Guotai Junan surged 190%, will Hong Kong stocks also usher in the crypto-stock boom?

On June 25, the share price of Guotai Junan International soared 80% in early trading and more than 190% during the day, becoming one of the strongest Hong Kong stocks of the day. Behind the surge in share prices, this traditional financial brokerage firm has entered the การเข้ารหัสลับcurrency stock market in a high-profile manner. The company announced today that it has obtained approval from the Hong Kong Securities Regulatory Commission to officially enter the cryptocurrency trading service. In addition to the previous layout of Bitcoin and Ethereum asset allocation by many Hong Kong-listed companies, as well as the policy catalysis brought about by the upcoming entry into force of the Stablecoin Ordinance, the Hong Kong stock market is quietly ushering in a crypto-stock boom.

Brokerage aircraft carrier

Guotai Junan International is a major subsidiary of Guotai Haitong Group, mainly engaged in traditional financial related businesses. The company operates through six business divisions. The brokerage division is engaged in providing securities, futures, options and leveraged foreign exchange trading, brokerage and insurance brokerage services to customers.

Its parent company, Cathay Haitong Securities, is a carrier-class brokerage firm formed by the merger of two leading brokerage firms, Guotai Junan Securities and Haitong Securities, in 2024. It provides various financial services including investment banking and asset management to individual and institutional clients, and was officially renamed Cathay Haitong Securities in April 2025. Among them, Haitong Securities was established in 1988, Guotai Securities and Junan Securities were both established in 1992, and merged to form Guotai Junan in August 1999. This aircraft carrier-class brokerage firm is not satisfied with traditional financial business and has begun to move into RWA and token securitization.

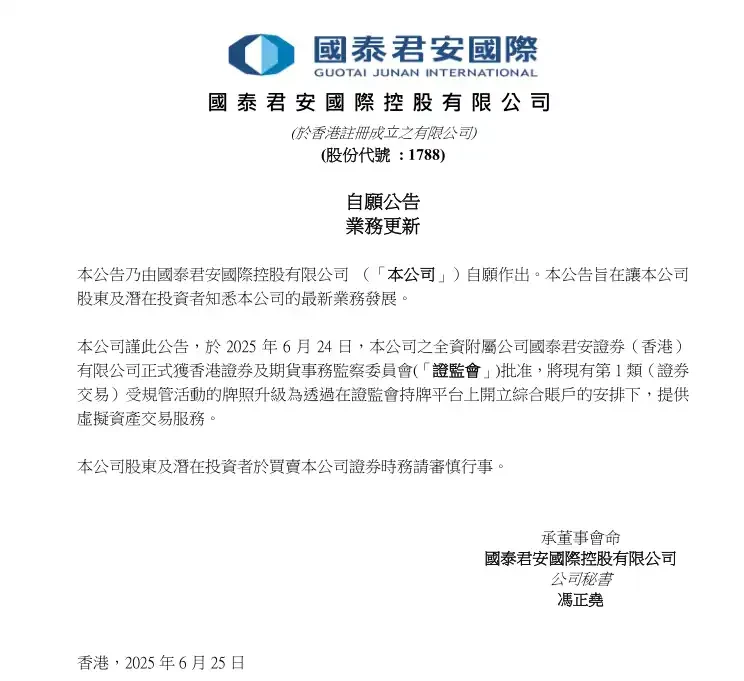

On June 25, Guotai Junan International officially obtained approval from the Hong Kong Securities and Futures Commission to upgrade its existing securities license to a comprehensive license that can provide virtual asset trading and related opinion services. It became the first Chinese brokerage firm in Hong Kong to obtain this full range of virtual asset trading service qualifications. Guotai Junan Internationals stock price soared by more than 80% at the beginning of the trading session, and the highest intraday increase once exceeded 190%.

At this point, Guotai Junan International has become the first Chinese securities firm in Hong Kong that can provide a full range of virtual asset-related trading services. Its service scope will fully cover virtual asset trading, provision of professional advice during the transaction process, and issuance and distribution of virtual asset-related products including over-the-counter derivatives.

This means that in the near future, Guotai Junan Internationals clients will be able to directly trade a variety of virtual assets including mainstream cryptocurrencies such as Bitcoin and Ethereum, as well as stablecoins such as USDT through its platform, indicating that traditional brokerages are accelerating their transformation to Web3 finance.

Competition or cooperation? Comparison with Hashkey

Guotai Junan Internationals path into crypto trading services can be summarized as: Based on the identity of a traditional securities firm, starting from asset tokenization, and gradually expanding to compliant virtual asset trading services.

HashKey is currently one of the most representative licensed crypto trading platforms in Hong Kong. Its path into crypto trading services can be summarized as: Starting from compliance, building institutional-level infrastructure, and steadily expanding the retail market.

Against the backdrop of Hong Kongs accelerated construction of a virtual asset center, HashKey แลกเปลี่ยน and Guotai Junan International represent crypto-financial practices under two different paths, entering the RWA and tokenized securities markets from the perspectives of Web3 native and traditional securities firms respectively.

As one of the first licensed virtual asset trading platforms in Hong Kong, HashKey has now opened BTC and ETH spot trading to retail users, and has opened deposit and withdrawal channels with local banks such as ZA Bank and Standard Chartered Bank. The platform also provides OTC and custody services, and actively expands infrastructure such as stablecoins and asset tokenization. Its parent company, HashKey Group, is also active in the Web3 investment field.

Unlike HashKey, which focuses on trading scenarios, Guotai Junan Internationals strategy is more inclined towards chain reform and security-grade asset tokenization. Since January this year, it has submitted and obtained approval from the Hong Kong Securities and Futures Commission for the issuance and distribution of tokenized structured notes, funds and digital bonds, with the goal of mapping traditional financial products onto the chain. The projects were approved in April and May this year.

HashKey is more suitable for crypto native users. For example, if you want to buy BTC, pledge on the chain, or arbitrage USDT, it is a compliant but decentralized friendly entrance. Guotai Junan Internationals service is closer to the role of an on-chain asset securitization investment bank. It does not trade coins with you, but may underwrite a tokenized treasury bond for you and provide on-chain delivery services.

Has the popularity of Hong Kong stocks shifted from stablecoin concept to cryptocurrency stocks?

The Legislative Council of Hong Kong recently passed the Stablecoin Ordinance, which will officially take effect on August 1. The first batch of coin issuers include JD CoinChain Technology, Yuanbi Innovation Technology and Standard Chartered Hong Kong Consortium. As soon as the news came out, related stablecoin concept stocks such as ZhongAn Online, JD Group and LianLian Digital collectively rose.

At the same time, the US stock market has set off a new round of listed companies hoarding coins. Companies have followed the MicroStrategy path to include cryptocurrencies in their balance sheets through financing, bond issuance, etc. SBET bought ETH and DFDV bought SOL, and their stock prices soared dozens of times. On June 24, Nano Labs announced that it would raise $500 million through convertible bond private placement for BNB reserve strategy, with the highest intraday increase reaching 170%. There are certain signs that this trend can be repeated in Hong Kong stocks.

Boyaa Interactive started buying and holding Bitcoin in 2023. As of March 31, 2025, Boyaa Interactive held 3,351 BTC and 297 ETH, making it the company with the most coins in Hong Kong stocks. Its share price doubled from HK$3.3 to HK$6.8 in April-May. In addition, Guofu Innovation purchased HK$36 million worth of Bitcoin from March to August 2024; Blueport Interactive held $8.8 million worth of BTC and ETH as of mid-2024. These Hong Kong-based MicroStrategy companies have benefited significantly from the recent cryptocurrency concept market and have become a new focus of capital pursuit.

In addition to the MicroStrategy model, other cryptocurrency concept stocks have also seen a concentrated outbreak recently. OKEx, which focuses on blockchain browsers, New Fire Technology, which focuses on digital asset custody business, and OSL Group, which provides digital asset infrastructure services, continued to strengthen in the market in May and became a hot spot for funds.

On June 25, Guotai Junan Internationals stock price soared by more than 190% in a single day due to the introduction of virtual asset trading business, marking a key step for traditional securities firms to transform into Web3. Whether it is the micro-strategy path or the layout of encryption business around trading, custody and infrastructure, they are jointly promoting a new round of market in the Hong Kong stock market.

This article is sourced from the internet: Guotai Junan surged 190%, will Hong Kong stocks also usher in the crypto-stock boom?

Related: Bitcoin officially enters state government treasury, will a reserve boom begin?

Original author: Fairy, ChainCatcher Original editor: TB, ChainCatcher A historic step! Bitcoin has officially entered the state governments treasury. Last night, New Hampshire took the lead in passing the Bitcoin Strategic Reserve Act (HB 302), becoming the first state in the United States to include Bitcoin in its official asset reserves. This groundbreaking move, like the first flag, ignited the fire of change in the financial landscape, and the flames are spreading rapidly. Small state with big ambitions, Bitcoin reserve ice-breaking journey New Hampshire may not be a prominent state on the map of the United States. It ranks fifth from the bottom in terms of land area and tenth from the bottom in terms of population. Its real GDP in 2024 is about $96.5 billion, which is not a…