trumps tariff stick is gradually being implemented, whether the bull market of altcoins including ETH can continue, may usher in a phased trial in early August.

Take profit VS continue to push higher?

This article is sourced from the internet: ETH unstacking waiting time hits a new high, are Ethereum holders about to call each other stupid?

Original author: TechFlow In July, the crypto market saw another wave of activity. BTC has broken all-time highs, and ETH spot ETF has maintained net inflows for 9 consecutive weeks; and last week, ETH spot net inflows reached 850 million US dollars, setting a record. The pace of funds has never stopped, and the market feels like it is getting better again. However, the real catalyst may not be in the price curve, but in the U.S. House of Representatives in Washington, DC. From July 14 to 18, the House of Representatives announced Crypto Week and for the first time focused on reviewing three landmark bills: the GENIUS Act, the CLARITY Act, and the Anti-CBDC Act, targeting stablecoins, digital asset classification, and central bank digital currency (CBDC), respectively. This intensive…