The essence of strategy is arbitrage business

บทความต้นฉบับโดย Dio Casares

ต้นฉบับแปล: TechFlow

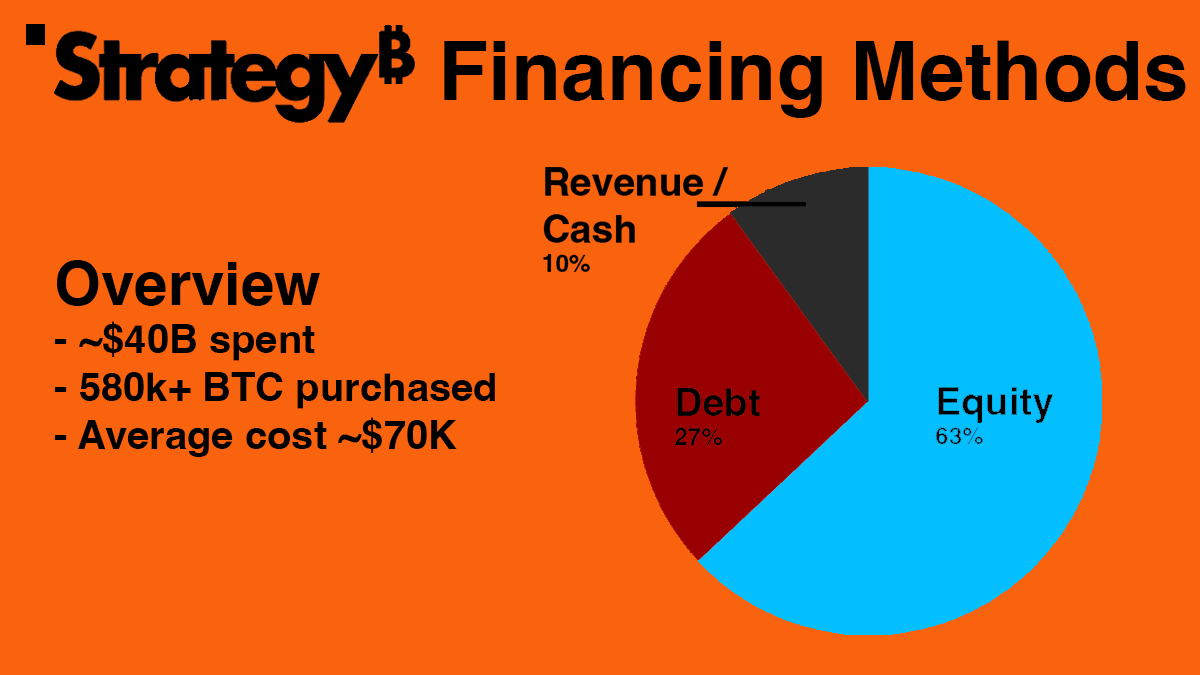

Over a period of nearly five years, Strategy spent $40.8 billion, equivalent to the GDP of Iceland, to purchase more than 580,000 บิตคอยน์s. This represents 2.9% of the bitcoin supply or almost 10% of all active bitcoins (1).

Strategy’s stock symbol $MSTR has risen 1,600% over the past three years, while Bitcoin has risen about 420% over the same period. This significant growth has led to Strategy’s valuation exceeding $100 billion and its inclusion in the Nasdaq 100 Index.

This massive growth has also brought doubts. Some claim that $MSTR will become a trillion dollar company, while others are sounding the alarm bells, with people questioning whether Strategy will be forced to sell its Bitcoin, causing a massive panic that could depress the price of Bitcoin for years.

However, while these concerns are not entirely unfounded, most people lack a basic understanding of how Strategy works. This article will explore in detail how Strategy works and whether it is a significant risk or a revolutionary model for Bitcoin acquisition.

How did Strategy buy so much Bitcoin?

Note: Data may differ from the time of writing due to new financing, etc.

Broadly speaking, Strategy obtains funds to purchase Bitcoin in three main ways: revenue from its operating business, sale of stock/equity, and debt. Of these three, debt is undoubtedly the most concerned. People tend to focus a lot on debt, but in fact, the vast majority of funds used by Strategy to purchase Bitcoin came from issuance, that is, selling shares to the public and using the proceeds to purchase Bitcoin.

This may seem counter-intuitive, why would someone buy Strategy shares instead of buying Bitcoin directly? The reason is simple, and it goes back to the favorite type of business in the การเข้ารหัสลับcurrency space: arbitrage.

Why people choose to buy $MSTR instead of buying $BTC directly

Many institutions, funds, and regulated entities are subject to “mandates.” These mandates dictate what assets a company can and cannot purchase. For example, a credit fund can only purchase credit instruments, an equity fund can only purchase stocks, a long-only fund can never go short, and so on.

These mandates allow investors to be confident that, for example, a fund that only invests in stocks will not buy sovereign debt, and vice versa. It forces fund managers and regulated entities (such as banks and insurance companies) to be more responsible and only take specific types of risks, rather than being able to take any type of risk at will. After all, the risks of buying Nvidia stock are completely different from those of buying U.S. Treasuries or putting money in the money market.

Because of the highly conservative nature of these mandates, a lot of capital sitting in funds and entities is “locked up” and unable to access emerging industries or areas of opportunity, including cryptocurrencies, and especially unable to directly access Bitcoin, even if the managers and associates of these funds wish to gain exposure to Bitcoin in some way.

Michael Saylor ( @saylor ), founder and executive chairman of Strategy, saw the discrepancy between the exposure these entities wanted and the risk they could actually take, and exploited it. Before the advent of a Bitcoin ETF, $MSTR was one of the few reliable ways for these entities that could only buy shares to gain exposure to Bitcoin. This meant that Strategy’s shares often traded at a premium because demand for $MSTR outstripped the supply of its shares. Strategy continually used this premium, the difference between the value of $MSTR shares and the value of the Bitcoin contained in each share, to buy more Bitcoin while increasing the number of Bitcoins contained in each share.

Over the past two years, if you held $MSTR, you would have made a 134% “gain” in Bitcoin terms, the highest return on a scaled Bitcoin investment in the market. Strategy’s products directly address the needs of entities that would not normally be able to touch Bitcoin.

This is a classic example of “mandate arbitrage”. Prior to the launch of the Bitcoin ETF, as mentioned earlier, many market participants were unable to purchase non-exchange traded stocks or securities. However, as an exchange-listed company, Strategy was allowed to hold and purchase Bitcoin ($BTC). Even with the recent launch of the Bitcoin ETF, it would be completely wrong to think that this strategy is no longer valid, as many funds are still prohibited from investing in ETFs, including most mutual funds that manage $25 trillion in assets.

A classic case study is Capital Groups Capital International Investors Fund (CII). The fund manages $509 billion in assets, but its investment scope is limited to stocks and cannot directly hold commodities or ETFs (Bitcoin is mostly considered a commodity in the United States). Due to these restrictions, Strategy is one of the few tools that CII uses to gain exposure to Bitcoins price fluctuations. In fact, CIIs confidence in Strategy is so high that it holds about 12% of Strategys shares, making CII one of the largest non-inside shareholders.

Debt terms: a constraint for other companies, but a boost for Strategy

In addition to the positive supply profile, Strategy also has certain advantages in the debt it takes on. Not all debt is the same. Credit card debt, mortgages, margin loans, these are all very different types of debt.

Credit card debt is personal debt, backed by your salary and ability to repay, not assets, and often carries an annual interest rate of 20% or more. Margin loans are usually loans against assets you already have (usually stocks), and if the total value of your assets approaches the amount you owe, your broker or bank may seize all your funds. Mortgages are considered the holy grail of debt because they allow you to use the loan to buy an asset that usually appreciates in value (such as a house) while only paying the monthly interest on the loan (i.e. the mortgage payment).

While it’s not completely risk-free, especially in the current interest rate environment where interest could accumulate to unsustainable levels, it’s still the most flexible compared to other types of loans because the interest rate is lower and the asset won’t be forfeited as long as the monthly payments are made on time.

Typically, mortgages are limited to homes. However, business loans can sometimes work similarly to mortgages, where interest is paid over a set period of time, and the loan principal (i.e., the initial amount of the loan) is only repaid at the end of that period. While loan terms can vary widely, typically, as long as the interest is paid on time, the debt holders do not have the right to sell the companys assets.

Image source: @glxyresearch

This flexibility allows corporate lenders like Strategy to more easily navigate market volatility, making $MSTR a way to “harvest” volatility in the crypto market. However, this does not mean that risk is completely eliminated.

สรุปแล้ว

Strategy is not in the leverage business, but in the arbitrage business.

While it does hold some debt currently, the price of Bitcoin would need to drop to ~$15,000 per coin in five years to pose a serious risk to Strategy. This will be another talking point as the number of “vault companies” (companies that replicate Strategy’s Bitcoin accumulation strategy) expands to include MetaPlanet, @DavidFBailey ’s Nakamoto, and many others.

However, if these vault companies stop charging a premium in order to compete with each other and start taking on excessive debt, the whole situation will change, with potentially serious consequences.

This article is sourced from the internet: The essence of strategy is arbitrage business

Fluence is building an AI infrastructure that cannot be achieved by centralized clouds: an open, low-cost, enterprise-class computing layer that is sovereign, transparent, and open to everyone. 2025 continued the trend of 2024, and cloud computing giants are accelerating their competition for dominance in AI infrastructure: Microsoft plans to invest more than $80 billion to build data centers, Google has launched an AI supercomputer, Oracle has invested $25 billion to build the Stargate AI cluster, and AWS is also shifting its focus to native AI services. At the same time, professional players are growing rapidly. CoreWeave raised $1.5 billion in its IPO in March this year and is currently valued at over $70 billion. As AI becomes a critical infrastructure, the right to acquire computing power will become one of…