Editors note: In the HypeVM ecosystem, there are several high-yield mining strategies worth paying attention to, including mining $HYPE tokens through HyperSwap and HyperLend, and using leveraged loop operations to increase holdings. The leveraged vault provided by Sentiment can also effectively increase returns, although there are certain risks. To protect capital, it is recommended to choose a team with a public identity and active in industry activities. In the Points Season, wise capital deployment can avoid losses.

Sau đây là nội dung gốc (để dễ đọc và hiểu hơn, nội dung gốc đã được sắp xếp lại):

The current market environment is not easy, but I hope that many of you still have some stablecoins in your hands, ready to invest in some profitable and productive operations.

There is still nearly one-third of the $HYPE supply to be distributed, and coupled with its strong price performance, everything related to $HYPE and its EVM is still a place where we can consider parking our funds.

This is also a macho-level ecosystem.

Today, we would like to highlight some new mining strategies in the Hyperliquid ecosystem:

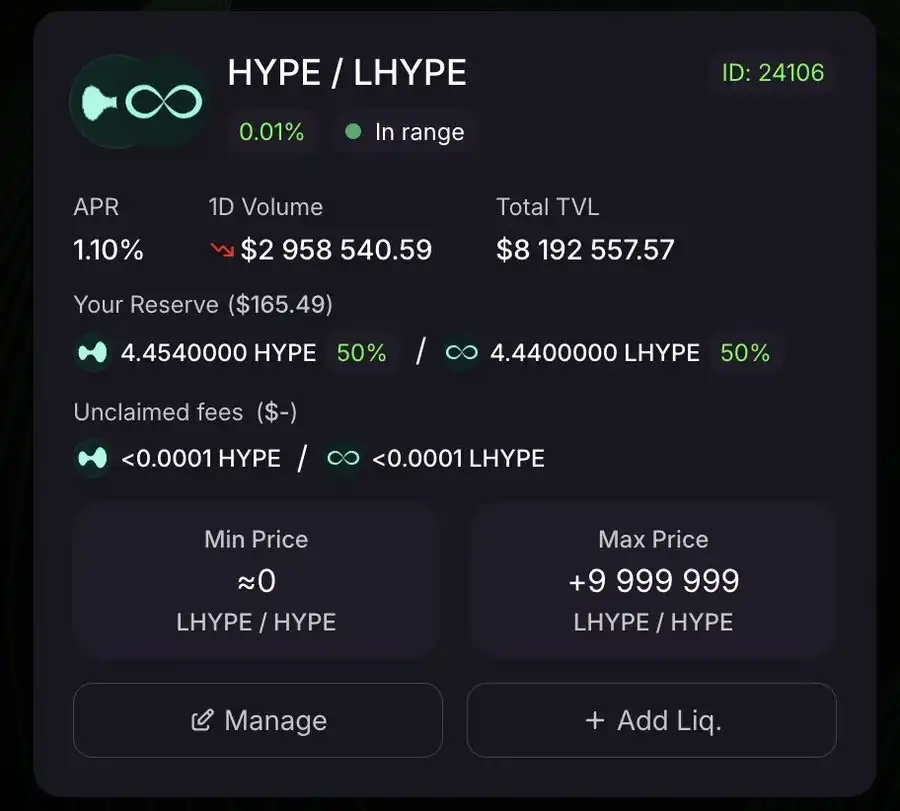

1. HyperSwap – @HyperSwapX

The mainstream decentralized exchanges on this chain have performed well in recent weeks, and TVL has also been rising rapidly.

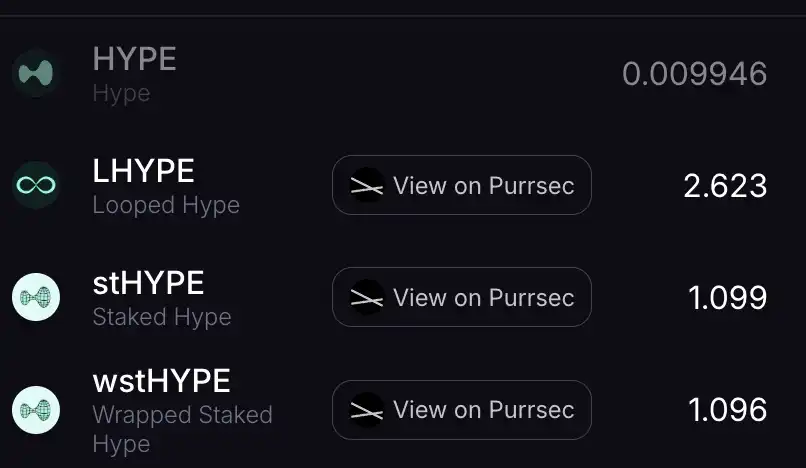

The strategy here is simple: buy $HYPE tokens on the order book, bridge to the EVM, and then buy some $LHYPE on loopedHYPE.

loopedHYPE is an innovative staking protocol that increases yields by looping and staking $HYPE; there is also stHYPE, another major staking service provider on the EVM.

Then, add some $HYPE and/or $LHYPE/$stHYPE liquidity on top. A true mining geek would, of course, do this repeatedly on multiple addresses.

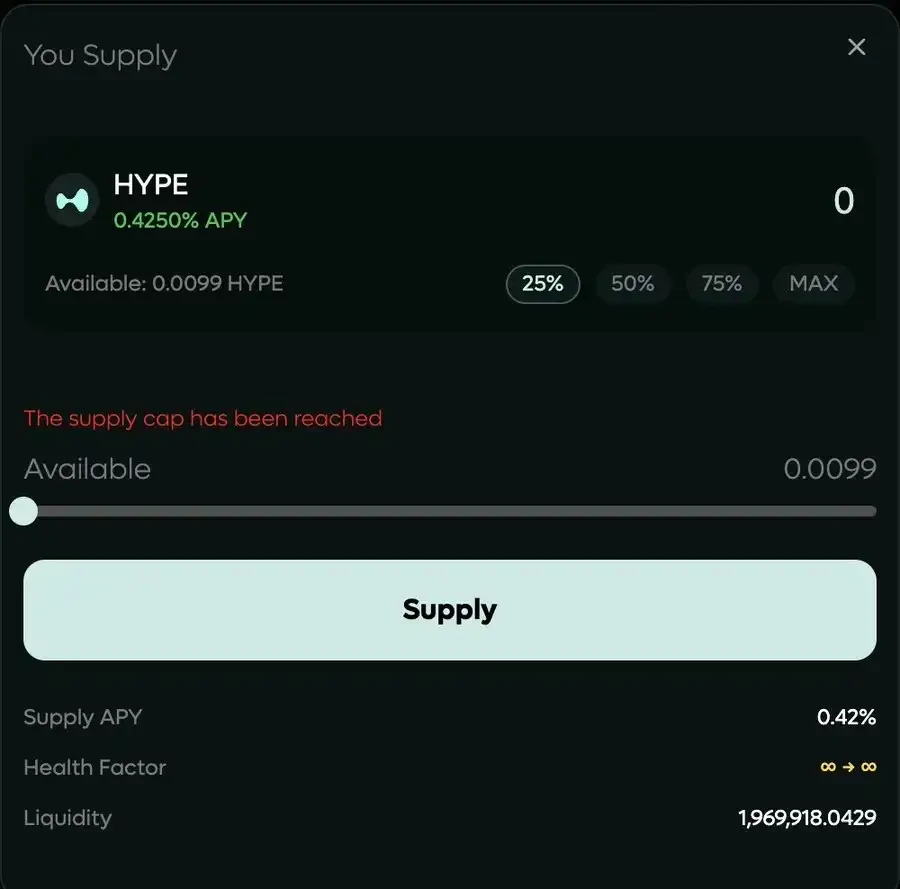

2. HyperLend is another obvious option for mining on HyperVM

Its goal is to become the native lending protocol on this chain. Since last month, HyperLend’s TVL has grown exponentially, which shows that we are bất chấpnitely not the only ones eyeing this.

However, all vaults are currently fully utilized.

In addition, I can only deposit a small amount of funds on some addresses at present, but the overall idea is: continue to pay attention to when more deposit space will be reopened, and then use multiple addresses to deposit/borrow $HYPE.

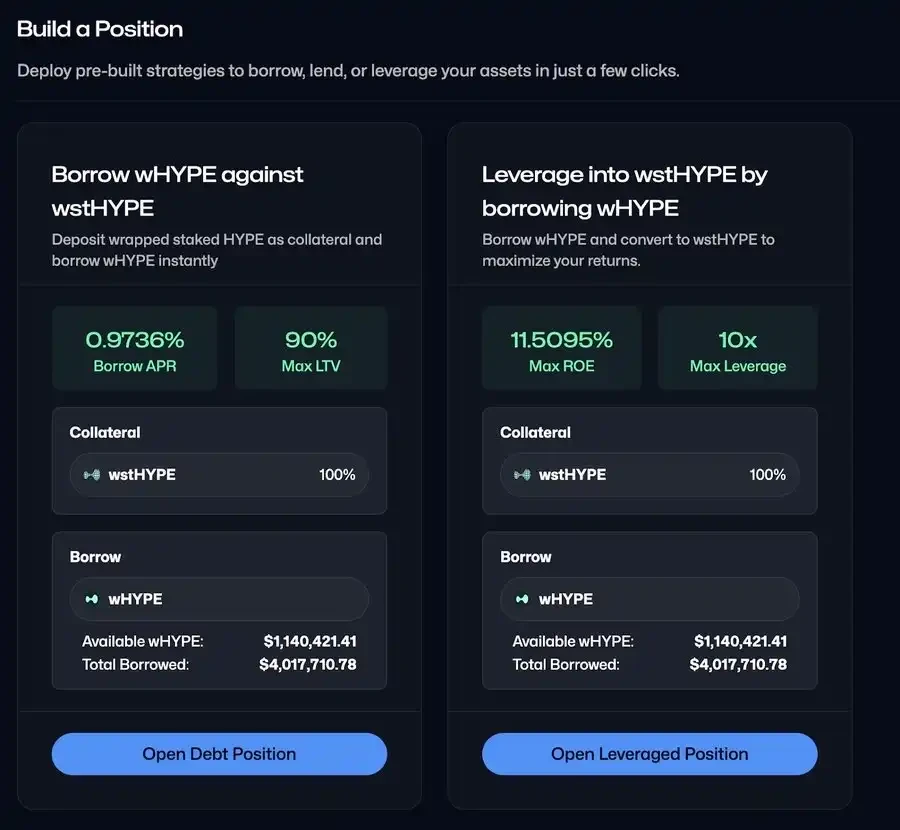

3. If you want to mine $HYPE, Sentiment is also a method worth paying attention to

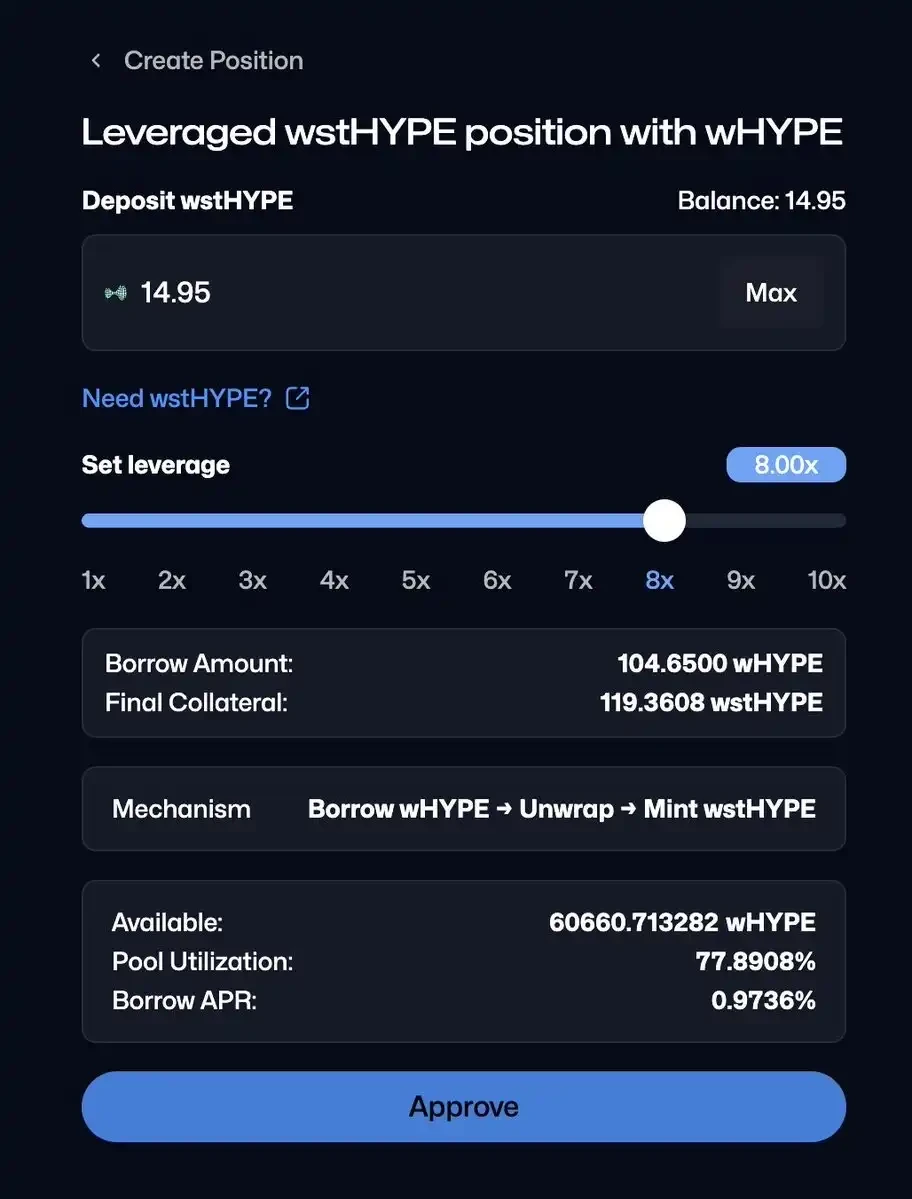

They offer a vault that can loop $HYPE with or without leverage, with the goal of increasing the amount of $HYPE a user holds while still being counted in the overall TVL. All you need to do is buy some $wstHYPE on Hyperswap and you can start looping. Choose your collateral, leverage, and of course, make your own decisions, NFA (not an investment advice).

In my opinion, this strategy, while risky, is great for accumulating points.

Tóm lại là

During the “points season” of mining, you must be careful about where your funds are deployed to avoid being “ripped off” or falling into some fraudulent contracts.

A simple trick to protect your capital? Choose teams that are public, have a real-life presence, and are active at conferences.

This article is sourced from the internet: Mining Strategy: How to earn good profits on HypeVM?

introduction Today, the importance of cross-chain bridges remains self-evident. However, the torrent of VC infrastructure coins also dimmed after the storm of inscriptions and Meme+AI. In this dull market , it is more appropriate to examine the evolution of history with objective emotions and take the opportunity to explore the immortal truth behind it. In 2023, LayerZero quickly rose to prominence with its unique ultra-light node architecture and became a star project in the cross-chain track. At that time, its valuation was as high as 3 billion US dollars. The LayerZero V2 version launched in 24 years brought 30 million on-chain cross-chain transactions, and it is also the industry leader. Omnichains vision has attracted many developers and gained the favor and investment of top institutions such as Sequoia Capital, a16z,…

见见你

hhh