The re-pledge track cools down: the transformation and breakthrough of leading projects

Original title: EigenLayer and Ether.fi both transformed, can the staking track business no longer be done?

Original author: Fairy, ChainCatcher

Original editor: TB, ChainCatcher

In the first half of 2024, the concept of secondary returns set off a market frenzy, and re-staking became a core topic sweeping the การเข้ารหัสลับ ecosystem. EigenLayer rose, and projects such as Ether.fi and Renzo emerged one after another, and re-staking tokens (LRT) blossomed everywhere.

However, the two leading projects in the track have now chosen to transform:

-

Ether.fi announced its transformation into a crypto neobank, planning to launch cash cards and staking services for US users;

-

Eigen Labs announced that it would lay off approximately 25% of its employees and reorganize its resources to focus fully on its new product EigenCloud.

The once hot re-pledge has now reached a turning point. Does the strategic adjustment of the two leading companies indicate that this track is becoming ineffective?

Emergence, boom and clearance

In the past few years, the re-pledge track has gone through a cycle from conceptual testing to intensive capital influx.

According to RootData data, more than 70 projects have been born in the re-staking track. EigenLayer of the Ethereum ecosystem is the first project to bring the ReStaking model to the market, and has spawned a collective outbreak of liquidity re-staking protocols such as Ether.fi, Renzo, and Kelp DAO. Subsequently, new architecture projects such as Symbiotic and Karak also appeared one after another.

In 2024, the number of financing events surged to 27, attracting nearly $230 million throughout the year, becoming one of the hottest tracks in the crypto market. In 2025, the pace of financing began to slow down, and the overall heat of the track gradually cooled down.

At the same time, the reshuffle of the track is accelerating. Currently, 11 projects including Moebius Finance, goTAO, and FortLayer have been shut down one after another, and the early bubbles have been gradually cleared.

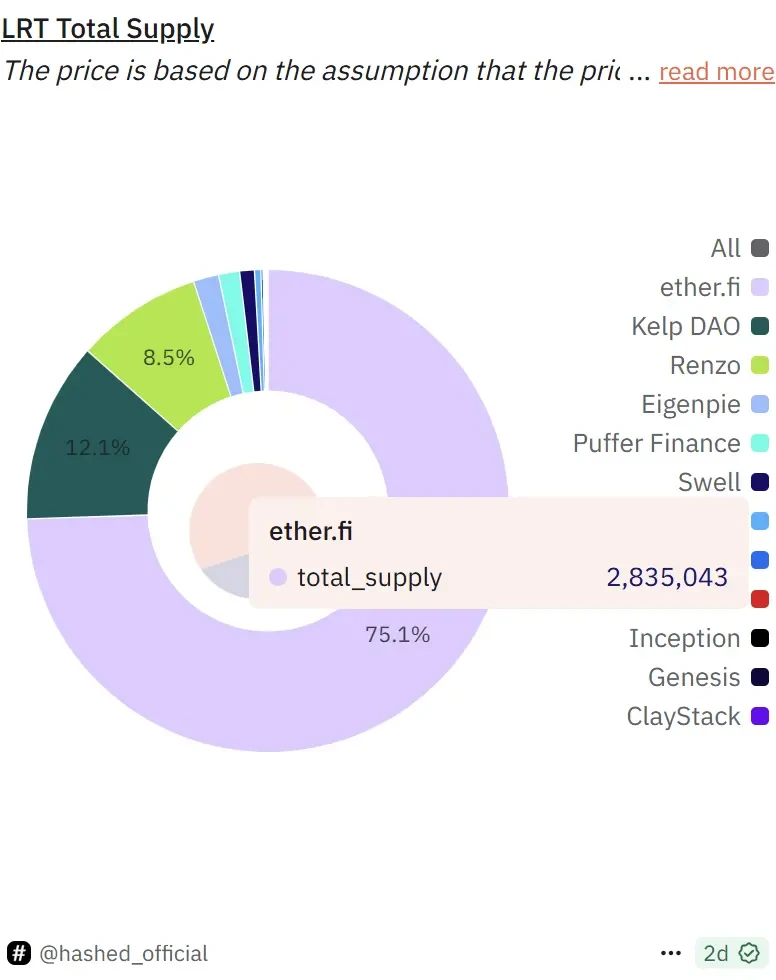

Currently, EigenLayer is still the leader in the field, with a TVL of about $14.2 billion, accounting for more than 63% of the market share in the industry. In its ecosystem, Ether.fi occupies about 75% of the share, Kelp DAO and Renzo account for 12% and 8.5% respectively.

Narrative Weightlessness: The Cooling Signal Behind the Data

As of now, the total TVL of the re-staking protocol is about 22.4 billion US dollars, which has dropped by 22.7% compared with the historical peak of about 29 billion US dollars in December 2024. Although the overall locked volume is still high, the growth momentum of re-staking has shown signs of slowing down.

Image source: Deflama

The decline in user activity is even more significant. According to data from The Block, the number of daily active deposit users of Ethereum liquidity re-staking has dropped sharply from the peak of thousands in July 2024 to only more than 30 people at present, and the number of daily independent deposit addresses of EigenLayer has even dropped to single digits.

Image source: The Block

From the perspective of validators, the attractiveness of re-staking is also weakening. Currently, the number of active re-staking validators on Ethereum is less than 3% compared to regular staking validators.

In addition, the token prices of projects such as Ether.fi, EigenLayer, and Puffer have all fallen back by more than 70% from their highs. Overall, although the re-staking track still has a certain volume, user activity and enthusiasm for participation have declined significantly, and the ecosystem is falling into a weightless state. The narrative-driven effect has weakened, and the track growth has entered a bottleneck period.

Transformation of leading projects: Can the pledge business no longer be carried out?

When the airdrop period bonus fades and the heat of the track subsides, the predictable yield curve tends to be smoother, and then the staking projects begin to face the question: How can the platform achieve long-term growth?

Take Ether.fi as an example. It achieved revenue of over 3.5 million USD for two consecutive months at the end of 2024, but by April 2025, the revenue fell back to 2.4 million USD. In the reality of slowing growth momentum, a single re-staking function may be difficult to support a complete business story.

It was also in April that Ether.fi began to expand its product boundaries and transform itself into a new crypto bank, building a closed loop of financial operations through real-world scenarios such as bill payment, salary distribution, savings and consumption. The dual-track combination of cash card + re-pledge has become a new engine for it to try to activate user stickiness and retention.

Different from Ether.fis application layer breakthrough, EigenLayer chooses a reconstruction that is more inclined towards the infrastructure strategy level.

On July 9, Eigen Labs announced that it would lay off about 25% of its employees and focus resources on its new product developer platform EigenCloud, which attracted a new round of $70 million investment from a16z. EigenCloud integrates EigenDA, EigenVerify, and EigenCompute, attempting to provide a universal trust infrastructure for on-chain and off-chain applications.

Although the transformation paths of Ether.fi and EigenLayer are different, they are essentially two solutions pointing to the same logic: changing re-staking from an end-point narrative to a starting module, and from a purpose in itself to a means of building more complex application systems.

Re-staking is not dead, but its single-threaded growth model may be difficult to continue. Only when it is embedded in a narrative of applications with greater scale effects can it continue to attract users and capital.

The mechanism design of the re-pledge track, which ignites market enthusiasm with secondary returns, is now looking for new landing points and vitality in a more complex application map.

This article is sourced from the internet: The re-pledge track cools down: the transformation and breakthrough of leading projects

In the traditional narrative of wealth inheritance, cash, real estate and precious metals have long occupied the core. However, when the market value of Bitcoin has jumped to the fifth largest asset in the world, surpassing Amazon and Google, and approaching Apple and Nvidia, a new logic of intergenerational inheritance is emerging: more than 33% of respondents prefer to pass on their wealth with crypto assets, surpassing traditional assets such as cash, real estate and gold. On the occasion of June 1st International Childrens Day, OKX jointly launched the Wealth and Courage Across Time: Bitcoin Inheritance Survey Questionnaire with five industry media including PANews, BlockBeats, Golden Finance, Planet Daily, and Chaincatcher, covering more than 5,000 crypto users in the industry. The survey group is positioned as users who have a…