Binance 2025 First Half Research Report: Bitcoin shows high Beta attributes, and stablecoins are accelerating mainstream

Original title: Half-Year Report 2025

Original source: Binance Research

Original translation: Chopper, Foresight News

In the first half of 2025, the криптовалюта market showed a volatile pattern of first decline and then rise: the total market value fell by 18.61% in the first quarter, rebounded by 25.32% in the second quarter, and finally increased slightly by 1.99% year-on-year in the first half of the year.

Year-to-date, the total crypto market value has increased by 1.99%

This dynamic stems from a number of factors:

· The Fed’s rate cuts and expectations of regulatory easing after the U.S. election in the second half of 2024 will push the market to $3 trillion;

· Sticky inflation, weak economic data and the Trump administration’s widespread tariffs implemented in April weighed on sentiment in early 2025;

The recent suspension of tariffs and improved regulatory clarity for stablecoins and DeFi have driven market recovery.

Timeline of important events in the first half of 2025

The core narrative of the crypto market in the first half of the year focused on Bitcoin investment tools, stablecoins, AI agents, and tokenized real-world assets (RWA). Looking ahead, global monetary policy, trade tariff dynamics, institutional entry, the integration of cryptocurrency and AI, and a new round of crypto IPOs after Circle will become key highlights.

1. Macroeconomic Background and Рынок Performance

The Great Divergence of the Global Economy

Economic trends diverge: the US economy is gradually slowing down, with the unemployment rate stabilizing at 4.1%, but the job market is cooling; Chinas GDP grew 5.4% year-on-year in the first quarter, exceeding expectations, benefiting from stimulus policies; the economies of the eurozone and Japan are recovering steadily.

G4 countries quarterly GDP performance and market forecast

Loose liquidity: The money supply of the four major economies of the United States, China, Europe and Japan increased by a total of US$5.5 trillion, the largest half-year increase in four years, driving a rebound in risk asset sentiment.

Geopolitical shock: The brief trade war between the United States and China caused tariffs to surge to 145%, exacerbating market volatility.

Bitcoin’s “High Beta Attribute”

Bitcoin has returned 13% year-to-date, outperforming most traditional stock indices, and its market value remains above $2 trillion. Its price cycle is seen as a leading indicator of the global manufacturing cycle (leading by 8-12 months), suggesting that there may be opportunities in the second half of 2025.

Year-to-date returns of some major global assets

2. Performance of core assets: Bitcoin and public chain ecosystem

Bitcoin ecosystem matures

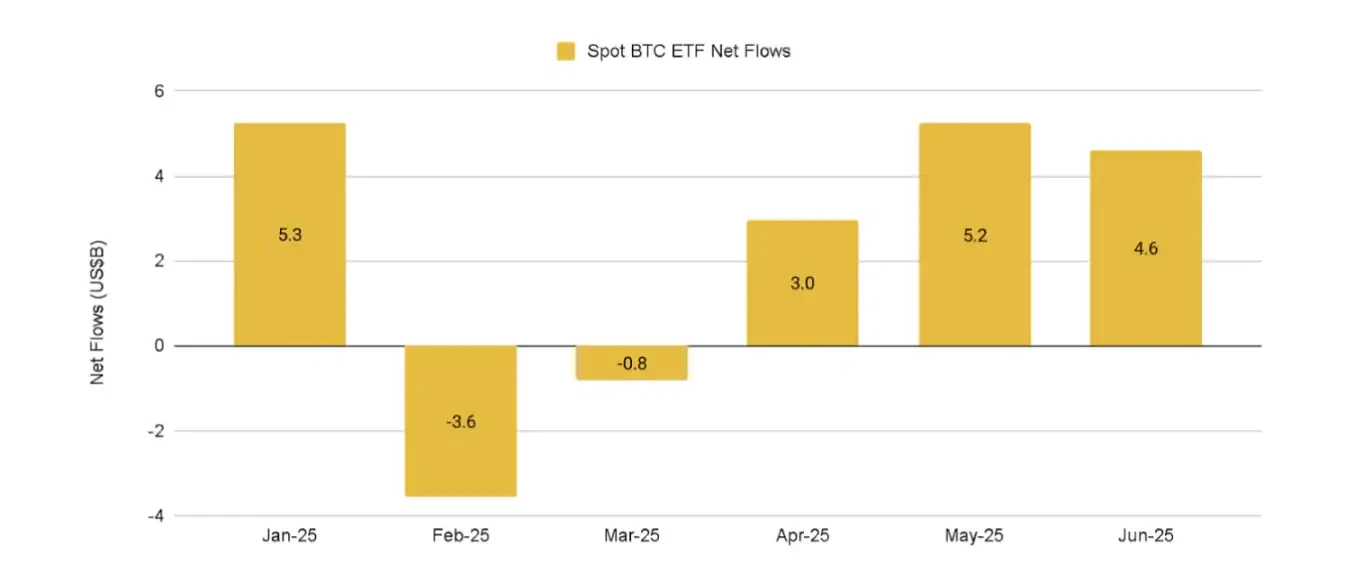

Institutional entry is accelerating: spot ETFs have accumulated net inflows of more than US$13.7 billion, and BlackRocks IBIT dominates the market; more than 140 listed companies hold 848,000 BTC, an increase of more than 160% over last year.

Spot Bitcoin ETFs have attracted more than $13.7 billion in net inflows so far this year

Ecosystem innovation and differentiation: Layer 2 solutions (such as Stacks and BitVM) promote expansion, and BTCFis total locked value (TVL) reaches US$6.5 billion, a year-on-year increase of 550%; however, speculation in Bitcoin native assets such as Ordinals and Runes cools down, and daily trading volume drops to an 18-month low.

Market dominance: Bitcoin’s dominance rate peaked at 65.1%, a four-year high, highlighting its core asset status.

Mainstream public chain dynamics

Ethereum: ETH price fell 26%, but the ecosystems resilience was highlighted. Pectra upgrade improved staking efficiency (the maximum balance of a single verification node increased from 32 ETH to 2048 ETH), and the staking volume reached 35.4 million ETH (accounting for 29.3% of the circulation); Layer2 (Base, Arbitrum, etc.) processed more than 90% of transactions and became the main expansion carrier.

Ethereum to Bitcoin exchange rate fell to 0.023, a multi-year low, data as of June 30, 2025

Solana: Continues to maintain high throughput (99 million transactions per day), the stablecoin market value reaches 10.9 billion US dollars, surpassing BNB Chain; institutional attention increases, and many asset management companies apply for spot SOL ETF, which is expected to be approved by mid-year.

Market capitalization of stablecoins on major public chains, data as of June 30, 2025

BNB Chain: DEX transaction volume hit a record high, of which PancakeSwap contributed more than 90%; through upgrades such as Pascal and Lorentz, the block time was shortened to 0.8 seconds, and the ecosystem expanded to Memecoin, RWA and AI fields, with daily active addresses reaching 4.4 million.

3. DeFi and Stablecoins: From Speculation to Practicality

DeFi enters a mature stage

Core data: TVL stabilized at US$151.5 billion, monthly active users reached 340 million (year-on-year +240%), and the proportion of DEX spot trading volume rose to 29%, reaching a historical high.

Changes of major DeFi indices in half a year and a year

Key trends:

· RWA exploded: The value of real-world assets on the chain reached 24.4 billion US dollars, with private credit accounting for 58%, becoming an important bridge connecting TradFi and DeFi.

· Prediction market breakthrough: Polymarket cooperated with social platform X, with transaction volume exceeding US$1.1 billion in June and 400,000 monthly active users, becoming an information analysis tool.

Liquidity stratification: Ethereum dominates institutional-level assets (heavy staking, RWA), Solana focuses on retail transactions, and BNB Chain attracts traffic with Memecoin and zero gas fee activities.

Stablecoin mainstreaming accelerates

Market structure: The total market value exceeded 250 billion US dollars, and USDT (153-156 billion US dollars) and USDC (61.5 billion US dollars) formed a duopoly, accounting for a total of 92.1%.

The total supply of stablecoins has increased by more than 22% this year, setting a new record

Key developments:

Institutional adoption: Circle went public on the New York Stock Обмен through an IPO, raising over $600 million; JPMorgan Chase, Société Générale and others launched bank-based stablecoins; Walmart and Amazon explored their own stablecoins to reduce payment costs.

Regulatory clarity: The passage of the US GENIUS Act and the full implementation of the EU MiCA provide a compliance framework for stablecoins and promote their use as a cross-border payment and settlement infrastructure.

IV. Institutional Admission

TradFi integration: 60% of Fortune 500 companies are deploying blockchain; JPMorgan Chase launches JPMD, a deposit token based on Base; Apollo Global Management tokenizes $785 billion of credit funds on Solana.

Asset tokenization: The on-chain movement of traditional assets such as stocks and bonds is accelerating. Backed Finance’s xStocks and Dinari’s dShares support 24/7 trading. Robinhood launches synthetic stock derivatives in the EU.

Comparative Analysis of xStocks, dShares, and Robinhood Токенized Stock Offerings

V. Regulatory landscape

Major cryptocurrency regulatory policies in the first half of 2025

United States: Shifting from “law enforcement and supervision” to “legislative leadership”, the “CLARITY Act” and “GENIUS Act” clarify the classification of digital assets and stablecoin rules, and promote compliance entry of institutions.

EU: MiCA is fully implemented, USDT is removed from some exchanges due to non-compliance, and the share of compliant stablecoins such as USDC increases.

Asia: Hong Kong attracts innovation through open licenses and tax incentives; Singapore cracks down on regulatory arbitrage, leading to corporate relocation.

Outlook for the second half of the year

The Federal Reserves policy shift, the advancement of U.S. crypto legislation, the wave of TradFi and crypto mergers and acquisitions, the penetration of stablecoin payments, and the outbreak of RWA will dominate the direction of the crypto market in the second half of the year.

This article is sourced from the internet: Binance 2025 First Half Research Report: Bitcoin shows high Beta attributes, and stablecoins are accelerating mainstreaming

Related: Bitcoin hits all-time high, have long-term holders started to sell?

Original author: Matt Crosby Compiled and edited by: BitpushNews After a period of volatility, Bitcoin has now reclaimed the $100,000 mark and hit a new all-time high, injecting new confidence into the market. But as prices rise, a key question also arises: Are Bitcoins most experienced and successful holders – the long-term holders – starting to sell? This article will analyze what on-chain data reveals about the behavior of long-term holders and whether recent profit-taking is a cause for concern or simply a healthy part of Bitcoin鈥檚 market cycles. Signs of profit taking The Spent Output Profit Rate (SOPR) provides instant insight into realized profits across the network. Focusing on recent weeks, we can clearly observe an upward trend in profit realization. The clustering of green bars suggests that a…