Ethena Launches USDe and sUSDe Revolving Loan Incentives; Falcon Finance Adds 60x Points Acceleration Channel (August 4t

Author|Azuma ( @azuma_eth )

This column aims to cover the current low-risk return strategies based on stablecoins (and their derivative tokens) in the market (Odaily Note: code risks can never be ruled out), to help users who hope to gradually expand their capital scale through U-based financial management to find more ideal interest-earning opportunities.

Previous records

New opportunities

Ethena Launches Liquid Leverage

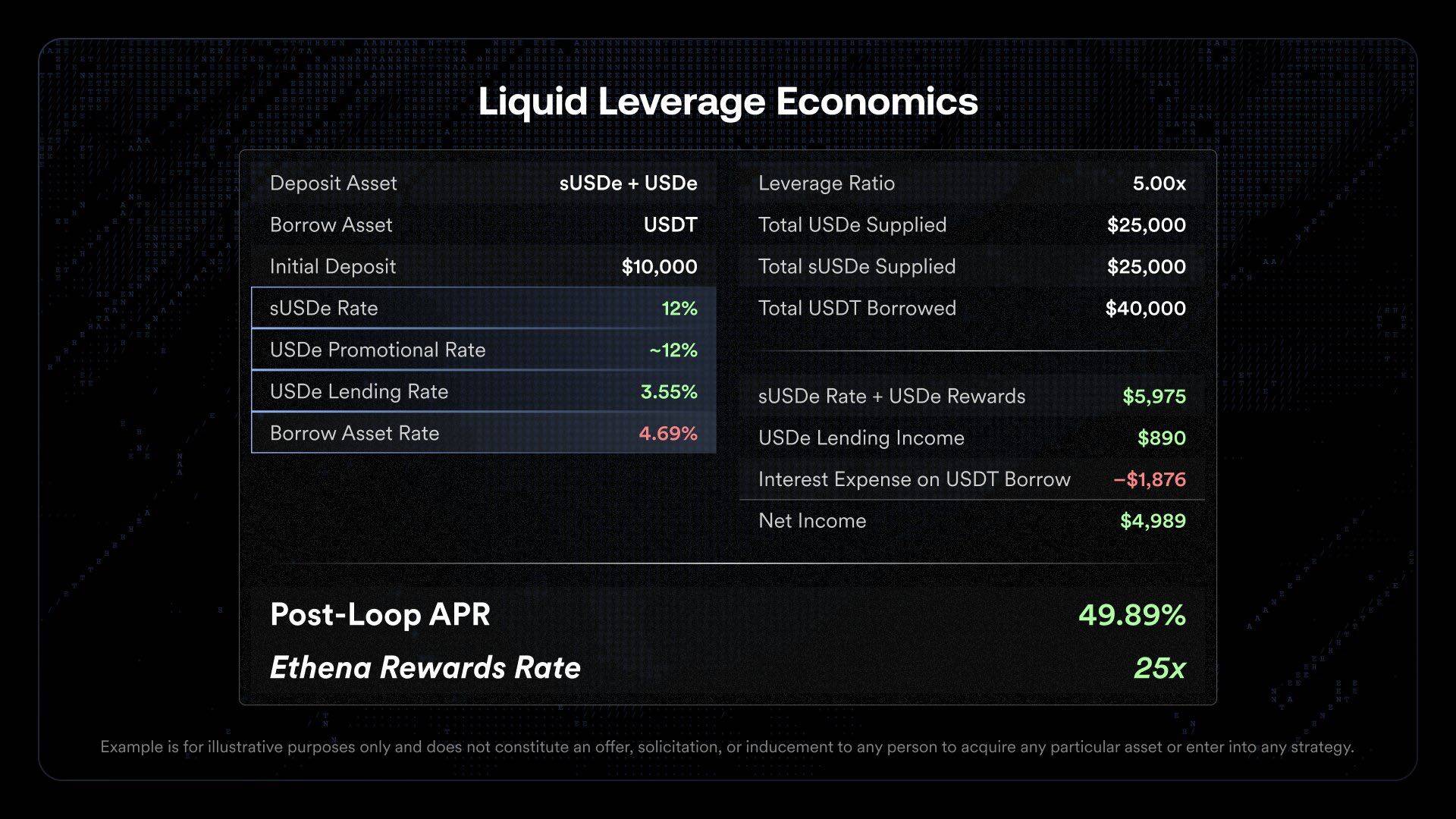

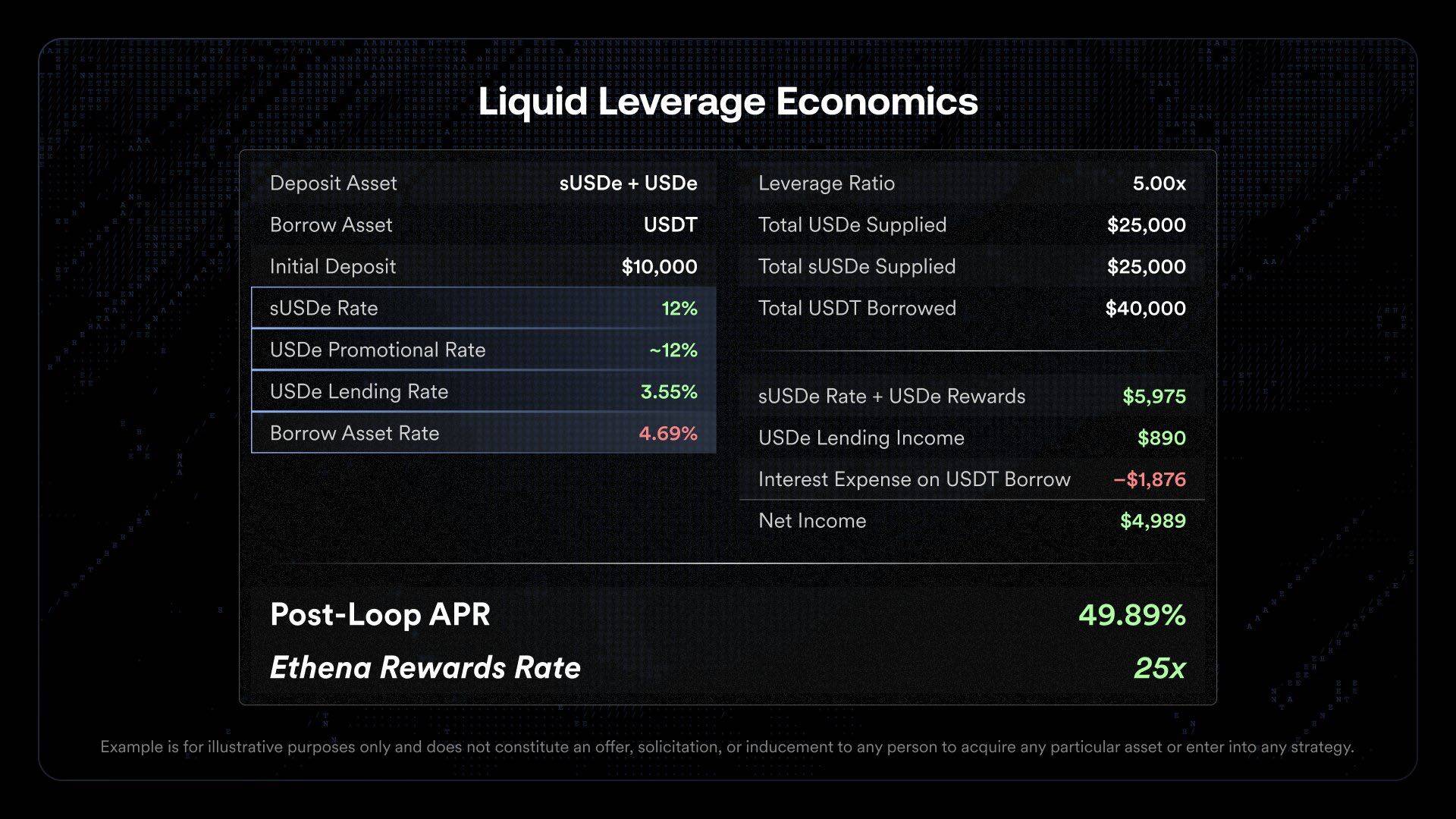

On July 29, Ethena and Aave announced the joint launch of the Liquid Leverage campaign. In essence, this can be understood as Ethena’s revolving loan incentive activity for USDe and sUSDe.

In short, users can deposit USDe (Ethena will provide an additional 12% incentive in the first month) or sUSDe (real-time yield is 11%) into Aave, borrow USDC, USDT or USDS as collateral, continue to exchange them for USDe and sUSDe, and then cycle borrowing again to amplify returns … Considering the current double-digit yield levels of USDe and sUSDe, after multiple cycles of lending (the risks will also be magnified accordingly), the compound yield can even be magnified to about 50%. This is almost the interest-earning opportunity with the strongest protocol endorsement, the largest capital capacity, and the relatively highest returns on the market.

It should be noted that in order to obtain the revolving loan incentive, you must deposit both USDe and sUSDe (only 50% of the USDe in the total deposit position can obtain additional incentives, so the deposit ratio should be kept at 50%:50%), and the loaned asset must be USDC, USDT or USDS instead of USDe. The most important thing is to complete at least one revolving loan.

With the overall market recovery and strong bullish sentiment, Ethena is experiencing another period of accelerated growth. As of this writing, ENA has once again broken through the $0.6 mark, making it one of the strongest performing altcoins in the entire Ethereum ecosystem. In the aforementioned revolving loan strategy, depositing both USDe and sUSDe earns 5x the points . With Ethena’s fourth quarter points promotion currently ongoing, the continued rise in ENA’s value means that the corresponding airdrop rewards for points will be amplified, providing another potential source of revenue for this strategy.

Falcon launches USDf/USD1 LP incentives

Falcon Finance, the stablecoin protocol under DWF, announced last week that it had secured a $10 million strategic investment from World Liberty Financial (WLFI) and had added WLFI’s USD1 stablecoin as collateral. The funds will be used to accelerate Falcon Finance’s technical integration, focusing on shared liquidity provision, multi-chain compatibility, and smart contract modules for seamless conversion between USDF and USD1.

Later, Falcon Finance announced it would establish USDf/USD1 liquidity on PancakeSwap and provide additional returns and points incentives to limited partners. As of this posting, the USDf/USD1 liquidity yield on PancakeSwap is currently reported at 9.75%. More importantly, Falcon Finance will provide a 60x bonus to limited partners in the pool (Miles) , currently one of the fastest ways to earn points on the project.

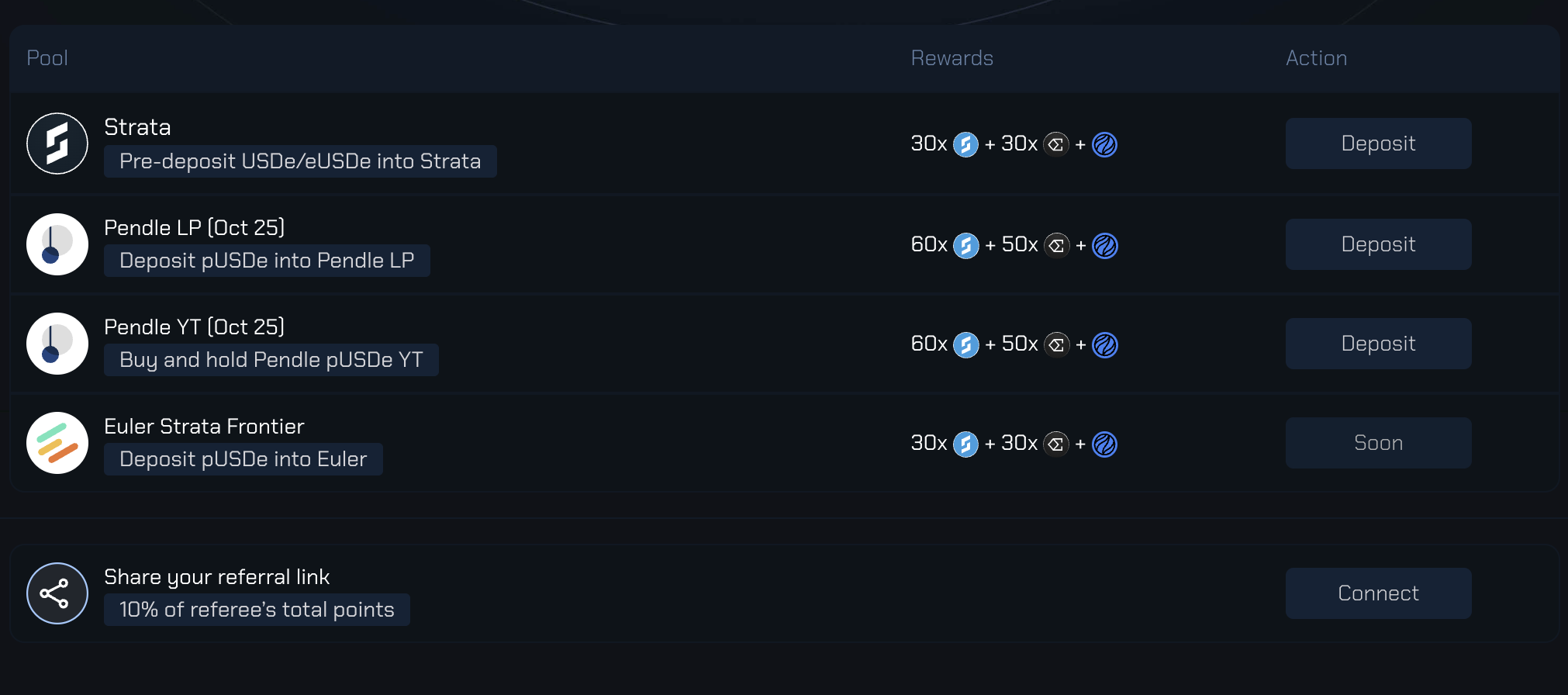

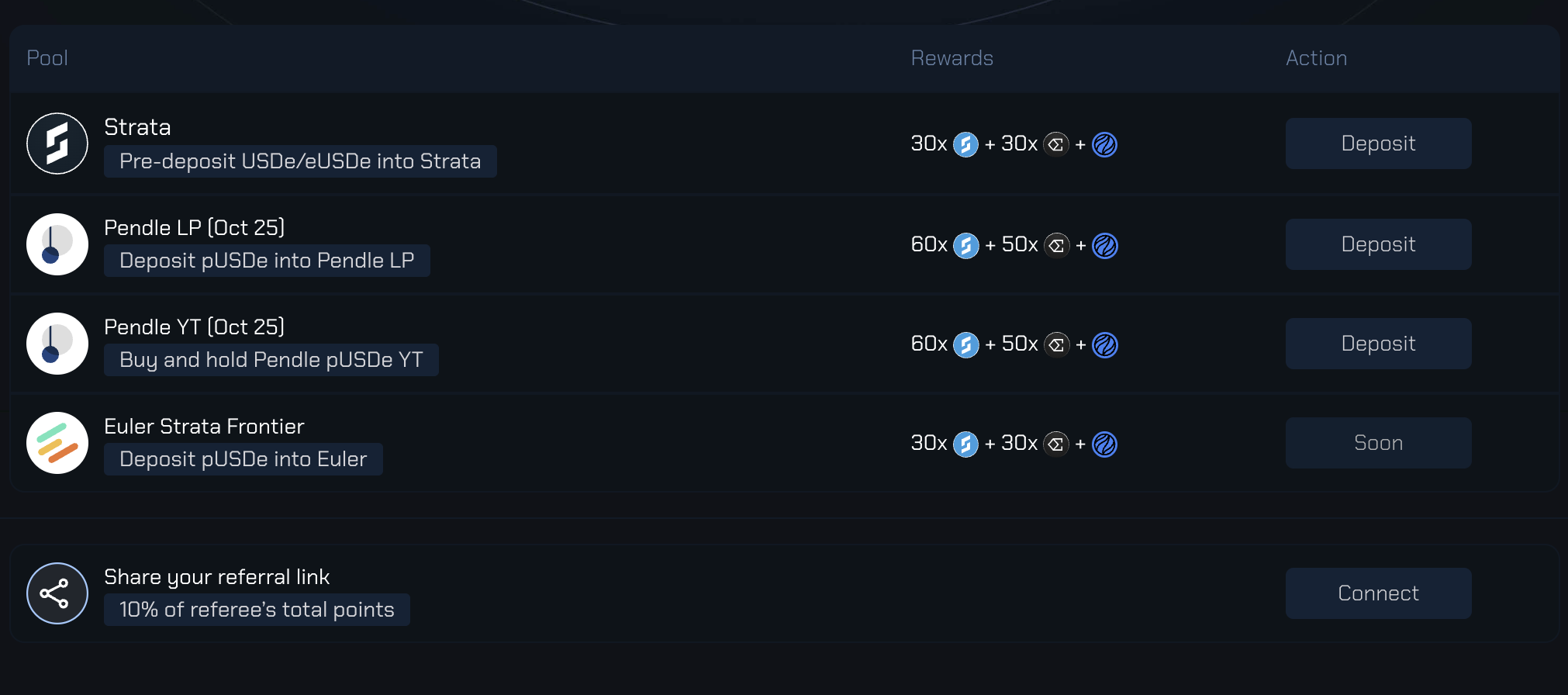

Strata launches Season 0 pre-deposit

On July 22, Strata, the structured income protocol of the Ethena ecosystem, announced the launch of the Season 0 pre-deposit activity. Users who deposit USDe and eUSDe (Ethereal’s USDe deposit certificate) can obtain 30 times the Strata points income, 30 times the Ethena points income, and Ethereal points income.

Considering the low base yield of deposits directly within the Strata protocol, users can also choose to deposit pUSDe (Strata’s deposit certificate) as LP in Pendle, which currently offers an annualized return of 7.98% (which can be increased to 9.91% if sufficient PENDLE is pledged), plus 60x Strata points income, 50x Ethena points income, and Ethereal points income.

Given the current positive trend of the entire Ethena ecosystem, I personally tend to think that Strata’s points still have some potential. Original | Odaily Planet Daily ( @OdailyChina )

Author|Azuma ( @azuma_eth )

This column aims to cover the current low-risk return strategies based on stablecoins (and their derivative tokens) in the market (Odaily Note: code risks can never be ruled out), to help users who hope to gradually expand their capital scale through U-based financial management to find more ideal interest-earning opportunities.

Previous records

New opportunities

Ethena Launches Liquid Leverage

On July 29, Ethena and Aave announced the joint launch of the Liquid Leverage campaign. In essence, this can be understood as Ethena’s revolving loan incentive activity for USDe and sUSDe.

In short, users can deposit USDe (Ethena will provide an additional 12% incentive in the first month) or sUSDe (real-time yield is 11%) into Aave, borrow USDC, USDT or USDS as collateral, continue to exchange them for USDe and sUSDe, and then cycle borrowing again to amplify returns … Considering the current double-digit yield levels of USDe and sUSDe, after multiple cycles of lending (the risks will also be magnified accordingly), the compound yield can even be magnified to about 50%. This is almost the interest-earning opportunity with the strongest protocol endorsement, the largest capital capacity, and the relatively highest returns on the market.

It should be noted that in order to obtain the revolving loan incentive, you must deposit both USDe and sUSDe (only 50% of the USDe in the total deposit position can obtain additional incentives, so the deposit ratio should be kept at 50%:50%), and the loaned asset must be USDC, USDT or USDS instead of USDe. The most important thing is to complete at least one revolving loan.

With the overall market recovery and strong bullish sentiment, Ethena is experiencing another period of accelerated growth. As of this writing, ENA has once again broken through the $0.6 mark, making it one of the strongest performing altcoins in the entire Ethereum ecosystem. In the aforementioned revolving loan strategy, depositing both USDe and sUSDe earns 5x the points . With Ethena’s fourth quarter points promotion currently ongoing, the continued rise in ENA’s value means that the corresponding airdrop rewards for points will be amplified, providing another potential source of revenue for this strategy.

Falcon launches USDf/USD1 LP incentives

Falcon Finance, the stablecoin protocol under DWF, announced last week that it had secured a $10 million strategic investment from World Liberty Financial (WLFI) and had added WLFI’s USD1 stablecoin as collateral. The funds will be used to accelerate Falcon Finance’s technical integration, focusing on shared liquidity provision, multi-chain compatibility, and smart contract modules for seamless conversion between USDF and USD1.

Later, Falcon Finance announced it would establish USDf/USD1 liquidity on PancakeSwap and provide additional returns and points incentives to limited partners. As of this posting, the USDf/USD1 liquidity yield on PancakeSwap is currently reported at 9.75%. More importantly, Falcon Finance will provide a 60x bonus to limited partners in the pool (Miles) , currently one of the fastest ways to earn points on the project.

Strata launches Season 0 pre-deposit

On July 22, Strata, the structured income protocol of the Ethena ecosystem, announced the launch of the Season 0 pre-deposit activity. Users who deposit USDe and eUSDe (Ethereal’s USDe deposit certificate) can obtain 30 times the Strata points income, 30 times the Ethena points income, and Ethereal points income.

Considering the low base yield of deposits directly within the Strata protocol, users can also choose to deposit pUSDe (Strata’s deposit certificate) as LP in Pendle, which currently offers an annualized return of 7.98% (which can be increased to 9.91% if sufficient PENDLE is pledged), plus 60x Strata points income, 50x Ethena points income, and Ethereal points income.

Given the current positive trend of the entire Ethena ecosystem, I personally tend to think that Strata’s points still have some potential.

This article is sourced from the internet: Ethena Launches USDe and sUSDe Revolving Loan Incentives; Falcon Finance Adds 60x Points Acceleration Channel (August 4th)Recommended Articles

Well-known options exchange Deribit and crypto derivatives platform SignalPlus jointly launched a new version of the options and futures trading competition – 2025 Summer Trading Competition. It is reported that the trading competition will last for five weeks, with a total prize pool of over 300,000 USDC, including Tesla cars, Rolex watches, Hawaiian travel vacation spots and other generous gifts. The competition includes activities such as leaderboard competition, recommendation competition and daily rewards, aiming to bring an experience event that combines trading skills, operation strategies and summer fun to global traders. Note: Register before June 26 to receive a free GOLD, ETH and SOL options package. Event details: 5 weeks, total prize pool exceeds 300,000 US dollars • Total prize pool: over 300,000 USDC • Registration period: Now until July…