September Web3 Funding Report: Capital Chases Liquidity and Maturity

Original translation by: AididiaoJP, Foresight News

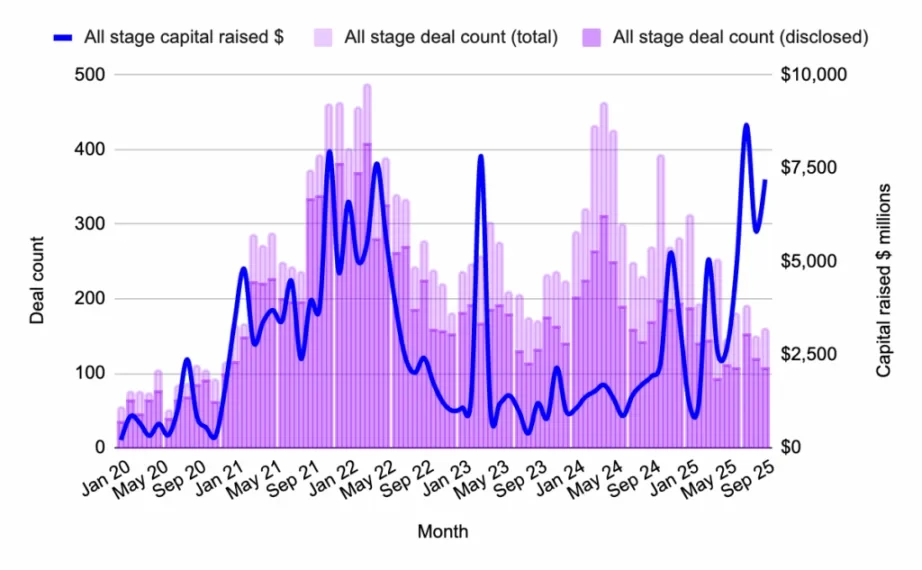

Web3 funding surged in September 2025 but did not reach its peak.

160 deals raised $7.2 billion, the highest total since the spring surge. However, with the notable exception of seed-stage Flying Tulip, later-stage capital investment dominated, as was the case in the previous two months.

بازار Overview: Strong but Top-Heavy

Figure 1: Number of Web3 capital deployments and transactions at each stage from January 2020 to September 2025. Source: Messari, Outlier Ventures.

- Total capital raised (disclosed): US$7.2 billion

- Disclosed transactions: 106

- Total transactions: 160

At first glance, September appears to be a high-profile return of risk appetite. However, with the exception of Flying Tulip, most capital investment has flowed into later-stage companies. This is a continuation of a trend we’ve observed in our recent quarterly market reports and aligns with VC insights we gathered at the ٹوکن2049 Singapore conference. September 2025 further demonstrates that while early-stage deal activity remains robust, real money is seeking maturity and liquidity.

Market Highlight: Flying Tulip ($200 million seed round, $1 billion valuation)

Flying Tulip raised $200 million in its seed round at a unicorn valuation. The platform aims to unify spot trading, perpetual contracts, lending, and structured yields into a single on-chain exchange, employing a hybrid AMM/order book model and supporting cross-chain deposits and volatility-adjusted lending.

Web3 Venture Fund: Shrinking in Size

Figure 2: Number of Web3 venture capital funds launched from January 2020 to September 2025 and the capital raised. Source: Messari, Outlier Ventures.

New funds in September 2025:

- Onigiri Capital, $50 million: Focused on early-stage infrastructure and fintech in Asia.

- Archetype Fund III, $100 million: focused on modularity, developer tools, and consumer protocols.

Fund launches cooled in September 2025. Only two new funds were launched, both relatively small in size and highly focused on a single theme. This trend points to selectivity rather than a slowdown: venture capitalists are still raising funds, but around sharper, more focused themes.

Pre-seed rounds: A downward trend lasting 9 months

Figure 3: Number of pre-seed stage capital deployments and deals from January 2020 to September 2025. Source: Messari, Outlier Ventures.

- Total capital raised: US$9.8 million

- Disclosed transactions: 5

- Median funding round: $1.9 million

Pre-seed funding continues to decline, both in terms of the number of deals and the amount of capital raised. This stage remains weak, with few high-profile investors participating. Funding is scarce for founders at this stage, but those that do successfully raise funds do so because of a compelling narrative and strong technological conviction.

Pre-seeding highlight: Melee Markets ($3.5 million)

Melee Markets, built on Solana, allows users to speculate on influencers, events, and trending topics, combining prediction markets and social trading. Backed by Variant and DBA, it’s a clever attempt to capture attention streams as asset classes.

Seed Round: Tulip Mania

Figure 4: Number of seed-stage capital deployments and deals from January 2020 to September 2025. Source: Messari, Outlier Ventures.

- Total capital raised: US$359 million

- Disclosed transactions: 26

Seed-stage funding saw significant growth, but this was entirely thanks to Flying Tulip’s $200 million round. Without it, funding in this category would have been roughly the same as in previous months.

More importantly, Flying Tulip’s structure is not typical fundraising. Its on-chain redemption rights provide investors with capital security and yield exposure without sacrificing upside potential. The project is not consuming its own funding; instead, it uses DeFi yields to finance its growth, incentives, and buybacks. This is a capital-efficient, DeFi-native innovation that could influence how future protocols self-fund.

While Flying Tulip investors do have the right to withdraw these funds at any time, it is still a significant capital investment for Web3 venture capitalists who would otherwise have invested in other early-stage projects through less liquid instruments: namely SAFE and/or SAFT. This is another manifestation of the current trend among Web3 investors to seek exposure to more liquid assets.

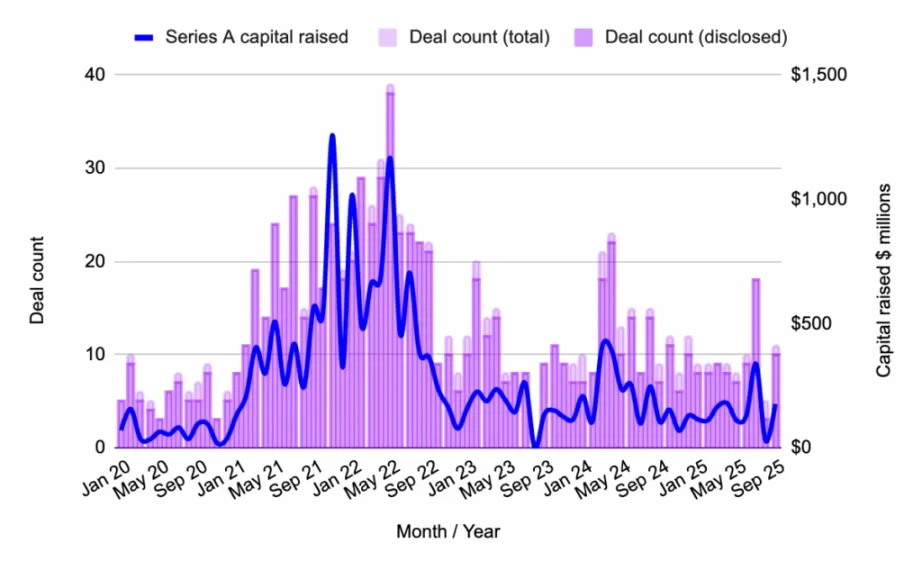

Series A: Tends to Stabilize

Figure 5: Number of Series A funding rounds and deals from January 2020 to September 2025. Source: Messari, Outlier Ventures.

- Total capital raised: US$177 million

- Disclosed transactions: 10

- Median funding round: $17.7 million

After a sharp decline in August, Series A activity recovered slightly in September, but it wasn’t a breakout month. Deal volume and deployed capital were just around the 2025 average. Investors remained selective, favoring later-stage momentum over chasing early-stage growth.

Series A Highlights: Digital Entertainment Asset ($38 million)

Singapore-based Digital Entertainment Asset has raised $38 million to build a Web3 gaming, ESG, and advertising platform with real-world payment capabilities. Backed by SBI Holdings and ASICS Ventures, the move reflects the growing interest in integrating blockchain with mainstream consumer industries in Asia.

Private token sale: Huge sums of money, participation from prominent figures

Figure 6: Capital Deployment and Transaction Volume of Private Token Sales from January 2020 to September 2025. Source: Messari, Outlier Ventures.

- Total capital raised: US$180 million

- Disclosed transactions: 2

Private token activity remains concentrated, with a single massive funding round completing the process. The pattern of recent months continues: fewer token rounds, larger checks, and exchange-driven gameplay absorbing liquidity.

Highlight: Crypto.com ($178 million)

Crypto.com has raised a massive $178 million, reportedly in partnership with Trump Media. The exchange continues to push for global accessibility and mass-market کرپٹو payment tools.

Public Token Sale: Bitcoin’s Profit Moment

Figure 7: Capital Deployment and Transaction Volume of Public Token Sales from January 2020 to September 2025. Source: Messari, Outlier Ventures.

- Total capital raised: US$126.2 million

- Disclosed transactions: 16

Public token sales remain active, driven by two compelling narratives: Bitcoin yield (BTCFi) and AI agents. This serves as a reminder that public markets are still chasing narratives.

Highlight: Lombard ($94.7 million)

Lombard is bringing Bitcoin to DeFi with the launch of LBTC, an interest-bearing, cross-chain, liquid BTC asset designed to unify Bitcoin liquidity across ecosystems. This is part of the growing “BTCFi” trend, where users earn DeFi yields through BTC.

یہ مضمون انٹرنیٹ سے لیا گیا ہے: September Web3 Funding Report: Capital Chases Liquidity and MaturityRecommended Articles

Related: Learn all about LBank’s $100 million bonus in one article

近日,为庆祝成为阿根廷国家队区域赞助商,LBank 重磅推出总价值达 1 亿美元的增强版赠金福利($100 M Bonus Pro)。全民可领、100%增强版赠金、个人无上限。福利上线即引发海内外加密圈关注,成为近期最受欢迎的免费赠金计划之一。 本文将带你全面了解福利机制、参与方式与申领操作流程,并提供实用交易建议,助你用好每一笔增强版赠金。 LBank 增强版赠金福利总奖池高达 1 亿美元,全球用户均可参与。福利采用 100%赠金发放机制,先到先得,赠完即止。用户可通过两种方式领取增强版赠金:第一,参与活动即可一次性领取 100 U 增强版赠金;第二,合约充值立返 100%,每笔划转均可获得 100%等额增强版赠金,且个人奖励无上限。 领取增强版赠金攻略 要申领 LBank 1 亿美元增强版赠金,你需要登录 LBank 官网 或打开 App,进入 1 亿美元增强赠金 页面,点击“参与”(必选项) 方式 1:参与活动,秒领 100 U 增强版赠金 参与优势: 该方式无需充值、零成本参与,参与活动即可领取$100 增强版赠金,增强版赠金可直接用于合约交易,产生盈利后可提现,助你轻松开启实盘交易体验。 适用对象:不限,新用户或 LBank 老用户都可 注册或登陆后,立即点击”领取“即可获得 100 U 增强版赠金 增强版赠金到账后即可直接用于合约交易 方式 2:合约充值,100%增强版赠金无上限 参与优势:该方式增强版赠金比例高达 100%,每笔划转至合约账户均可获得等额增强版赠金,划转越多,增强版赠金越多,且个人奖励无上限,支持多次划转,适合大资金用户,也受到小资金用户青睐。增强版赠金即时到账,可与本金一起配合使用于合约交易,盈利部分可自由提取,助你高效撬动市场机会。 适用对象: 所有 LBank 用户 点击“领取”开始获得 100% 增强版赠金福利 从「现货账户」划转资金至「合约账户」 系统将根据划转金额 1:1 发放增强版赠金,如划转 1000 U,将立即获得$1000 增强版赠金 增强版赠金如何使用?这些技巧帮你放大盈利机会 LBank 合约市场排名已跻身全球 TOP 4,在 Meme 币、山寨币合约领域表现尤为突出,新币上线速度快,潜在 100 x 机会丰富,并设立 1 亿美元风险保障基金,为用户交易保驾护航。 与传统空投不同,LBank 增强版赠金可搭配本金直接用于合约市场,尤其适用于中小资金、短线策略用户。灵活运用增强版赠金策略,不仅能放大你的交易杠杆,还能实现“零成本练兵 + 实盘盈利”双重目标。对于想快速提升交易能力、验证策略的用户而言,这是一场不可多得的实战机会。操作建议: 小额高频交易: 利用增强版赠金聚焦波动性较高的 Meme 币或山寨币合约,抓住日内 10%~30% 的行情机会,快速实现短线盈利。 稳健策略组合: 搭配轻仓位操作,设置合理的止盈止损点,构建“低风险 + 高弹性”的交易结构,提升增强版赠金使用效率,控制风险同时放大收益空间。 T+0 高频操作: 借助增强版赠金优势,灵活应对市场价格异动,实现快进快出,把握更多即时套利窗口。 当世界杯冠军精神遇上加密创新,LBank 1 亿美元增强版赠金,是一场极具诚意的合约福利共享之旅,既降低了交易门槛,也极大放大了用户的潜在收益空间。现在报名,一键开启你的 1 亿美元增强版赠金福利共享之旅。 福利入口:LBank 官网 $100 M Bonus Pro 页面This article is sourced from the internet: Learn all about LBank’s $100 million bonus in one articleRecommended ArticlesRelated: Is the end of traditional banks approaching? Tether’s…