July’s Big Economic Events at a Glance: A Key Timeline for Crypto Traders

จุดสำคัญ

-

Key volatility time: July 3 (US non-farm payrolls), July 15 (US CPI China GDP), July 24 (ECB decision) and July 29-30 (Federal Reserve interest rate meeting) are expected to trigger large market fluctuations, which will have a key impact on the trends of BTC and ETH.

-

Geopolitical focus in mid-July: The G20 Finance Ministers Meeting and key nodes in the China-US tariff negotiations are approaching, which may trigger a rise in risk aversion and affect the direction of การเข้ารหัสลับ assets.

-

Strategy on the day of the event: Consider using methods such as two-way take profit and stop loss or conditional mutually exclusive orders to capture volatility opportunities near key support and resistance levels without forcibly judging the direction.

-

On-chain trends: Pay close attention to data such as stablecoin minting/destruction, inflows and outflows of pledged funds, and changes in trading volume, which will help you gain insight into the movements of large funds.

As macroeconomic variables and policy expectations increasingly affect the crypto market, smart traders have long regarded the traditional economic calendar as a key tool to control market fluctuations. In July 2025, the world will usher in intensive inflation data releases, central bank policy meetings and geopolitical events, which may cause severe fluctuations in Bitcoin (BTC) , อีเธอเรียม (ETH) and even the entire crypto market.

From the US CPI and non-farm payrolls to the interest rate decisions of the European Central Bank and the Federal Reserve, each key moment may have a direct impact on the BTC price , ETH price , and spot and derivatives trading volumes.

Whether you are observing BTC spot flows on major exchanges, planning to participate in Bitcoin staking , or looking for stable income products like XT Earn , understanding the linkage between macro data and the crypto market will determine the quality of your operations in the market.

นี้ แนะนำ will break down the key events of July for you week by week, analyze the impact that each week may have on the price of the currency, and share practical trading strategies for different situations. Start planning your trading plan for this month now to prepare for a wave of possible ups and downs and trading opportunities.

Table of contents

July Economic Calendar· Weekly Key Points Analysis

How to trade around economic data

Risk Management and Common Pitfalls

July Macro and Policy Overview

Interest rate signals and liquidity trends

July will see important meetings of the Federal Reserve, the European Central Bank, the Bank of Japan, and the Peoples Bank of China. Once the market senses the expectation of a rate cut or the signal that the central bank will maintain an accommodative stance, a new round of liquidity may be released. This usually means that funds will flow into high-growth asset markets, including the Bitcoin spot และ อีเธอเรียม trading markets.

At the same time, when the yields of U.S. Treasuries, German bonds or Japanese bonds fall, the attractiveness of crypto asset staking and DeFi strategies will be relatively enhanced, surpassing holding cash.

Inflation data and foreign exchange fluctuations

Focus on three key data:

-

July 15 US CPI

-

July 18 Eurozone preliminary inflation data

-

Mid-July Chinas second quarter GDP

If the US CPI is higher than expected, it may push up bond yields and strengthen the US dollar, prompting investors to lock in profits in BTC และ ผลประโยชน์ทับซ้อน . On the contrary, if inflation falls and the purchasing power of fiat currency declines, the market will be more inclined to the digital gold narrative, and Bitcoin and the overall crypto market may rebound accordingly.

Geopolitical and regulatory risks

Other key regulatory and policy events in July include:

-

G20 Finance Ministers Meeting

-

End date of the China-U.S. tariff buffer period

-

EU MiCA Stablecoin Regulation Officially Implemented

These events may trigger short-term market fluctuations. Investors may turn to traditional safe-haven assets such as gold, or switch to compliant income platforms such as XT Earn . Paying close attention to these policies and international developments will help you more accurately grasp the timing of entering and exiting Bitcoin spot , อีเธอเรียม (ETH) and mainstream stablecoin funding pools.

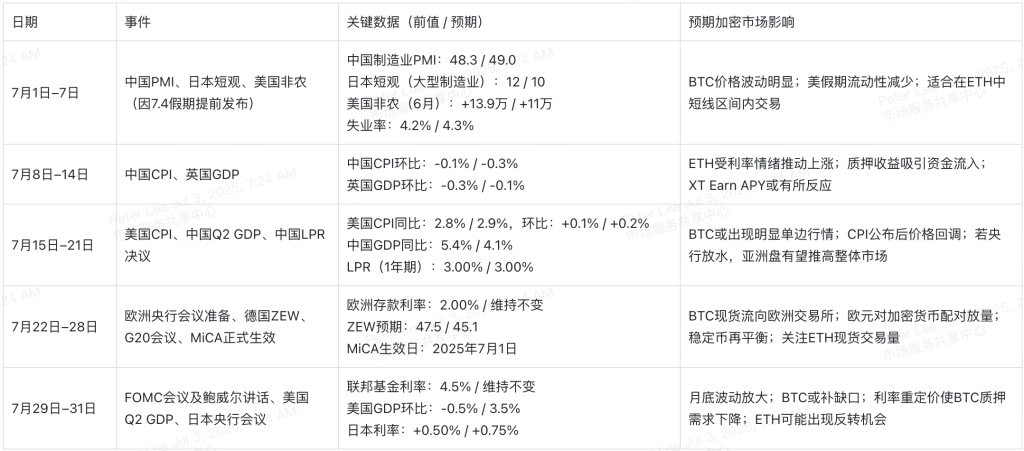

July Focus Schedule

Central bank meetings

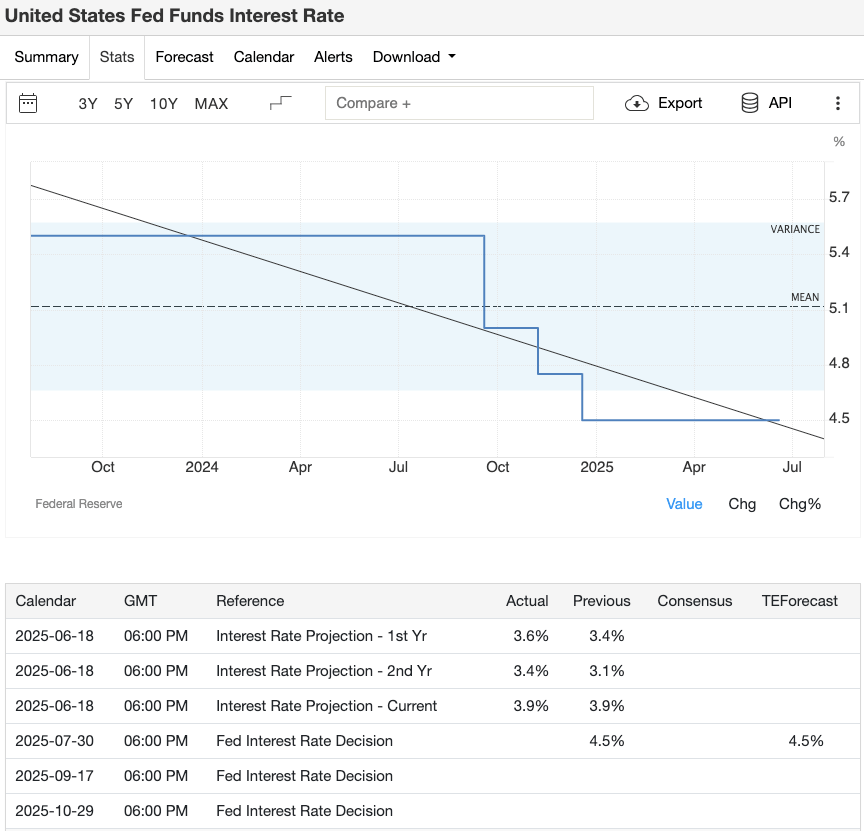

Federal Reserve Meeting (July 29-30)

-

If the current interest rate is maintained or a hawkish signal is released, it may trigger a pullback in บิทคอยน์ and risky assets

-

If dovish signals are released, the market usually rebounds, and ผลประโยชน์ทับซ้อน and DeFi sectors perform particularly well.

-

It is recommended to pay attention to federal funds futures and US Treasury yields to gain insight into changes in market expectations

Image Credit: New York Times (Jerome H. Powell, Federal Reserve chair)

As the end of the month approaches, the market will focus on the Fed meeting. If Chairman Powell and officials hint that interest rates will remain unchanged or rise further, risk assets such as บิทคอยน์ will usually be under pressure; if there is a hint of a rate cut, the market tends to rebound quickly, and อีเธอเรียม and DeFi sectors may lead the gains. It is recommended to pay close attention to changes in federal funds futures and US Treasury yields to find the markets initial reaction to policy attitudes.

ECB meeting (July 24)

-

Deposit rate remains at 2%, with possible guidance on future rate cuts

-

The strength of the euro and European market risk sentiment will affect the BTC spot trading volume denominated in euros

-

Pay attention to EUR/USD fluctuations and the flow direction of euro stablecoins

Image Credit: RTE.ie (ECB HQ)

On July 24, the European Central Bank will announce its latest interest rate decision and give a policy outlook. If President Lagarde speaks cautiously, it will often drive Eurozone investors into the crypto market, especially the Bitcoin /Euro trading volume will increase significantly. If it is not in a hurry to cut interest rates, the strengthening of the euro may suppress the flow of funds into the crypto market. It is recommended to pay attention to the EUR/USD exchange rate and the changes in the on-chain and exchange liquidity of euro-denominated currencies.

Bank of Japan meeting (July 30-31)

-

Even a small adjustment to yield curve control could boost the yen and weigh on crypto assets

-

It is recommended to pay attention to the fluctuations of Japanese government bond yields and USD/JPY

Image Credit: Reuters (Bank of Japan Governor Kazuo Ueda)

The Bank of Japans month-end meeting will focus on whether it adjusts its yield curve control strategy. Even if the 10-year JGB yield is only allowed to rise slightly, the yen may strengthen, putting pressure on crypto assets in the Asian market. It is recommended to pay attention to the linkage changes between the JGB yield and the USD/JPY, which often indicates the trend of บีทีซี และ ผลประโยชน์ทับซ้อน during the Tokyo and Hong Kong trading hours.

Peoples Bank of China (July 20)

-

If the loan market benchmark rate (LPR) is lowered, new market liquidity may be released

-

Pay attention to the BTC contract trading volume in the Asian market and the order depth of local exchanges

Image Credit: Bloomberg (Peoples Bank of China Governor Pan Gongsheng)

Chinas LPR will be announced in mid-July. If there is an unexpected interest rate cut, it will usually stimulate market liquidity inflows, including boosting Bitcoin contract trading on local exchanges. It is recommended to pay attention to the order book depth on the chain and the exchange, as well as the changes in the open interest of the contract, to capture rebound signals. Policy easing is often reflected fastest in the Asia-Pacific market.

Key economic data

Geopolitical and regulatory matters

G20 Finance Ministers Meeting (mid-July)

Hosted by South Africa, this G20 focuses on global financial stability and crypto asset regulation. If there is a push for crypto regulation or global consensus on anti-money laundering, it may affect ผลประโยชน์ทับซ้อน liquidity and stablecoin trading strategies.

Image Credit: capetownetc

The suspension period of China-U.S. tariffs expires (around August 1)

The 90-day tariff ceasefire agreement between China and the United States will expire in early August. If no extension agreement is reached, it may trigger an increase in market risk aversion, causing the Bitcoin spot order book to thin rapidly and funds to turn to fiat currency or stablecoins for risk aversion.

Image Credit: The Detroit News

EU MiCA stablecoin regulations officially come into effect (July)

With the full implementation of the EU Crypto-Asset ตลาด Regulation (MiCA), stablecoin issuers are required to hold reserves at a 1:1 reserve ratio and obtain regulatory approval. It is expected that the market will shift from non-compliant stablecoins to compliant stablecoins backed by the euro, and on-chain minting and redemption data and exchange liquidity will reflect this change.

Image Credit: Yahoo Finance

July economic calendar: week-by-week breakdown

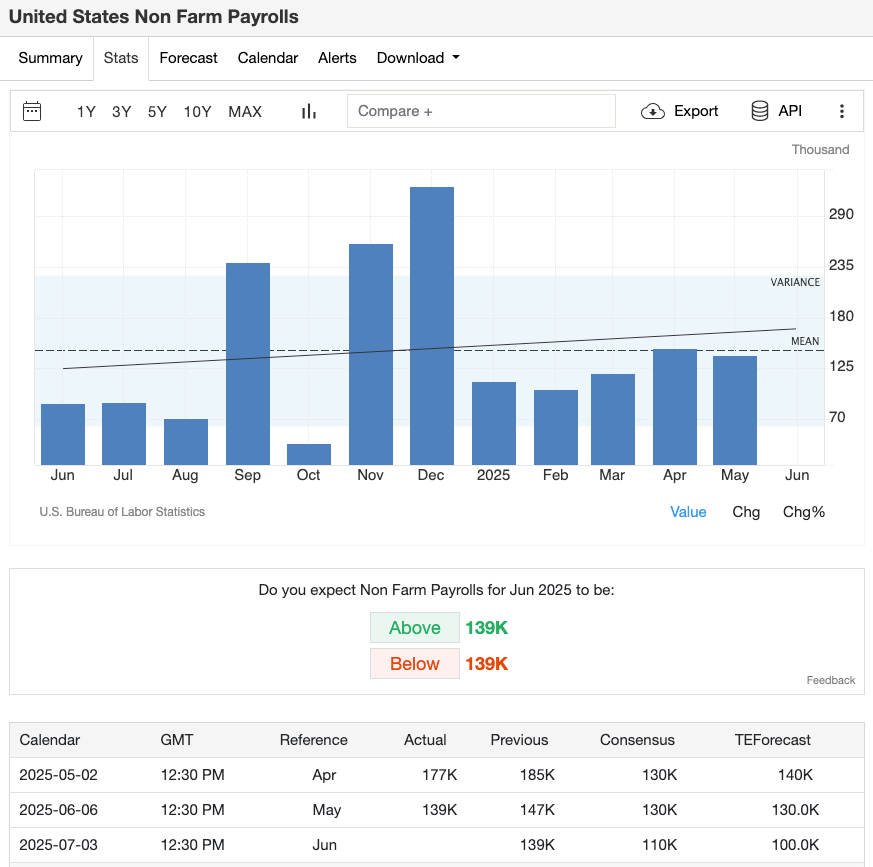

Week 1 (July 1–7)

-

– China PMI Japan Tankan: As an early signal of the market, if PMI is better than expected, บีทีซี and Asian concept altcoins may usher in a corrective rebound; if Japans Tankan is weak, the mining sector and related tokens may be under pressure.

-

– US non-farm payrolls: Due to the US Independence Day holiday, the market trading hours are shortened and liquidity is weak, which may lead to sharp price fluctuations. Traders should appropriately expand the stop loss range, or transfer idle funds to stable income products such as XT Earn , and wait for the market to return to normal rhythm.

Image Credit: Trading Economics

July begins with the release of Chinas official PMI and Japans Tankan survey, which are often seen as a barometer of business confidence in the Asia-Pacific region and will affect risk appetite in the global market to a certain extent. If Chinas manufacturing PMI is unexpectedly strong, บีทีซี and altcoins highly correlated with the Asian market (such as miner coins and Asian concept tokens) may rebound in the short term; on the contrary, if Japans Tankan survey shows weak confidence in the manufacturing industry, market sentiment will be suppressed, and related tokens and miner sectors may be under downward pressure.

In addition, July 4th is the Independence Day in the United States, and the market trading hours are shortened or closed. Historically, the liquidity of the crypto market often drops significantly during this period, and price fluctuations are often amplified. For traders, it is recommended to increase the stop loss range of BTC spot positions during this period, or transfer idle funds to stable income products such as XT Earn , and wait for the market to return to normal rhythm before re-entering the market.

Week 2 (July 8–14)

-

– Chinas inflation UK GDP: If Chinas CPI is lower than expected, it is expected to stimulate market risk appetite and push up ผลประโยชน์ทับซ้อน ; if UK GDP unexpectedly falls, it may temporarily suppress บีทีซี , but it may also bring opportunities for bargain hunting.

Image Credit: Trading Economics

China will release June CPI data earlier this week. If inflation continues to be weak, it will strengthen the expectation of global interest rate cuts, which will help risky assets (such as อีเธอเรียม ) to return to a staged high. Soon after, the UK will release the initial GDP value for June. If there is an unexpected negative growth, although it will disturb the market in the short term, it may also provide บีทีซี with an opportunity to buy on dips.

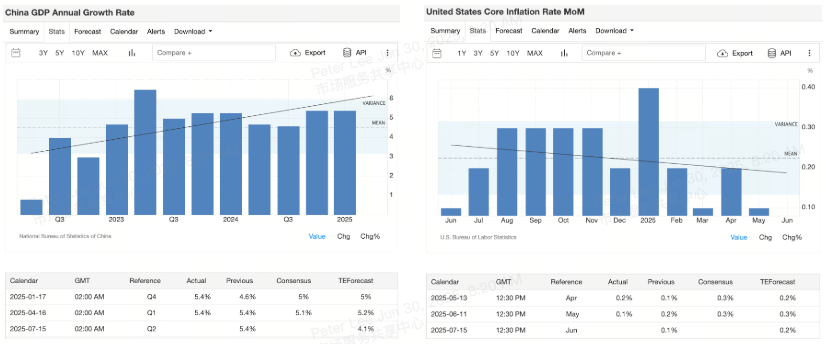

Week 3 (July 15–21)

-

US CPI China Q2 GDP: Two major data often trigger violent fluctuations. If US CPI is higher than expected, it will trigger short-term profit-taking of BTC ; if Chinas GDP is impressive or the central bank releases a signal of interest rate cuts, the Asian trading session is expected to provide support.

-

Chinas LPR: If it is adjusted downward, it will be conducive to the release of liquidity, and the mining concept and altcoins may usher in short-term rotation opportunities.

Image Credit: Trading Economics ( China GDP Growth US Core CPI )

This week will see the release of two important macro data: US CPI and Chinas second quarter GDP. If US inflation rises beyond expectations, it will push up US bond yields and the US dollar index, leading to short-term profit-taking in บิทคอยน์ ; on the contrary, if Chinas GDP performs strongly or the Peoples Bank of China releases a signal of a LPR interest rate cut, market liquidity will pick up, and mining tokens and small-cap altcoins may attract capital rotation.

It is recommended to focus on the market performance during the Asian trading session, which often reacts to good news first.

Week 4 (July 22–28)

-

ECB meeting preparation German ZEW index: The market generally expects a pause in interest rate hikes in July. If Lagarde releases dovish remarks, the euro will rise against crypto assets; ZEW reflects the eurozones macro expectations in advance.

-

G20 MiCA takes effect: If the G20 expresses a positive attitude towards crypto regulation, Ethereum liquidity will be released; after MiCA is officially implemented, the market will flow from non-compliant stablecoins to compliant stablecoins backed by the euro, and the arbitrage space may be temporarily narrowed.

Image Credit: The Globe and Mail

On July 24, the European Central Bank will hold a monetary policy meeting. The market generally expects that it will stand still, so Lagardes speaking style is crucial. If her tone is mild, the market may interpret it as continued easing, which will help boost the trading volume of euro-denominated cryptocurrencies; on the contrary, if she is cautious, trading enthusiasm may be limited.

Germanys ZEW economic sentiment index will also be released this week, providing a short-term basis for European economy.

At the same time, the G20 Finance Ministers Meeting and the EU MiCA stablecoin regulation officially took effect also brought policy-level attention this week. If the G20 sends a positive signal in terms of crypto asset regulation, ผลประโยชน์ทับซ้อน liquidity may be released; after MiCA takes effect, a large amount of USDT or USDC funds are expected to flow into compliant euro stablecoins, and the minting/destruction data and on-chain flow of stablecoins will be the focus of observation.

Week 5 (July 29–31)

-

FOMC Decision Powell Speech: The most influential events of the month. If the market maintains stability and releases a dovish attitude, บีทีซี และ ผลประโยชน์ทับซ้อน will usually rise rapidly, with the spot market leading the rise.

-

US Q2 GDP Bank of Japan meeting: Two major data released on the same day are likely to cause violent fluctuations. It is recommended to appropriately reduce leverage, or adopt strategies such as futures arbitrage to control risks, while participating in the market and reducing the impact of violent reversals.

Image Credit: Trading Economics

The end of July will usher in the most influential event combination of the month: the Federal Reserve interest rate decision + Powell press conference. If the Federal Reserve maintains the current interest rate unchanged and releases expectations of future interest rate cuts, บีทีซี และ ผลประโยชน์ทับซ้อน will usually rebound quickly, especially in the spot market.

On July 31, the US second quarter GDP data and the Bank of Japan’s interest rate decision will be released. Such a high density of important macro events may trigger drastic market fluctuations. To control risks, traders are advised to reduce leverage reasonably or adopt low-risk strategies such as contract cross-period arbitrage, which can not only participate in market fluctuations but also avoid capital losses caused by sudden reversals.

How to trade in July? A practical guide for traders

It is safer to plan ahead and build positions in batches

Before the release of key data such as CPI or FOMC, it is not recommended to enter the market with a large position all at once. You can choose to build บีทีซี และ ผลประโยชน์ทับซ้อน positions in batches to spread the entry cost and avoid concentrated risks under high volatility. At the same time, reduce leverage to prevent market fluctuations from causing liquidation in an instant.

On the event day: Bidirectional orders to deal with uncertainty

If you expect a big move in the market but are unsure of the direction, you can use the futures straddle strategy:

-

Place a buy stop order above a significant resistance level;

-

Place a sell stop order below a key support level;

-

Use One-Cancels-the-Other (OCO) logic to avoid simultaneous transactions.

No matter which side the market breaks through, you can enter the market and lock in the opportunities brought by the fluctuations at the first time.

Linked Observation: Is Bitcoin “decoupling”?

Observe the relationship between Bitcoin and traditional assets (such as US stocks and gold):

-

If BTC rises and US stocks are weak, it means that the market has a safe-haven demand for it;

-

If BTC outperforms gold, it will further strengthen the “digital gold” narrative.

After the data is landed: the key to judging true and false breakthroughs is trading volume

Dont rush to chase high prices. Wait until the market calms down and observe the trading volume:

-

High Volume + Breakout = Trend Likely to Continue

-

Low volume + breakout = easy pullback

Combining the Fibonacci retracement tool can also help determine whether there is an ideal second entry point after a pullback (such as a 61.8% technical retracement after CPI rises).

Don’t ignore the staking strategy

If you are participating in BTC staking หรือ ETH staking , remember to pay close attention to the changes in the annualized rate of return (APY). Market fluctuations may cause the staking income to decline. At this time, you can consider temporary redemption and transfer to a spot account or a product with better returns.

Risk Management Common Misconceptions

-

Beware of false breakouts: The release of major data often results in a pattern of rumors driving up prices, while announcements driving down prices. Dont chase every big positive candle, and wait until the price closes firmly above the target level before adding to your position.

-

Be aware of flash crash risks: Breaking news may trigger violent fluctuations, especially for small-cap altcoins, which are more likely to be liquidated. Consider suspending trading after the event is released and wait and see how the market reacts.

-

Slippage and spreads: During holidays or before and after policy releases, the market depth becomes shallower and large บีทีซี / ผลประโยชน์ทับซ้อน orders may experience severe slippage. It is recommended to split large orders or execute large trades through OTC counters.

-

Stablecoin liquidity bottleneck: As new stablecoin regulations come into effect, redemptions of USDT, USDC, etc. may become slower. It is recommended to reserve some liquidity in non-algorithmic stablecoins or fiat currency areas to facilitate quick position adjustments when liquidity is tight.

July Economic Calendar FAQs

Q: What are the most critical dates in July?

A: July 3 (US non-farm payrolls), July 15 (US CPI + China GDP), July 24 (ECB meeting), and July 29-30 (Federal Reserve decision + Powell press conference) are the time windows with the greatest market volatility.

Q: How to prepare in advance?

A: It is recommended to start arranging บีทีซี และ ผลประโยชน์ทับซ้อน positions in batches a few days in advance to avoid concentrated positions. Appropriately reduce leverage to prevent excessive risks caused by market gaps when data is released.

Q:What should I do on the day when the data is released?

A: You can use the two-way stop order strategy: set buy stop and sell stop orders at key positions, and use the OCO function to automatically cancel the unfulfilled direction. This way you can catch the market without having to predict the direction.

Q: How to judge whether a breakthrough is true or false?

A: The key is to look at the trading volume. A true trend is often accompanied by a large number of transactions. If the volume breaks through, it is more credible; a low volume rise is usually difficult to sustain.

Q: How does the staking strategy cope with volatility?

A: When the market fluctuates violently, the annualized rate of return on staking may change. Remember to pay attention to the platform APY changes, adjust the staking position if necessary, and transfer funds to more attractive income channels, such as short-term spot trading or XT Earn products.

This article is sourced from the internet: July’s Big Economic Events at a Glance: A Key Timeline for Crypto Traders

Related: Aethir data analysis report: A glimpse into the present and future of the DePIN track

Original author: Yue Xiaoyu (X : @yuexiaoyu111 ) I have talked about Aethir, the leading project in the decentralized computing power track, many times. It is a project I focus on. Aethir鈥檚 recently launched Eigen ATH Vault allows community users to participate in revenue sharing on its decentralized GPU network by staking ATH tokens. This time, lets analyze this project from a data perspective to help you analyze whether this project is worth participating in. @AethirCloud @AethirMandarin 1. Aethir鈥檚 core data analysis According to information disclosed by โทเค็น Terminal, Aethirs cumulative expenses have reached US$55 million, and its annualized revenue is approximately US$110 million. This revenue level is impressive in the decentralized physical infrastructure network (DePIN) field. In comparison, competitors like Render Network only have annual revenue of about $40…