Mai Gang: He changed Pop Mart and Bitcoin

ผู้เขียนต้นฉบับ: TechFlow

Labubu is popular all over the world, and Pop Mart’s market value of HK$340 billion has made its founder Wang Ning the richest man in Henan.

A paragraph was mentioned again:

Before Pop Mart went public, investors commented on Wang Ning as follows: he had a mediocre education, had never worked properly, spoke calmly and unconvincingly, and had no elites in his team. After Pop Mart went public, investors commented on Wang Ning as follows: Wang Ning has a calm personality, doesn’t talk much, doesn’t show his emotions, and possesses many excellent qualities of a “consumer entrepreneur”.

Another person who received the same treatment was Pop Mart’s angel investor, Mai Gang.

Before the rise of this trendy toy giant, Mai Gang self-deprecatingly called himself an alternative investor who was kicked out of the group chat by the mainstream capital circle; but when the market value of Pop Mart soared, he was invited to the altar and transformed into a legend in the investment community.

However, Mai Gang’s legend goes far beyond the field of trendy toys.

What is not well known is that Xu Mingxing, the founder of OKX, the worlds leading การเข้ารหัสลับcurrency trading platform, is also an investor in Pop Mart, and has reaped thousands of times in returns, and all of this is inseparable from Mai Gang.

Mai Gang is also Xu Mingxings mentor. He founded and invested in his earliest entrepreneurial project, Docin.com, and later co-founded OKCoin.

In fact, Mai Gang is also the crypto แนะนำ for Binance co-founder He Yi.

In 2014, at a private party organized by Mai Gang, he introduced He Yi, who was still a program host at the time, to Xu Mingxing, which led to He Yi joining OKCoin. Subsequently, He Yi introduced Zhao Changpeng (CZ), the current founder of Binance, to join the team, thus opening the prelude to the disputes in the global cryptocurrency exchange industry.

His investment portfolio spans two seemingly unrelated fields, but in each track, he has spawned giant companies that have changed the industry landscape. It can be said that Mai Gang not only made Pop Mart successful, but also changed Bitcoin to a certain extent.

Early Bitcoin Evangelist

“In 2013, I was kicked out of two mainstream VC WeChat groups because of my discussion on Bitcoin. The group members were all highly educated people. I thought my teaching method was very professional, but some people still thought I was selling something. I felt very lost at the time. After all, as a social animal, everyone wants to be recognized.

This was the first time I felt “abandoned” by the VC circle, and it also made me realize for the first time that there are mainstream and non-mainstream circles, as well as individual cognitive differences. ”

In 2021, Mai Gang said this in an interview with New Wisdom of Family Office.

In 2025, this article titled Mai Gang: The Years I Was Abandoned by the VC Circle once again swept the circle of friends.

At this moment, Pop Mart’s market value exceeds HK$340 billion, an increase of more than 20,000 times compared to the valuation of Mai Gang’s angel investment (RMB 10 million).

At this moment, the price of Bitcoin exceeds $100,000, an increase of more than 5,000 times from the price of $20 at the beginning of 2013.

Mai Gang has never concealed his identity – one of the earliest evangelists in Chinas investment community who invested in and promoted the knowledge of Bitcoin.

In 2013, when most people did not know about Bitcoin or still regarded it as a financial bubble, he had already spared no effort to promote Bitcoin knowledge and his own understanding across the country.

Crypto industry OG Shentu Qingchun recalled that he met the famous angel investor Mai Gang in July 2013 and accidentally talked about Bitcoin.

Mai Gang studied finance, and his views on Bitcoin are very accurate and advanced. For example, the national reserve currency was what Mai Gang said at the time, and now it has become a reality. I have to say that Mai Gang is a very strong Bitcoin enthusiast. He greatly strengthened my idea of working in Bitcoin. He said he invested in OKCoin and introduced me to celebrities. I immediately withdrew all my funds from the stock market and bought 800 Bitcoins from OKCoin at a price of $90 at the time.

In Mai Gangs opinion, Bitcoin can be explained in two sentences: First, Bitcoin is the property of a perfect currency simulated by mathematicians, geeks, and network scientists using distributed algorithms; second, this property is maintained by the computing power of distributed and extremely powerful computers.

He divides the monetary forms of human society into three types: the first is the monetary system represented by precious metal gold, and the second is the credit currency supported by government credit. The emergence of Bitcoin has ushered in the third monetary era. He emphasized that these three forms of currency will coexist for a long time, just as the emergence of the Internet did not completely replace fax machines and telephones.

Regarding Bitcoin, Mai Gang made a prediction in 2014: Bitcoin will become a tool for great power games.

“I am not an anarchist, nor do I advocate that we use Bitcoin instead of RMB today. But I can tell you that in the next 10 years or 30 years, the United States will rebuild a global monetary system, and in this global monetary system, the United States is likely to link the dollar to a new series of assets, including virtual currencies represented by Bitcoin. Before doing this, the United States only needs to do one thing, which is to gain a voice in the field of Bitcoin. This voice may be computing power, reserves, or pricing power. Why does the United States have an advantage in doing this? Because the United States has Wall Street, the elite of the global elite.”

This expression may not seem unfamiliar now, but please note that it came from Mai Gang’s speech in 2014. He actively popularized Bitcoin in the hope that Chinese entrepreneurs, Chinese companies, and ordinary Chinese people would gain a voice in the Bitcoin field.

“I hope everyone, including government agencies, should realize the greatness and complexity of the Bitcoin game, which is truly related to our future generations. In the last century, Americans used the power of the dollar to obtain the right to mint the dollar and made the whole world work for them. If Americans use it for a few more decades to gain the right to speak on Bitcoin, they will continue to make the whole world work for them.”

Perhaps it was because of this understanding that Mai Gang chose to invest in incubation when OKCoin was first established in 2013.

Xu Mingxing and Mai Gang knew each other as early as 2011, when Xu Mingxing was the CTO of Docin and Mai Gang was its angel investor.

Mai Gang and his partner, Tim Draper, founder of DFJ in the United States, jointly served as angel investors of Xu Mingxing and invested RMB 5 million. Tim Draper is a famous American investor who invested in Baidu, Tesla, etc. in the early stage.

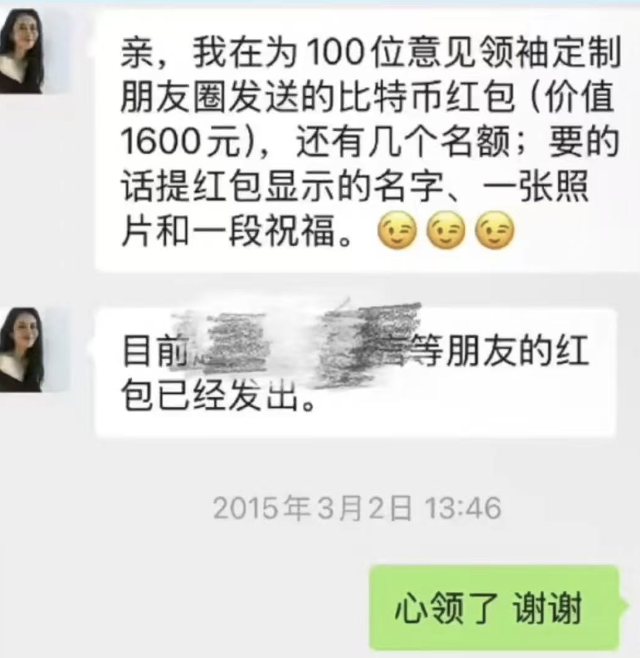

During the Spring Festival of 2014, Mai Gang found He Yi, who was a TV host at the time, and asked her to post OKCoins Bitcoin red envelopes on her WeChat Moments. He Yi readily agreed.

The gears of fate began to turn from then on, which not only opened the door to the world of Bitcoin for He Yi, but also changed the history of the crypto world.

After the Spring Festival, Mai Gang and OKcoin founder Xu Mingxing organized a thank you party and invited all those who helped send out red envelopes to a party. Thats how He Yi met Xu Mingxing.

Xu Mingxing comes from a technical background, and He Yi is good at marketing. At the party, Mai Gang suddenly said, Hey, Mingxing, isnt your company looking for someone to do marketing? Isnt this just right?

The second week after the show, He Yi joined OKcoin as vice president, responsible for brand building and marketing. He Yi used his past TV media resources to join the If You Are The One BOSS team to promote OKcoin, and also planned the OKcoin exchange to appear in New Yorks Times Square. The current common method of attracting KOLs for publicity was also a marketing method He Yi often used ten years ago.

In addition, He Yi also recruited Zhao Changpeng, who had worked at the Tokyo Stock แลกเปลี่ยน, to work as CTO of OKcoin.

Mai Gangs series of seemingly random referrals and connections eventually changed the entire competitive landscape of cryptocurrency exchanges.

After that, Zhao Changpeng left OKCoin and founded Binance, and He Yi later joined. Together, they built Binance into the worlds largest cryptocurrency exchange, and OKCoin has also become the worlds leading trading platform OKX.

The first investor of Pop Mart

In June 2020, half a year before Pop Marts listing on the Hong Kong Stock Exchange, Mai Gang published an article on the Startup Factory official account – The Story of Pop Mart: From 10 Million to 100 Billion, of which 10 million was the valuation of Pop Mart when Mai Gang invested in the angel round, and 100 billion was Mai Gangs expectations for Pop Mart at the time.

One hundred billion is a number and a goal. I believe the Pop Mart team led by Wang Ning has the opportunity to challenge this goal and become an international company.

As a result, Pop Marts market value exceeded 100 billion yuan on the day of its listing. Now, five years after its listing, Pop Marts market value has exceeded 300 billion yuan, firmly ranking among the star companies in the Hong Kong stock market.

Back in 2012, Pop Mart was just a small company living in a simple house in Beijing. In May of that year, founder Wang Ning sent an email to Mai Gang, but it lay quietly in the other partys mailbox for three months before being discovered.

This accidental discovery led to a precious investment opportunity.

In August 2012, 25-year-old Wang Ning met Mai Gang for the first time. Young Wang Ning was wearing a pair of trendy shorts that had not yet been launched in China. This detail made Mai Gang keenly aware of his unique sense of fashion. From the first meeting to the signing of the investment agreement, the whole process took only five days.

On August 10, 2012, Mai Gang paid the first investment amount of 2 million yuan, becoming the first angel investor of Pop Mart.

According to 36kr, after signing the investment agreement, the two went to a bar in Wudaokou. Amid the noise, Wang Ning, who had always been very peaceful, suddenly raised his voice: Brother Mai, you invested in me today. If I am Jay Chou, you are Wu Zongxian.

Later, when talking about the reasons for the investment, Mai Gang said that what really touched him were the qualities displayed by Wang Ning: calm, composed, clean and not deceptive.

At that time, most investors and entrepreneurs focused on e-commerce and believed that offline retail was counter-trend. However, Mai Gang and Wang Ning firmly believed that there were still huge opportunities in the offline retail market, especially those trendy products that were rich in design and could touch peoples emotions.

For Wang Ning, this investment was of extraordinary significance. After receiving the investment, he immediately called his father and said, Dad, from today on, your child is a multimillionaire, because the shares I hold are worth 10 million.

As an investor who is rather stingy with praise, Mai Gang spoke highly of Wang Ning in his circle of friends one year after investing, saying, He is young and promising, with great ambitions. There will เด็ดขาดnitely be a place for him in Chinas future retail industry.

However, apart from Mai Gang, not many people in the capital market are really optimistic about Wang Ning and Pop Mart.

Wang Ning met with almost all investors and FAs. He not only visited financial institutions, but also industrial capitals such as Light Media and Aofei. However, every time he left with high hopes and returned with disappointment.

A typical example is the Hunan Satellite TV fund, which did not invest after a long period of due diligence, and even said to Wang Ning during the last meeting: How could such a golden opportunity fall to you?

Continuous setbacks in financing have also led to Pop Mart being in a long-term financial tight situation. At one point, the company had less than 1 million yuan left in its account, and even paying salaries became a problem.

The financing information circulating online is inaccurate. Many figures are equity transfers between shareholders after the company has developed smoothly in the later stage, not the companys financing. The total amount of funds raised from outside during the companys development history is actually very small. In the early days of Pop Marts development, financing was very difficult. Basically, most well-known investment institutions have seen this case, and I dont know why they didnt invest.

Mai Gang later recalled that he could empathize with the inner torment Wang Ning had experienced during the period of financing setbacks, but when facing difficulties, he could still feel Wang Nings inner confidence and belief in the companys value.

On the night of Pop Mart’s listing in 2020, an article titled “Behind Pop Mart’s ตลาด Value Exceeding 100 Billion: A Collective Failure of China’s Big Funds” by 36 Kr went viral in the entire venture capital circle, serving as an emotional catharsis and expression of attitude.

This situation is like an inspirational plot in a fantasy fairy tale novel – the male protagonist who was once regarded as a loser finally makes a big splash and makes all those who once looked down on him ashamed.

In Mai Gang’s opinion, Wang Ning’s repeated setbacks in financing may be a very important test in the development process of Pop Mart. Without this test, Pop Mart might not have reached its current stage.

First, because there is no financing, Pop Mart is very cautious when spending every penny; second, the company is always looking for breakthroughs, forcing the founder to keep thinking.

Mai Gang has always been a person who is against the theory of the hot spot. He believes that because Pop Mart did not obtain large-scale financing, it basically had no media exposure and had never become a hot company. Later, it became a myth of creating a hot spot (starting an industry).

About Mai Gang

After reading this, you may be even more curious about what kind of person Mai Gang is, and why an outlier in the eyes of mainstream VCs can get such big results as Pop Mart, Bitcoin, and OKCoin at the same time?

In 1996, after graduating from Renmin University of China, Mai Gang joined the venture capital industry and was one of the earliest people engaged in venture capital in China.

In 2001, he went to the University of California (UCLA) to study for an MBA, during which he won the first place in the University of California Entrepreneurship Competition and the fifth place in the National University Entrepreneurship Competition. While in the United States, he met his Wu Zongxian and became acquainted with Tim Draper, the godfather of Silicon Valley venture capital, and thus entered the Silicon Valley venture capital circle in the United States.

“Tim Draper is my mentor, former boss, and my earliest angel investor. I am very grateful to him for nurturing me and investing in my company.”

In 2005, he and Tim Draper co-founded VenturesLab, one of the earliest entrepreneurial incubators in the country.

Completely different from mainstream VCs, Mai Gang chose an alternative investment path.

He has never raised funds from outside and always insisted on investing with his own funds. In his opinion, the current venture capital industry has a scale curse – many large funds adopt a sprinkling money model to increase the investment hit rate, which often reduces the return rate of LP. The best operating model for the venture capital industry is a small team workshop style approach – a leader leads three or five elite soldiers to work hard and strive to have three or five projects succeed out of twenty.

He is cautious about the trend. He believes that entrepreneurs and investors should pay more attention to the essence of opportunities rather than blindly chasing them. He has summarized three verification formulas to judge projects:

-

What problem does your company solve?

-

Who are your competitors?

-

Why will you win?

Based on his rich entrepreneurial and investment experience, Mai Gang divided the models of Internet entrepreneurship and proposed the famous mouse and cement theory.

The first is the mouse mode, which is a pure Internet mode, represented by early search engines, community websites, etc., and is characterized by entrepreneurs being able to conduct business mainly through computers;

The second is the mouse plus cement model, such as 58.com and Qunar. These companies obtain traffic through the Internet and then convert the traffic into commercial value for traditional industries.

The third type is the cement plus mouse model, with typical representatives such as Xiaomi and Huang Taiji. These companies are essentially traditional industries, but they make full use of the characteristics of the Internet to innovate.

Perhaps you would think that Mai Gang, who worked as a VC right after graduating from college, is more of a theorist and lacks entrepreneurial experience, but he has another identity – a serial entrepreneur.

In 1999, while working at Pudong Science and Technology Innovation Center, Mai Gang invested in Yide Ark, which won first place in the China University Student Entrepreneurship Competition that year. It was also because of this project that Mai Gang made many good friends and started a journey of continuous entrepreneurship with many entrepreneurs.

In 2003, Mai Gang co-founded Yiyou with Jack Ma, one of the founders of Yide Ark, and served as CEO. The company received angel investment from Silicon Valley tycoon Tim Draper, the chairman of Japans rich optical communications, and others, and was later acquired by French listed company Meetic.

In 2005, Mai Gang invested as an angel investor in China Online, which was founded by Tong Zhilei, one of the founders of Yide Ark. In January 2015, the company was successfully listed on the A-share Growth Enterprise Market.

In 2006, Mai Gang and Lu Jun, one of the founders of Yide Ark, founded Tongka, which later became Chinas largest O2O customer relationship software company, which was later acquired by Tencent. In 2007, Mai Gang also co-founded Douban, once the worlds largest Chinese document sharing website, with Jonathan Lin, who had interned at Yiyou.

In 2010, he and Deng Yu, another founder of Tongka, co-invested in Chinas largest smart TV content aggregation service provider – Taijie.

In 2013, he co-invested with Docin CTO Xu Mingxing to establish the Bitcoin trading platform – OKCoin.

Behind this seemingly magical entrepreneurial experience, there is actually a clear clue: Be kind to others and make good friends.

Life is the continuation of the entire relationship between you and the friends around you. Therefore, only by treating friends and others well can you achieve yourself. Of course, you must know people. Making friends with bad people will harm yourself. I think whether it is starting a business or investing, in the end you will find that what is given back to you is actually your character, or the amplified effect of your character. Mai Gang once said.

But what moved me most was a detail.

20 years ago, when Mai Gang founded Entrepreneurship Workshop, he designed the logo and built the website by himself, and wrote this sentence on the companys official website: Maybe your life goal is to start a successful business, but in the end, what will be left on your tombstone is kind father (mother), the most beloved partner of life, generous friend, not great CEO. You will find that what you cant take away is fame and wealth, and what remains are emotions and memories.

Today, this passage is still on the homepage.

This article is sourced from the internet: Mai Gang: He changed Pop Mart and Bitcoin

Related: Dissecting Hyperliquid’s top whale operations: The high leverage art of “50x brother”

Original author: Frank, PANews As the market conditions pick up, the whale operations on Hyperliquid have once again attracted market attention. These mysterious big investors, known as whales, have created ripples on the platform with their strong financial strength, unique trading strategies and accurate grasp of the market pulse. Their every move is not only a magnifying glass of market sentiment, but also provides us with a window to observe how top traders play the game. Analyzing their different trading methods, risk preferences and logic of success and failure. Here, PANews attempts to uncover a corner of their wealth code and explore what experiences and lessons ordinary investors can learn from them. Short-term sniper @qwatio: The event-driven and high-leverage art of 50 times brother This trader is an industry OG…